- 68.20% of top SUI traders hold long positions, while 31.80% hold short positions.

- Traders are over-leveraged at $3.326 on the lower side and $3.538 on the upper side.

As a seasoned analyst with years of experience navigating the volatile cryptocurrency market, I find myself intrigued by the current state of SUI. The bullish flag and pole pattern on the daily time frame is a promising sign, especially when coupled with the token’s impressive performance against major cryptocurrencies and financial assets.

The indigenous coin of the Sui network, referred to as SUI, is causing a stir in the fast-paced world of digital currencies. It’s been showing superior performance compared to significant cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), as well as other prominent financial assets.

In addition to delivering strong results, the digital currency (altcoin) appears ready to extend its upward trend due to the formation of a positive price movement pattern.

SUI technical analysis and key levels

Based on specialized technical assessments, it appears that the SUI token has developed a ‘bullish flag and pole’ pattern on its daily chart, which suggests it might soon break free from this structure, potentially signaling an uptrend.

If SUI manages to break its current daily high of $3.5 and ends the day above this point, there’s a good chance it might surge by approximately 60%, potentially hitting around $5.70 in the near future.

According to the SUI’s daily graph, it seems that the price has had enough adjustment to potentially escalate its upward trend even more.

Looking on the optimistic side, SUI’s Relative Strength Index (RSI) currently reads 58.60, implying that there might be room for growth since it is still within the non-overbought region.

Bullish on-chain metrics

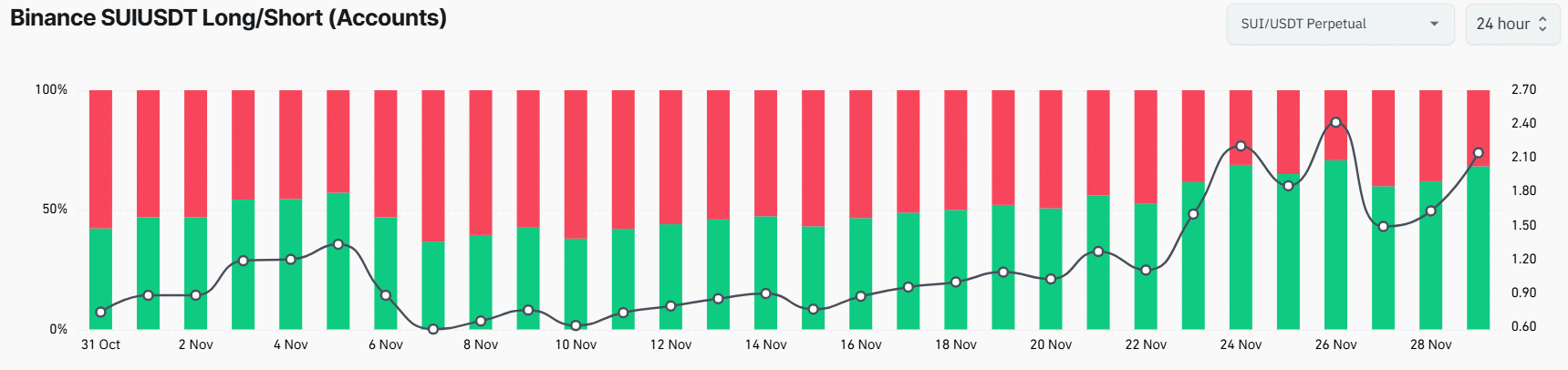

Based on robust uptrends in the market, traders on Binance are actively engaging with the token, according to reports from Coinglass, a firm specializing in on-chain analysis.

Based on the latest figures, the Binance SUIUSDT Long/Short ratio is at 2.14, suggesting a robust bullish outlook among investors. As it stands, approximately two-thirds (68.20%) of top SUI traders are long, while slightly less than a third (31.80%) have short positions open.

Based on information provided by a blockchain analysis company, it seems traders are anticipating a price surge, possibly drawing in additional investors and traders in the near future.

Major liquidation level

Presently, key selling points stand around $3.326 (on the downside) and $3.538 (on the upside), based on the liquidation levels indicated by Coinglass’s SUI liquidation map data. At these points, traders seem to have taken on excessive leverage.

Should the market mood stay consistent and the price ascends to approximately $3.538, it’s estimated that around $22.18 million in short positions might need to be closed out.

If the sentiment changes and the price falls to around $3.326, it’s estimated that about $10.5 million in long positions may need to be sold off.

Read Sui’s [SUI] Price Prediction 2024–2025

In the last day, SUI saw a decrease of more than 3.5% in its value, with the token currently hovering around $3.31. Meanwhile, the number of trades involving SUI has decreased by approximately 35%, suggesting that fewer traders are actively participating in the market.

This implies that traders and investors could be holding back, anticipating a significant move or breakout, before they choose to invest more.

Read More

2024-11-30 08:08