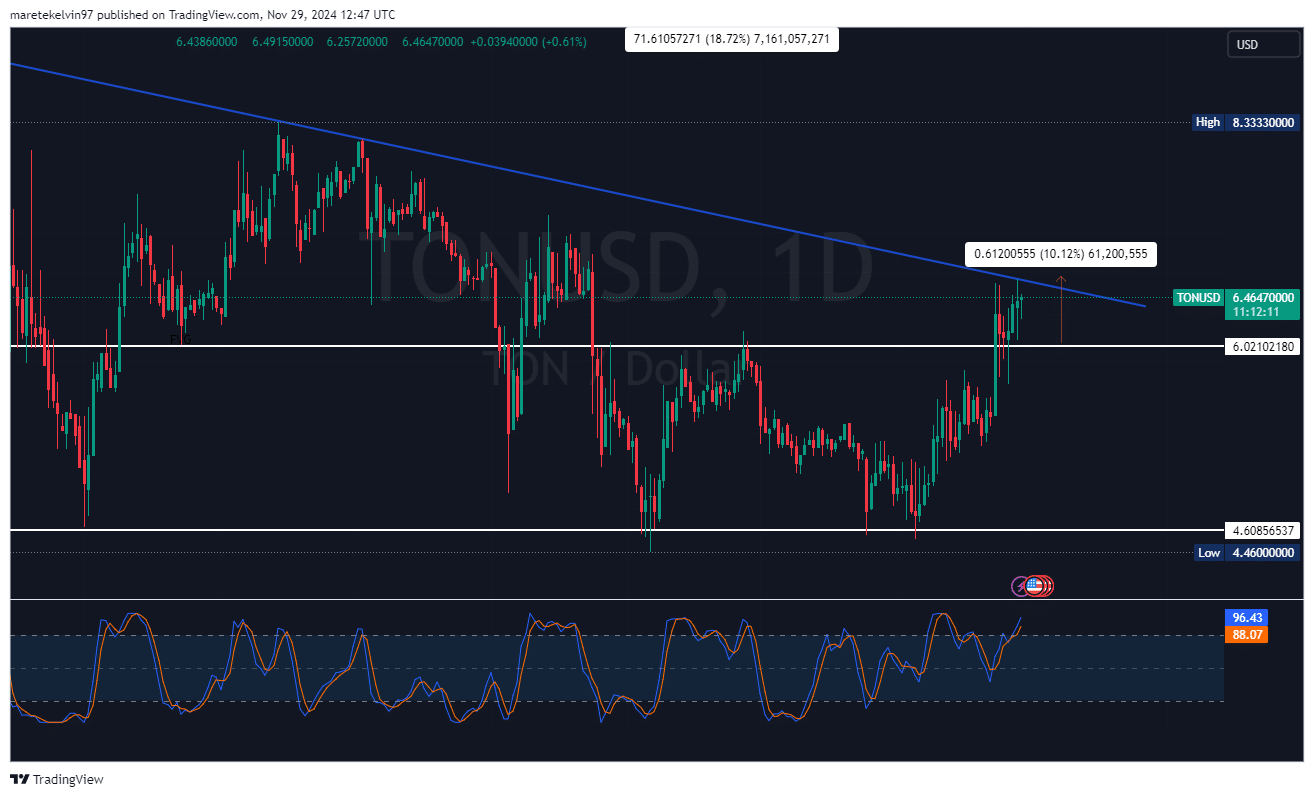

- At the time of writing, Toncoin’s price seemed to be approaching a key trendline resistance level

- Active Addresses and large transactions surged over the last 24 hours

As a seasoned crypto investor with over a decade of experience under my belt, I’ve witnessed countless trends and market shifts. The recent surge in Toncoin (TON) has piqued my interest, especially given the positive on-chain metrics we are seeing.

Lately, Toncoin (TON) has been receiving significant interest, as its on-chain data suggests a bullish outlook for a potential surge. Currently, the digital currency is examining a crucial downward trendline, after a robust 10% increase from the $6.02 price point.

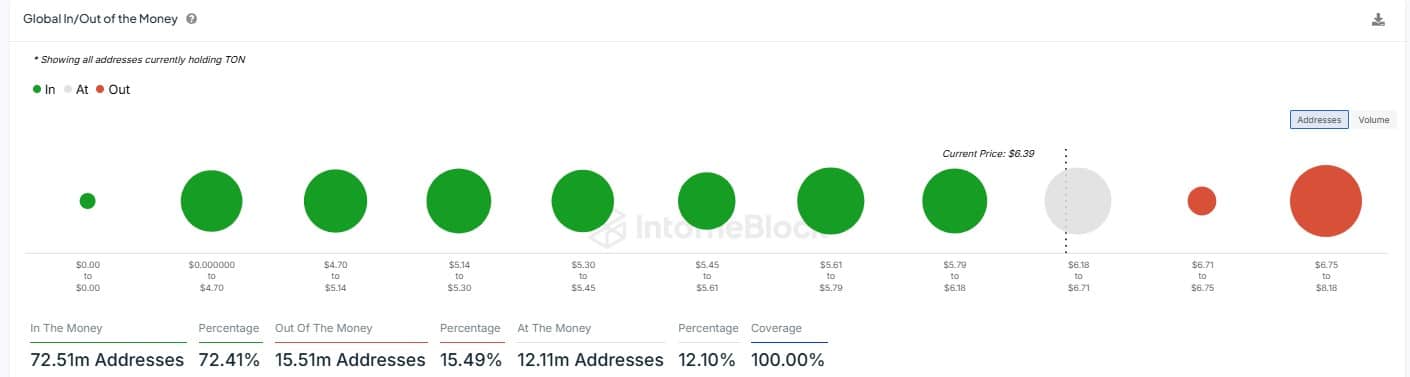

Approximately 3 out of every 4 addresses within the market are currently earning a profit, suggesting a generally positive outlook. So, the query arises: Could this growing trend manage to overcome its current resistance?

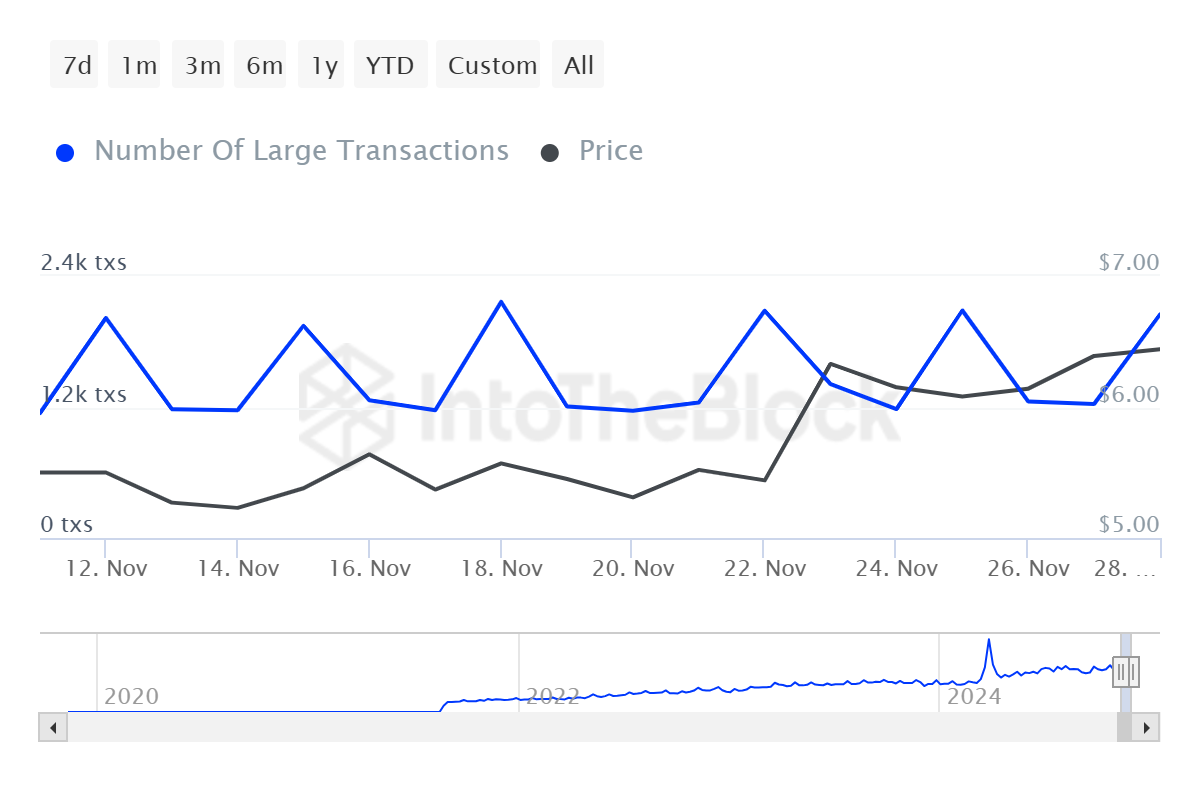

Toncoin whale activity hits new highs

Large-scale transactions involving TON whales have surged significantly. As per the latest data from IntoTheBlock, these substantial transactions have risen by an impressive 110% over the past 24 hours. Such a surge in high-value trades often reflects a robust level of market confidence.

An increase in whale activity could potentially build up the demand needed to surpass TON’s existing price barrier, as shown on the charts.

Indeed, the increase in whale behavior seems to be consistent with the overall market’s price fluctuations as well. This suggests that significant investors might be preparing for a significant shift in Toncoin’s value movement.

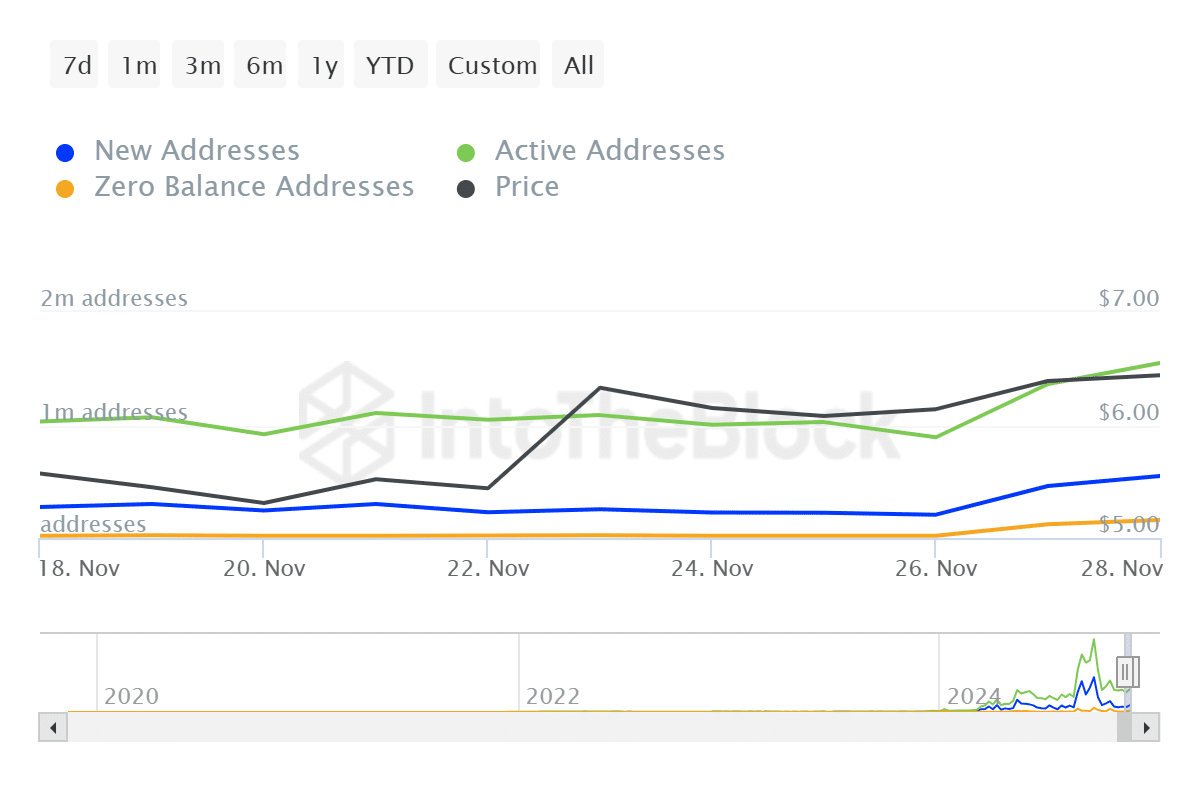

Active addresses surge

As whale activity rose, there was also a significant 14% surge in active Toncoin wallets, underscoring the expanding curiosity and investment in this alternative coin.

Simultaneously, about 72% of Toncoin accounts were showing profits when its current pricing was considered. This optimistic profit situation suggested a robust market attitude, typically favorable for upward price movements, or bullish tendencies.

On the other hand, it was proposed that a decline in the charts might lead to increased selling activity. This is particularly relevant since investors are eager to lock in their profits.

A key trendline resistance

Technically speaking, Toncoin’s price was getting close to a significant resistance line on the daily graphs. This resistance point has led to multiple successful price reversals lately, making it a crucial juncture where decisions about the price direction might be made.

If the altcoin manages to surge past the current resistance trendline, it might indicate a robust upward trend, possibly aiming for the $7 region.

Instead, if the trendline’s critical resistance level isn’t surpassed, there might be a pullback. The price could find initial support at the $6.02 level in this scenario.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-11-30 11:03