- FLOKI seemed to have a bullish structure on the daily timeframe

- It retested the $0.000202 support, but lacked the demand to push higher

As a seasoned researcher with years of experience in the crypto market, I’ve seen my fair share of bulls and bears. Looking at FLOKI’s current situation, it seems we might be witnessing a bearish phase. The bullish structure on the daily timeframe earlier this month was promising, but the lack of demand to push higher after retesting the $0.000202 support is concerning.

Currently, FLOKI is experiencing a 2.37% increase in value for the day as Bitcoin makes an effort to surpass the $97k threshold. Notably, Bitcoin and FLOKI have both shown some short-term bullish activity over the past two days.

Despite failing to surpass its March peak and subsequently experiencing a decline in June, concerns arose about the possibility of another repeat of such a trend.

FLOKI momentum and demand slow down

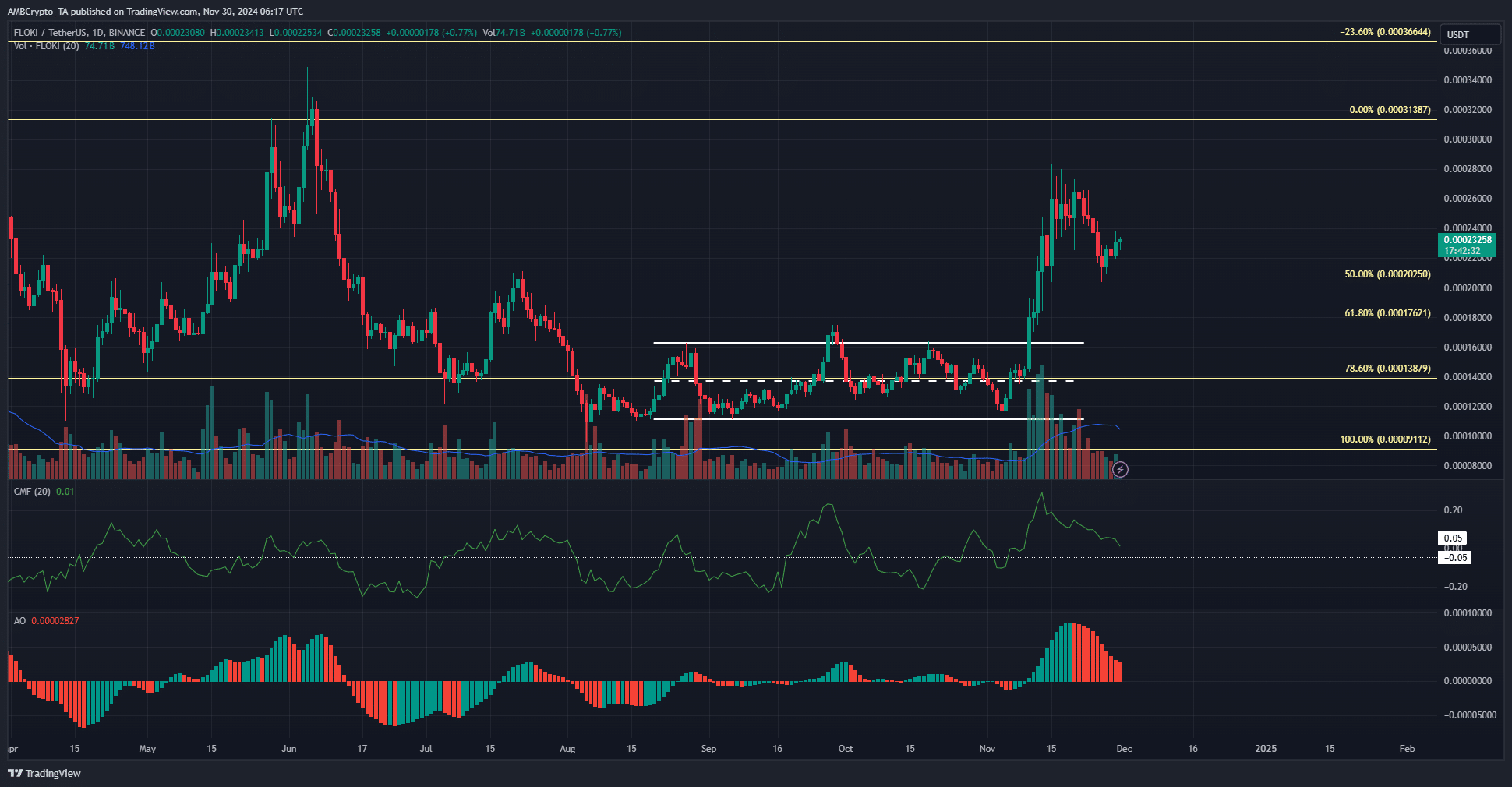

Over the three-month stretch from August to November, I found myself trading FLOKI within a specific price range, which ranged from $0.000111 on the lower end to a high of $0.000165. Interestingly, this range’s midpoint aligned perfectly with the 78.6% retracement level at approximately $0.000138.

On November 10th, we saw a surge past the set price range, driven by substantial trading activity. By November 21st, this rise peaked at $0.00029, but since then, it has started to decline.

Over the last week, this price decrease occurred alongside a decline in both trading activity and demand, as indicated by the daily CMF remaining low at approximately 0.01, which suggests that there was no significant net inflow of capital.

Over the last several days, the Awesome Oscillator has shown downward bars (or “red bars”) on its graph, which underscores a bearish trend. This, combined with other indicators, signaled FLOKI’s recent pullback following its positive performance.

Liquidation map hinted at deeper retracement

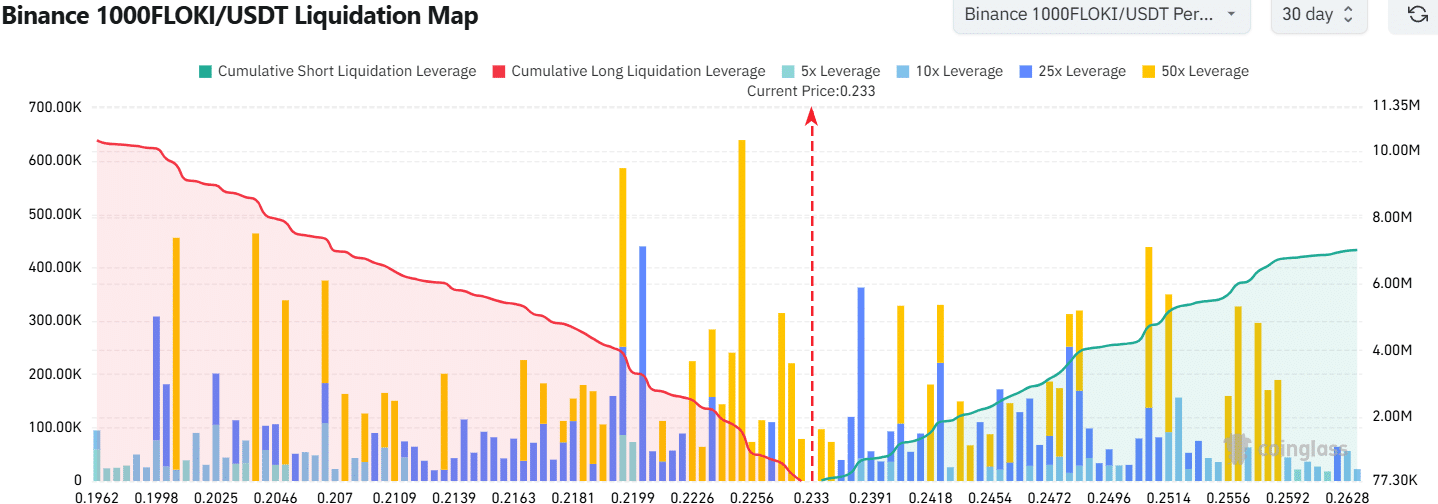

As an analyst, I recently examined Floki’s one-month liquidation map, which pinpointed significant upcoming long and short position liquidations. Notably, the levels at $0.000225 and $0.000219 appeared close by and were particularly notable due to the high concentration of highly leveraged long positions’ liquidations in those areas.

Is your portfolio green? Check the FLOKI Profit Calculator

As a researcher, I’ve noticed that the position I was studying, specifically $0.219, had a significantly high cumulative long liquidation leverage. This could potentially draw prices towards it. On the other hand, while the cumulative short liquidation leverage was smaller in the range of $0.000248-$0.00025, there might be a short-term bearish reversal occurring in this area.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-11-30 20:07