- Jupiter might be forming another bullish flag pattern on the charts soon

- Token could face a liquidation barrier near the $1.2-level

As a seasoned analyst with a knack for spotting trends and patterns in the crypto market, I must say that the recent movements of Jupiter [JUP] have piqued my interest. While its consolidation phase has been relatively quiet, it seems to be silently building up a secret plan.

For several days now, the price of Jupiter (JUP) has been showing relatively small fluctuations in its chart, indicating consolidation. But it’s worth noting that beneath this quiet facade, the altcoin has managed to surpass another bullish formation, suggesting a potentially significant development might be unfolding.

Will this be the trigger that’ll push the token to $2 in the coming days?

Jupiter’s secret plan

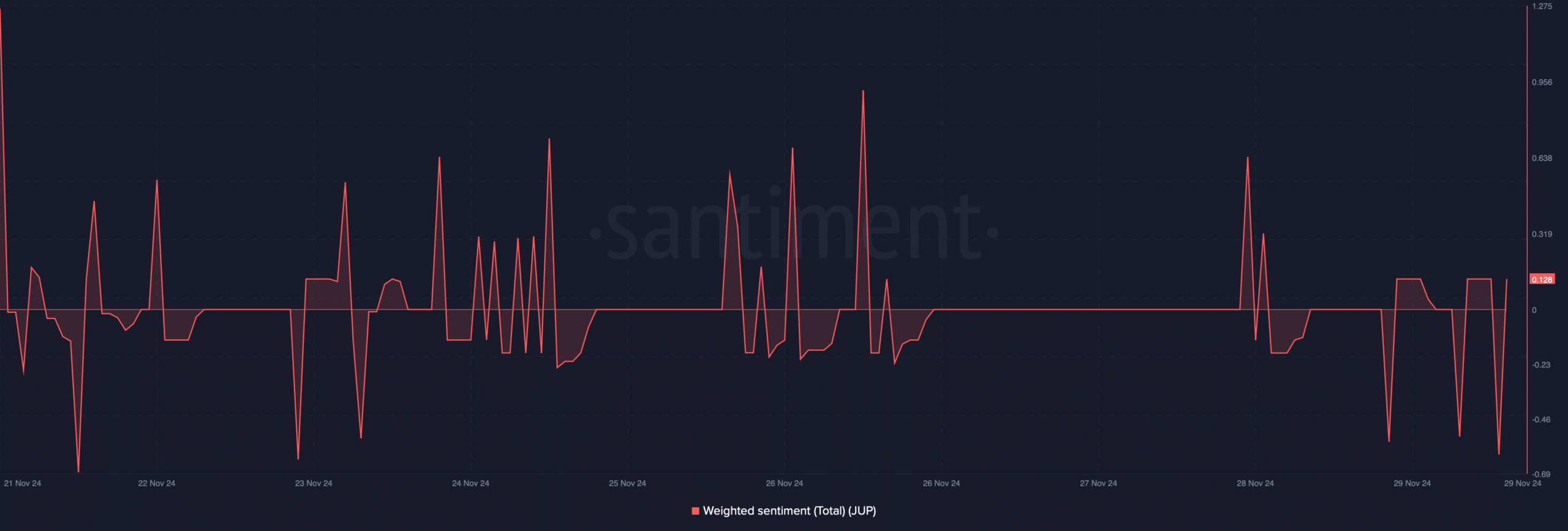

Due to the recent period of stability in cryptocurrencies, this decrease in volatility has unfortunately affected its social indicators. Specifically, the overall sentiment towards the token has significantly dropped – an indication of growing pessimism within the market.

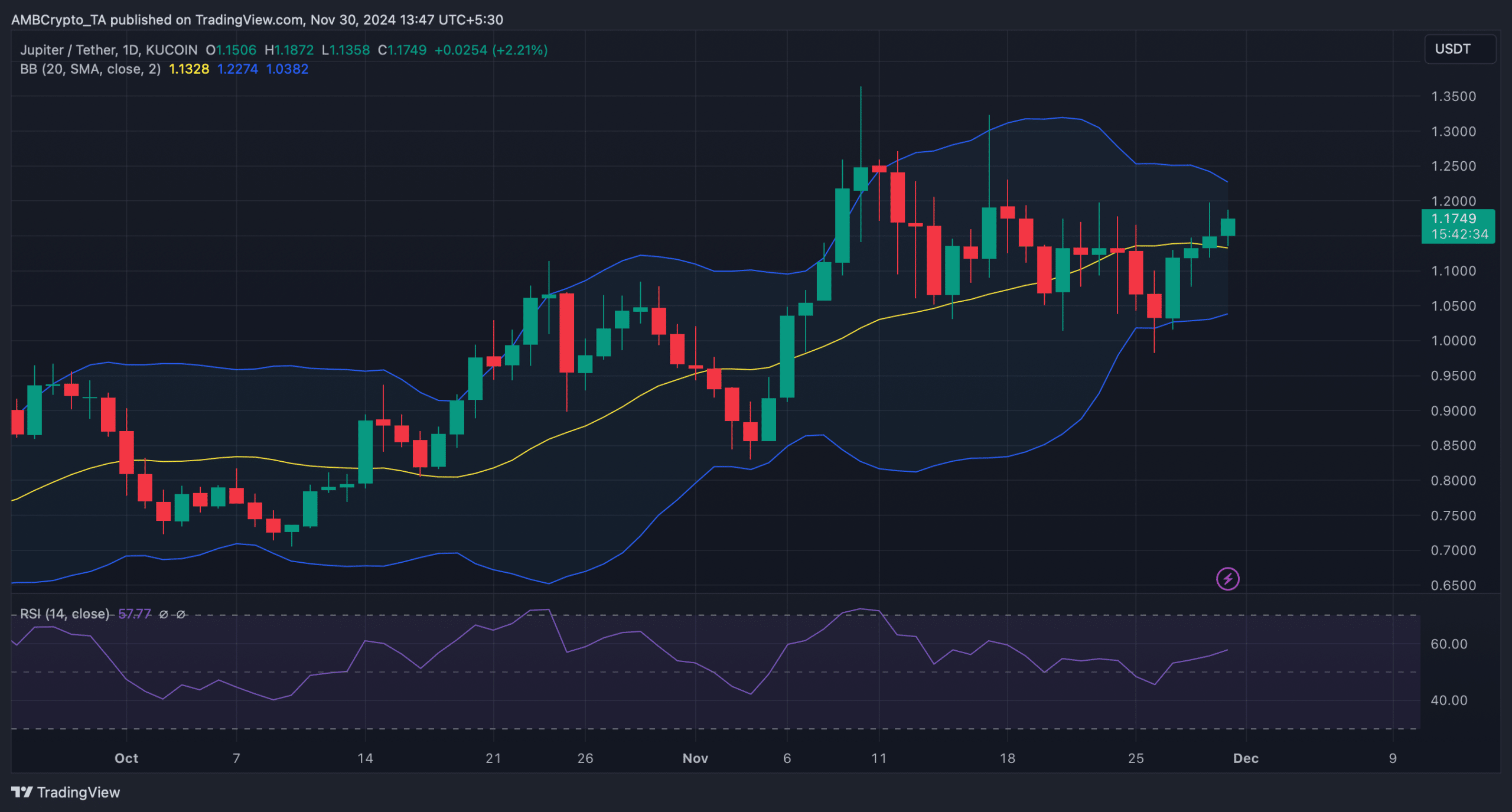

Yet, investors should remain patient, as there might still be surprises from Jupiter. Notably, World Of Charts, a well-known crypto analyst, pointed out an essential update: JUP has quietly moved beyond another pattern, suggesting a bullish falling wedge formation. This optimistic pattern was formed during the first week of November.

After that point, the value of Jupiter seems to have stabilized within certain limits. However, it broke through these limits on November 29th. If the current analysis holds true, this could lead to Jupiter forming another pattern, potentially pushing its price up towards $2 within the next few weeks.

What’s next for JUP?

It’s suggested that JUP may soon develop a bullish flag pattern. If this occurs and JUP breaks out, it could potentially reach $2. Consequently, investors should be prepared for a possible price drop after JUP initially shows some extended candlesticks. To determine if this scenario is feasible, AMBCrypto has been examining JUP’s on-chain data.

As I’m typing this, there were more bets against (short positions) than for (long positions) in the market. This is supported by Jupiter’s long/short ratio dropping significantly. This trend can be linked to a growing pessimism (bearish sentiment) in the market due to JUP’s slow price movement.

Nonetheless, the token’s Open Interest (OI) has also moved sideways lately. This suggested that investors’ interest in the token hasn’t been increasing much. And, this could trigger a trend reversal in the coming days.

On top of that, market indicators also supported the possibility of a bullish trend reversal.

For instance – The Relative Strength Index (RSI) has been moving north, indicating a rise in buying pressure. Jupiter’s price seemed to be testing the support at its 20-day SMA too. In the event of a successful test, supported by high buying pressure, it won’t be ambitious to expect a fresh bull rally, before it forms a bullish flag.

Realistic or not, here’s JUP’s market cap in SOL terms

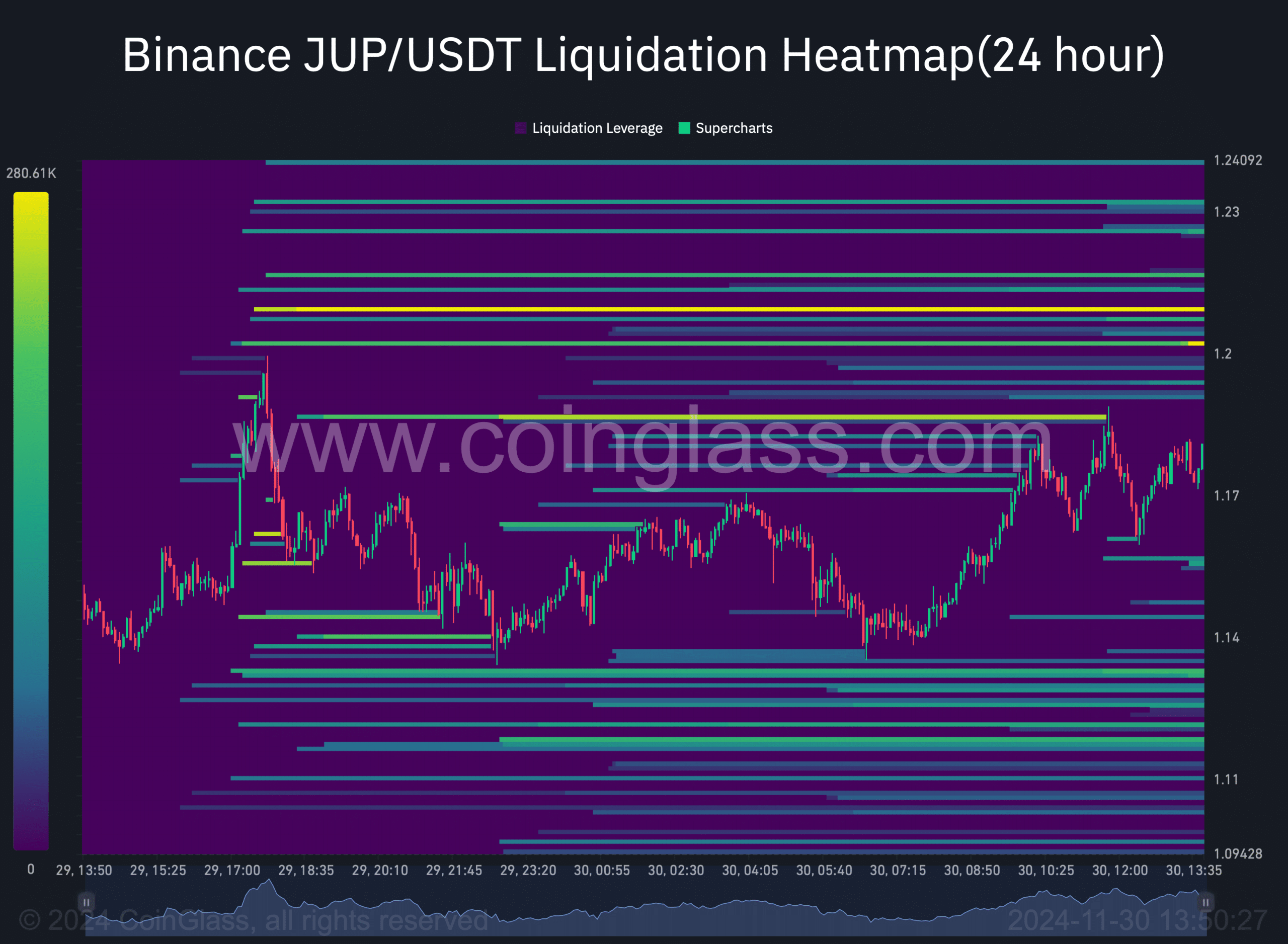

However, the token will face a crucial barrier going forward.

As an analyst, I’ve been analyzing Jupiter’s liquidation heatmap and it appears that token liquidations are expected to increase significantly around the $1.2 mark. Historically, high liquidation levels often lead to price adjustments. Consequently, if we want to see a potential jump towards $2 in the near future, the token needs to surpass that threshold of $1.2.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-11-30 22:15