- $48 resistance holds the key for Avalanche’s next big move.

- Stochastic Oscillator warns of overbought levels for AVAX.

As a seasoned analyst with over two decades of experience navigating various market cycles, I see the $48 resistance as a significant hurdle for Avalanche [AVAX] to overcome if it aims for another bull run. The token’s recent performance has been impressive, but the gap between its current price and all-time high remains substantial.

At the moment of publishing, the price of Avalanche (AVAX) stood at approximately $45.28, marking a 3.60% rise over the last day.

The market cap was $18.53 billion, with a 24-hour trading volume of $827.93 million.

Over the past day, AVAX has fluctuated between a low of $43.37 and a high of $45.95.

Despite the progress the token has shown lately, it hasn’t managed to surpass its record high of $146.22 set on November 21, 2021. This represents a steep drop of approximately 68.89% from its all-time peak.

$48 resistance stands in the way

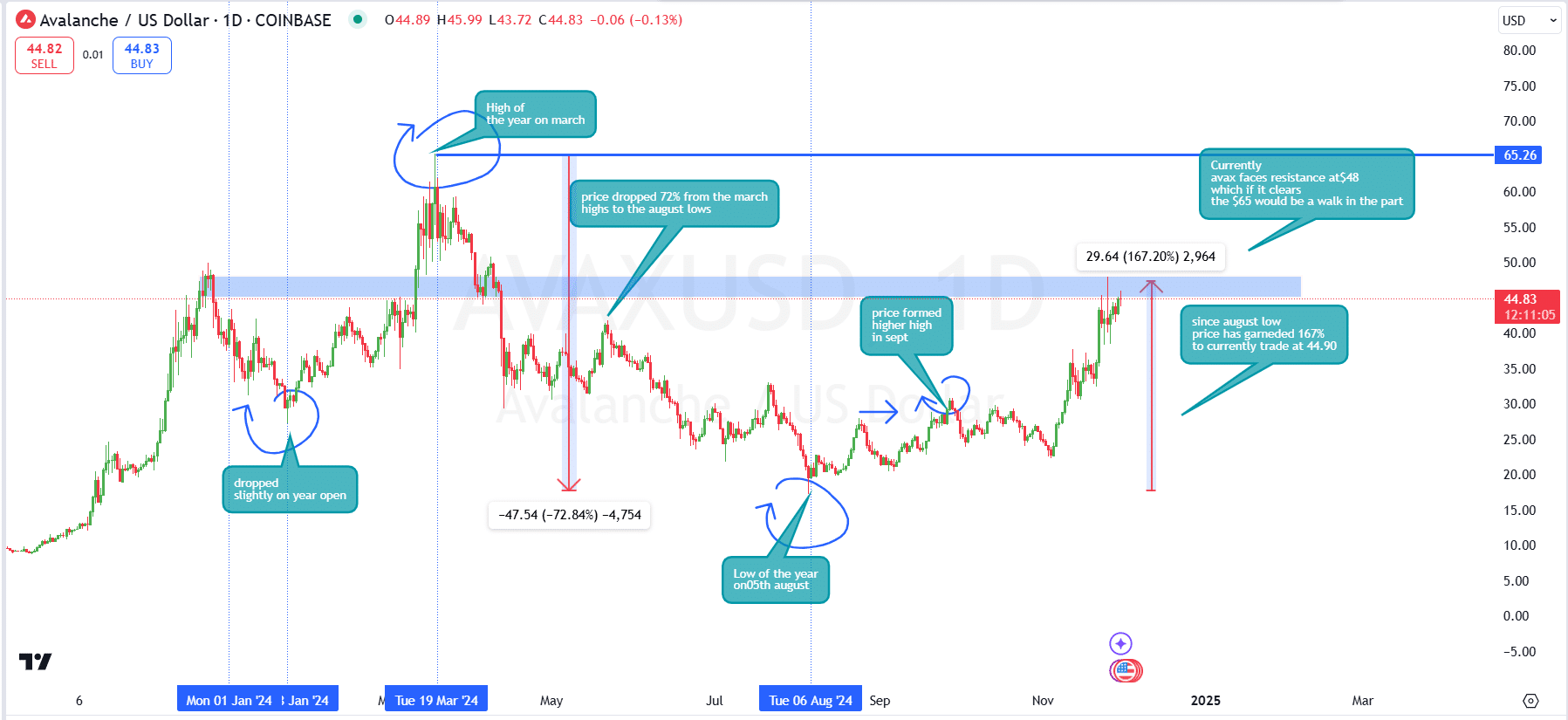

2024 saw unpredictable fluctuations in Avalanche’s performance, beginning the year modestly lower but soaring to its annual peak of $65.26 in March.

This peak marked a strong start to the year, driven by bullish sentiment and increased activity.

Starting from March, AVAX underwent a significant drop, shedding approximately 72% of its worth and reaching its lowest point for the year at $17.72 on the 5th of August.

After experiencing a dip in August, Avalanche (AVAX) entered a robust period of growth, surging by approximately 167% to its current price of $44.83. In September, the token reached a new peak, suggesting a positive change in investor sentiment.

At present, AVAX is attempting to break through the $48 resistance point. If successful, it might pave the way for an upward trend towards its former peak of $65, with possibilities extending even to $100.

Short-term cooling on the way?

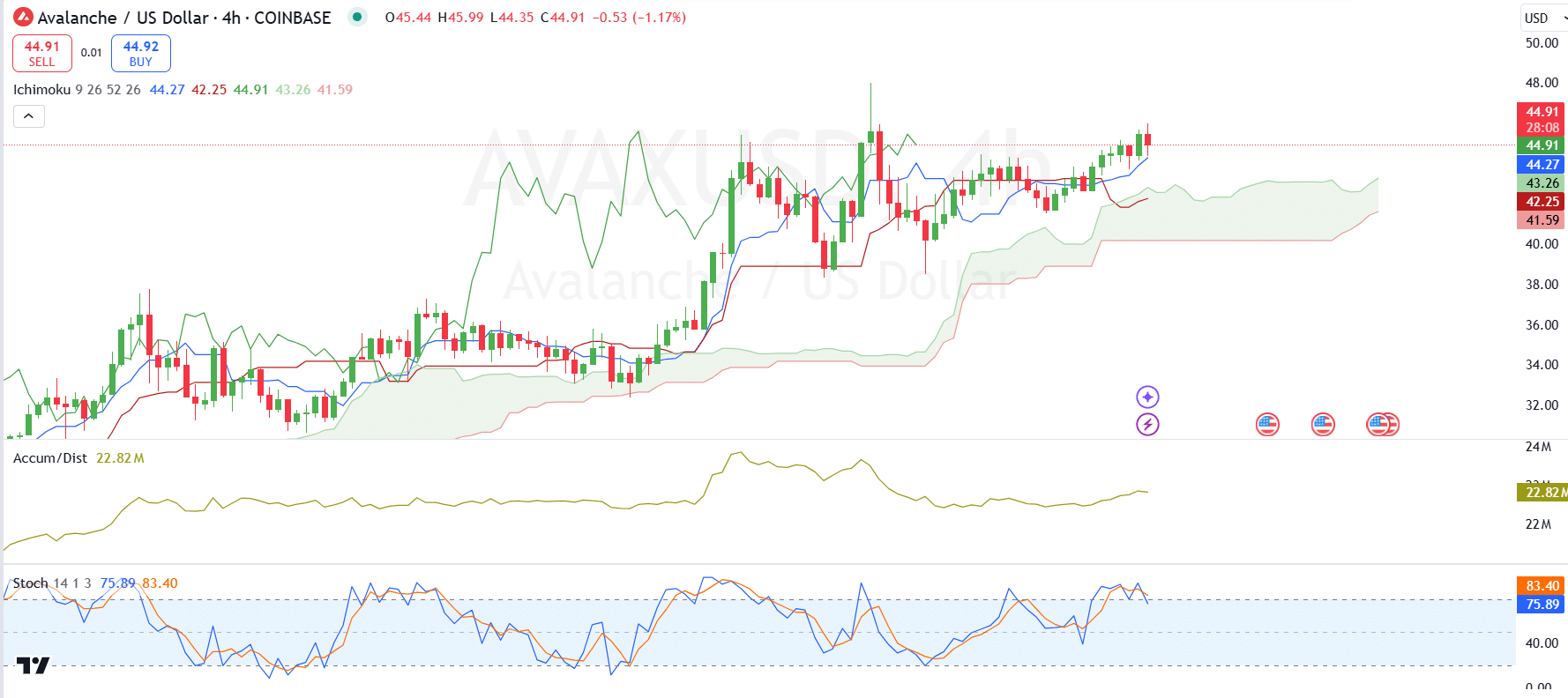

At the point of composition, the Ichimoku Cloud suggested an upward trend. The Tenkan-sen, represented by a blue line, and the Kijun-sen, shown in red, were providing temporary support levels at approximately $44.27 and $42.25 respectively, suggesting possible resistance for price drops during the short term.

As a cryptocurrency investor, I’ve noticed a surge in upward movement that seems to be backed by growing accumulation. This is evident from the trending rise in the Accumulation/Distribution indicator, currently standing at approximately 22.82 million.

According to the Stochastic Oscillator, there were signs that AVAX was approaching an overbought state. Specifically, the blue line reached a point of 83.40, surpassing the orange line at 75.89.

This signals a potential slowdown or minor pullback in the short term.

Currently, Avalanche (AVAX) appears to be in a bullish trend supported by robust foundations. However, the market could experience temporary pullbacks due to signs of being overbought, which might momentarily halt its ascent and pave the way for further growth.

Traders should watch the $44 and $42 levels for support during any retracements.

Rising volume powers AVAX comeback

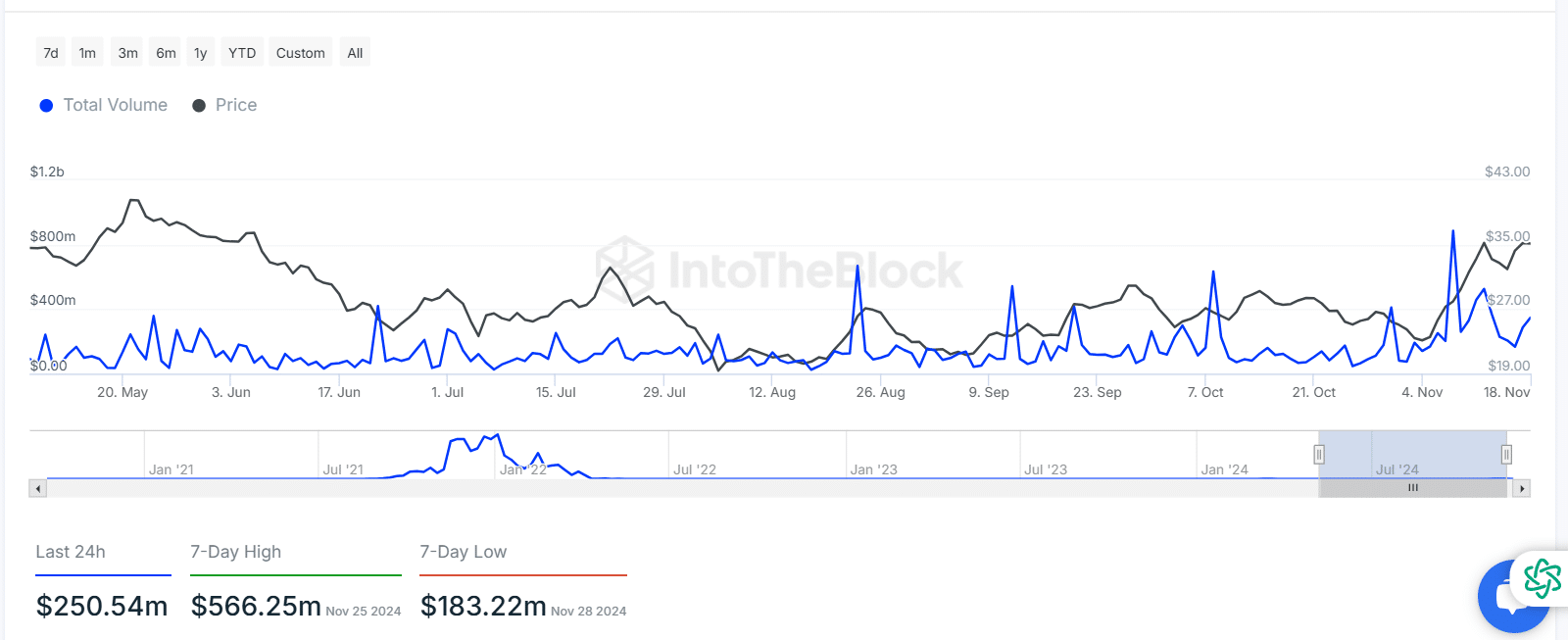

According to IntoTheBlock’s data, transaction volume for AVAX reached an all-time high of approximately $800 million during May and June, contributing to a price rise that took it up to around $43.

By the month of July, both the number of transactions and their prices experienced a significant drop, causing Avalanche (AVAX) to settle within the range of $19 to $27.

Between August and September, small bursts in trading activity temporarily boosted prices, but these increases were not enough to significantly alter the general direction of the market, which stayed level.

In November, the transaction volume peaked at a 7-day maximum of $566 million, which in turn boosted the price of AVAX up to $35.

At the moment of publication, the volume was holding steady at $250 million, offering a stable position around the mid-$30s. Increased activity hints at revived curiosity, implying a possibility for additional price growth.

AVAX sees rising adoption

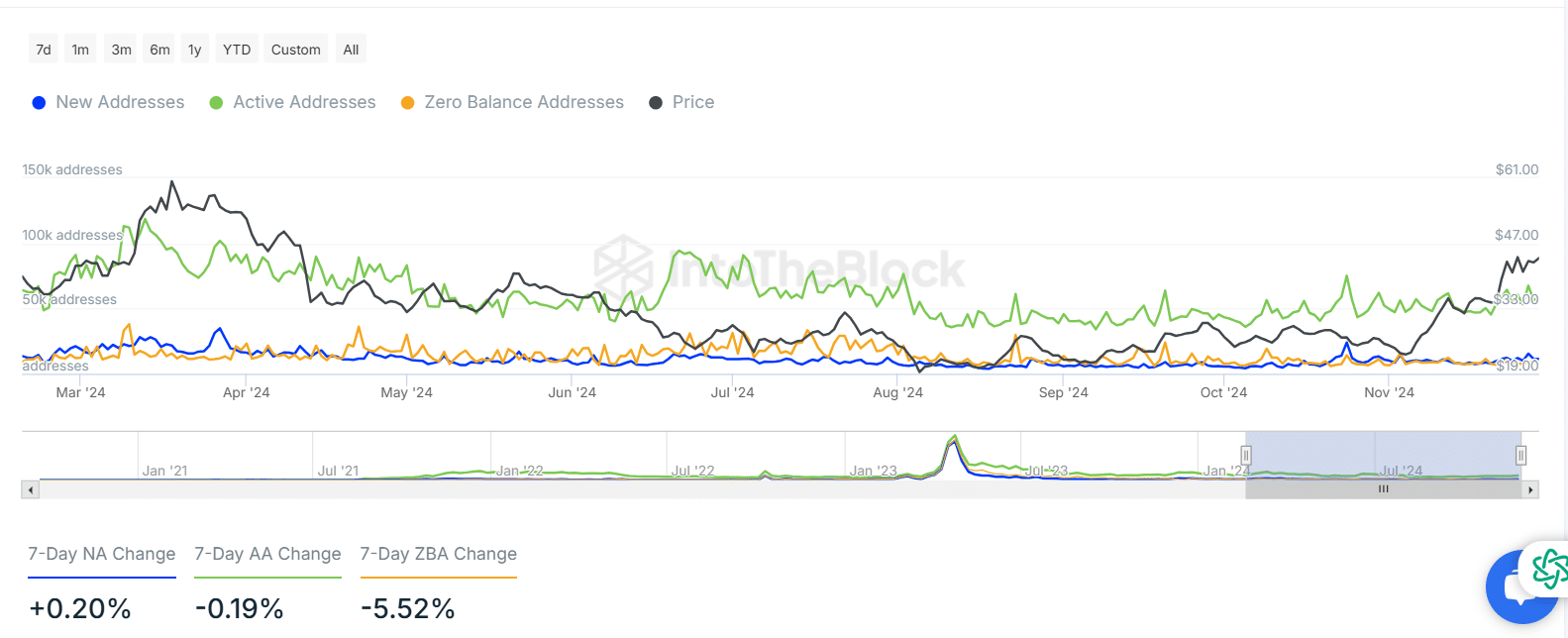

Between the months of March and June, we saw a significant surge in active addresses approaching 150,000, coinciding with a rise in price to around $61. Yet, from July onwards, both active addresses and the price started to drop steadily, indicating decreased network activity and waning market interest.

Toward the latter part of 2024, the number of active wallets remained steady, whereas there was a slight increase in newly created wallets. This incremental growth in new addresses seemed to contribute to a gradual rebound in prices.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

In just seven days, the number of zero-balance addresses dropped by 5.52%, causing the price to rise to $47. This suggests that more coins are being put back into circulation.

This renewed activity signals growing market confidence and increased utility for AVAX.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-01 11:04