- XRP surged 6% and surpassed the $107B market cap, primarily driven by whale accumulation.

- There was key resistance at $2.00, with potential for a short-term pullback.

As a seasoned crypto investor with over a decade of experience navigating the volatile world of digital assets, I must admit that the recent surge of XRP has piqued my interest once again. The 6% spike and market cap breach of $107B is reminiscent of the thrilling rollercoaster ride we’ve all come to love (or dread) in this space.

Today, XRP is creating a splash, with a 6% increase and breaking through a market capitalization of $107 billion, sparking curiosity among investors and fueling discussions about where it might be headed next.

As a researcher, I find myself pondering this question: Could XRP be on the brink of an extensive bull market, or is its current rise merely a temporary price spike?

Breaking down XRP’s price surge

The recent increase of 6% for XRP signifies the ongoing powerful progression it’s experiencing. This growth has pushed its market capitalization over $107 billion.

The significant increase is due to increased trading activity and boosted investor trust, coinciding with a wider market surge and recent resolution in the Ripple-SEC lawsuit, which could be stimulating optimistic feelings among investors.

Furthermore, the surge in trading activity and continuous price rise beyond $1.85 indicated strong buying by ‘whales’ and active market involvement.

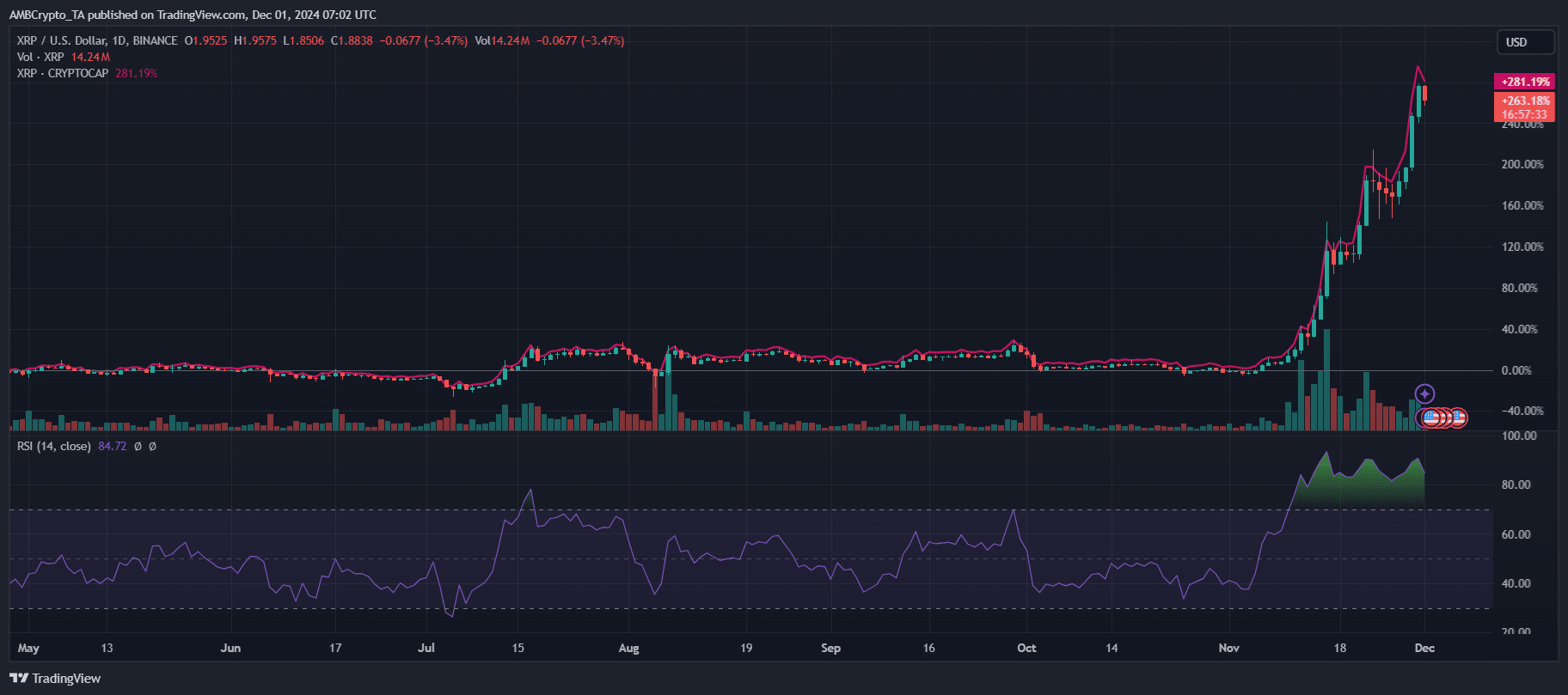

Technical analysis suggested potential resistance close to $2.00, an important psychological and structural barrier.

The question arises as to whether XRP’s price trend will continue climbing or be impacted by profit-taking, considering the high Relative Strength Index (RSI) and the excitement in the market.

Short-term momentum or long-term rally?

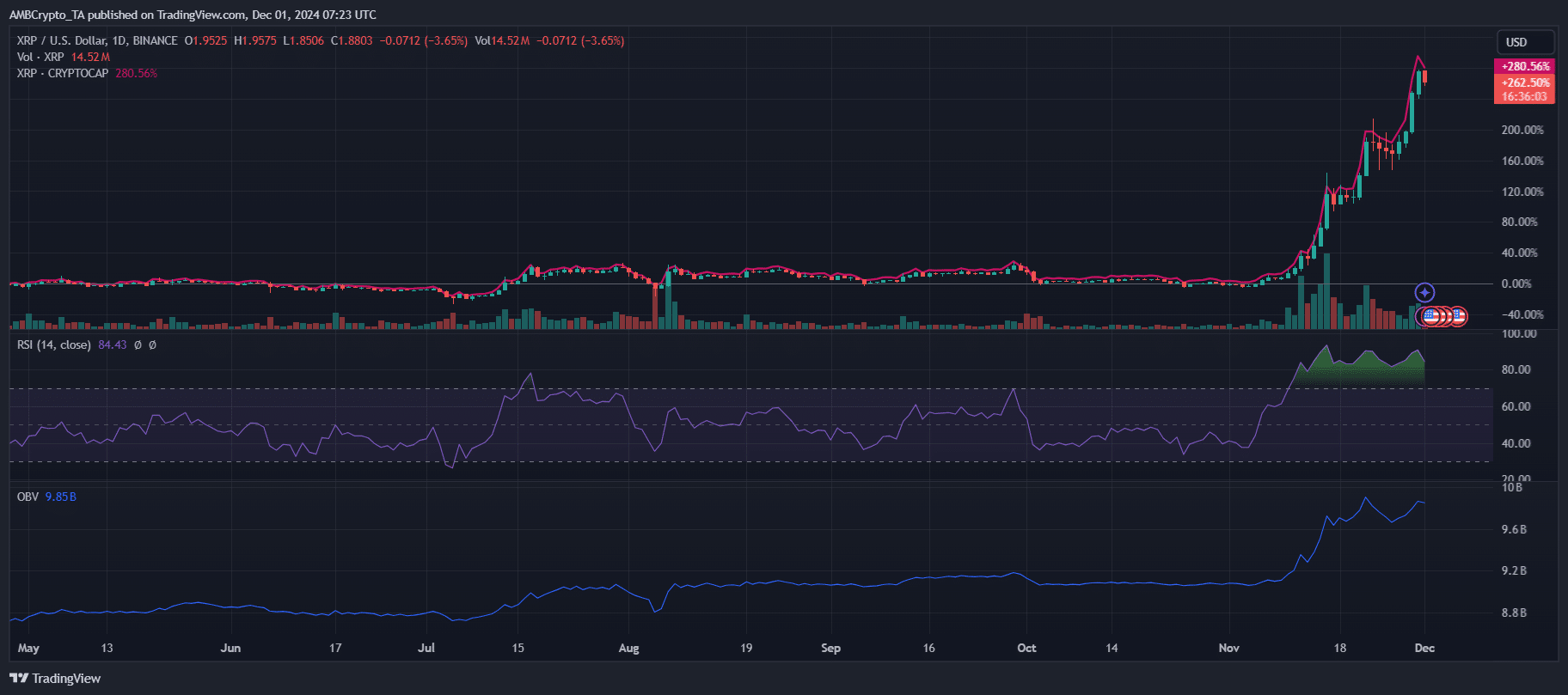

As a researcher examining the Relative Strength Index (RSI), I’ve noticed a reading of 84.49. This high RSI value indicates overbought conditions, potentially signaling a brief period of correction or pullback as the price approaches resistance around $2.

In spite of this, the Open Interest on the OBV has reached a high of 9.85 billion, demonstrating robust accumulation and continuous optimism among buyers.

As a researcher, I’ve observed historically that increased Relative Strength Index (RSI) levels tend to signal a period of profit-taking. However, persistent growth in On-Balance Volume (OBV) might suggest that large-scale institutional buyers and ‘whales’ are supporting the rally, thus maintaining its momentum.

Support is strongest around the $1.75 mark, which coincides with previous breakthrough points. The $2.00 level, however, serves as both a psychological and technical hurdle.

The divergence between increasing volume and stretched momentum metrics implies a tug-of-war between bullish euphoria and consolidation risks.

The future course of XRP depends on its success in drawing new investment, all the while handling extended market situations.

In the past, XRP has shown remarkable expansion, particularly during market upswings (bull runs), like the one in 2017 where its worth increased dramatically by more than 36,000 times.

In late 2021, XRP saw a substantial increase, driven by rising adoption and anticipation in the market.

At present, the situation appears to be mirroring past trends remarkably, as we witness increased trading activity and a revival of investor trust.

In contrast to previous market cycles, the emergence of regulatory clarity and the increasing use of XRP for cross-border transactions might be crucial in maintaining this price surge.

Possible catalysts behind XRP’s recent surge

The continued surge in value is due to a combination of influences. Clearer regulations following Ripple’s successful court battles have boosted institutional trust, and collaborations in the global remittance market underscore XRP’s practical uses.

An uptick in whale behavior, evident through ascending On-Balance Volume (OBV), suggests substantial hoarding is taking place. The overall market mood, fueled by Bitcoin‘s robust performance and altcoin surges, is boosting the positive trend.

Read XRP’s Price Prediction 2024–2025

Furthermore, the approaching launch of liquidity paths for RippleNet and the increasing popularity in the Asia-Pacific region may well have driven this increase.

Combined, these elements make XRP shine, possibly setting it on a path for continuous expansion in an ever-changing market environment.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-01 16:08