- Theta has surged by 158.86% over the past month.

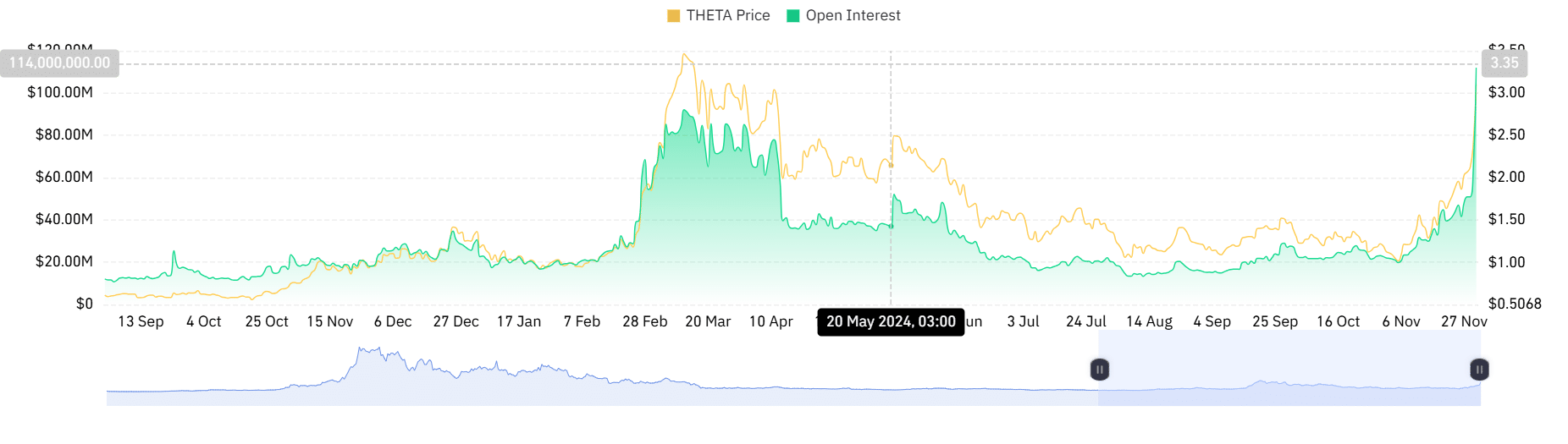

- The Futures Open Interest spiked over the past 24 hours to a new ATH of $111.9 million.

As a seasoned crypto investor with over a decade of experience in this dynamic market, I find myself intrigued by Theta Network’s [THETA] recent surge. Having witnessed numerous bull and bear cycles, I can confidently say that THETA’s 158.86% rise over the past month is noteworthy.

For about a month now, Theta Network’s price, represented by its token [THETA], has been steadily increasing. After dipping down to $1.25 towards the beginning of the previous month, it has since soared up to an 8-month high of $3.1.

At the moment, THETA is currently being exchanged for approximately $2.8. This represents a substantial 24.67% rise over the past day. Furthermore, the digital currency has also experienced a significant surge on both weekly and monthly charts, climbing by 45.62% and an impressive 158.86% respectively.

But despite the recent price pump, THETA remains 81.91% below its ATH of $15.90. However, the current market condition points towards rising demand and positive sentiment.

What THETA’s charts say

Based on AMBCrypto’s assessment, there was robust demand and a positive outlook for THETA as the markets were closing.

According to Santiment’s data analysis, the Weighted Sentiment significantly increased from -0.1 to 0.7. This indicates that a majority of investors leaned towards positive sentiments, as opposed to those exhibiting negative ones.

When positive sentiment is higher, it implies that most investors are betting on prices to rise.

Furthermore, AMBCrypto noted a surge in demand due to escalating trading activities. Consequently, the trading volume surged by an astounding 442% over the past 24 hours, reaching a substantial level of $682.33 million.

As a crypto investor, I’ve noticed an increasing demand in the market, as indicated by the soaring Open Interest. Over the last 24 hours, the Open Interest for Futures has surged significantly, reaching an unprecedented peak of $111.99 million – a new record high.

A significant increase in Open Interest indicates that investors are likely creating new investments as well as maintaining their current positions, suggesting high levels of trading activity.

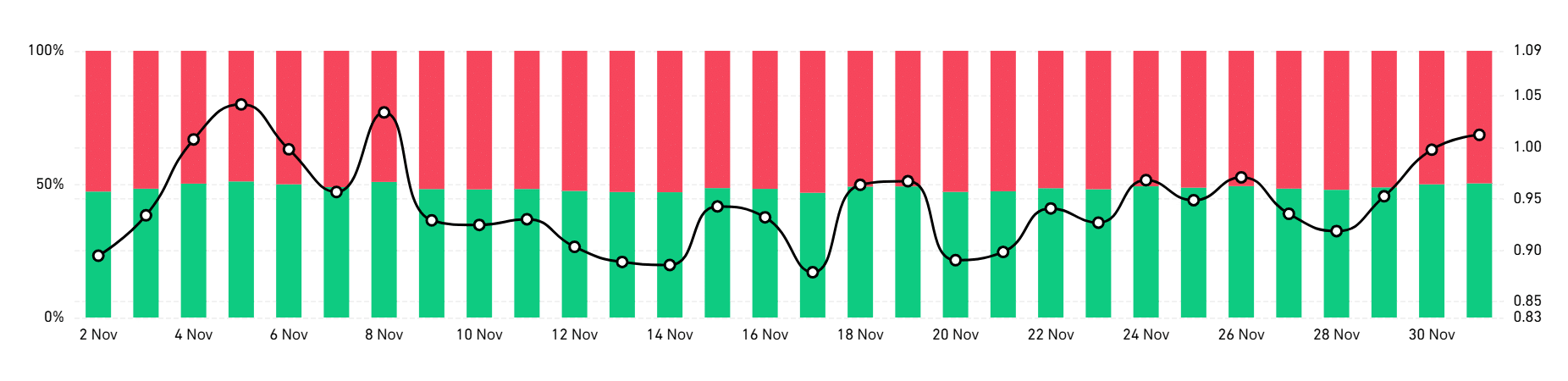

Notably, the majority of these vacant roles tend to be long-term positions, as reported by Coinglass. The Long/Short Ratio for THETA suggests that those holding long positions have been predominantly controlling the market.

This implied that most traders were betting on prices to rise.

The optimism among buyers is quite noticeable, and this is shown through THETA’s Advance Decline Ratio (ADR) rising to 1.9. This suggests that buyers held the majority, thereby driving prices upward for further growth.

This dominance among buyers has created a strong upward momentum, as evidenced by a rising RVGI.

Read Theta Network’s [THETA] Price Prediction 2024–2025

What’s the next move?

At the current moment, THETA was showing a significant surge in its price trend. Consequently, traders who were buying had been leading the market, causing a continuous upswing or bullish trend.

Given the current market trends, it’s likely that THETA may encounter its next major resistance at approximately $3.3. Following this, we might observe a market adjustment causing THETA to retreat to around $2.6.

Read More

2024-12-02 01:11