- BTC’ biggest threat right now is a decline in institutional backing at a time when volatility is increasing.

- If this trend continues, $90K could serve as the local support level.

As a seasoned researcher with over a decade of experience in the financial markets, I have witnessed numerous cycles and trends that have shaped my perspective. From the 2008 global financial crisis to the rise of cryptocurrencies, I’ve seen it all.

🚀 EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastAs a researcher, I’ve been closely observing the dynamic behavior of Bitcoin (BTC) lately. Remarkably, the market has exhibited an impressive level of resilience, maintaining its bullish stance even as we approach the final month of the year without crossing the $100K threshold. The robust demand seems to be effectively counterbalancing the sell-side pressure, fueling this optimistic outlook.

As an analyst, I’ve observed that numerous investors have cashed out their gains, leaving the market cycle. However, the lack of a substantial correction suggests a strong fear of missing out (FOMO) among current investors, indicating their eagerness to continue participating in this market trend.

Despite clear signs of progress towards reaching $100K and the expected Federal Reserve rate cut boosting confidence, AMBCrypto questions if a possible correction down to $90K might serve as the trigger for Bitcoin’s significant upcoming shift.

Loss of institutional support could pose a major threat

At the moment, Bitcoin finds itself at a pivotal juncture, where its future direction depends largely on continued backing, stemming from consistent investment by both individual and institutional investors.

Due to Microstrategy’s significant investment in Bitcoin, fluctuations in the value of Bitcoin tend to have a larger impact on the performance of their stock (MSTR).

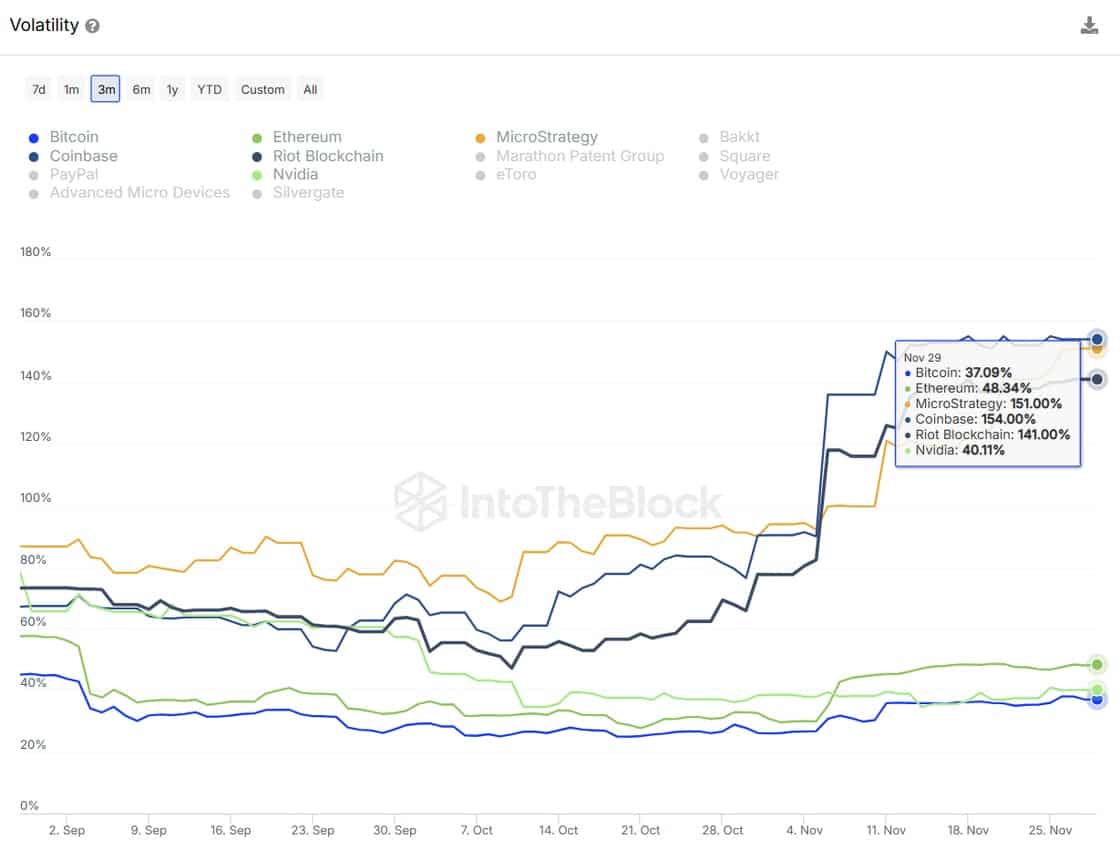

According to the graph, it’s shown that MicroStrategy’s volatility is around four times greater than Bitcoin’s. This means that compared to Bitcoin, the price of MicroStrategy’s stock may potentially swing up or down by a factor of four, leading to a significantly increased and quantifiable risk for its investors.

Source : IntoTheBlock

Under these weather conditions, the allure of Bitcoin as a safe investment might diminish, possibly leading to mass selling by institutions and forced liquidation of holdings.

As the volatility in MicroStrategy’s stock increases, it is causing investors to reconsider their investments related to Bitcoin, especially those involving MSTR. This potential shift could trigger a wider adjustment across the financial markets.

Due to some intense selling activity, Mastercard’s (MSTR) premium Bitcoin holdings have plummeted from a high of 240 on November 20th down to 135 within approximately seven trading days. If this selling pressure persists, it could lead to substantial losses for Bitcoin investors, possibly causing the price to dip even further in a more pronounced market correction.

So, keep the volatility in check

In simpler terms, at 63, the cryptocurrency volatility index shows a moderate level of market fluctuations, not too intense, but still noticeable. This reading comes after a recent surge two days back that pushed it above the traditionally strong 60 threshold.

Source : CryptoVolatilityIndex

If the Volatility Index recovers significantly, it might increase toward, or even surpass, the earlier resistance level approximately at 70. An index value above 70 suggests potential for larger price swings and increased market turbulence.

Looking at Bitcoin’s recent price graph, it appears to have experienced significant ups and downs during the last week. This volatility could potentially dampen the trust of institutions when it comes to a steep upward trend (parabolic run).

Historically, a volatility index hitting a peak has coincided with Bitcoin reaching a bottom.

This new development lends credence to the previous analysis by AMBCrypto, suggesting that Bitcoin might reach a temporary low point. This could result in a period of reduced fluctuation, heightened institutional fear of missing out (FOMO), and possibly a breakaway from its unpredictable price trends.

Where could BTC see a healthy retracement?

According to the latest findings, there appears to be a crucial support point at around $90,000. This level signifies a substantial base for potential recovery, primarily due to strong retail buying activity and institutional backing from Exchange-Traded Funds (ETFs).

In other words, when market volatility reaches a level where large price fluctuations happen quickly, it’s quite likely we might experience a market correction or pullback.

As a researcher, I find myself pondering over a situation where a sum of $90,000 might function as an enticing liquidity pool. This attractive pool could draw the interest of both individual swing traders and larger institutional entities. Such increased attention might potentially trigger a surge in price.

As an analyst, I’m observing a notable trend among traders regarding the upcoming Federal Reserve meeting. They are progressively raising their expectations for a 25-basis point interest rate reduction in December. Currently, the market estimates a 64.7% likelihood of this event occurring, which is a significant increase from the 55.7% probability just a week prior.

Read Bitcoin’s [BTC] Price Prediction 2024-25

It’s quite possible that this economic decision could lead to abrupt fluctuations in the derivatives market, potentially causing a situation where many who have sold these derivatives without owning them (short sellers) may be forced to buy them back quickly due to rising prices. This rapid buying could escalate the price even higher.

Consequently, the instability in the market could increase significantly, offering potential opportunities for a correction since numerous institutions might decide to halt their Bitcoin buying spree due to the perceived high risk involved.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- E.T.’s Henry Thomas Romances Olivia Hussey’s Daughter!

- Gumball’s Epic Return: Season 7 Closer Than Ever!

2024-12-02 11:36