- Between the first week of January and now, DOGE has increased by around 480%.

- It saw more positive trends in November.

As a seasoned crypto investor with a knack for spotting trends and interpreting charts, I can confidently say that the current bullish outlook for Dogecoin [DOGE] is nothing short of intriguing. Over the past few weeks, DOGE has demonstrated a remarkable performance, with its value skyrocketing by around 480% since early January, and even more positively in November.

Dogecoin (DOGE) is drawing interest in the market once more, as its technical signals and price movements hint at a possible surge against Bitcoin (BTC), potentially signaling a breakthrough.

A chart analysis revealed a bullish pattern that could propel DOGE by as much as 2,400%. Recent on-chain data analysis showed positive trends, adding further weight to this potential upward move.

Dogecoin vs. Bitcoin

The graph of Dogecoin clearly indicated a powerful escape from a prolonged downward trending pathway. This escape, characterized by robust positive energy, sets up Dogecoin for a possible significant increase in value.

As an analyst, I’ve calculated that if we see a breakout, the potential price target for Bitcoin could reach approximately 0.00009375 BTC. This represents a significant increase of around 2,400% from our current levels.

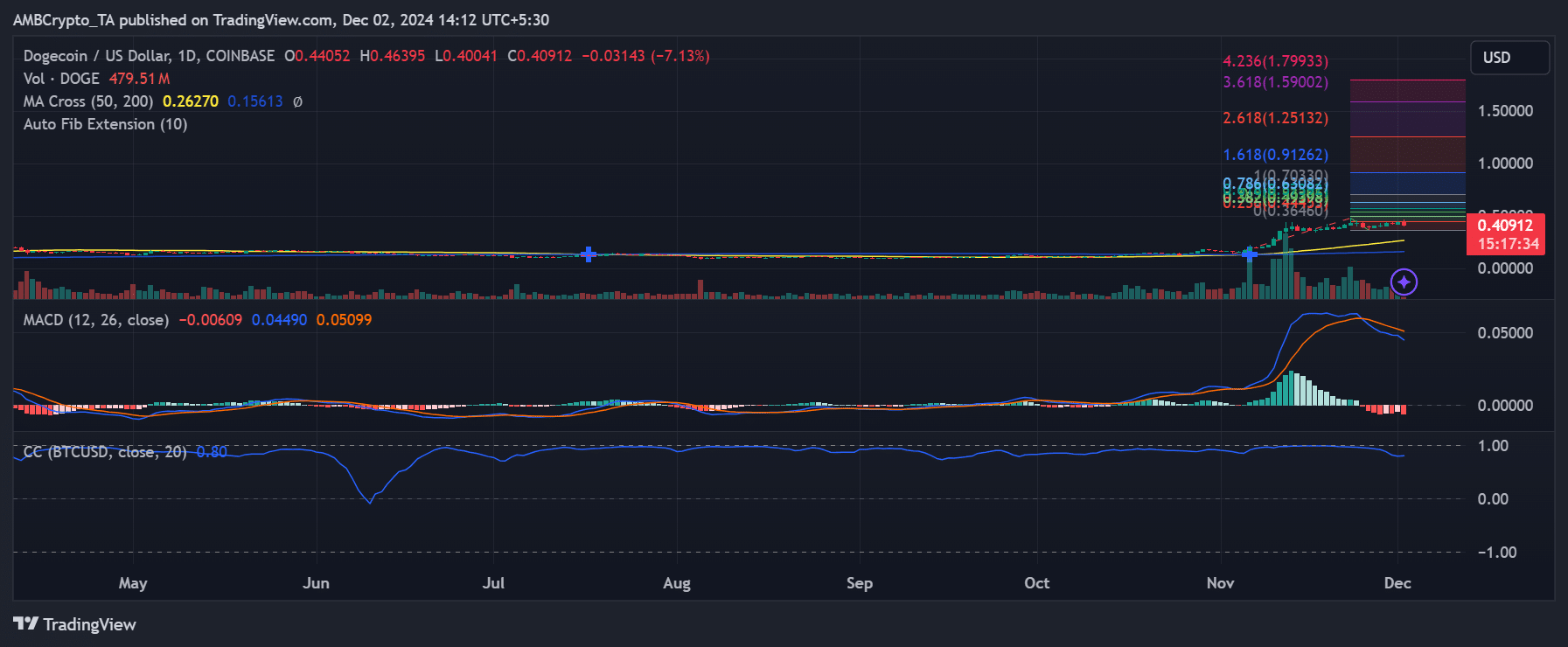

On the Dogecoin-to-US-Dollar daily chart, the Moving Average Convergence Divergence (MACD) indicator reinforced a bullish outlook. Specifically, the MACD line surpassed the signal line, suggesting an escalating positive trend.

The histogram shows slight consolidation – this is typical during early breakout phases. Additionally, the 200-day moving average provided strong support around $0.26, reinforcing the possibility of sustained bullish momentum.

At the current moment, the connection between Bitcoin (BTC/USD) and Dogecoin (DOGE/USD), as represented by the correlation coefficient (CC), shows a value of -0.80. This suggests that these two cryptocurrencies tend to move in opposite directions, implying an inverse relationship.

When Bitcoin was holding steady around $95,000, Dogecoin seemed ready to take advantage of the market’s increasing focus on alternative coins, a pattern often seen during bull markets as liquidity tends to move towards altcoins.

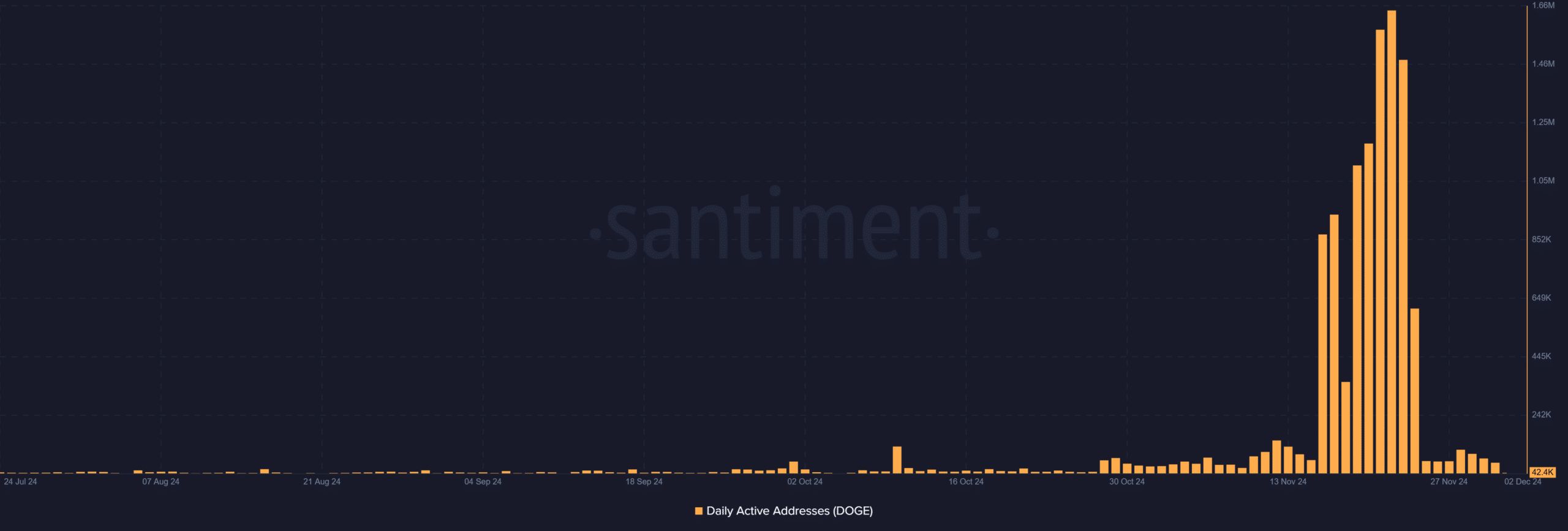

Surge in daily active addresses

According to AMBCrypto’s analysis of Santiment data, there was a substantial spike in the number of daily active Dogecoin users towards the end of November, reaching approximately 1.6 million. This represents a considerable uptick compared to the relatively low activity observed earlier in the year.

Historically, an increase in active addresses has often been a precursor to significant price surges, indicating that investors are showing renewed enthusiasm and engaging more with the network.

Furthermore, it appears that the frequency of significant whale transactions is increasing, suggesting that either institutional investors or wealthy individuals are preparing for a possible price increase.

The coordination between on-chain actions and technical breakout indicators strengthens the optimistic perspective regarding Dogecoin’s price trend.

Dogecoin market sentiment and price projections

The general feeling or anticipation towards Dogecoin is positive, as shown by the rise in conversations and mentions about DOGE online.

Based on my personal experience and observations, I’ve noticed that certain assets tend to perform exceptionally well in high-energy markets fueled by hype. This phenomenon has been consistent throughout my career as a trader, and I’ve learned that such environments can significantly boost an asset’s potential growth. In these circumstances, the excitement and anticipation surrounding the asset create a self-reinforcing cycle, driving prices upwards and potentially leading to substantial returns for investors who are attuned to the market dynamics. However, it is important to remember that hype-driven markets can also be volatile, and there is always a risk of sudden corrections or crashes when the hype subsides. So, while riding the wave of hype can lead to impressive gains, it’s crucial to exercise caution, conduct thorough research, and maintain a disciplined approach to investment strategies.

As a researcher studying the cryptocurrency market trends, I’ve observed that based on Fibonacci extensions from the recent low, Dogecoin appears to encounter resistance at approximately $0.78 (the 2.618 Fibonacci level). If this trend continues, there seems to be a long-term target for Dogecoin at around $1.79 (the 4.236 extension).

This forecast corresponds with the potential high point indicated in the Dogecoin to Bitcoin (DOGE/BTC) price chart, suggesting a strong likelihood for significant returns. Yet, it’s essential for traders to be mindful of potential selling spikes at notable psychological thresholds, like $1.00.

Realistic or not, here’s DOGE market cap in BTC’s terms

Dogecoin appears poised for a potentially significant surge, backed by promising technical signals.

As Bitcoin stabilizes, Dogecoin’s opposite relationship with Bitcoin makes it even more fascinating, placing it at the forefront of altcoins that are showing strong performance.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

2024-12-02 21:12