- Ethereum whales accumulate $188M in two days, sparking speculation of a $4,000 target

- Retail interest rises as Ethereum eyes key levels, with risks and momentum in play

As a seasoned analyst with over two decades of market observation under my belt, I’ve seen my fair share of market shifts and trends. The current surge in Ethereum [ETH] activity has definitely caught my attention. Whale accumulation to the tune of $188 million within just two days is a significant move, signaling a potential change in market sentiment.

The cryptocurrency Ethereum (ETH) is causing a stir again, as the activity of major investors (whales) increases significantly, leading to these big players amassing substantial amounts of ETH valued in millions of dollars.

Over the course of only two days, large Ethereum investors, known as whales, have accumulated roughly $188 million worth of Ethereum, suggesting a possible change in the overall market outlook.

The rising demand for whales purchasing along with escalating retail interest suggests a possibility that the price of Ethereum might exceed crucial thresholds, and a target of $4,000 is becoming increasingly likely.

In the midst of anticipation about the future direction of the cryptocurrency market, I find myself closely monitoring Ethereum’s price movements, trying to gauge if its current bullish trend has staying power.

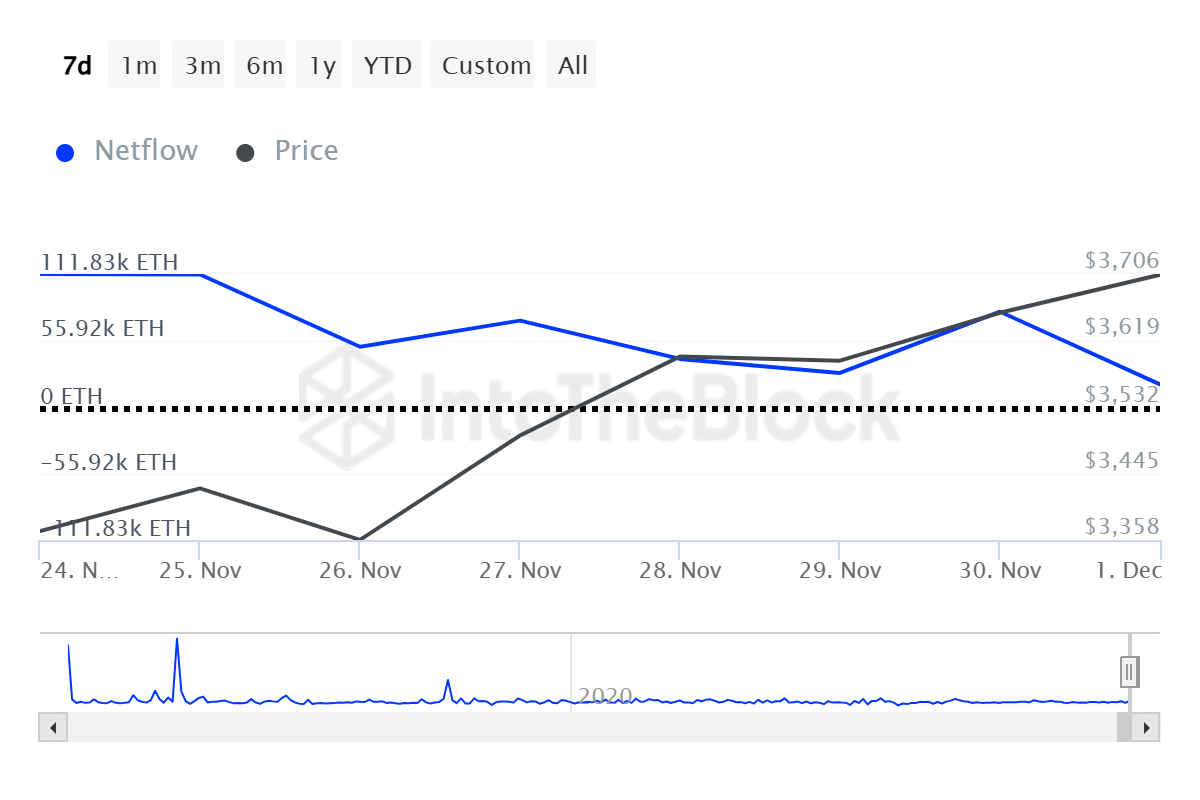

Ethereum whales netflow signals a shift in market behavior

In the past two days, there’s been a noticeable increase in large investors (whales) purchasing Ethereum, amassing approximately 111,000 ETH, which is equivalent to around $188 million.

On November 24th, there was a significant surge in the data depicted by the network flow chart, which subsequently decreased at a steady pace, indicating a period of deliberate stockpiling or accumulation.

It’s worth noting that this increase aligns with Ethereum reaching the $3,600 mark again, implying that large investors may be anticipating additional price growth.

Generally speaking, when there’s more money flowing into an investment (positive net inflow) from institutions and wealthy individuals, it usually suggests they have increased trust or optimism about the investment’s future performance. Such confidence often leads to a surge in the market value of the investment (bullish price action).

However, sustained inflows will be critical to maintaining this momentum, particularly as Ethereum approaches the psychologically significant $4,000 resistance.

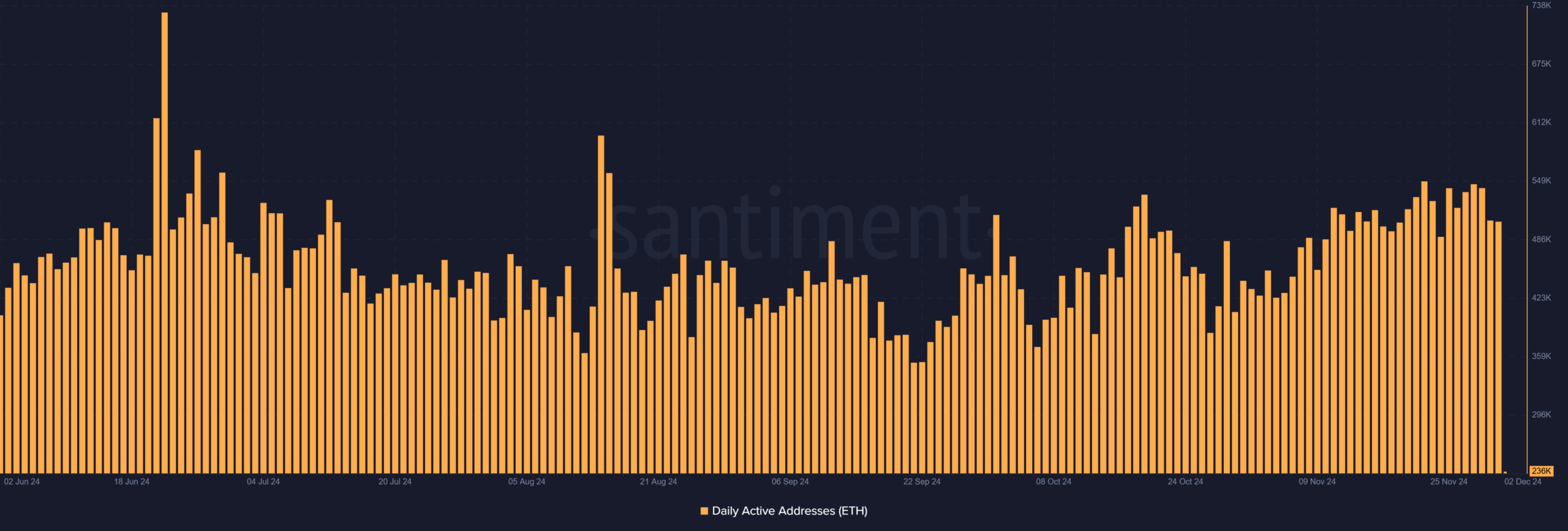

Retail interest in ETH soars

While whale accumulation leads, retail activity in Ethereum was seeing notable growth.

In late November 2024, there was a significant surge of over 500,000 daily active Ethereum users, demonstrating consistent involvement by individual investors, suggesting ongoing engagement from the retail market.

Moreover, the growth of Ethereum’s DeFi sector and excitement about the upcoming Shanghai update are adding to the sense of optimism.

Although retail enthusiasm often fuels market surges, it can also lead to heightened volatility. Thus, it’s wise to exercise caution as Ethereum approaches the $4,000 threshold.

What’s next for Ethereum?

The direction of Ethereum’s advancement hinges on its capacity to surpass the significant barrier at $4,000. Should it accomplish this feat, a surge towards $4,500 may ensue, bolstered by substantial involvement from both large investors (whales) and regular investors (retail).

Moreover, it’s clear that Ethereum is becoming increasingly useful, as demonstrated by the growth of its Decentralized Finance (DeFi) environment and its leading role in the Non-Fungible Token (NFT) market. Notably, transactions on Ethereum platforms have experienced a substantial surge recently, even amidst some market volatility.

Nevertheless, potential hazards persist. If the broader cryptocurrency market experiences a correction, especially if Bitcoin dips below $94,000, it might slow down Ethereum’s progression.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Also, rising gas fees might discourage retail adoption, limiting potential price growth.

Currently, the positive perspective on Ethereum continues, yet it’s essential for Ethereum to sustain purchasing power among both institutional and individual investors for further growth and prosperity.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Solo Leveling Season 3: What Fans Are Really Speculating!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-12-02 23:04