- More BTC LTHs have sold their holdings in the past week.

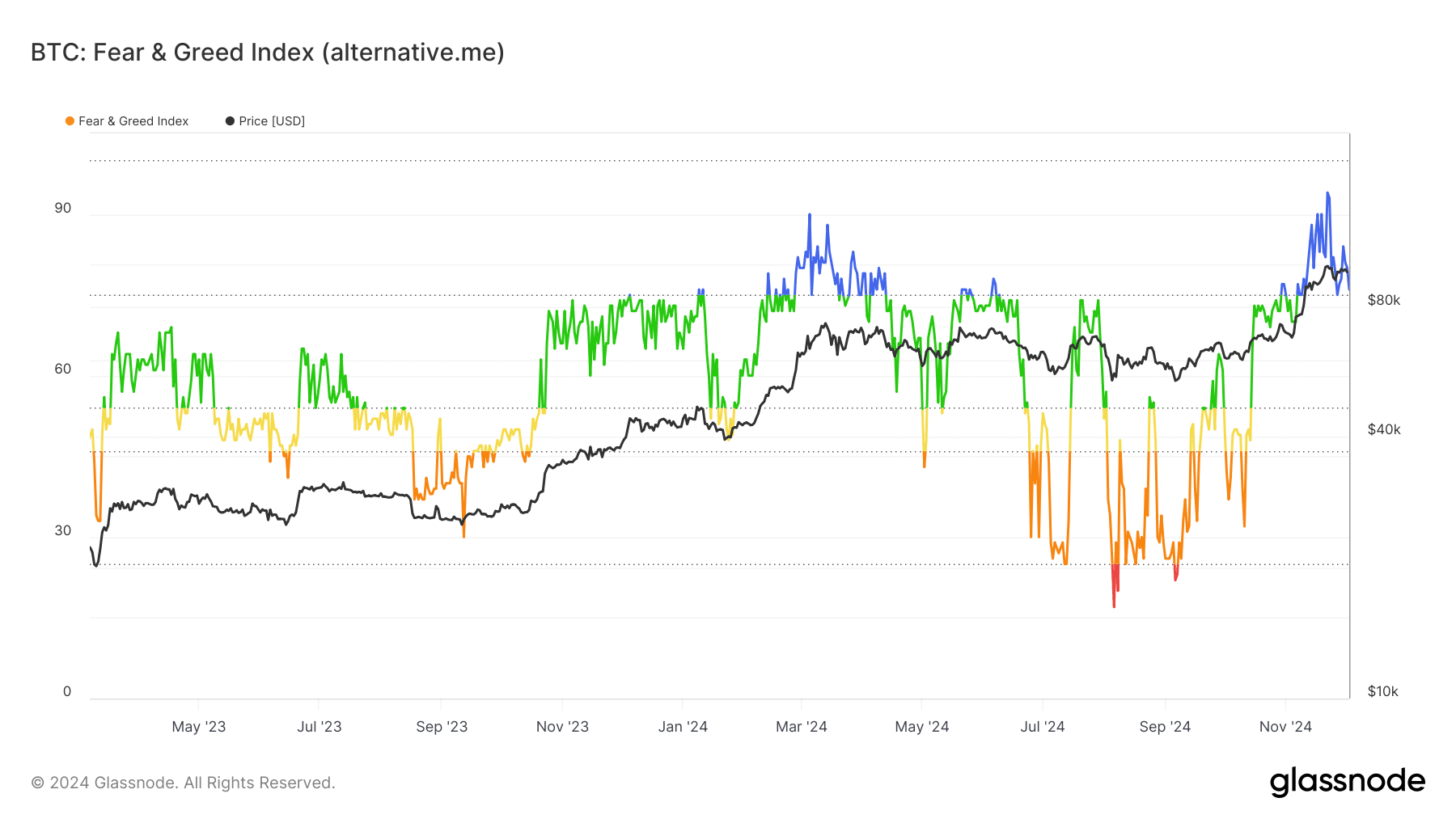

- The market remained in the “Greed” phase despite these sell-offs.

As a seasoned researcher with years of experience analyzing cryptocurrency markets, I must say that the recent developments in Bitcoin are intriguing and reminiscent of some patterns we’ve seen before. The significant drop in exchange balances to levels not observed since early 2023, coupled with the surge in Bitcoin’s price above $90,000, seems to tell a compelling story of accumulation by both retail and institutional investors.

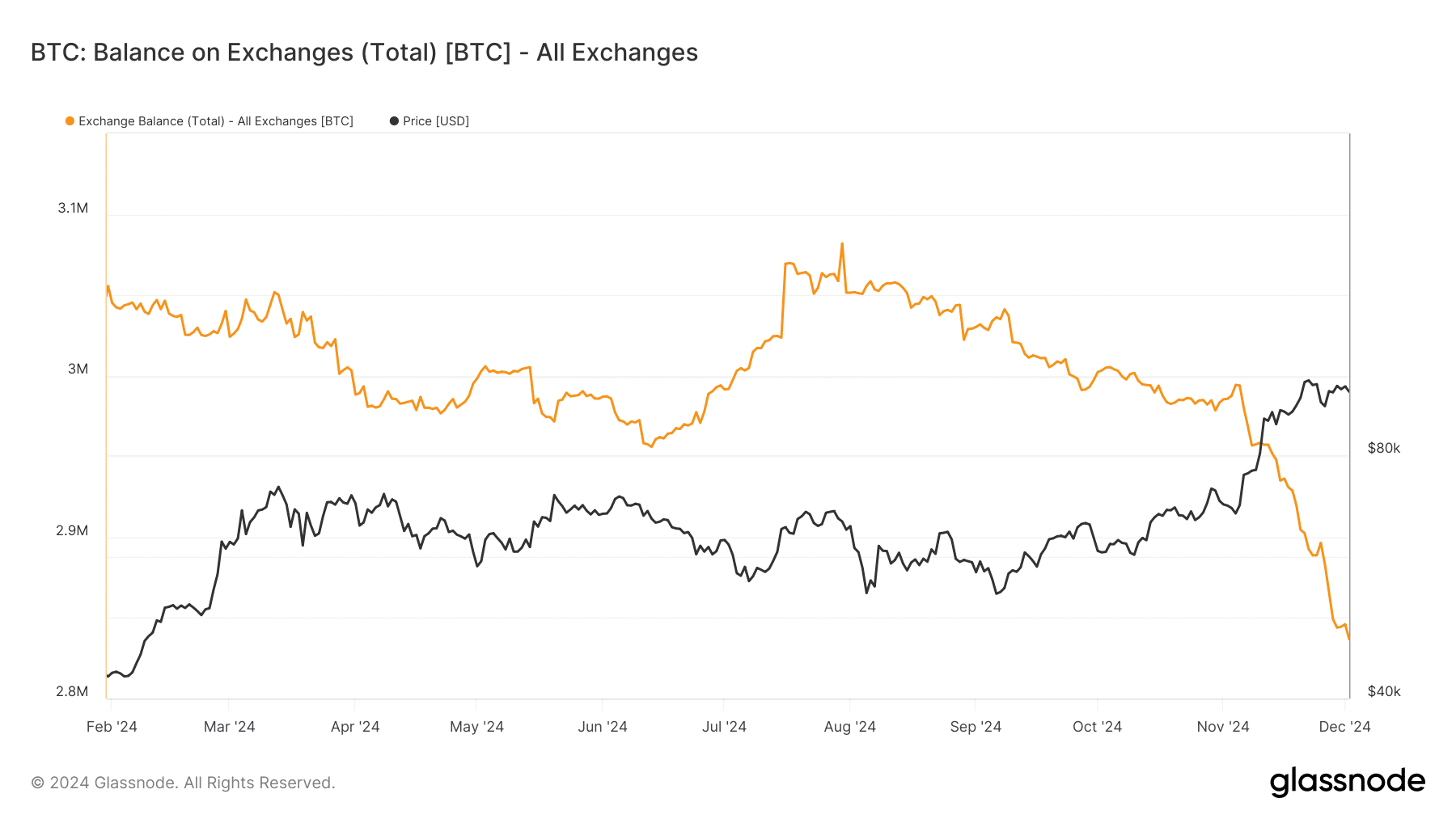

The balance of Bitcoin [BTC] on exchanges has noticeably reduced, dropping to levels last seen in the beginning of 2023. This steep decrease, along with rising prices and shifts in long-term investor habits, creates a persuasive depiction of the present market conditions.

Examining key indicators like exchange reserves, long-term investor holdings, and the Fear & Greed Index, AMBCrypto uncovered insights about how Bitcoin’s price movement might unfold in the near future and its potential impact on the overall cryptocurrency market.

Bitcoin exchange balance hits multi-year lows

The data indicates a decrease in the total Bitcoin holdings on all trading platforms, which currently stands at around 2.8 million Bitcoins. This figure was higher, at over 3.2 million Bitcoins, just a few months ago.

A substantial decrease in available reserves for exchange often aligns with optimistic market attitudes, implying reduced chances of intense selling activity.

People transferring Bitcoin to their personal wallets frequently show signs of long-term investment strategies or a shift towards personally managing their assets. This action suggests they are optimistic about Bitcoin’s potential price growth in the future.

As a researcher, I’ve noticed an intriguing correlation: the recent surge in Bitcoin’s price exceeding $90,000 seems to indicate a period of accumulation, potentially driven by both individual and institutional investors.

A decrease in available exchange balances accompanied by an increase in prices may indicate a shrinking supply of liquidity on trading platforms. This situation could potentially cause price swings to become more pronounced if there’s a surge in demand.

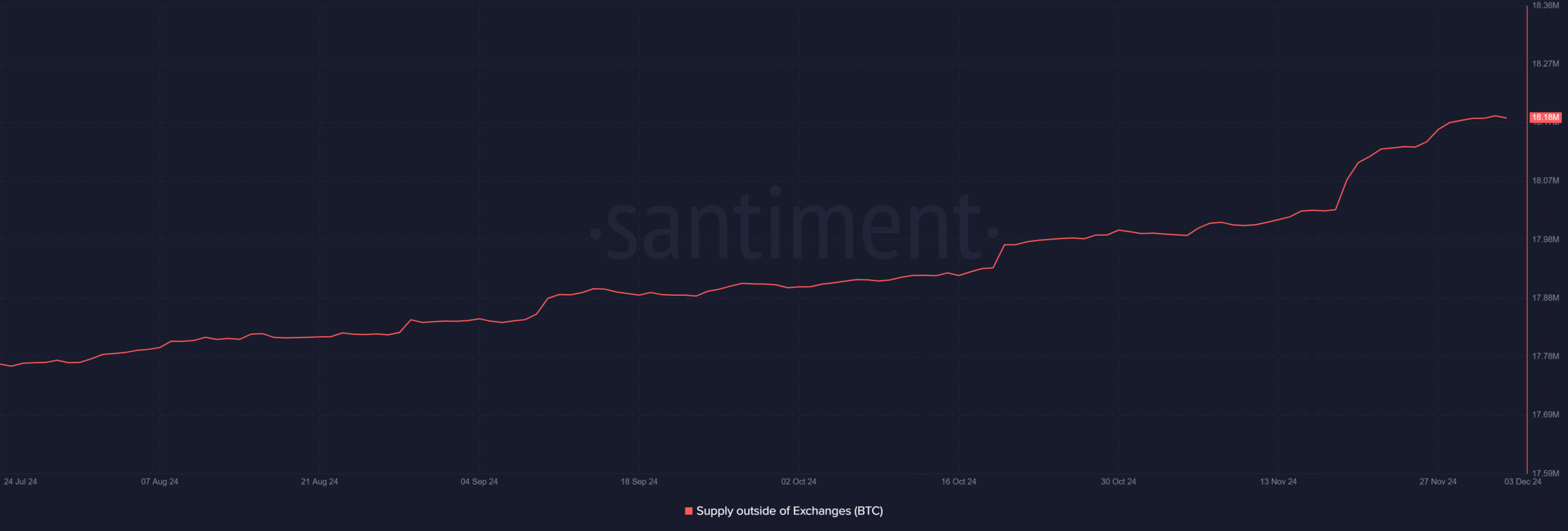

More BTC goes off exchanges

Building on this trajectory, I’ve observed an incremental increase in the circulation of Bitcoin beyond cryptocurrency exchanges, reaching a milestone of approximately 18.18 million Bitcoins.

Historically, stepping back from trading platforms tends to decrease the amount of sellers, leading to a tightening of supply. This situation usually fosters beneficial circumstances for price increases, particularly when there’s high demand in the market.

Long-term holders shift gears

Examining the shift in Long-Term Holders’ (LTHs) net position shows an intriguing storyline. For several months now, LTHs have been amassing assets, but recently, they have begun to sell off their holdings. This downward trend suggests that these investors are realizing profits at current price points, a normal occurrence during bullish market periods where prices increase over time.

Yet, the decrease in Long-Term Holder (LTH) positions might not signal bearishness straight away. Instead, this trend could be counterbalanced by heightened involvement from short-term traders and a spike in self-custody.

Sentiment remains positive amid declining balance

The Fear & Greed Index signals “Greed,” reflecting Bitcoin’s recent price highs and bullish sentiment. The index has stayed in the “Greed” or “Extreme Greed” zone for several weeks, which is linked to increased retail participation and speculative buying.

In other words, excessive greed might indicate a market is overbought, but it could also be indicative of robust short-term or medium-term growth momentum.

A decrease in the amount of Bitcoin held on exchanges suggests a possible shortage in supply, which might cause Bitcoin prices to increase, unless there are major economic events that interfere.

What does this mean for Bitcoin

Bitcoin’s significant drop in exchange holdings paired with an increase in circulation beyond exchanges signifies a market undergoing change. This situation is intricate yet potentially positive, as it results from lower exchange balances due to profit-taking by long-term investors, increased greed, and high levels of supply outside exchanges.

Reduced foreign currency reserves suggest that the availability is becoming more restricted. Yet, the act of cashing out by long-term investors could potentially lead to temporary price fluctuations in the market, as it processes these transactions.

Read Bitcoin (BTC) Price Prediction 2024-25

Moving forward, whether Bitcoin can maintain its upward trend relies heavily on the continuation of accumulation patterns, a stable economic environment, and the attraction of fresh investment funds.

Given the ongoing trajectory, it’s possible that Bitcoin might keep ascending to unprecedented peak values, boosted by robust on-chain indicators and optimistic market feelings. As we speak, Bitcoin is being exchanged at approximately $95,000.

Read More

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

2024-12-03 17:12