- US government moved $1.92 billion in Bitcoin, fueling concerns about potential market impact.

- Bitcoin sale fears rise, but transfers may be for safekeeping, not imminent liquidation.

As a seasoned crypto investor with over two decades of experience navigating the digital asset landscape, I find myself constantly monitoring market trends and government actions that could potentially impact the value of my investments. The recent move by the US government to transfer $1.92 billion worth of Bitcoin has certainly caught my attention.

During the preparation for Donald Trump’s second term inauguration on 20th January, 2025, the United States administration has made substantial moves concerning its Bitcoin reserves.

Lately, approximately $1.92 billion in Bitcoin, mostly confiscated during the Silk Road case, has been moved to new digital wallets.

Out of this amount, $963 million was instantly transferred to Coinbase, an action suggesting possible upcoming transactions.

This transaction is an indication of a wider movement, as the U.S. authorities have moved significant amounts of Bitcoin, roughly $2.6 billion from July to August, suggesting possible plans for selling off these assets.

Is the Biden admin planning something big?

With rising apprehensions, people in the community are questioning whether President Joe Biden could be trying to transfer the U.S. government’s Bitcoin holdings prior to Donald Trump’s inauguration, which might jeopardize efforts to create a national Bitcoin Reserve.

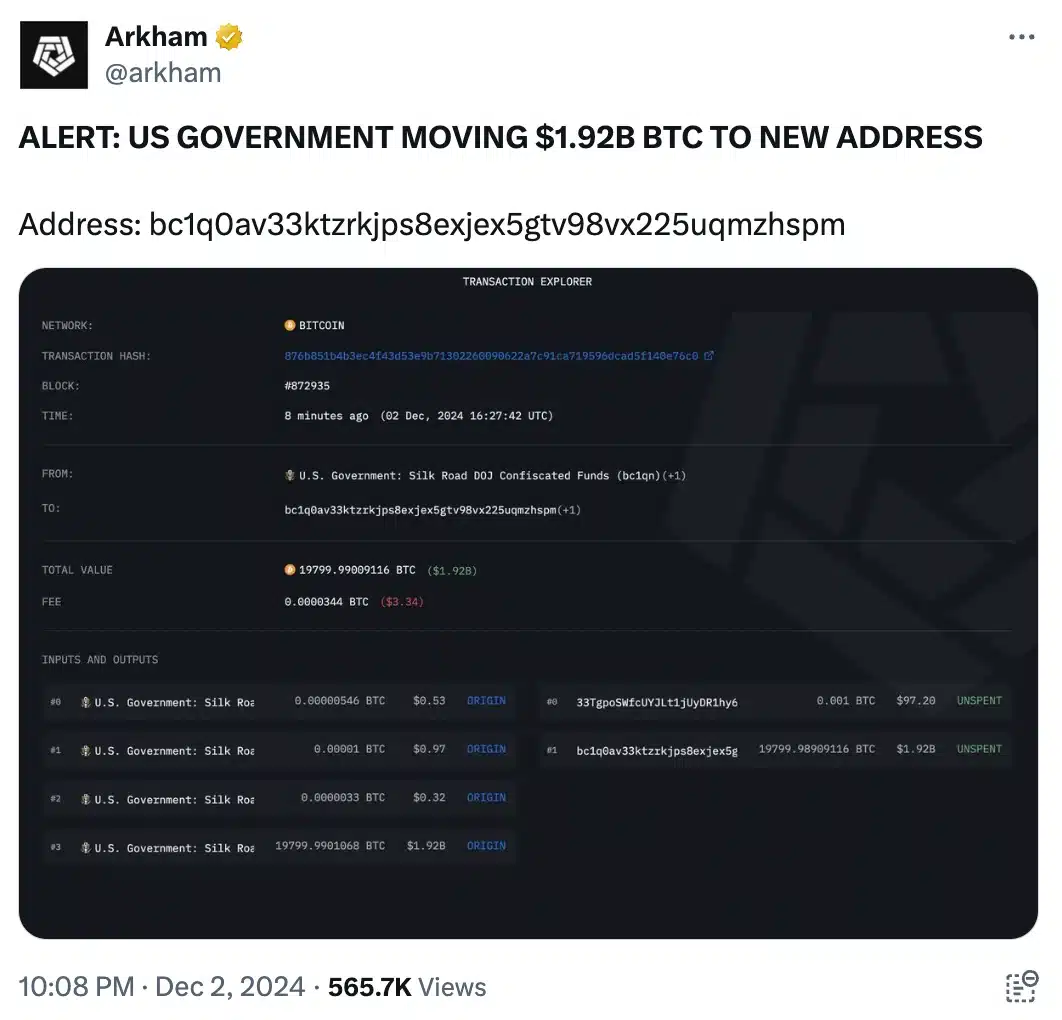

On December 2nd, 2024, Arkham’s on-chain data analysis indicated a transfer of approximately $1.92 billion in Bitcoin by the U.S. authorities to newly created digital wallets.

In this transaction, the assets were divided between two digital wallets. Later, approximately $963 million worth of Bitcoin was transferred to Coinbase, which has sparked discussions about possible future sell-offs and their potential effects on the cryptocurrency market.

The Bitcoins at issue were taken from the well-known Silk Road, and since they now belong to the U.S. authorities, worries are increasing that these could be auctioned off in large quantities, potentially causing a drop in the Bitcoin market.

Bitcoin’s recent and upcoming trends

This sale might lead to a noticeable decrease in Bitcoin’s value, potentially worrying investors.

In just a blink of an eye, the anticipated dread surfaced, as Bitcoin’s value, almost touching the $100k mark, plummeted to $95,229.66. This sudden drop represented a 0.20% decrease over the past 24 hours, as reported by CoinMarketCap.

Remarking on the situation, Carl B. Menger, an industry commentator said,

Is there a possibility that the government might dispose of Bitcoins prior to the inauguration of the new President? It is generally considered inappropriate for outgoing administrations to weaken the position of the incoming President, as the people’s vote has already signified their exit from office.

Yet, although there are worries about a possible deceleration in the cryptocurrency market after Donald Trump’s inauguration, the crypto community is maintaining a hopeful yet cautious outlook.

Challenges ahead

Based on historical trends, market rallies tend to slow down following presidential transitions; however, the cryptocurrency sector has demonstrated a strong capacity for resistance in previous instances.

To give an example, when the American administration recently decided to auction off $600 million worth of Bitcoin four months back, the market showed initial signs of instability. However, it swiftly recovered once the influx of institutional investments picked up pace.

Furthermore, even though the latest Bitcoin transactions from the Biden administration have ignited curiosity, these activities might not necessarily suggest an immediate intention to sell.

As a researcher, I’ve learned that the U.S. Marshals Service, who have a secure custody arrangement with Coinbase Prime, has indicated that the transferred assets were relocated for safekeeping purposes, rather than being immediately liquidated. It’s crucial to note that regulatory procedures must be followed before any sale can take place.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-03 17:44