- Bitcoin’s stablecoin influx hints at growing buying power and potential price breakout

- A 36% increase in short-term holders’ “HODL” behavior strengthens Bitcoin’s upward potential

As a seasoned researcher with over two decades of market analysis under my belt, I’ve seen trends come and go, but Bitcoin’s current trajectory is truly intriguing. The influx of stablecoins and the surge in HODLers’ confidence are reminiscent of the early days of the internet – you remember, when everyone was saying it would never amount to anything and then suddenly, boom!

Currently, Bitcoin (BTC) is fluctuating in a limited price band, with a ceiling at approximately $98,804 and a base close to $94,603. Yet, certain indicators from its on-chain activity hint that the primary cryptocurrency might be preparing for a substantial price rise.

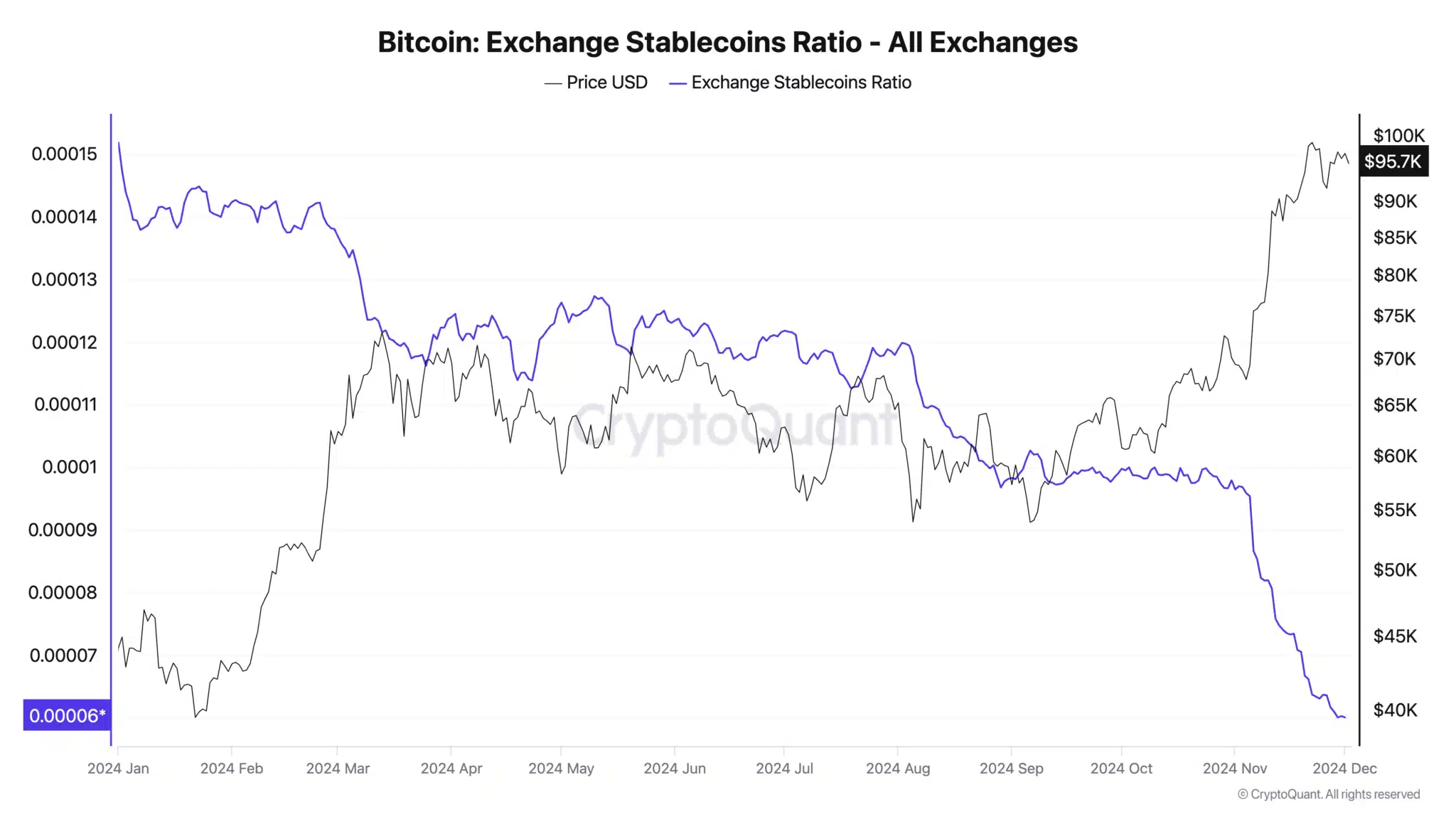

Significantly, the Exchange Stablecoins Ratio has dropped significantly, suggesting a surge in purchasing power on these platforms. This change in market trends has fueled speculations that Bitcoin could soon experience a surge, possibly exceeding its existing price band and heading towards new record prices.

As the market braces for potential growth, investor sentiment is growing increasingly optimistic.

A look into BTC’s performance

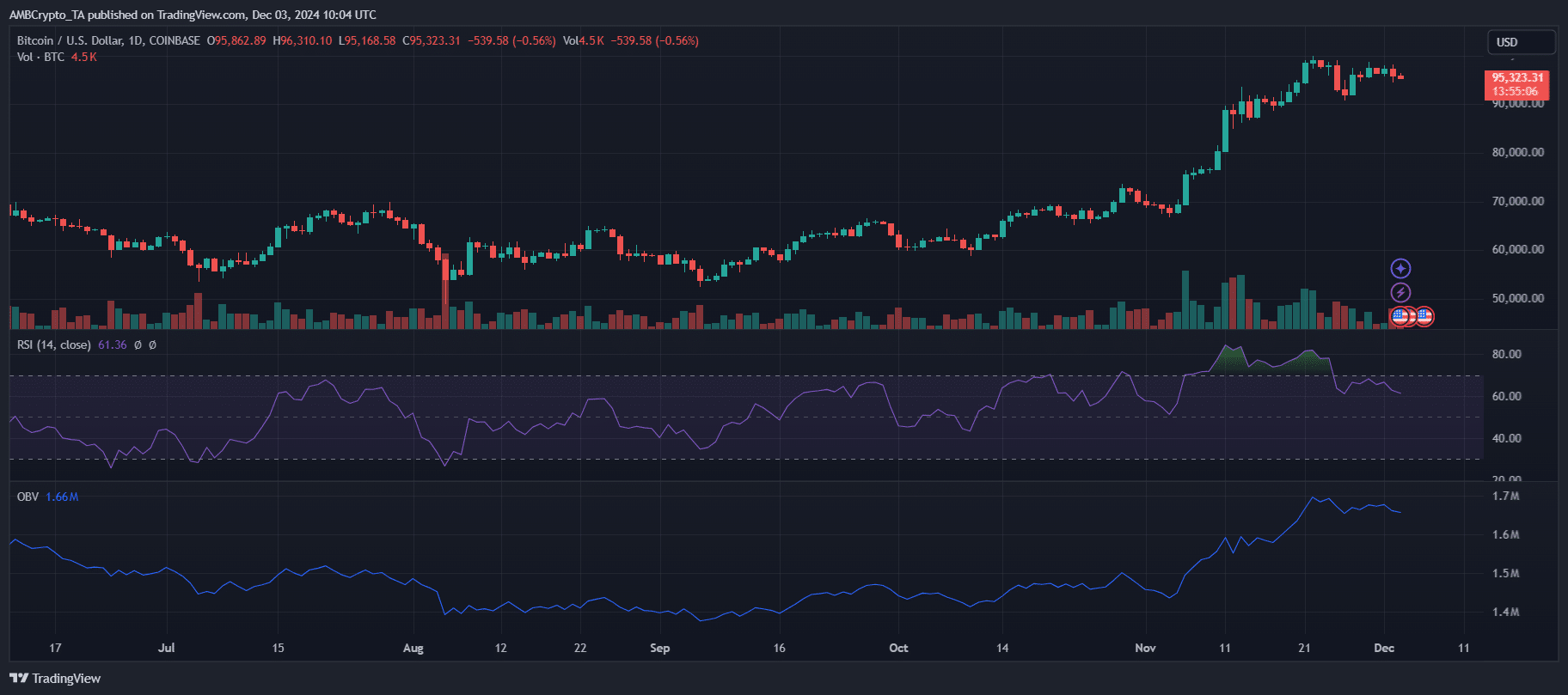

In simpler terms, the current fluctuations in Bitcoin’s price indicate that the market is stabilizing. The price has been unable to break through the barrier at $98,804, but it’s still holding steady above its support level of $94,603.

Based on the current Daily Relative Strength Index (RSI) of 61.41, there’s a hint of strong upward momentum, but a definitive breakout signal is yet to materialize. Interestingly, trading activity has seen a slight dip, suggesting that traders are treading carefully and waiting for a significant market movement to make their next move.

As a crypto investor, I’ve noticed that On-Balance Volume (OBV) has been on an uptrend, signifying continuous buying activity even during times of price stagnation. This disparity between the price action and the OBV suggests hidden bullish tendencies, implying there could be potential for a positive price movement in the near future.

Moreover, the drop in the Exchange Stablecoin Ratio indicates a similar perspective, hinting at an accumulation of buying potential within the exchange platforms.

If the price surpasses $98,804, it might trigger an upward movement towards $100,000. However, if this momentum isn’t sustained, there’s a possibility of a return to previous support levels that are lower.

Exchange stablecoins ratio and hodling impact

In simple terms, the Exchange Stablecoin Ratio currently at 0.000060 (its lowest point in 2024) indicates a strong buying power on cryptocurrency exchanges. This ratio, which shows the increasing supply of stablecoins compared to Bitcoin, suggests that investors have a prime opportunity to buy Bitcoin.

Historically, such conditions have preceded bullish price action as demand outpaces supply.

Furthermore, an increase in long-term ownership of Bitcoin by short-term investors is worth mentioning. According to CryptoQuant’s recent findings, there has been a 36% rise in their typical holding duration during the last month.

This action eases the urgency for quick sales, thereby promoting a sense of rarity in the market and enhancing the resilience of prices.

Combined, these factors – the low ratio of Exchange Stablecoins and increased holder confidence – strengthen Bitcoin’s ability to surpass the resistance at $98,804, making a $100,000 price point more attainable.

What to expect from Bitcoin?

Currently, a single Bitcoin is being transacted for approximately $95,323, just under its crucial resistance point of $98,804. The surge of stablecoins onto trading platforms, as indicated by the reduced Exchange Stablecoin Ratio, hints at substantial purchasing power that could potentially increase demand.

If investors who own Bitcoin for a short period continue with their “hold” approach and there’s an overall positive outlook among investors, Bitcoin could potentially break through its current resistance and move nearer to the significant price level of around $100,000.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

But if there’s an uptick in selling activity, Bitcoin may find itself holding steady within its current price range or even falling back to the crucial support level of $94,603 before making another attempt at breaking out.

The market’s trajectory hinges on whether demand sustains its momentum in the coming sessions.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-12-03 22:16