- Bitcoin’s price stagnated at $95,000 as rising whale transfers signaled potential selling pressure.

- Increasing MVRV ratio and active address growth suggested optimism despite uncertainty.

As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of market cycles and trends. The current stagnation of Bitcoin at $95,000 is an intriguing development that demands careful analysis.

Over the past few weeks, Bitcoin’s [BTC] price has remained relatively steady near the $95,000 mark, as its fluctuations have been limited.

Regardless of efforts by bears to drive down the price beneath a significant level, Bitcoin has managed to hold its ground, demonstrating strength yet showing only modest signs of growth.

For the last seven days, Bitcoin (BTC) has experienced a moderate rise of approximately 1.1%. However, over the past day, there’s been a small decrease of about 0.4%. As I write this, Bitcoin is being traded at $95,463.

The stagnation in Bitcoin’s price has prompted analysts to examine underlying market dynamics.

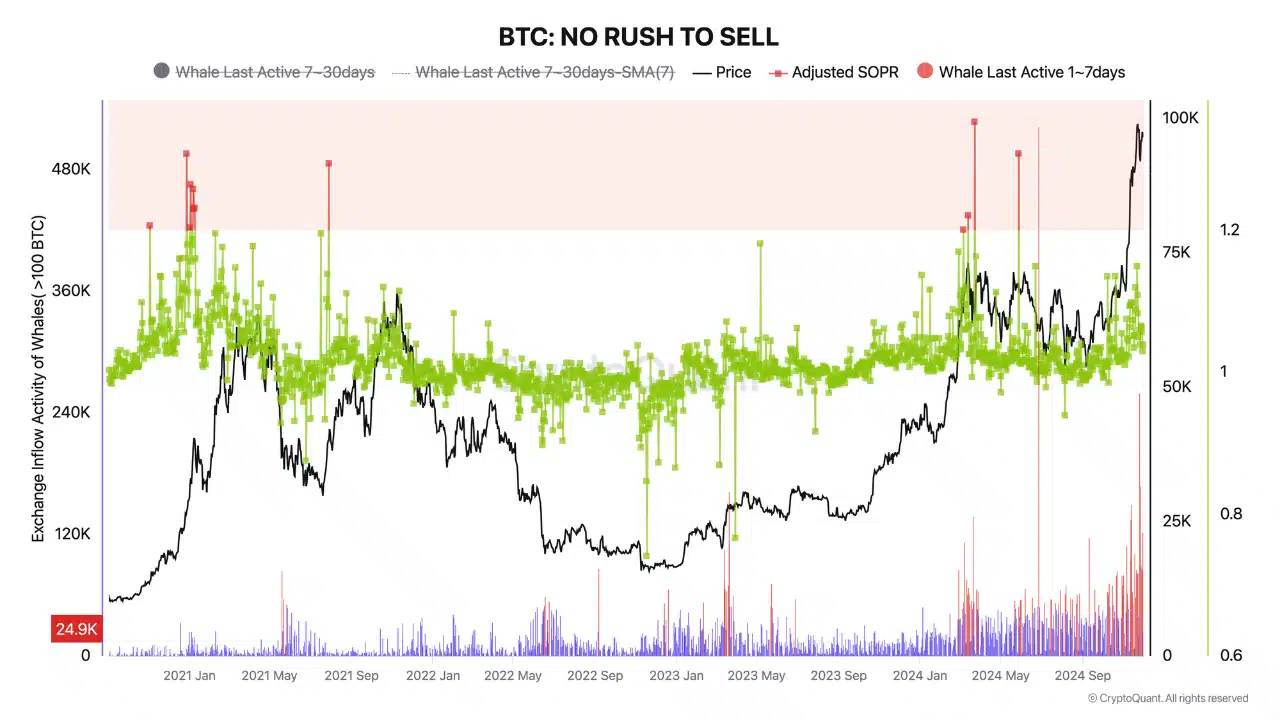

An analyst named Onatt from CryptoQuant pointed out an interesting pattern in the behavior of large investors (whales) following the U.S. Presidential election when Donald Trump emerged as the winner.

Based on Onatt’s findings, there seems to be an increase in Bitcoin transfers from active ‘whale’ wallets to exchanges starting from November 5th.

On the other hand, the revised SOPR metric, a tool that gauges profit-taking actions, hasn’t shown any substantial signs of mass sell-offs so far.

A significant increase in Bitcoin might indicate a possible short-term urge to sell, but if these Bitcoins haven’t been offloaded yet, it could mean they are being used for activities like over-the-counter trades or serving as collateral, rather than being sold immediately.

The careful behavior exhibited by whales could be seen as a “watch-and-assess” tactic, emphasizing the importance of keeping a close eye on such actions to detect potential effects on the market.

Key indicators to watch

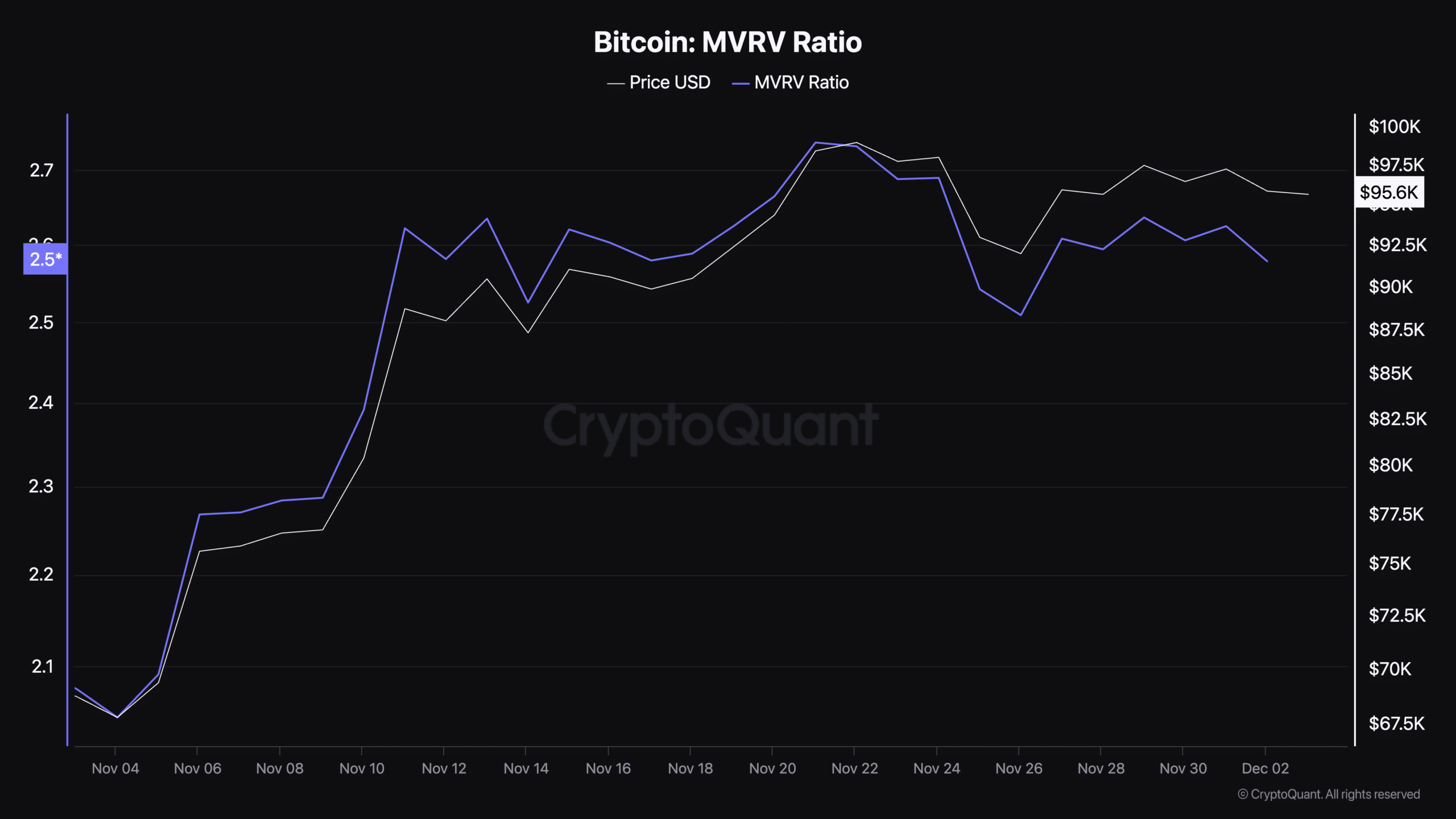

Bitcoin’s trajectory can be better understood with its MVRV ratio and active addresses.

Remarkably, the MVRV ratio—which compares market capitalization to realized capitalization—can help determine if Bitcoin’s current value is higher or lower than its fair market value.

For the majority of investors, a ratio exceeding 1 suggests profitability, with a value of 3.7 indicating potential overvaluation. As for Bitcoin right now, its MVRV ratio stands at 2.57, pointing towards a moderate level of profitability.

This level indicates that Bitcoin might not have been in the overbought state yet, but it emphasizes the importance of keeping a close eye on the ratio to spot any indications of the market heating up excessively or due for a possible correction.

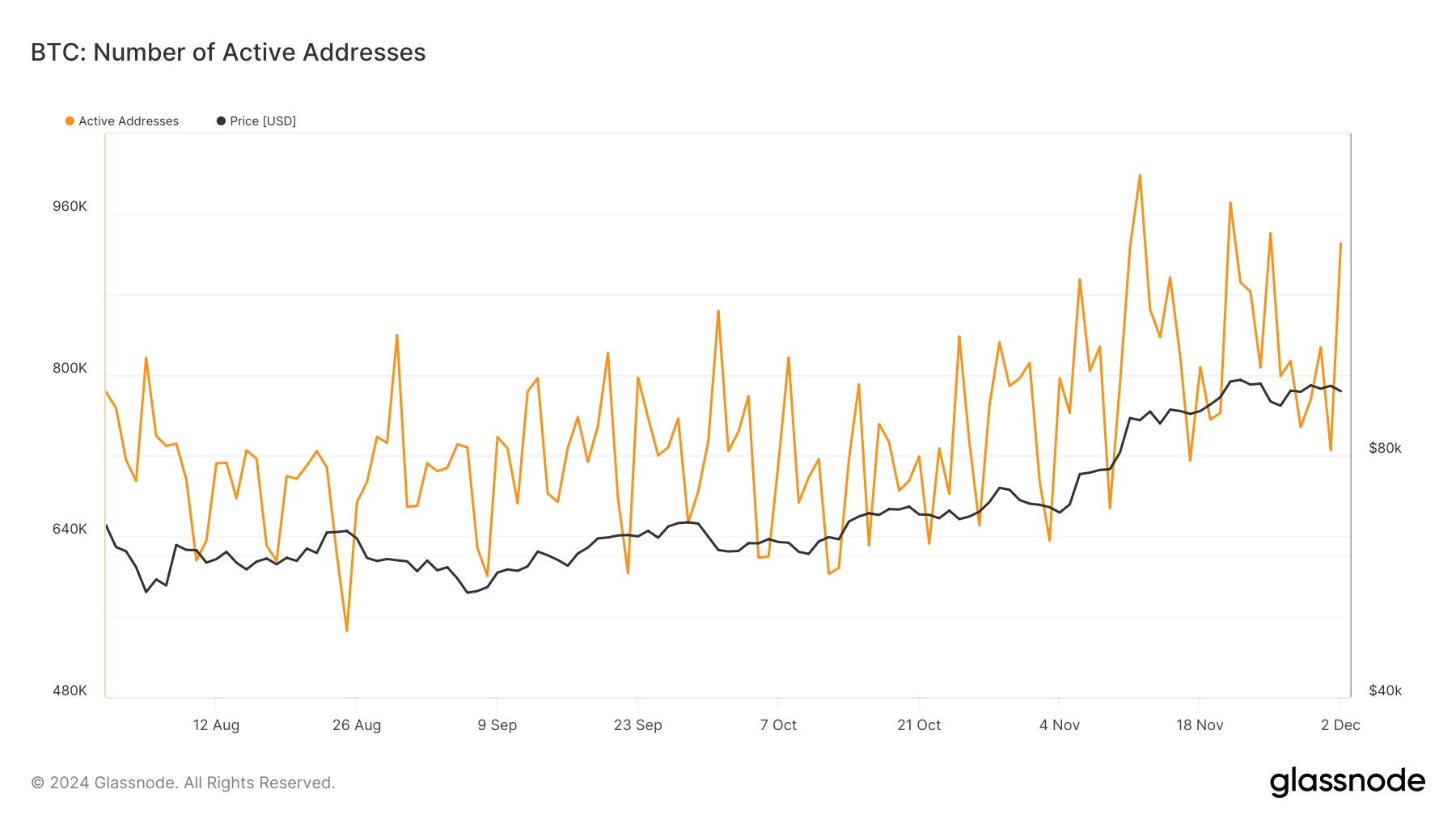

Additionally, the number of actively used Bitcoin addresses, a measure indicative of network activity and investor engagement, has been on an upward trend since August 2024, as suggested by data from Glassnode.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Despite a brief dip below 750,000 on December 1st, active addresses have since surged past 900,000 by the time of this report.

As an analyst, I’ve noticed a surge in active addresses within the network, suggesting increased user engagement. This growth might contribute to price stability and could be interpreted as a positive sign of potential bullish trends, provided it continues over time.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-04 00:07