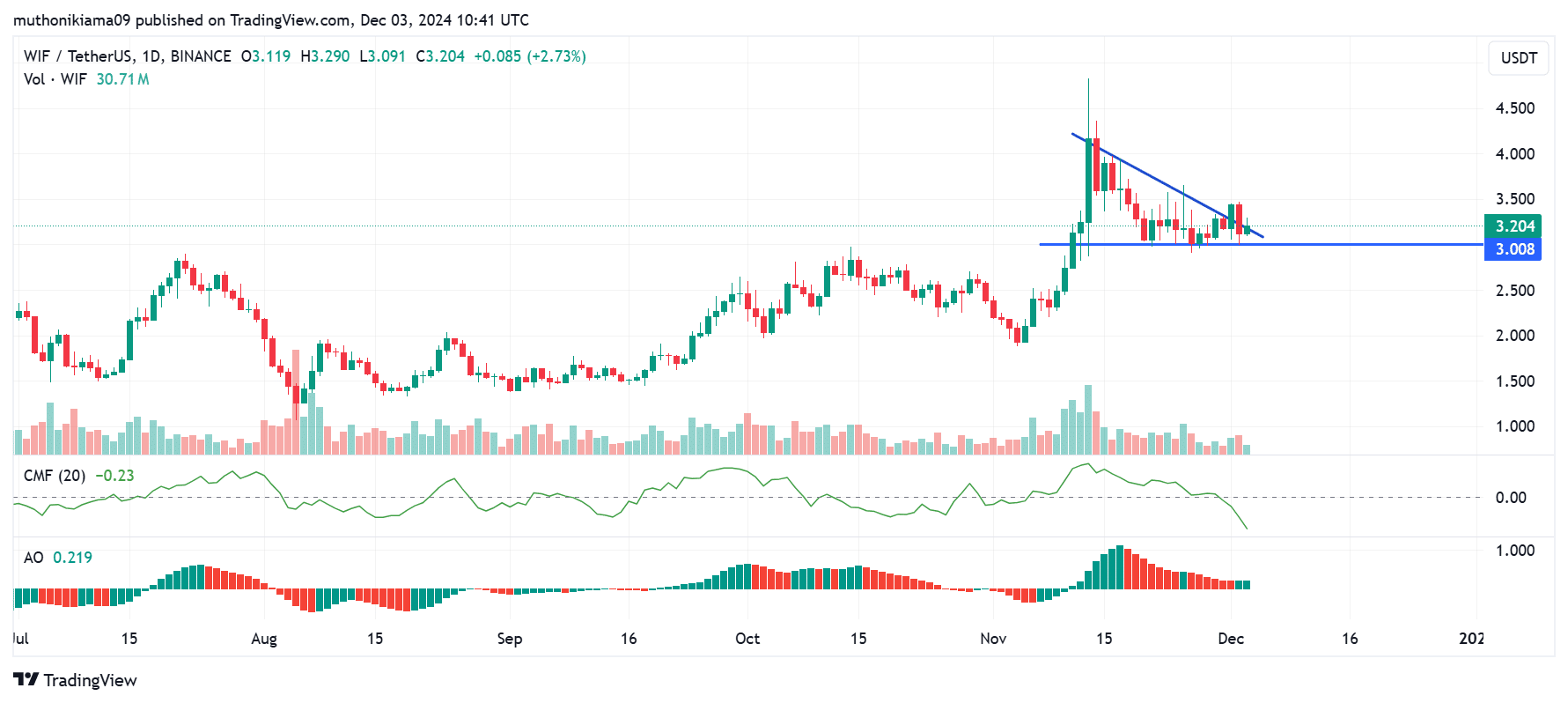

- dogwifhat was trading within a descending triangle channel on its one-day chart, suggesting a bearish reversal.

- The negative CMF showed that despite recent gains, selling activity has outpaced buying activity.

As a seasoned researcher with over a decade of experience in the crypto market, I find myself often intrigued by the dance between bulls and bears that unfolds on the charts. The current state of dogwifhat [WIF] is no exception. While it has managed to gain 5% in the last 24 hours and a staggering 54% monthly, the bearish signs cannot be ignored.

At the moment, the virtual currency known as Dogwhathat [WIF] is currently trading at $3.22, representing a 5% increase over the past day. This surge in value has propelled the memecoin’s monthly gains to an impressive 54%. The sustained uptrend seems to have enticed long-term investors to distribute their holdings.

Based on information from Lookonchain, a user known as “blockgraze” transferred 1.5 million WIF tokens, worth approximately $4.56 million, to the Coinbase trading platform. This trader had held onto these tokens for a period of eight months prior to this transaction.

Although the trader has made it clear that he hasn’t sold the coins yet, the transfer of these funds aligns with some negative indicators appearing in WIF’s one-day chart, suggesting a potential downtrend.

It appeared that a triangle pattern going downward indicated potential for dogwifhat to experience a decrease. The crucial level of $3 serves as a support, helping WIF prevent the predicted bearish trend.

As a crypto investor, if World Internet Fuel (WIF) manages to surge past the resistance at $4.83 and accumulate liquidity in that price range, it would effectively debunk my current bearish outlook on its market direction.

At the moment, technical signs are providing conflicting predictions about WIF’s potential price trajectory. Specifically, the Chaikin Money Flow (CMF) has reversed to a negative reading, suggesting that there’s more demand from sellers than buyers in the current market.

Nevertheless, the Awesome Oscillator (AO) bars have switched to green, indicating a bullish divergence. In other words, while both bulls and bears are fighting for dominance, the derivatives market suggests that upcoming liquidations may influence the direction of WIF’s future trajectory.

WIF long liquidations surge

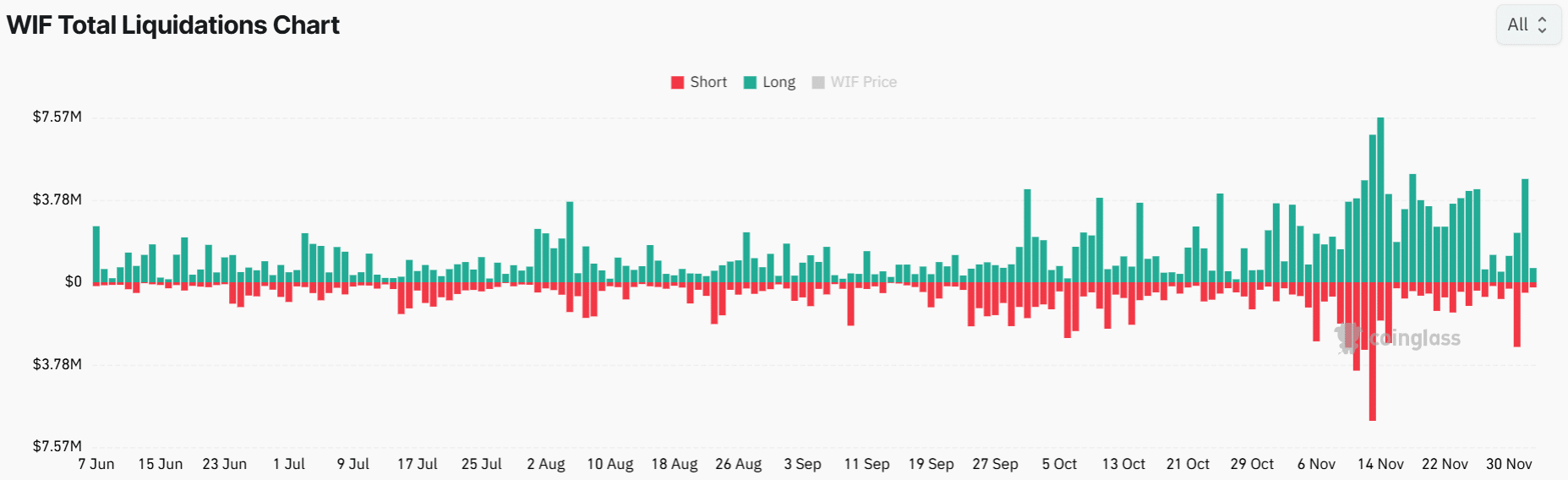

Data from Coinglass shows that a surge in long liquidations might be suppressing WIF’s rally.

Over a span of merely two days, over $5 million dollars’ worth of long positions for WIF were liquidated, further strengthening the trend of such liquidations observed during the past fortnight.

When a trader’s long position is terminated, they must dispose of their tokens by selling them. This enforced selling could exceed the level of buying activity, leading to a pause or halt in the market’s upward momentum.

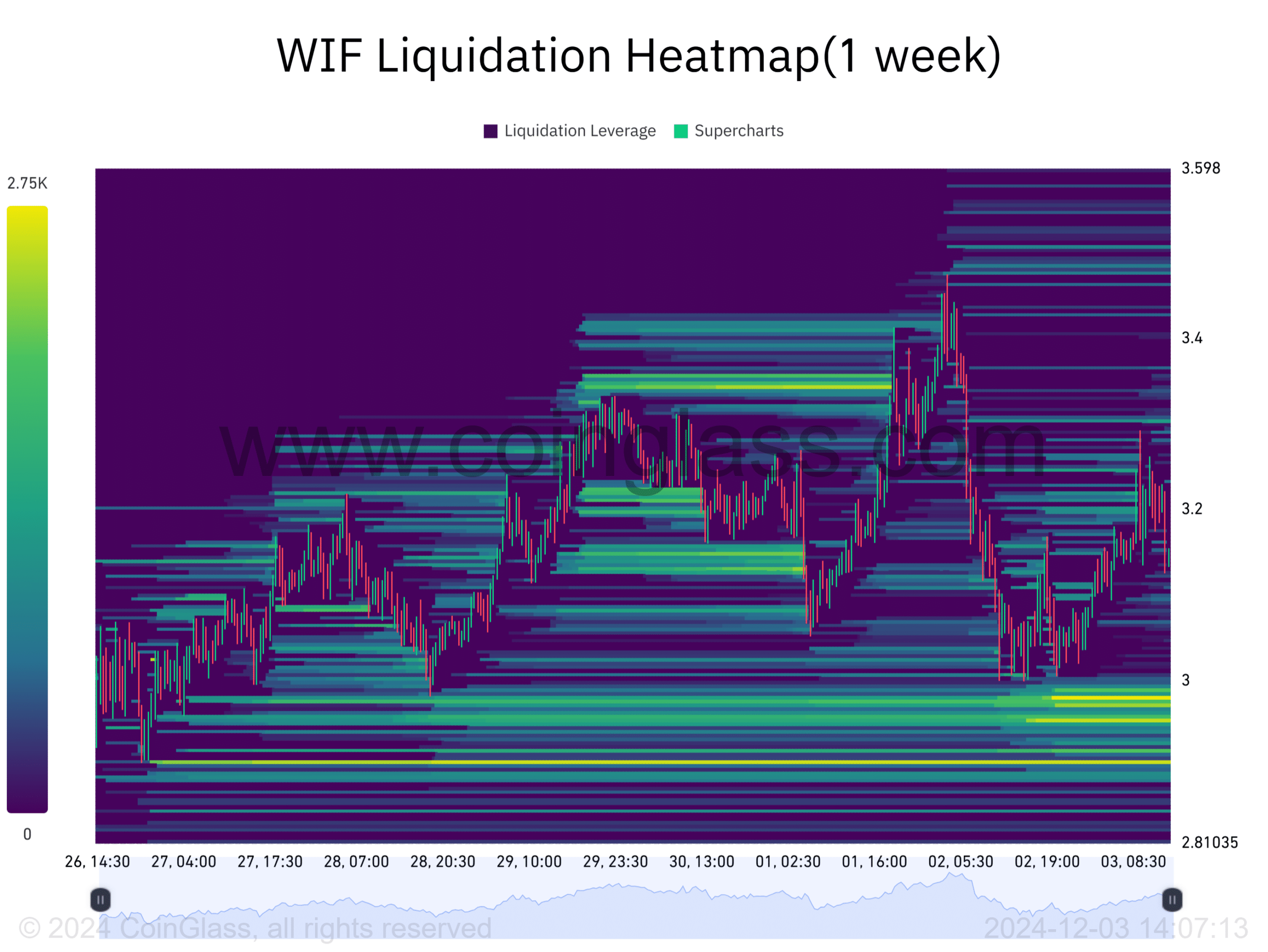

The one-week liquidation heatmap for dogs, if you will, distinctly illustrates a surge in liquidations every time the upward trend faltered.

Despite the current situation, a potentially powerful drop area for liquidation remains beneath the current price level. This liquidation concentration might function as a pullback point, contributing to a potential decline in WIF’s value. Should WIF dip below $3, these liquidations may exert additional pressure, causing the price to fall further.

WIF Funding Rates hit record highs

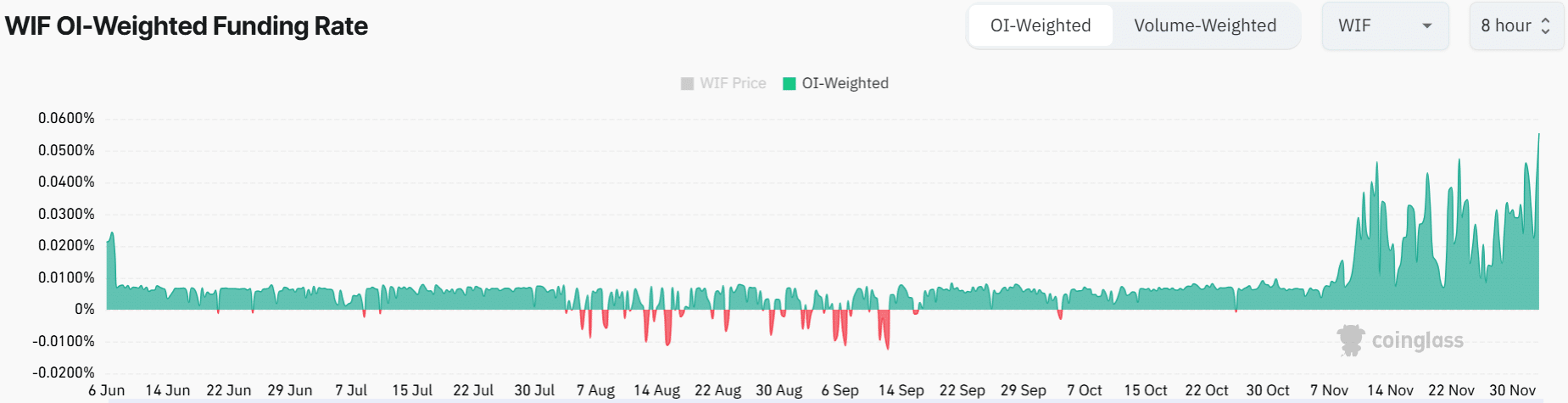

In spite of many traders getting liquidated, these positions are still dominating the market, indicating a generally optimistic outlook or bullishness regarding WIF.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

Currently, the Funding Rates for WIF are at a record peak of 0.0555%. This implies that traders are ready to pay higher fees to keep their long positions open.

Keep in mind that a sudden drop in WIF’s price might lead to a long squeeze situation. This is due to the fact that such a drop could trigger a wave of forced liquidations, which in turn could intensify the downward trend.

Read More

2024-12-04 05:44