- KAIA’s sentiment was overwhelmingly positive, with its TVL reaching levels last seen in 2023—its highest point this year.

- On-chain metrics further supported the bullish outlook.

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I must say that witnessing KAIA’s remarkable performance over the past week has been nothing short of thrilling. The 101% surge in just seven days is a testament to the power of blockchain and the unpredictable nature of this industry.

Kaia’s [KAIA] progression over the last week has been astonishing, boasting a 101% surge. This expansion follows a trend that began a month ago, leading to an accumulated 197.6% return—a feat replicated by very few tokens in the market.

A surge in interest has brought forth many enthusiastic purchasers, causing the price to climb further, offering an enticing prospect for potential investors.

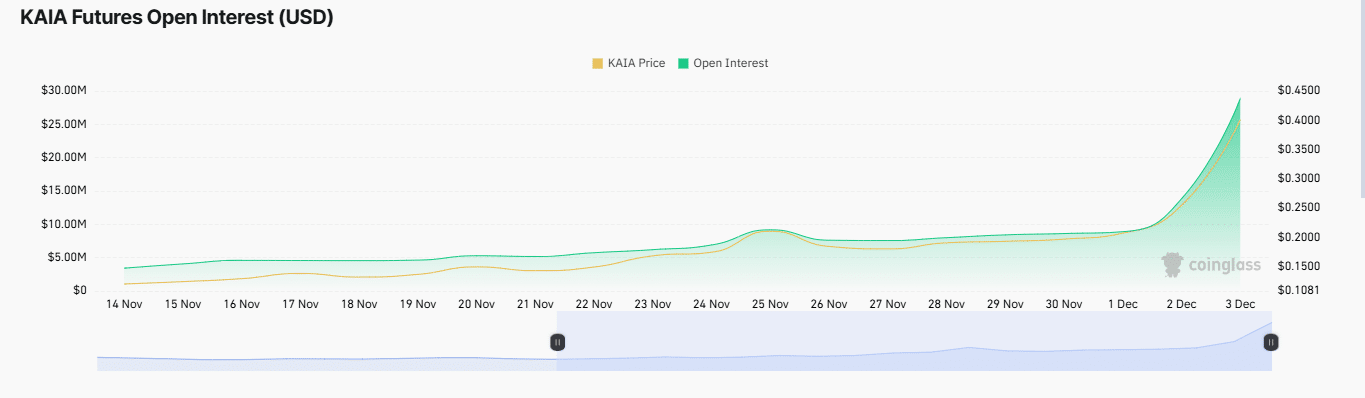

Collective interest in KAIA spikes

There’s been a significant boost in the popularity of KAIA, pushing it up to the fourth spot on CoinMarketCap following a 35.05% price hike. This surge was also accompanied by a remarkable 281.63% jump in trading activity, as per Coinglass, with numerous buyers and sellers actively engaging in trades within the market.

The increased attention noticeably boosted KAIA’s market performance, causing the token’s overall worth, as reflected in its market capitalization, to skyrocket by an impressive 36.27%, reaching a staggering $2.25 billion.

Simultaneously, the Total Value Locked (TVL) for KAIA, a significant measure reflecting investor engagement within their blockchain system, escalated to an impressive $128.49 million.

This year’s level is at its maximum, comparable to a high point reached in December 2023, demonstrating an increase in investor trust and dedication to the platform’s expansion.

Should the current trend continue, it’s likely that KAIA’s price will see more increases, given the growing interest from the market.

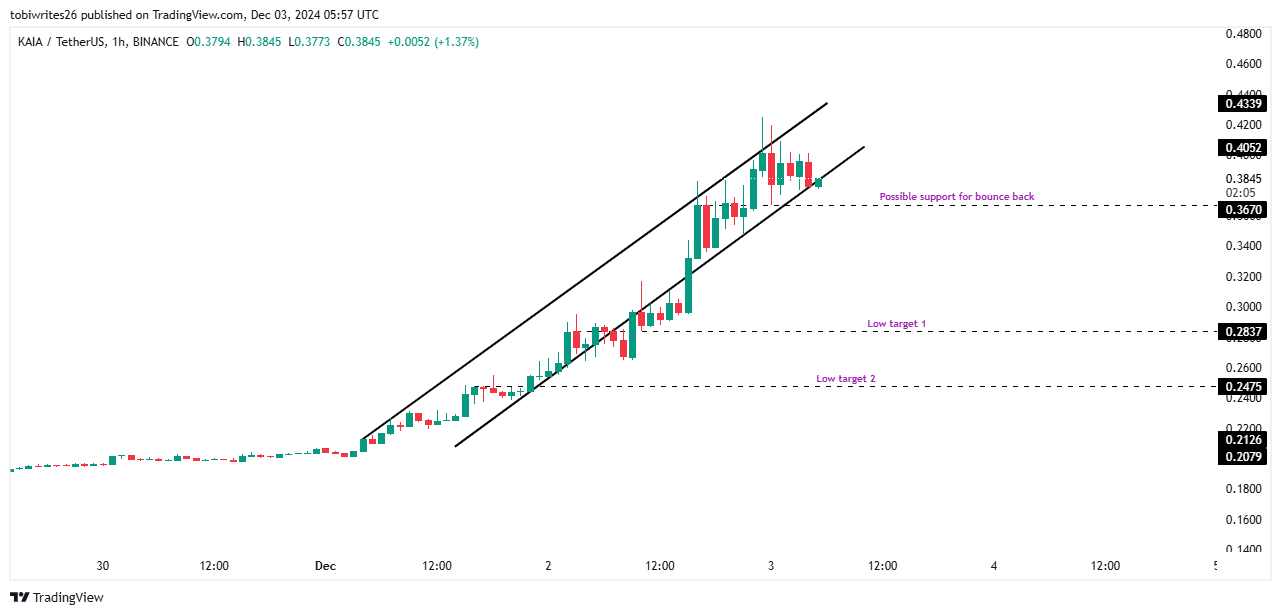

Warning sign: A potential drop in price

It’s possible that KAIA’s price could decrease due to its current trading within an ascending triangle structure. This pattern, which involves price fluctuations between a rising resistance level and a supporting level, tends to result in a drop if the support level is broken. When this happens, there can be a substantial decline.

If this situation arises, there’s a possibility that KAIA’s price might pull back towards the bottom of its channel. A brief recovery at approximately $0.3670 could provide temporary respite, but if it can’t hold this level, the price may drop further to two potential lower levels: $0.2837, and if no recovery occurs, $0.2475.

Further declines could follow, depending on on-chain sentiment.

Even though there are potential risks involved, AMBCrypto observes that the general sentiment within the blockchain network is still optimistic, potentially boosting or even increasing the price.

Bullish momentum sustained by on-chain activity

At the time of writing, Coinglass reported a bullish market sentiment for KAIA, with its Open Interest(OI) surging by 107% to reach $35.15 million.

A rise in Open Interest (OI) often reflects market optimism, as it suggests that more traders are buying and holding onto (or opening new) long positions for KAIA. This trend underscores a positive sentiment towards KAIA’s price movement and strengthens the existing bullish perspective.

Read Kaia’s [KAIA] Price Prediction 2024–2025

Furthermore, the Funding Rate currently stands at 0.00254%. This implies that long traders are actually paying a fee to preserve equilibrium between the perpetual and spot markets, thereby contributing to market price stability.

Should these tendencies persist, it’s probable that KAIA’s price will maintain its rising trend, thereby amplifying the current surge.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Beyond Paradise Season 3 Release Date Revealed – Fans Can’t Wait!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

2024-12-04 11:03