- HBAR market interest and trading volume hit all-time highs

- Will 2021’s HBAR pattern reveal itself amid higher buyer exhaustion at the $0.4 level?

As a seasoned researcher with a penchant for deciphering cryptocurrency trends, I must admit that Hedera Hashgraph [HBAR] has been a fascinating case study this year. The 9x pump over the past month is nothing short of remarkable, outperforming Bitcoin [BTC] no less!

Hedera Hashgraph [HBAR] has been a major highlight of this cycle’s altcoin season.

Over the last month, it experienced a significant increase of approximately nine times its original value, climbing from $0.04 to $0.35. Notably, it exceeded the performance of Bitcoin [BTC] during this period. The question remains, what factors contributed to this impressive surge?

What’s driving HBAR?

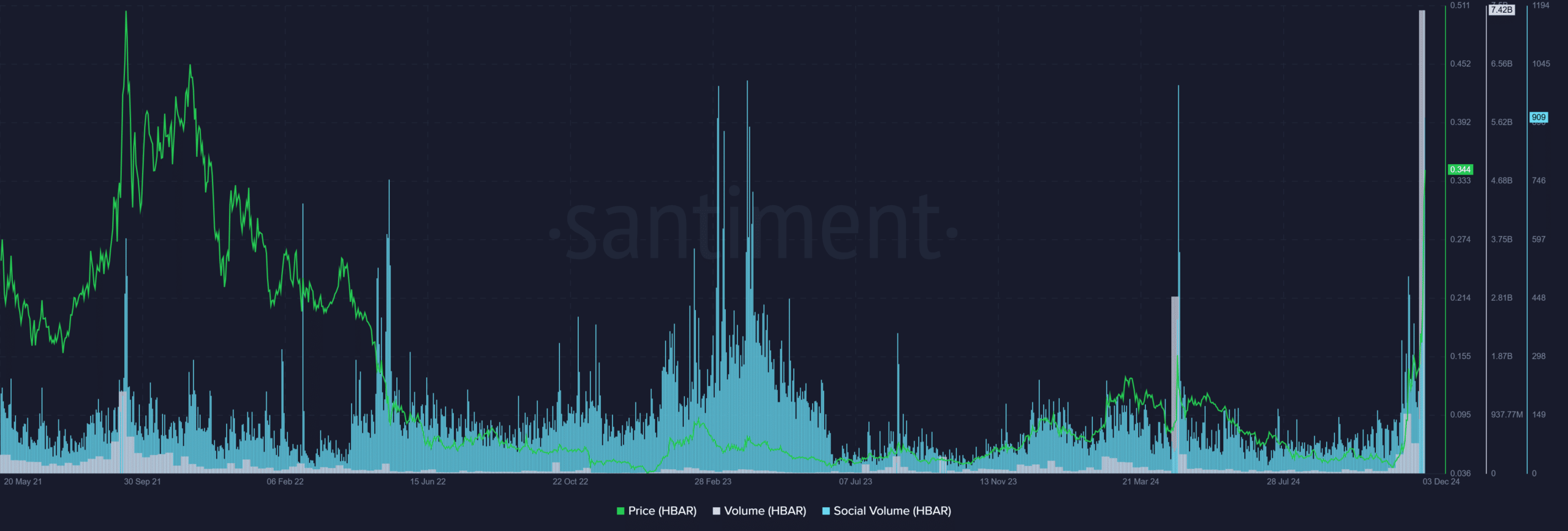

The primary reason for HBAR’s 9-fold surge is overwhelming market demand, causing trading activity to surge past the highest levels seen in 2021.

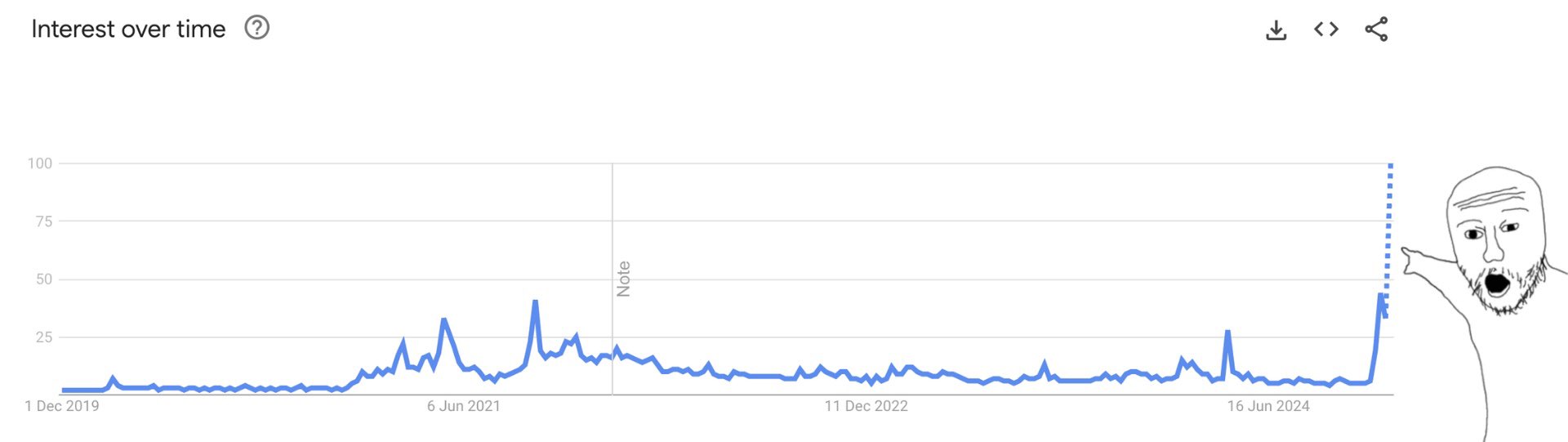

As a researcher delving into trends related to Hedera, I’ve observed that there was a significant surge in search interest for this topic in the month of November. Remarkably, it peaked at its highest point ever during the early days of December.

Increased interest rates in the market stimulated a surge in social activity, as seen by an increase in trading volume. Remarkably, HBAR’s trading volume reached an all-time high of $7.42 billion, surpassing both its previous records from March 2021 and March 2024.

2021 saw the highest trading volume reach $1.31 billion, and by March 2024, it had set a new record at $2.84 billion – an almost threefold increase in trading activity.

It’s important to mention that whispers about President-elect Donald Trump appointing Brian Brooks, a member of the Hedera board, as the chairman of the SEC were another factor contributing to the surge in value.

Presently, while Paul Atkins is favored by prediction markets for the position, the mention of Brooks’ name has significantly influenced the choice for the cryptocurrency (altcoin). Remarkably, HBAR experienced a surge of 63% this week following his proposed appointment as a possible replacement for Gary Gensler.

It seems that the significant surge in HBAR’s price was fueled more by increased market attention rather than just its strong partnerships and foundational elements.

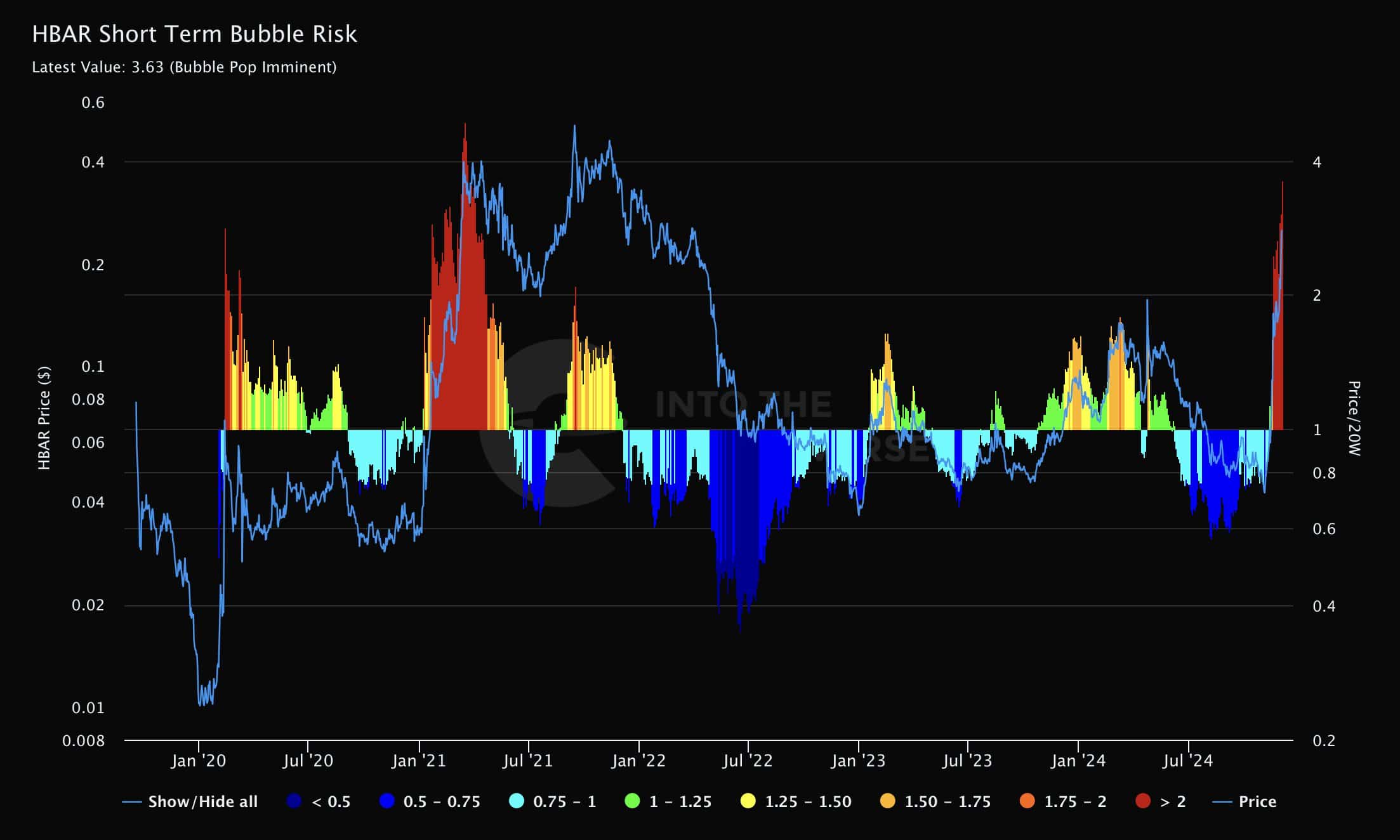

In essence, crypto expert Benjamin Cowen warned that the recent surge might indicate a short-term bubble, suggesting the possibility of a temporary halt or reversal in the altcoin’s progression.

Read Hedera Hashgraph [HBAR] Price Prediction 2024-2025

During that period, it appeared that HBAR was encountering a lack of buyers around the $0.4 price point, as evidenced by the extended upper shadow on its weekly candlestick chart.

In 2021, HBAR temporarily stopped advancing at a certain point and dropped back down to around $0.2. However, it subsequently increased to reach $0.57. So, the question now is whether this pattern will recur in the future.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- OM PREDICTION. OM cryptocurrency

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Gold Rate Forecast

2024-12-04 12:07