- Bitcoin was trading at around $96,000 at press time.

- Indicators are making a strong case for it rising to $100K.

As a seasoned researcher who has been observing Bitcoin’s market dynamics since its early days, I find myself at a fascinating crossroads. The current consolidation phase presents both a challenge and an opportunity for investors. On one hand, we have technical indicators pointing towards a potential breakout to $100K, but on the other, some on-chain data suggests that Bitcoin might be approaching overvaluation.

The current fluctuations in Bitcoin’s (BTC) price have generated significant attention because it’s currently holding steady within a narrow band just under the $100,000 level, triggering broad interest.

Experts believe that the current phase of sideways movement in the market is a required rest after a strong surge, giving it time to settle down and prepare for the next major advance.

Consolidation or preparation?

As I delve into the intricacies of the Bitcoin market, it appears that we’re currently navigating a period of consolidation, with price fluctuations confined within the range of approximately $95,000 to $98,000. The diminished volatility indicates a certain uncertainty or indecision among market participants, suggesting they are hesitant to make significant moves at this time.

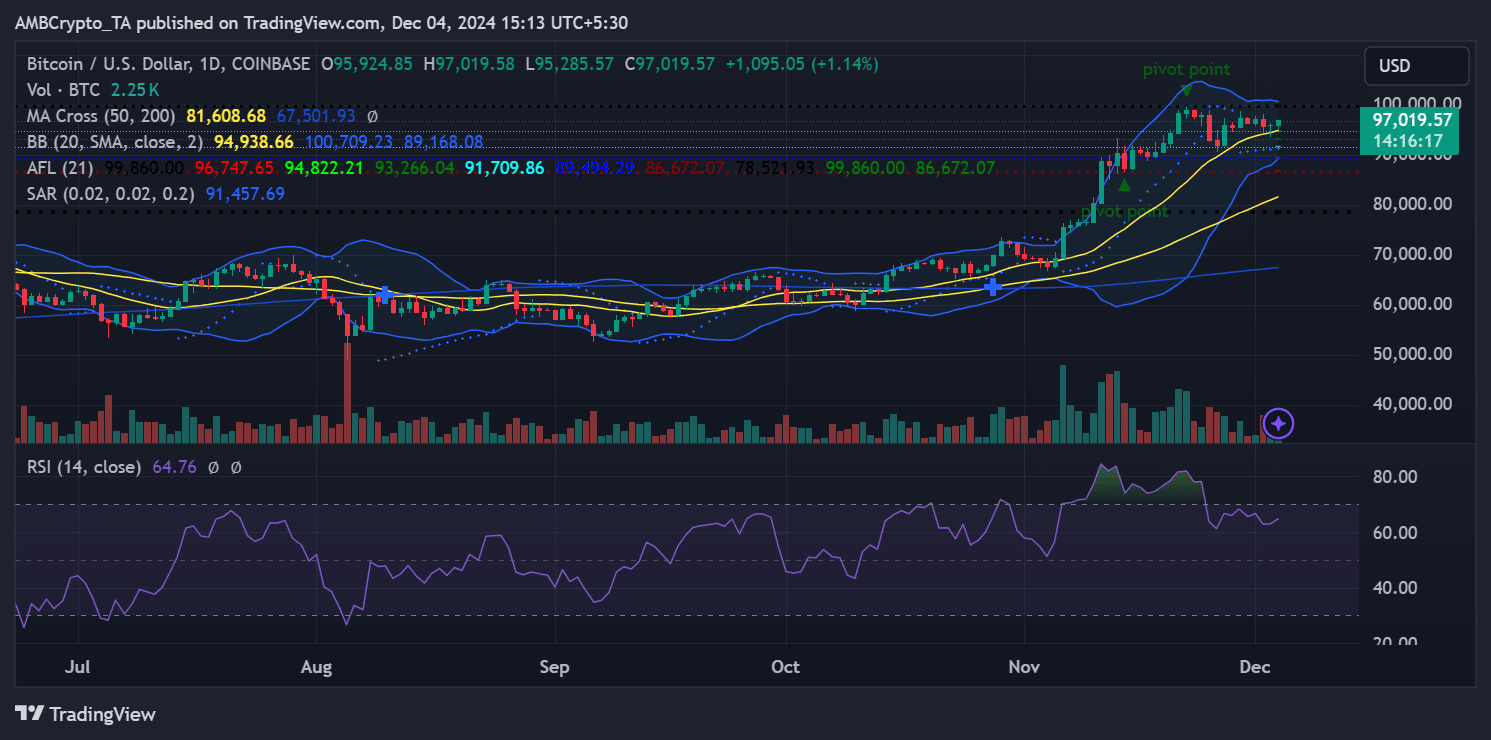

Technical indicators, however, reflected an overall bullish structure.

The 50-day and 200-day moving averages continued to form an upward trend, also known as a “golden cross,” indicating persistent positive market trends, since the shorter-term average remained above the longer-term one.

The Bollinger Bands have tightened, which typically precedes a sharp directional move.

Currently, the Relative Strength Index (RSI) stood at approximately 64.76, moving towards the zone that suggests the market may be approaching overbought conditions. However, there’s still some potential for further growth, as the index hasn’t quite reached the point of no more room for increase yet.

The Parabolic SAR dots, positioned below the candles, further reinforce the upward momentum.

MVRV ratio and exchange reserves

Information derived from on-chain data enriched our understanding of Bitcoin’s recent period of stability. At the moment of reporting, the MVRV ratio, a tool that compares market value to the actual cost basis, stood at approximately 2.7.

Although it’s not yet reaching record-breaking heights, the current level indicates that Bitcoin might be nearing overpricing, a red flag for brief-term traders. Typically, when this ratio surpasses three, it tends to signal upcoming phases of selling off and price adjustments.

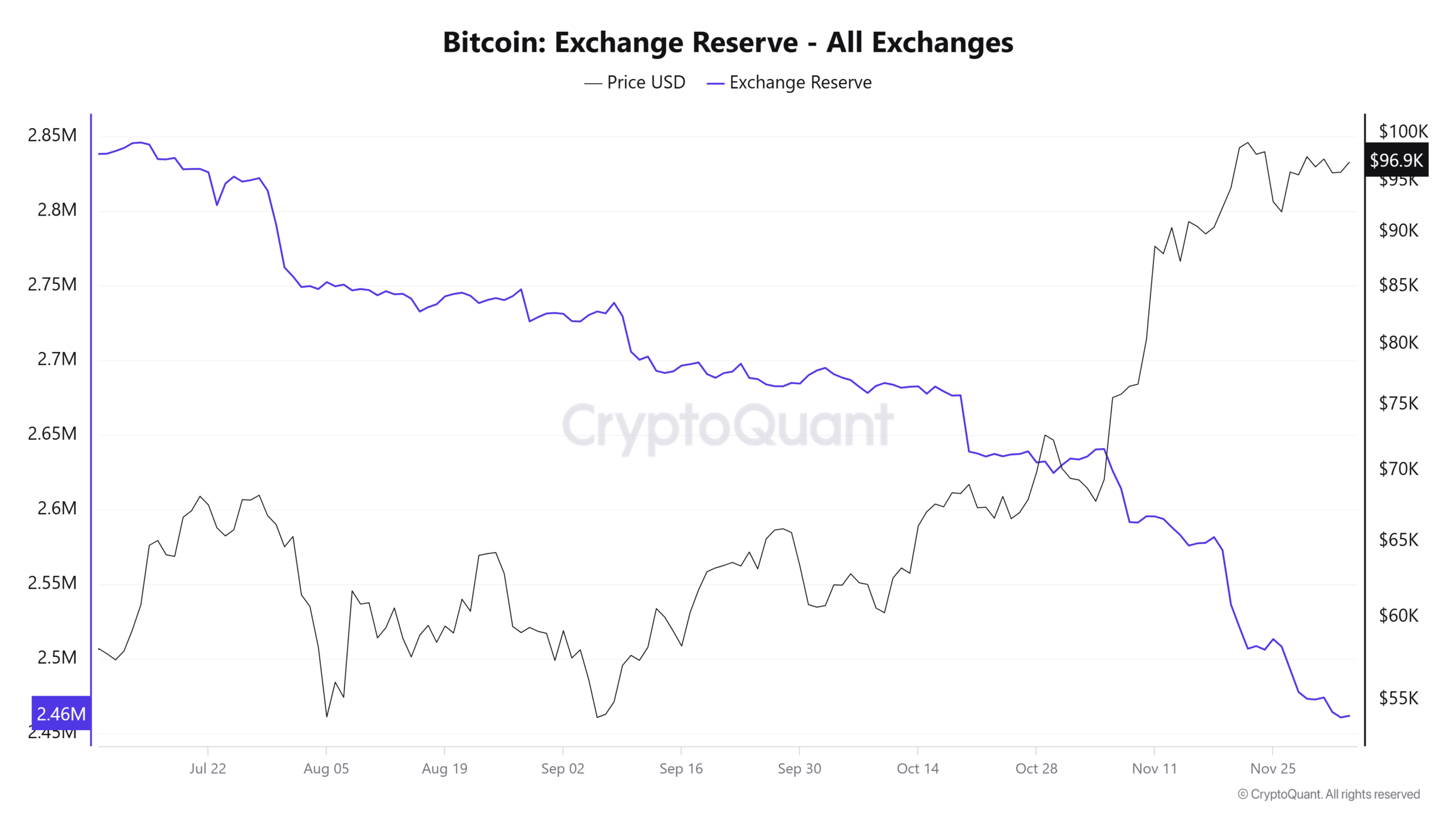

Based on information from CryptoQuant, the amount of cryptocurrency held as reserve is decreasing. This reduction suggests less selling pressure from holders, which can be seen as a positive sign for the market.

It appears that the current pattern indicates investors prefer to hold onto their Bitcoin personally, rather than keeping it on exchanges. This could be interpreted as a strong belief in the digital currency’s future value and prospects.

Market sentiment: Derivatives and accumulation

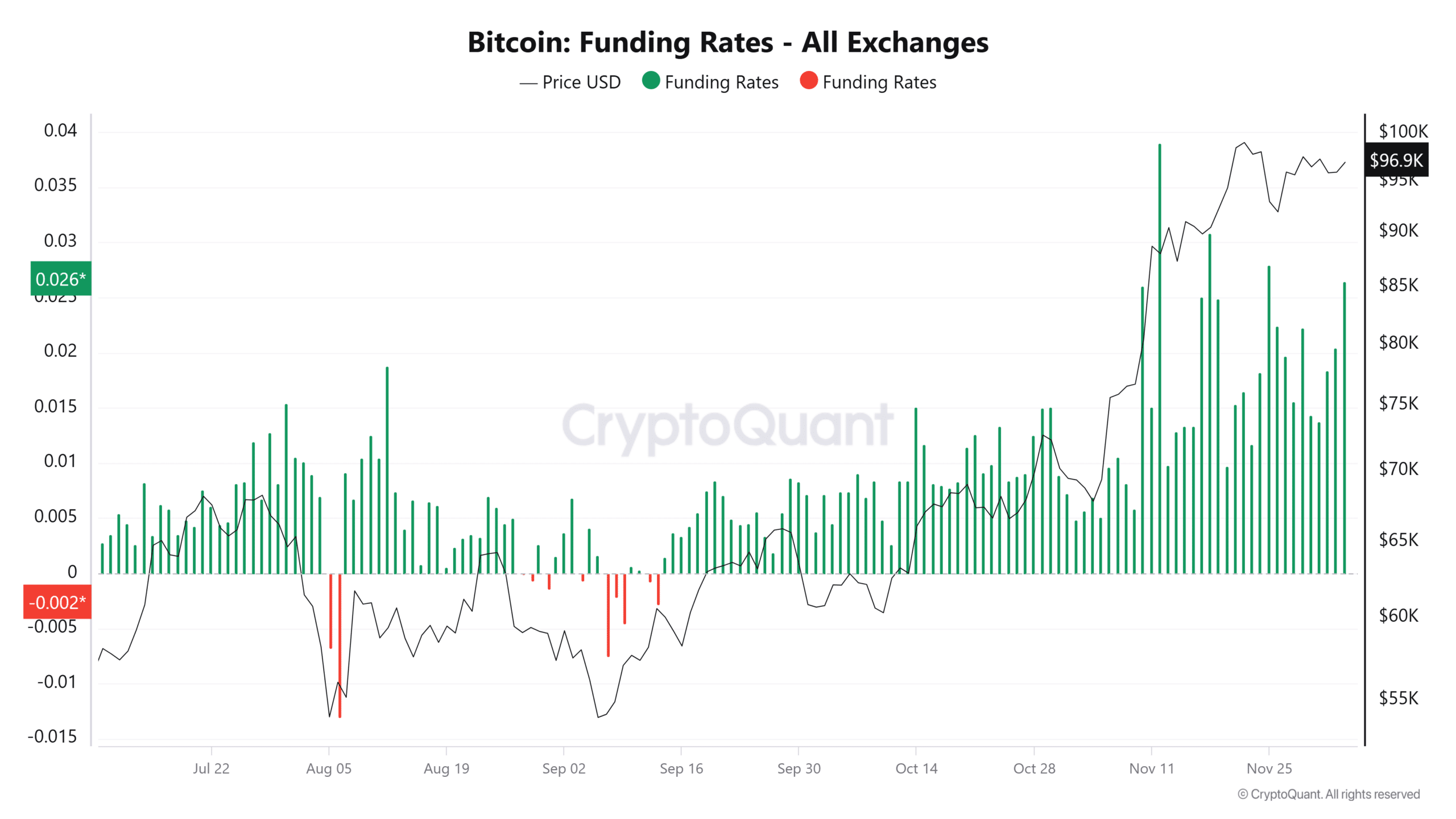

The funding rates for Bitcoin on prominent trading platforms have recently shifted into a positive territory, indicating a surge in optimism among traders who deal with Bitcoin derivatives.

Investors seem eager to buy higher priced positions for the future, indicating their faith in additional price rises. This bullish sentiment is also reinforced by the persistent buildup of large holdings by significant investors as indicated in the blockchain data.

In simpler terms, many big investors are buying more Bitcoin, suggesting they believe in its continued growth over a longer period.

As an analyst, I’ve observed a contrasting trend: retail activity is decreasing, suggesting that it’s the larger investors who are primarily fueling this market rally at present. This disparity tends to bring a sense of stability to the price movements, as it often signifies that ‘whales’ or large-scale investors are accumulating more assets, which typically underpins higher price levels.

Outlook: Bitcoin to $100K

As a crypto investor, I find solace in Bitcoin’s current consolidation phase – it’s a vital part of its market cycle that sets the stage for a possible surge towards the six-figure mark. In other words, this period of stability could pave the way for a breakout toward the anticipated $100,000 price point.

A leap surpassing $98,000, driven by higher trade volumes, might signal the restart of the upward trend.

Nevertheless, investors need to stay vigilant about unexpected increases in reserve balances or excessive expansion in the MVRV ratio, as these might indicate a potential shift or adjustment.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite these risks, the broader market structure remains favorable.

After Bitcoin’s recent growth spurt, it seems poised for even more positive momentum, as robust technical and blockchain signals suggest a potential breakthrough could be imminent.

Read More

2024-12-05 02:16