- Curve has experienced a significant price surge, driven by heightened developer activity.

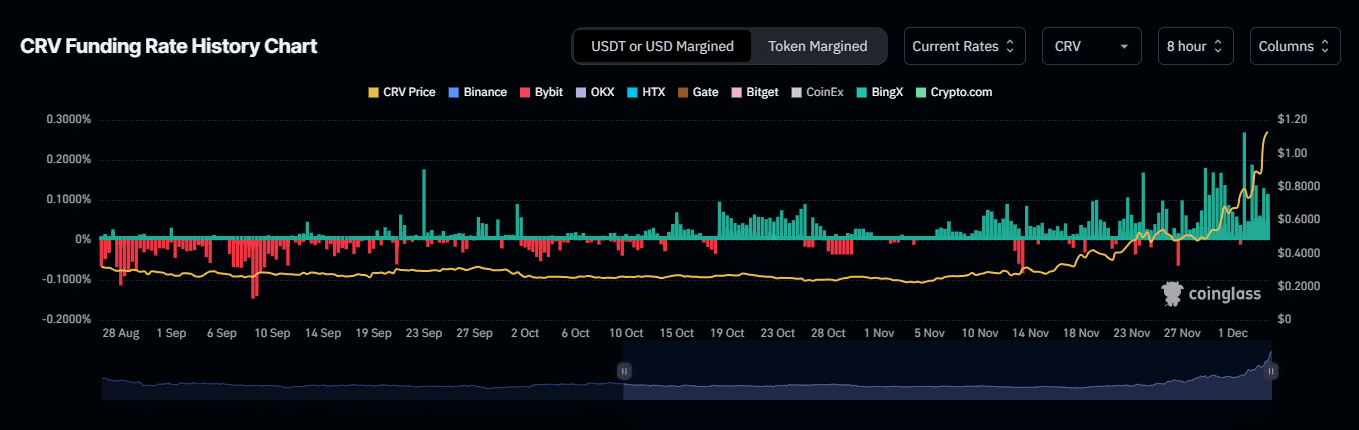

- In the derivatives market, there has been a notable uptick in bets predicting that CRV will climb higher.

As a seasoned crypto investor with a knack for spotting trends and reading market signals, I’ve witnessed my fair share of price swings and market cycles. Over the past week, the surge in Curve [CRV] has caught my attention, and not just because it’s been one of the top performers in the market.

Over the past week, Curve [CRV] has maintained its upward trajectory.

After experiencing an impressive 123.49% surge in its weekly rally, the token saw another 44.13% growth over the past 24 hours, placing it among the top performers within the market.

In simpler terms, we’re looking at why the cost of CRV has spiked lately and deciding if this upward trend might continue with AMBCrypto.

Investors show renewed interest in CRV

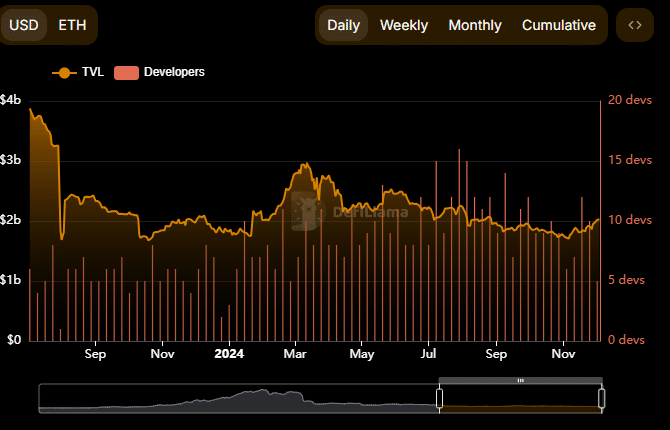

It appears that CRV is experiencing an increase in developer engagement and the amount of money tied up within it, indicating a surge of investor trust.

In simple terms, the Total Value Locked (TVL) is an important measure that shows how active investors are within a blockchain network. This value represents the combined amount of assets users have put into the system for development and maintenance purposes.

Following several months of decrease starting from September, the Total Value Locked (TVL) in CRV has experienced a substantial surge, now standing at approximately $2.03 billion. This resurgence brings TVL back to its pre-decline levels, hinting at a growing positive outlook among market participants.

The rise in TVL aligns with a surge in developer activity, as reported by DeFiLlama.

A higher level of developer participation suggests continuous enhancements and inventiveness within the CRV system, potentially fueling a positive trend in its market value.

It’s clear that this surge in purchasing isn’t limited to those within the ecosystem, but also extends to the derivatives market, where traders are growing more optimistic about CRV’s potential success.

Derivative traders push CRV’s momentum higher

Derivative traders are imitating investor behavior by launching long trades on CRV, indicating a robust optimism about its price increase.

Over the last day, the Funding Rate has significantly increased, peaking at 0.0820% as we speak. This substantial upward trend suggests an expanding group of long-term investors in the market, hinting at a generally bullish sentiment.

In simpler terms, the Funding Rate is crucial for maintaining harmony between an asset’s current price and its future price. When the Funding Rate goes up, it typically means that more people who are buying the asset (or long traders) are actively participating in the market.

Open Interest has also surged, recording a 30.42% increase to $270.33 million.

As a researcher, I observed an upward trend in the market, which I attribute to an increase in active purchasers. These buyers not only had open contracts but also maintained their positions, thereby strengthening the optimistic perspective towards CRV.

Increasing long positions on CRV

According to data from Coinglass, there’s been an increase in the number of long positions being taken by traders, suggesting that they are becoming more optimistic about the market.

Read Curve’s [CRV] Price Prediction 2024–2025

As of now, the Long/Short Ratio has risen to 0.9739, indicating a growing curiosity or investment in CRV.

Should this ratio exceed 1, it may serve as additional evidence for the continued rise in CRV’s price, particularly if there is a persistent increase in both investor and derivatives trading activity.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-12-05 05:43