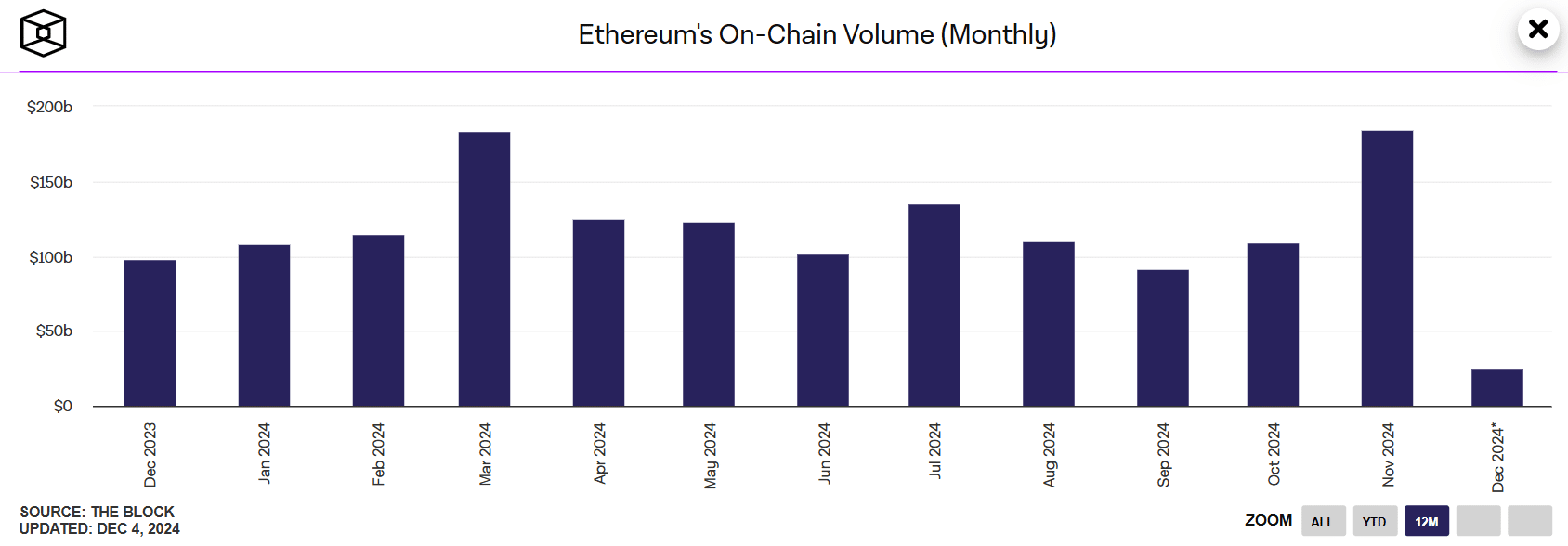

As a seasoned researcher who has witnessed the evolution of blockchain technology and digital assets over the past decade, I must say that Ethereum’s performance in November was nothing short of impressive. The network’s on-chain activity soared to record levels, with its monthly transaction volume surpassing the $180 billion mark – a feat not seen since 2018.

In the month of November, the number of transactions conducted directly on the Ethereum network reached extraordinary heights, as its monthly transaction volume exceeded a staggering $180 billion.

Reaching this milestone, the network experienced its highest monthly transaction volume in almost three years, outperforming previous months and underscoring Ethereum’s crucial position within the blockchain community.

Ethereum volume reaches a new high

Based on IntoTheBlock’s data analysis, Ethereum reached its peak on-chain transaction volume in the year 2024.

Examining the graph revealed that the volume hit a new high of $183.74 billion in November, outdoing the previous record of $183.94 billion achieved in March.

Further analysis showed that its NFT volume also saw a significant increase in the last 30 days.

Data from CryptoSlam shows that the platform’s NFT sales volume exceeded $253 million in the last 30 days, indicating an over 32% increase. With this figure, Ethereum outperformed all other blockchains in NFT sales.

TVL and ecosystem growth

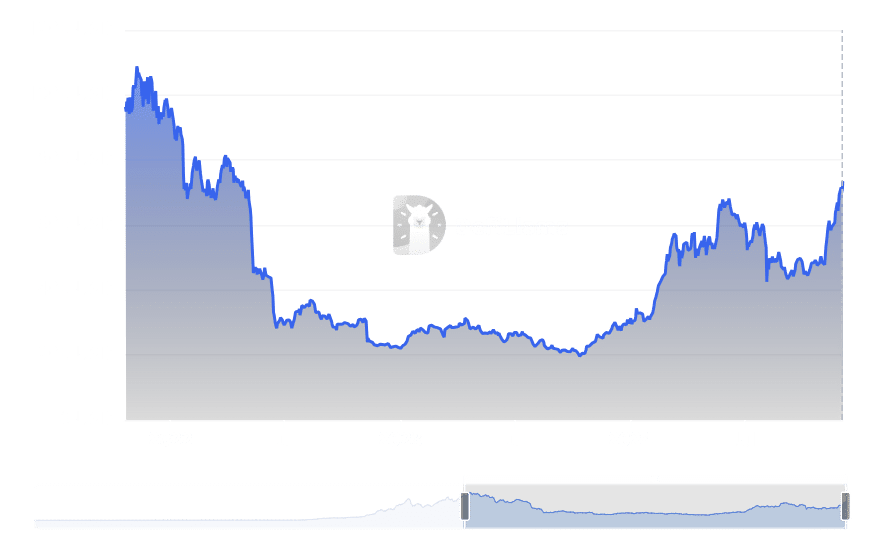

The overall value held within the network’s DeFi ecosystem (Total Value Locked or TVL) has been consistently increasing, indicating growing investor enthusiasm for decentralized finance.

Based on DeFiLlama’s assessment of the Total Value Locked (TVL) graph, Ethereum’s TVL has bounced back from its mid-year minimum levels. A significant amount of money is currently secured across various Ethereum-based protocols.

Currently, the TVL (Total Value Locked) stands at approximately $73.48 billion, with the total TVL reaching about $135 billion. The increasing trend in Ethereum’s volume and TVL suggests a favorable outlook for the network.

Analyzing Ethereum’s price momentum

Regarding its pricing, Ethereum has been following an upward trend. A closer look at the daily graph shows that the price of Ethereum to US Dollar (ETH/USD) has repeatedly traded above both its 50-day and 200-day moving averages, suggesting a robust upswing.

currently, the Relative Strength Index (RSI) stands at 67.7, indicating that the asset might be approaching an overbought state, yet there’s potential for additional price increases.

Ethereum’s price closed in November at nearly $3,700, solidifying gains from previous months.

In simpler terms, when Parabolic SAR (Stop and Reverse) lines are positioned below the current market trend, it strengthens the optimistic outlook, indicating that the positive movement in prices is likely to continue.

As Ethereum nears significant resistance points, investors continue to be hopeful that it can maintain its upward trend and reap benefits from the expanding activity on the network.

Realistic or not, here’s ETH market cap in BTC’s terms

The extraordinary on-chain transaction volume on Ethereum, combined with its dominance in Non-Fungible Token (NFT) sales and Total Value Locked (TVL), presents a very optimistic outlook for the network’s future.

Since the network has been operating at its peak activity levels seen since 2021, Ethereum appears poised to capitalize on this momentum and continue its growth trajectory towards 2025.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

2024-12-05 07:03