- Solana whales are seizing the ‘dip,’ snapping up bargain-priced tokens in hopes of a major rebound.

- But for this comeback to happen, two key conditions need to align.

As a seasoned crypto investor with a knack for spotting trends and reading market signals, I’ve witnessed my fair share of ups and downs. The recent dip in Solana (SOL) has piqued my interest, as it presents an opportunity that I haven’t seen since the early days of Bitcoin.

As an analyst, I’ve observed an impressive surge in Solana [SOL] prices, which climbed from $157 on election day to an unprecedented all-time high of $264 within a span of 20 trading days. This remarkable rise has seen Solana breaching the resistance level at $260 and solidifying its position as a leading performer in the market.

This rapid ascent highlights SOL as a notable beneficiary of both external and internal trends.

From an outside perspective, the surge of SOL mirrored that of Bitcoin, as Bitcoin maintained its status as a preferred investment category, attracting wider market investments which in turn propelled Solana to record-breaking heights.

Inside, Solana’s nickname as an “Ethereum Alternative” has boosted its popularity, improving its performance across essential indicators. Yet, over the past fortnight, SOL has encountered substantial obstacles at its latest all-time high, causing a dip below $240.

Under two main circumstances, there might be a rebound:

If all these factors fall into place, it’s possible that SOL might reach a new all-time high. Now, let me ask you, what do you think are the chances?

Potential for growth as big players eye the dip

Generally, when Bitcoin reaches a point of high fear, uncertainty, and doubt (FUD), often signifying a significant price increase, there’s usually a surge of capital into alternative cryptocurrencies (altcoins). Bitcoin has recently passed the $100K mark, moving beyond this FUD phase.

Currently, it appears reaching a new all-time high (ATH) for Solana may be overly optimistic, given that investor attention is primarily directed towards Bitcoin at the moment.

On the other hand, maintaining Solana in the current market could be significant, as it might help prevent its price from dropping below $220. This is because investors may choose to hold onto Solana as a hedge against potential Bitcoin corrections, should the market sentiment shift negatively.

This optimistic outlook is reinforced by a neutral Relative Strength Index (RSI), suggesting that investors looking for substantial profits may find a good buying opportunity as Bitcoin nears an overly heated condition.

It seems that whales (large investors) are adopting a particular tactic by purchasing Solana (SOL) coins at reduced costs following a significant decrease in its value, over 60%, during the last fortnight.

In simpler terms, if they offer their support, Solana might reach the $240 price range soon. After crossing that point, the factors previously discussed will significantly influence where Solana’s price goes next.

Solana needs to reclaim its dominance

Previously mentioned, the significant leap forward by Bitcoin has prepared an environment where alternative coins could breach mental barriers. Yet, Solana seems to be trailing behind in this aspect.

During the last 24 hours, as the buzz on social media about the potential $100K worth of Ethereum grew stronger, its owners took advantage and increased their holdings, seeing its value also rise.

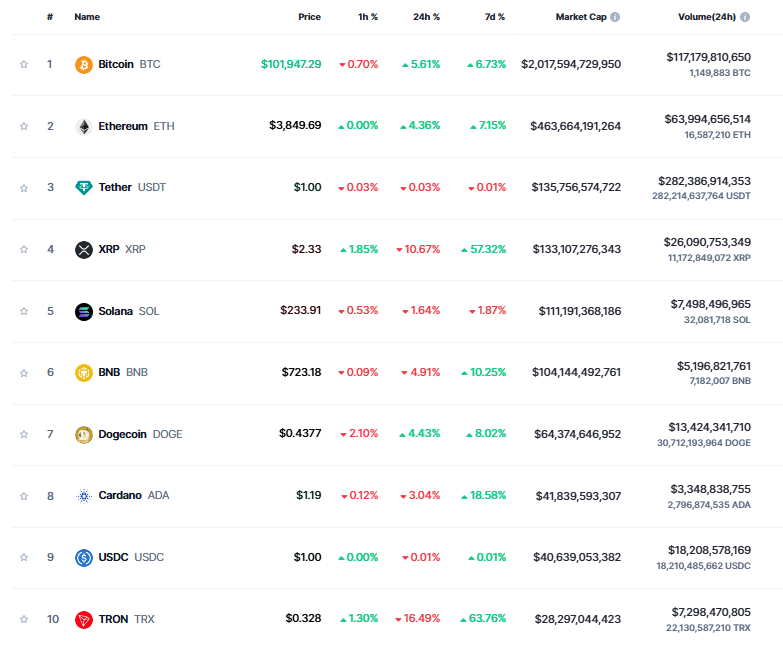

Source : CoinMarketCap

Even though it’s still relatively early, Solana hasn’t managed to spark the same investor interest as before, instead finding itself confined within a lower price bracket.

Nevertheless, there’s a positive aspect: the significant investors remain firm in their stance. This makes their backing increasingly crucial since they can help alleviate growing selling pressures, particularly as individual investors seem to be moving away from Solana towards other potential investments.

Reaching beyond $240 might spark a wave of Fear Of Missing Out (FOMO), serving as an effective psychological trigger. This could pave the way for a fresh all-time high (ATH).

Still, it all comes down to the “Crypto King”

At last, the eagerly-expected milestone has been achieved – Bitcoin surpassed $100K for the first time. Analysts foresee further growth, but there are increasing warnings about a potentially overheated market sparking increased greed.

In a critical juncture for altcoins, significant earnings might solidify their image as a ‘secure refuge.’ This could lead to swift portfolio adjustments by traders, seeking to safeguard their investments from potential dangers.

At the moment, Solana finds itself at a crucial point, presenting a significant chance for buyers (bulls) to aim for a grand slam. This becomes even more promising with the backing of whales. However, maintaining this momentum hinges on a rise in retail investor interest.

Read Solana’s [SOL] Price Prediction 2024–2025

When Bitcoin hits its maximum value, it’s probable that this will ignite a strong interest, leading to widespread selling – a moment Solana should be prepared to seize and profit from.

For the time being, it seems like $240 is within reach for Solana. But surpassing its all-time high of $264 requires more than just whale support. Two essential factors to monitor are increased retail investments and Bitcoin reaching its maximum point.

Read More

- OM/USD

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

2024-12-05 16:08