- Coinbase CEO viewed BTC as a better hedging tool against inflation.

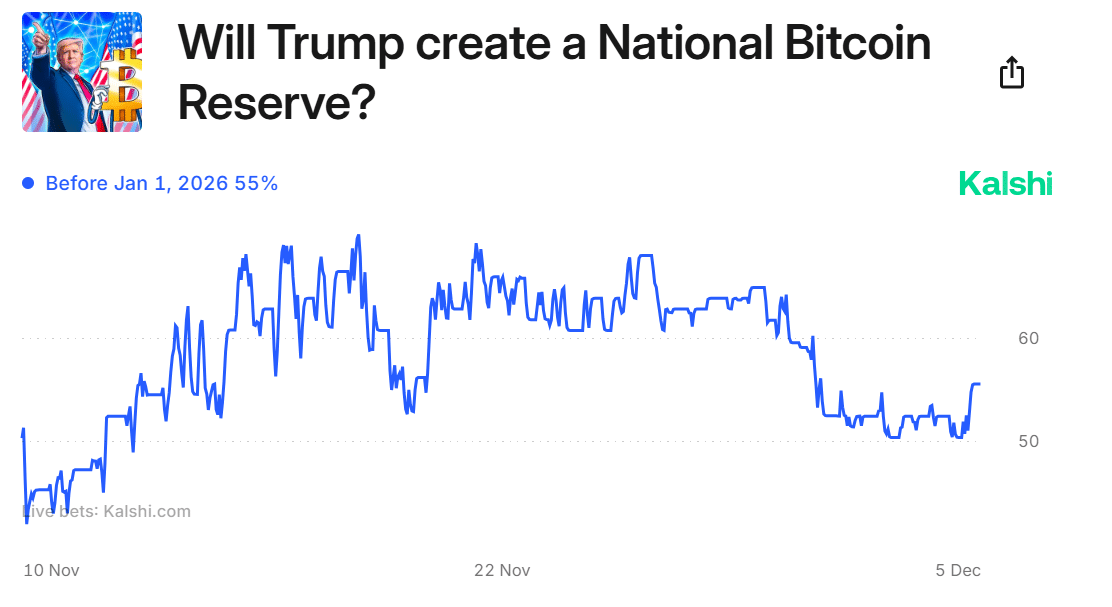

- The markets were optimistic about a U.S. BTC reserve before 2026.

As a seasoned researcher with a keen interest in financial markets and cryptocurrencies, I find the prospect of governments adopting Bitcoin (BTC) reserves intriguing, especially given the current economic climate. The potential for BTC to serve as a hedge against inflation, as suggested by Coinbase CEO Brian Armstrong, is an interesting perspective that warrants further exploration.

In light of multiple nations, such as the United States, grappling with escalating federal debt and rising inflation that depletes assets, is there perhaps an alternative method for safeguarding wealth during times of inflation or economic upheaval?

As per CEO Brian Armstrong of Coinbase, Bitcoin (BTC) presents an appealing option for hedging, particularly following its surge to reach the $100,000 mark.

Referencing Bitcoin’s 12-year development, Armstrong pointed out that a $100 investment in 2021 is equivalent to around $17 today. Yet, when considering Bitcoin value, that same $100 equates to roughly $1.5 million. He advocated for governments to ponder over the concept of Bitcoin reserves as a means to safeguard wealth. In simpler terms, he suggested that governments should think about holding Bitcoin reserves to preserve their wealth.

Over the past twelve years, Bitcoin has proven itself as the top-performing investment. With its potential yet to be fully realized, it’s an opportune time for consideration. Particularly for governments aiming to safeguard their assets from inflationary pressures, establishing a strategic reserve of Bitcoin could be a wise move.

U.S. Bitcoin reserve outlook

Armstrong’s backing for a Bitcoin (BTC) reserve carries weight, considering his role in endorsing pro-cryptocurrency candidates during the 2024 U.S. elections.

In simpler terms, the newly elected President Donald Trump has promised to position the United States as the global leader in cryptocurrency technology and establish a government-backed Bitcoin reserve.

Is he going to keep his word about using the transferred $2 billion worth of Bitcoin, a portion of which has been set aside for the national reserve?

Currently, there’s a general skepticism that Trump will establish the reserve during the initial 100 days of his term.

As a researcher, I’ve been monitoring the prediction market on Polymarket, and at this point, it appears that the formation of a national Bitcoin reserve carries a relatively low probability of 24%.

However, Kalshi is pricing a 55% chance of creating a U.S. BTC reserve before 2026.

It’s worth noting that some nations, such as Brazil, have proposed keeping Bitcoins in their reserves. Financial analysts predict that if the United States were to approve a Bitcoin reserve, it could set off a game of strategy, compelling other countries to do the same.

As certain experts forecast that Bitcoin’s worth might surge to an astronomical figure, the ultimate aim is expected to drive the price of BTC upward. Currently, BTC is priced at approximately $102,500 and has increased by 6% over the past day.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-12-05 18:15