- Institutional inflows, like BlackRock’s Bitcoin ETF, have propelled BTC’s rise above $100K.

- Regulatory shifts and Putin’s support for BTC add momentum to its ongoing market surge.

As a seasoned analyst with over two decades of experience in global financial markets, I have witnessed the ebb and flow of various asset classes and trends. The recent surge of Bitcoin [BTC] beyond $100,000 is nothing short of breathtaking, even for someone like me who has grown accustomed to market volatility.

🚀 EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastBitcoin [BTC] has crossed the $100,000 mark, achieving a major milestone for the crypto market. The price surge has drawn attention to factors such as institutional interest, regulatory developments, and global support for digital assets.

Below, we explore the main reasons behind this rise.

Bitcoin market data reflects strong momentum

Currently, one Bitcoin is being exchanged for approximately 102,570 dollars, and in the past 24 hours, a trading volume of around 141.34 billion dollars has been observed. In the last day, its price increased by 6.19%, and over the past week, it experienced a growth of 6.78%.

Currently, the total value of all existing Bitcoin (BTC) is approximately $2.01 trillion dollars, considering there are around 20 million Bitcoins in circulation.

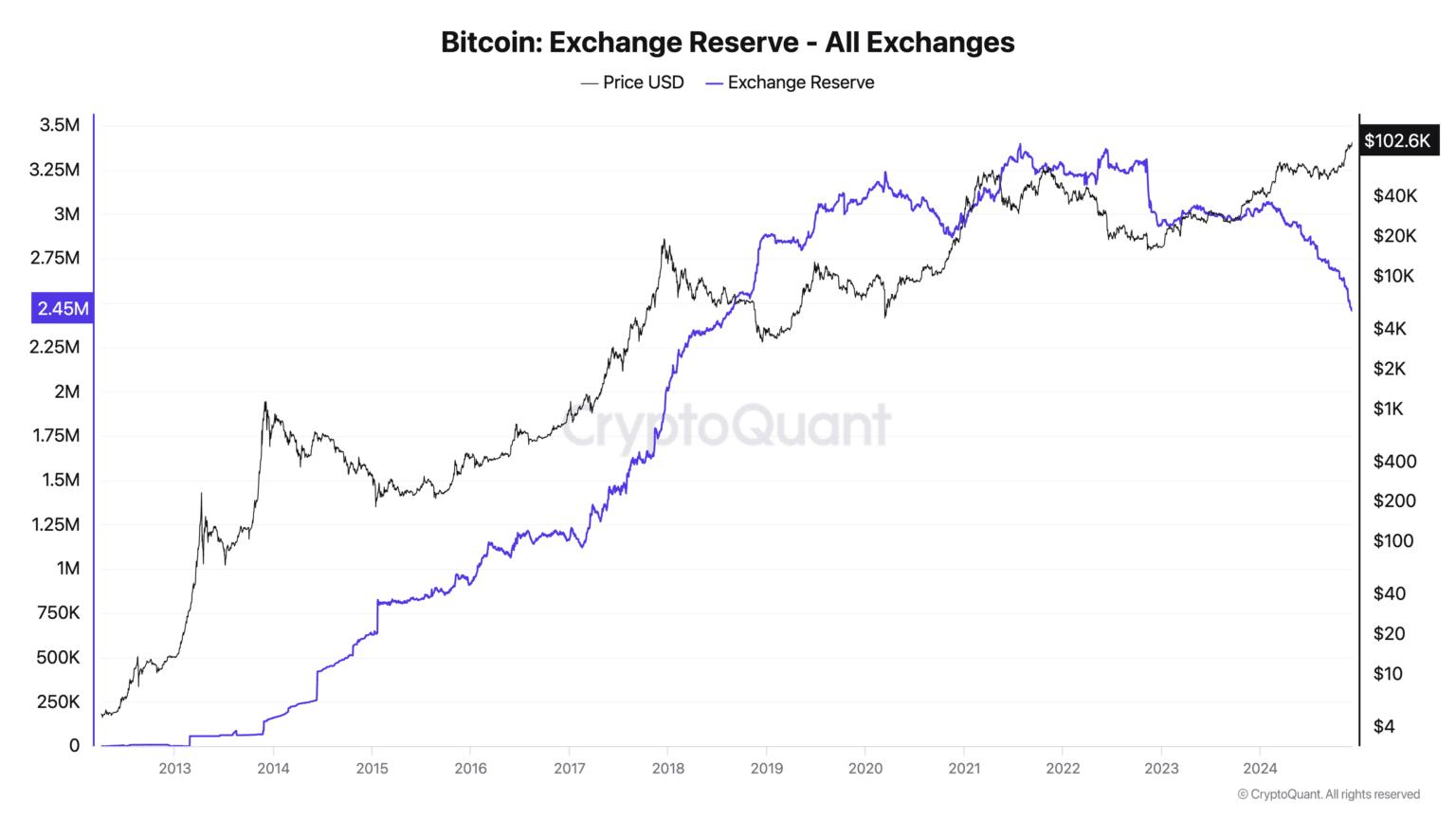

Bitcoin’s price fluctuated over the past day from $94,870 to $103,679, reaching a record high of $103,679. Moreover, the amount of Bitcoin being held on exchanges has been decreasing, suggesting less selling activity is happening.

This suggests that investors are choosing to hold their assets.

Institutional inflows bolster Bitcoin rally

The involvement of institutional investors, notably BlackRock’s iShares Bitcoin Trust ETF (IBIT), has significantly propelled the value of Bitcoin beyond $100,000. This ETF, now managing over $50 billion in assets, is a major factor driving Bitcoin’s surge.

It’s worth mentioning that IBIT managed to hit a significant mark in only 228 days, much quicker than typical ETFs, which often take years to attain comparable milestones.

The swift expansion of IBIT clearly shows the escalating interest in Bitcoin from institutional investors. Notably, BlackRock has incorporated Bitcoin investment opportunities within their conventional funds, underscoring their confidence in Bitcoin’s future prospects.

As more institutions adopt BTC as a key financial asset, the market continues to show strength.

Regulatory shifts drive positive sentiment

The recent regulatory adjustments have added more power to Bitcoin’s growth trend. Specifically on December 4th, it was announced that Paul Atkins, who is well-known for his supportive views towards cryptocurrencies, will take over as the new chairman of the SEC, replacing Gary Gensler.

This action has sparked hope within the cryptocurrency sector, as it fuels anticipation for more transparent and favorable laws in the United States.

Furthermore, during the Russia Calling Investment Forum, President Vladimir Putin voiced his firm backing for Bitcoin. At the event, Putin emphasized his support for the cryptocurrency.

As an analyst, I can confidently state that I foresee these tools evolving in some capacity. The drive to minimize expenses and enhance dependability is universal, so it’s only natural for us all to seek ways to develop and refine these tools to meet those goals.

His remarks highlight the global recognition of Bitcoin as a transformative financial technology, contributing to the ongoing rally.

Surge in futures market activity

The derivatives market has seen a considerable increase in size as Bitcoin’s value increases. The amount of open interest in Bitcoin futures contracts has risen to a staggering $64.70 billion, suggesting that both large-scale institutions and individual investors are actively participating, based on data from AMBCrypto.

The increase in open positions indicates that traders remain optimistic about Bitcoin, despite potential short-term selling for profits.

The increased activity in future Bitcoin trades underscores its popularity as a valuable asset, not just in the immediate market but also in derivative markets.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Matty Healy’s Cryptic Response Fuels Taylor Swift Album Speculation!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

2024-12-05 19:36