- ADA has broken out of consolidation, approaching key resistance at $1.40, targeting $3.00.

- Positive on-chain metrics and development activity hint at sustained momentum, despite some bearish sentiment.

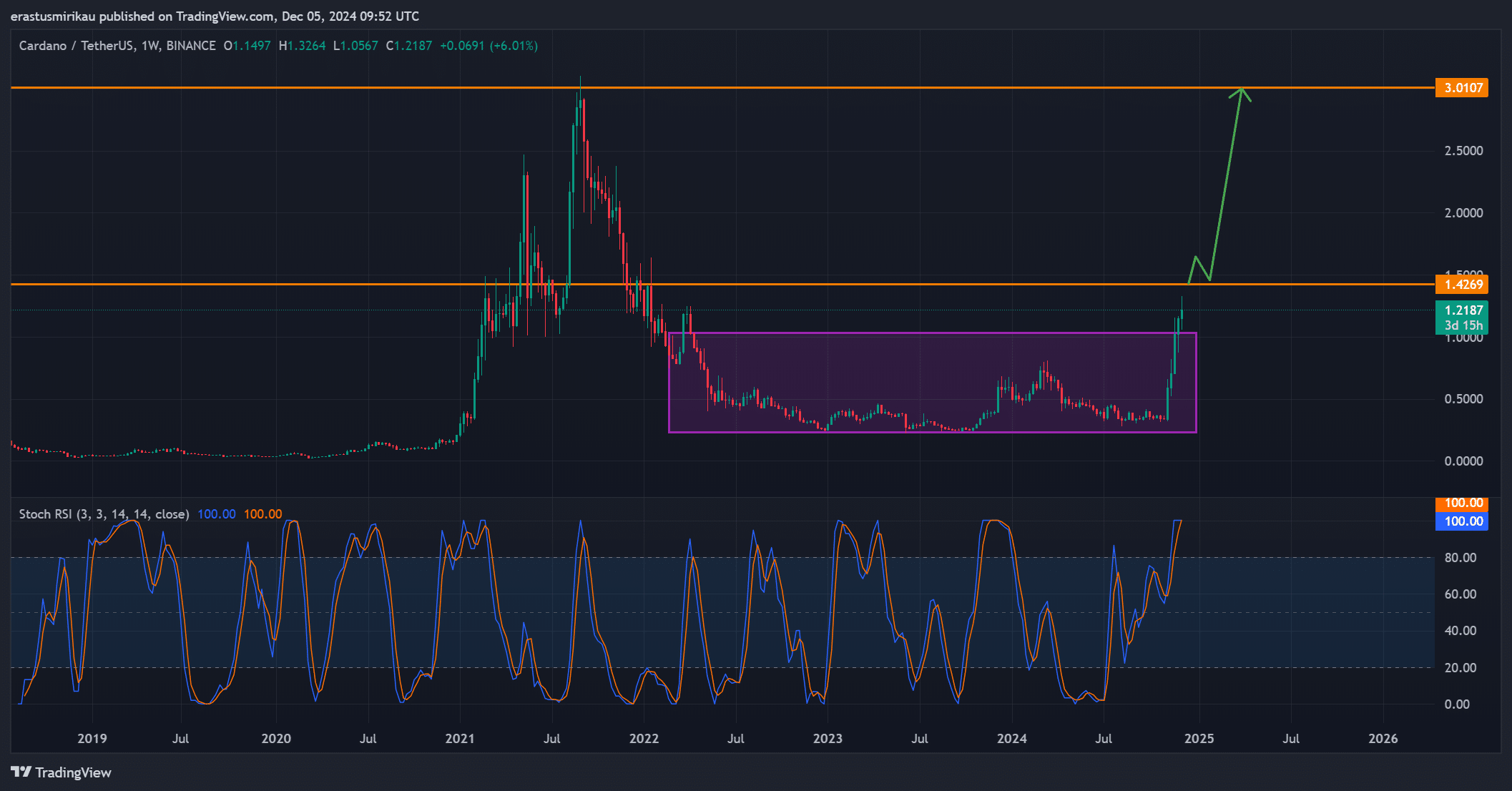

As a researcher with years of experience in the crypto market, I’ve seen my fair share of price movements and trends. The recent breakout by Cardano [ADA] from its consolidation phase has piqued my interest, especially given its approach towards the $1.40 resistance level.

💥 EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

Market chaos looms — top analysts release an urgent forecast you must see!

View Urgent ForecastIn the realm of cryptocurrencies, Cardano (ADA) is generating buzz by breaking a significant barrier, achieving approximately 130,000 transactions per second on its network. Currently, one ADA token is valued at around $1.22, marking a minor decrease of 0.28% in the last 24 hours.

Although there was a slight drop, the cryptocurrency has managed to break free from a lengthy holding pattern and is moving towards significant resistance at approximately $1.40.

Making such a step, Cardano might ignite a possible upward trend, pushing ADA towards unprecedented peaks. Yet, the question remains: Will it sustain this surge, or will obstacles halt its progress?

ADA’s chart analysis: A breakout to new heights?

Traders are taking notice as ADA, having just burst free from a period of holding steady, is nearing the significant resistance point of $1.40. This level could potentially determine the direction of its upcoming growth stage.

Should ADA manage to exceed its current threshold, its potential ceiling could rise up to $3.00. At present, the Stochastic RSI reading of 100 indicates robust bullish energy, signaling that Cardano (ADA) is experiencing an overbought state.

However, this may indicate that a correction is near unless the breakout is sustained.

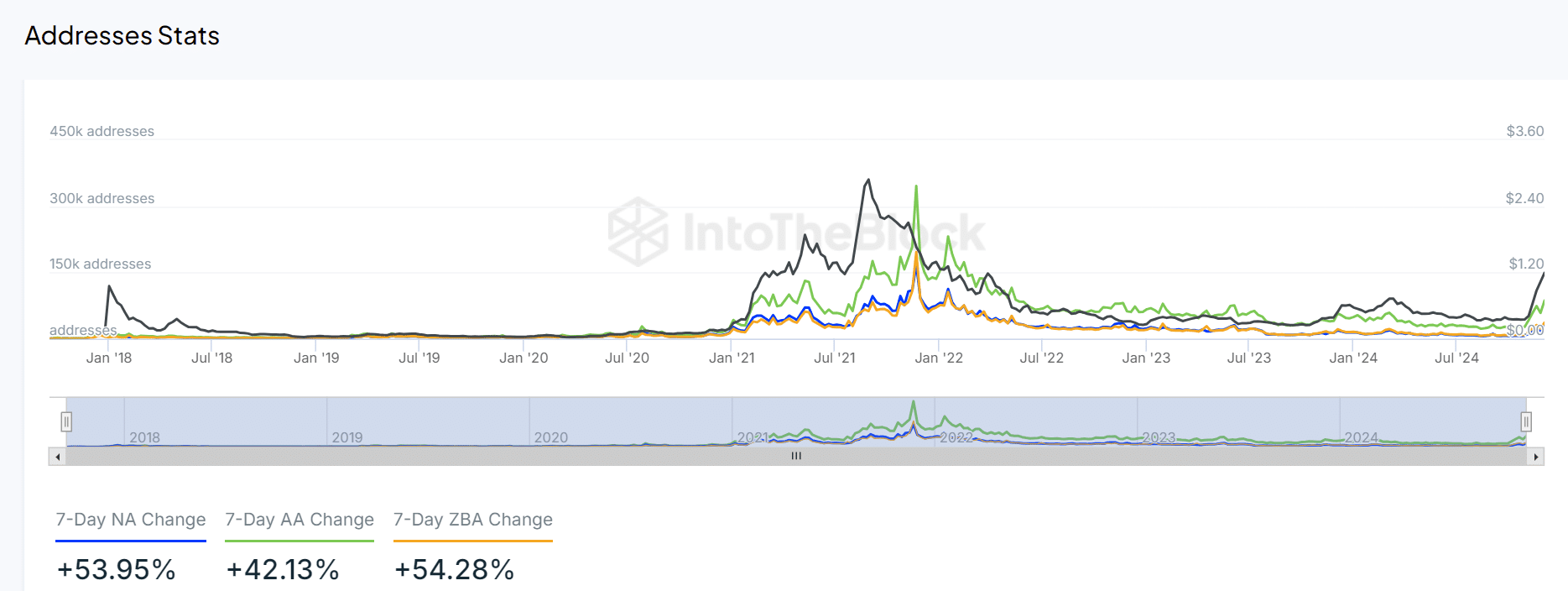

Are ADA’s on-chain metrics supporting the rally?

The statistics of transactions directly on the Cardano network indicate an upward trajectory, lending credence to the optimistic outlook. Within the last week, there’s been a 53.95% surge in newly created wallets, which suggests increased user engagement with the platform.

The increase in active user participation has risen by approximately 42.13%, suggesting these users are growing more involved.

Moreover, there’s been a 54.28% rise in the usage of zero-balance addresses, indicating a surge of newcomers joining the system. This trend suggests that Cardano’s ecosystem is expanding, potentially boosting its market dynamics.

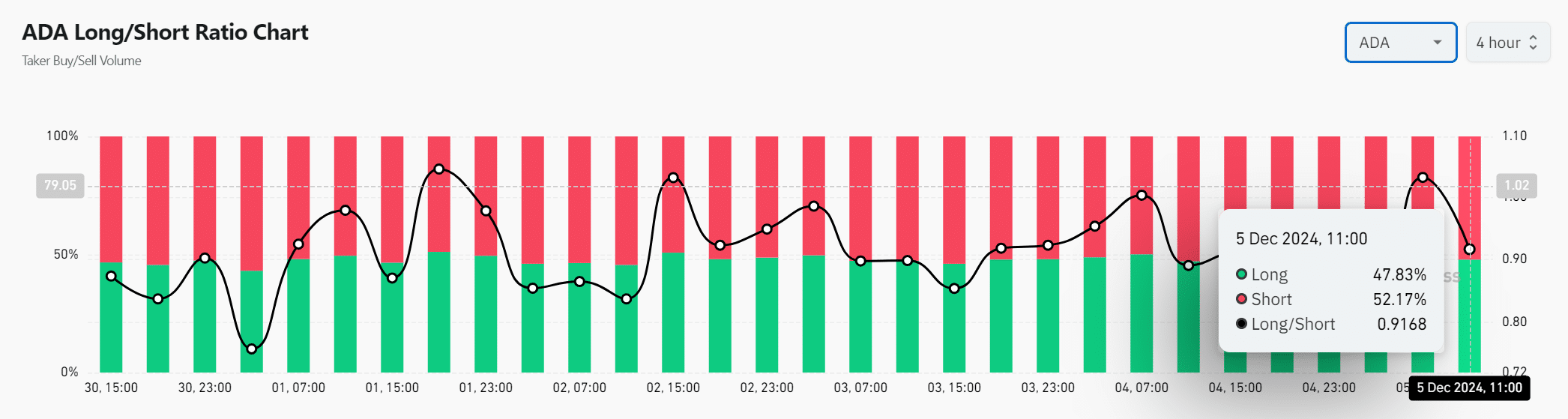

What do ADA’s trading sentiment and long/short ratios suggest?

At the moment, there are more traders taking short positions on ADA (52.17%) than those taking long positions (47.83%), indicating a slightly skewed preference towards shorting this cryptocurrency.

The ratio between length and short positions is approximately 0.92, which might indicate a pessimistic outlook in the market. Yet, it’s also plausible that this could signal a potential short squeeze scenario, particularly if Cardano manages to break through its resistance thresholds and continue its upward trend.

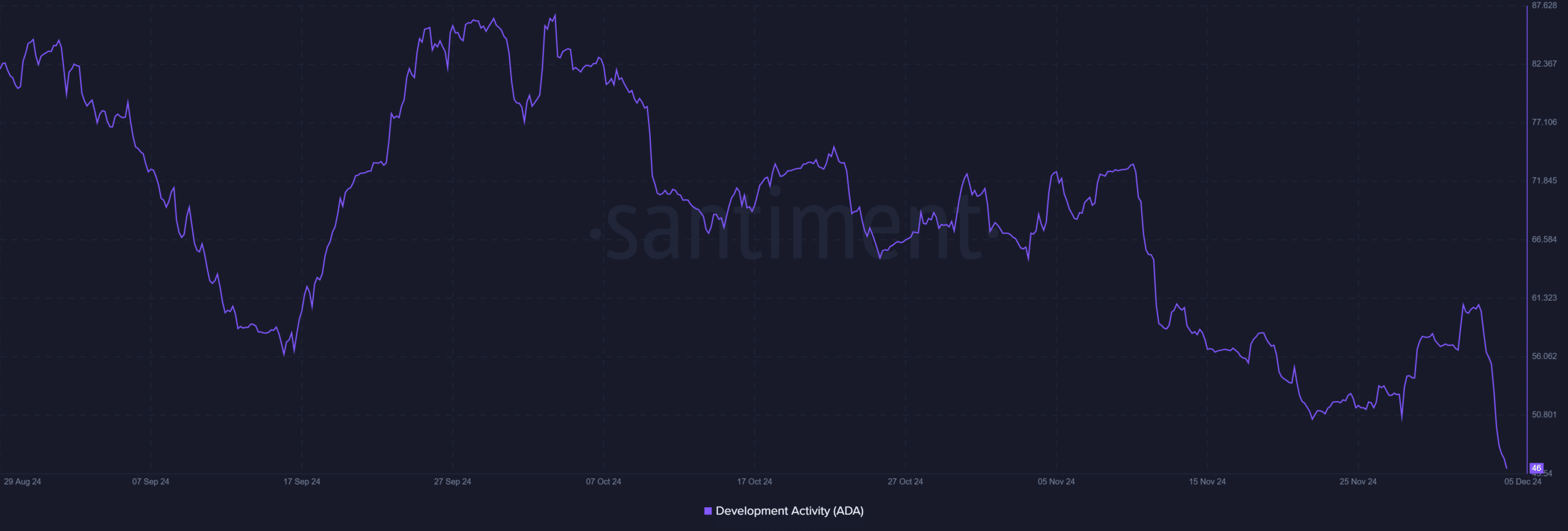

Is Cardano’s development activity paving the way for growth?

Although there’s plenty of action happening on Cardano’s blockchain, its development activity is comparatively slow, scoring only 46. This might mean that even though the network is expanding, the pace of development isn’t keeping up as quickly.

Consequently, it seems like the recent price fluctuations might be influenced more by speculative activities and general market feelings rather than substantial improvements.

Read Cardano’s [ADA] Price Prediction 2023-24

Will ADA break through or face resistance?

ADA’s latest surge and the favorable on-chain indicators suggest a potential continuation of development. Yet, overcoming the significant hurdle at around $1.40 remains crucial.

If ADA manages to surpass this barrier, it might trigger an upward momentum pushing the value towards $3.00. Conversely, if it encounters resistance, ADA could experience a dip. The market will be keenly observing the price movements as Cardano progresses and expands its platform.

Read More

- OM PREDICTION. OM cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered – Ring of Namira Quest Guide

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Quick Guide: Finding Garlic in Oblivion Remastered

2024-12-05 23:36