- XRP could rally by 18% to reach the $2.90 level if it closes a daily candle above the $2.50 level.

- 50.8% of top XRP traders held short positions at press time, while 49.2% held long positions.

As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself intrigued by the current state of XRP. The recent surge of 370% over the past month has certainly piqued my interest, and the ongoing outflow of $288 million since December hints at potential buying opportunities.

Even though XRP, Ripple‘s native digital currency, has been affected by recent price adjustments, data from Coinglass suggests that it continues to evade the attention of large investors (whales) and the broader investor community.

A possible explanation for this appeal might stem from XRP’s impressive growth trajectory over the last month, with an outstanding increase of approximately 370%.

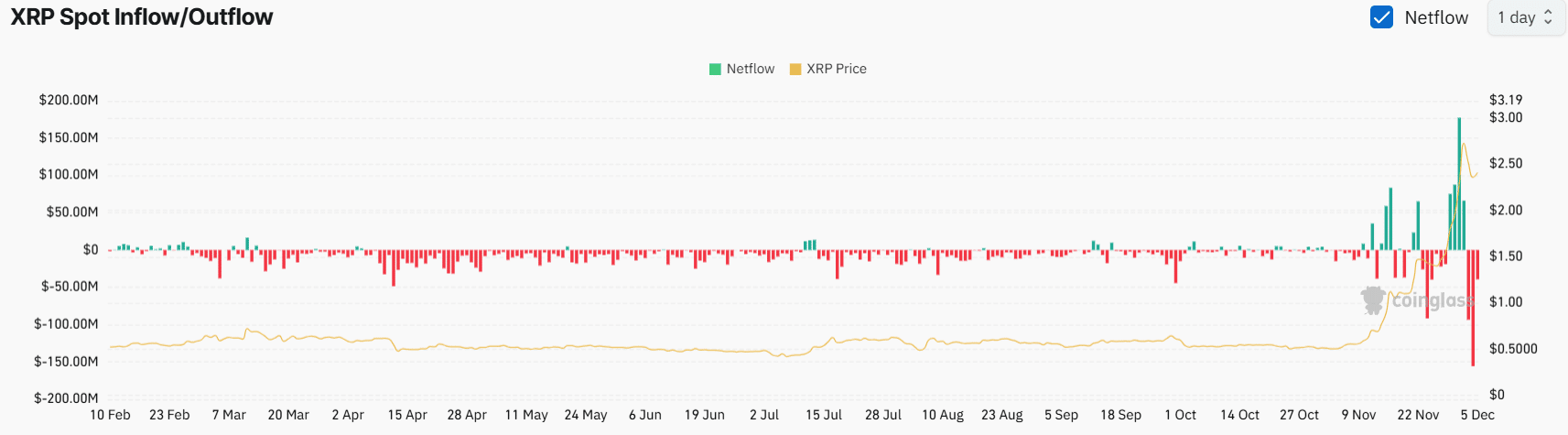

$288 million XRP outflow

Based on data from CoinGlass regarding XRP’s spot inflows and outflows, there has been a substantial withdrawal of approximately $288 million worth of tokens from exchanges since early December.

In terms of cryptocurrencies, a significant withdrawal refers to moving assets from digital exchanges into personal wallets for long-term storage or holding.

This situation could be a good chance for purchasing, suggests a probable increase in positive movement, and lessens the urge to sell.

Bearish sentiment among traders

Besides choosing to hold onto their assets for a prolonged period, traders seem to maintain a balanced stance, potentially anticipating an upcoming surge in XRP prices.

At the present moment, data indicates a XRP Long/Short Ratio of 0.98, suggesting that most traders are leaning towards a bearish outlook. Approximately half (50.8%) of the leading traders are currently holding short positions, while the remaining 49.2% have long positions.

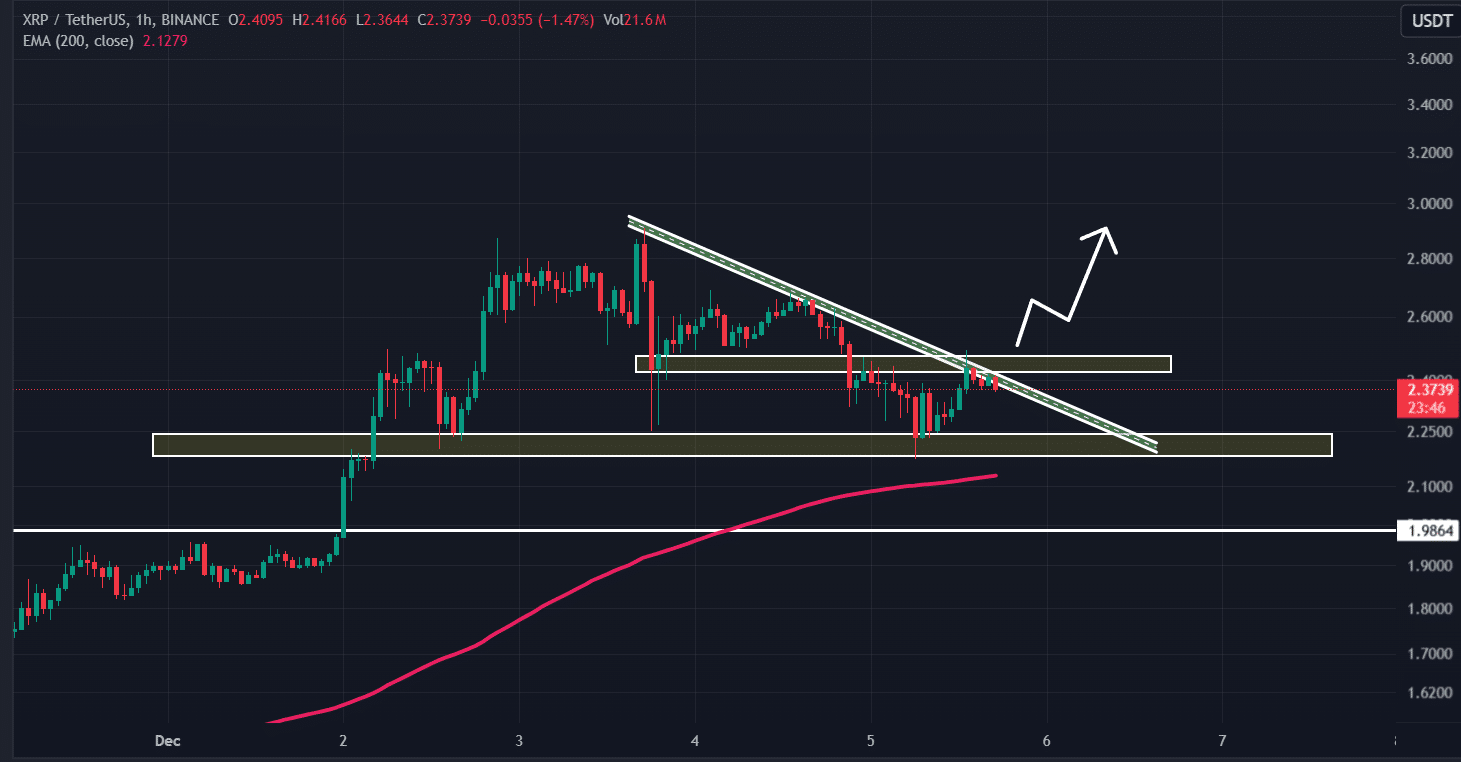

As per AMBCrypto’s technical assessment, the price graph for XRP shows a recent break beyond a sloping trendline in the hourly chart, encountering resistance around the $0.247 mark.

Given the latest market trends and previous performance, if XRP manages to surpass its current resistance and end the day’s trading above $2.50, it may significantly increase by around 18%, potentially reaching approximately $2.90 over the next few days.

On a favorable note, the altcoin was transacting above its 200 Exponential Moving Average (EMA) on shorter as well as longer time periods, suggesting an upward trend. However, Ripple’s Relative Strength Index (RSI) stood at 40, approaching the oversold region.

When a financial asset’s Relative Strength Index (RSI) nears the oversold region, it usually suggests that the asset has potential for strong gains in the near future.

Read Ripple’s [XRP] Price Prediction 2024–2025

XRP’s price momentum

Currently, at the point of publication, XRP was close to approximately $2.40 per unit. Over the previous 24-hour period, it experienced a decrease in value amounting to 7.2%.

Over that timeframe, there was a 25% decrease in trading activity, suggesting less involvement from traders and investors as compared to earlier periods.

Read More

2024-12-06 07:03