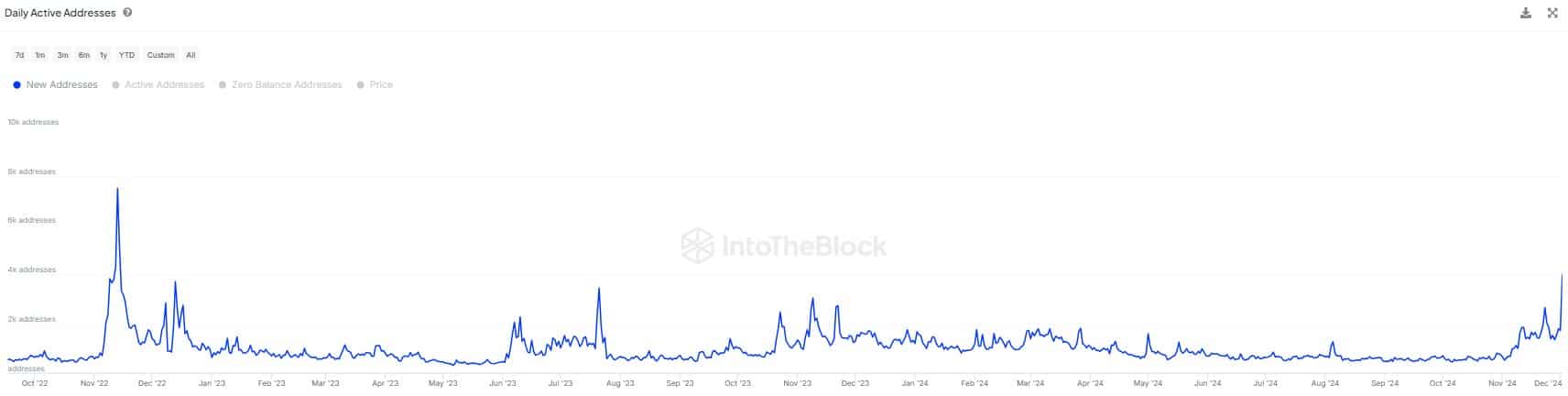

- The number of new LINK addresses has surged, returning to levels not seen since 2022.

- This increase coincides with a rise in large transactions and longer average holding periods.

As a seasoned researcher with extensive experience in the ever-evolving cryptocurrency landscape, I find myself intrigued by the recent surge in Chainlink [LINK] activity. The influx of new addresses and large transactions, coupled with extended holding periods, paints a bullish picture for this asset.

At the current moment, following a notable increase of 126.19% over the past month, Chainlink [LINK], seems to be experiencing a period of stability, with a slight dip of 1.29% observed in the previous 24 hours.

This appears as a healthy retracement that could pave the way for renewed upward momentum.

According to AMBCrypto’s analysis, although LINK appears to be temporarily pulling back, its market circumstances seem to indicate another surge could be imminent, similar to the bullish trend observed last month.

New entrants hint at potential surge

Data from IntoTheBlock revealed a significant increase in the creation of new LINK addresses.

At present, approximately 4,000 new links associated with Chainlink have been set up. This pattern seems to indicate growing curiosity about the asset, possibly from investors who are planning to invest.

If a significant number of new buyers decide to purchase LINK, this increased demand might boost its price even further, reinforcing its current upward trend.

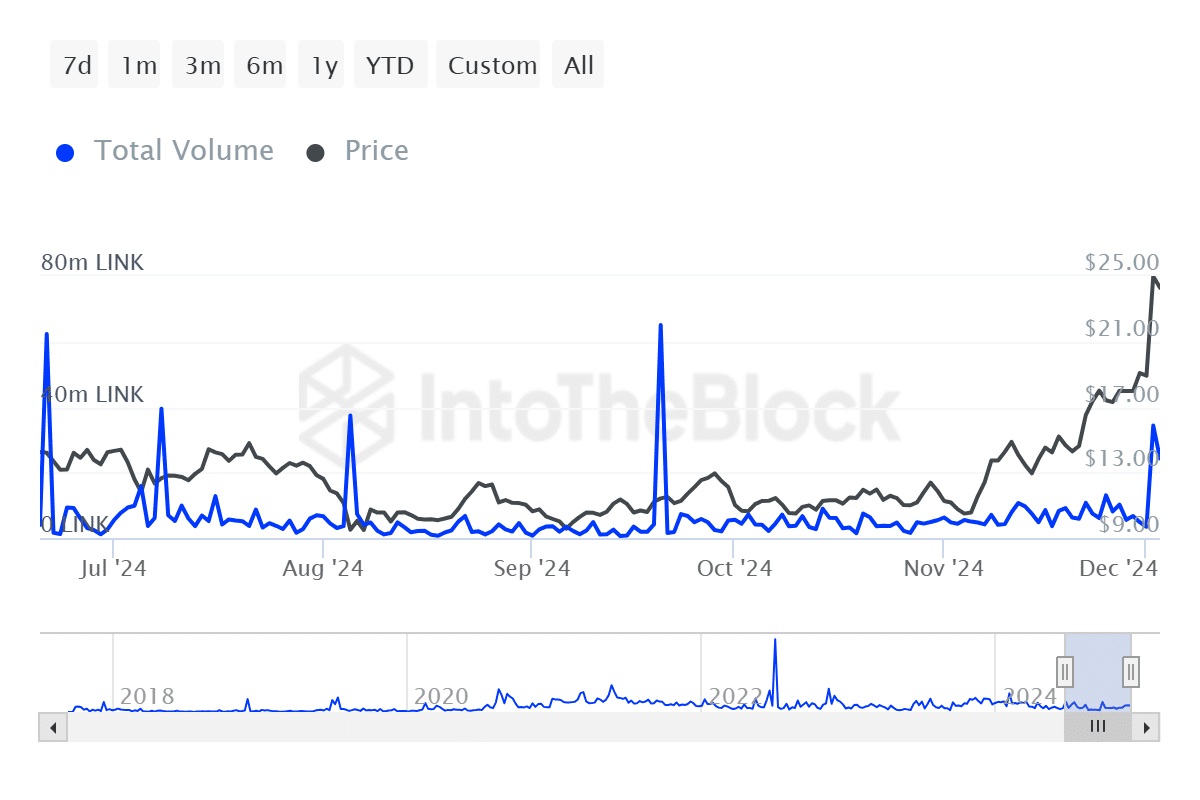

Spike in large transactions and volume

In recent times during December, there’s been a significant increase in both the number and size of transactions, which is often linked to investors owning at least one percent of the asset’s total supply.

For the last week, we’ve seen approximately 1,980 large transactions occur, summing up to around 34.34 million Links worth about $858.08 million in total.

Although this volume dipped over the last 24 hours to $290.99 million, it still reflected sustained upward activity.

It’s worth noting that an uptick in large transactions occurred concurrently with relatively steady or mildly decreasing prices.

Frequently, this pattern suggests that significant investors are preparing for possible profits by strategically building their positions in LINK, hinting at anticipated growth in its future returns.

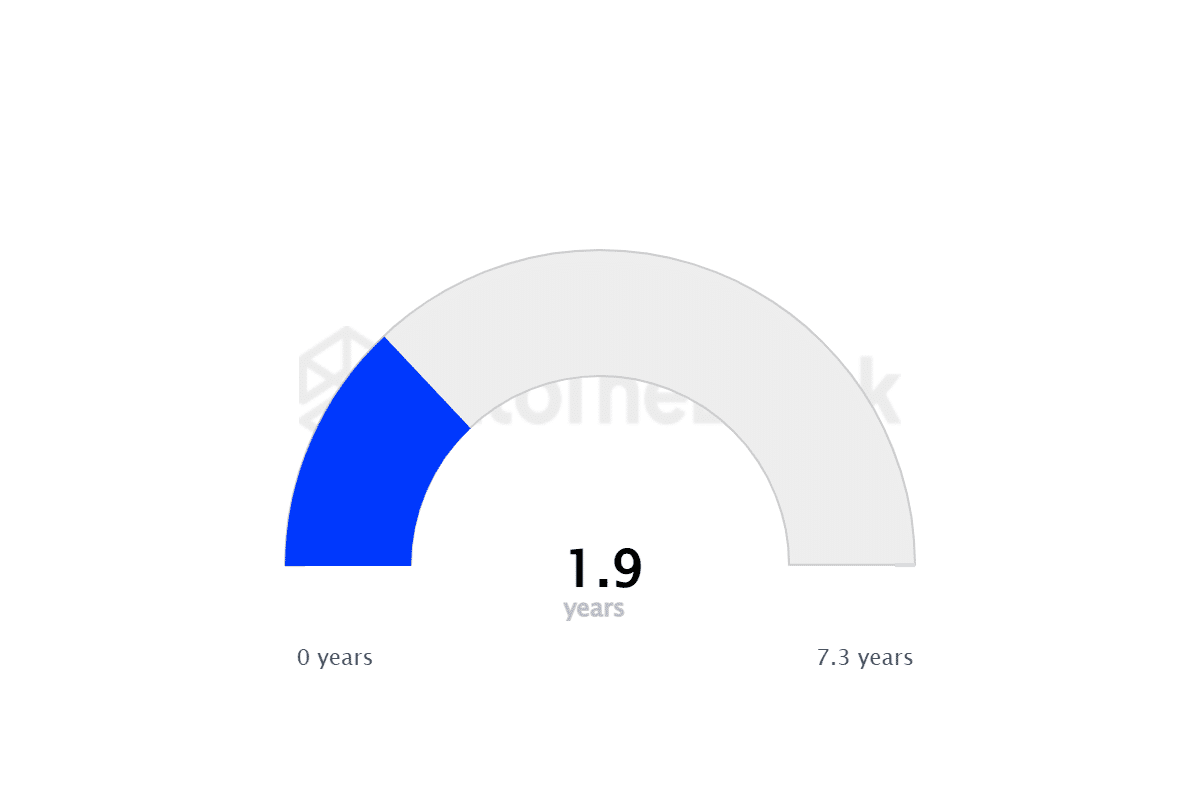

Long-term LINK holding suggests…

Based on the Average Time Token is Held data, it’s been found that the typical holding duration for LINK has substantially increased, now standing at approximately 1.9 years.

On average, LINK tokens remain dormant in wallets for nearly two years before being transacted.

Read Chainlink’s [LINK] Price Prediction 2024–2025

Prolonged holding periods imply that significant traders could be stockpiling the asset, suggesting they plan to hold onto it for an extended period as well.

This pattern shows high levels of investor trust, suggesting a definite intention to boost LINK’s value in the long run. It demonstrates an increasing tendency among owners to consider the asset as a long-term financial commitment.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Elder Scrolls Oblivion: Best Thief Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Ludicrous

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Gold Rate Forecast

2024-12-06 08:08