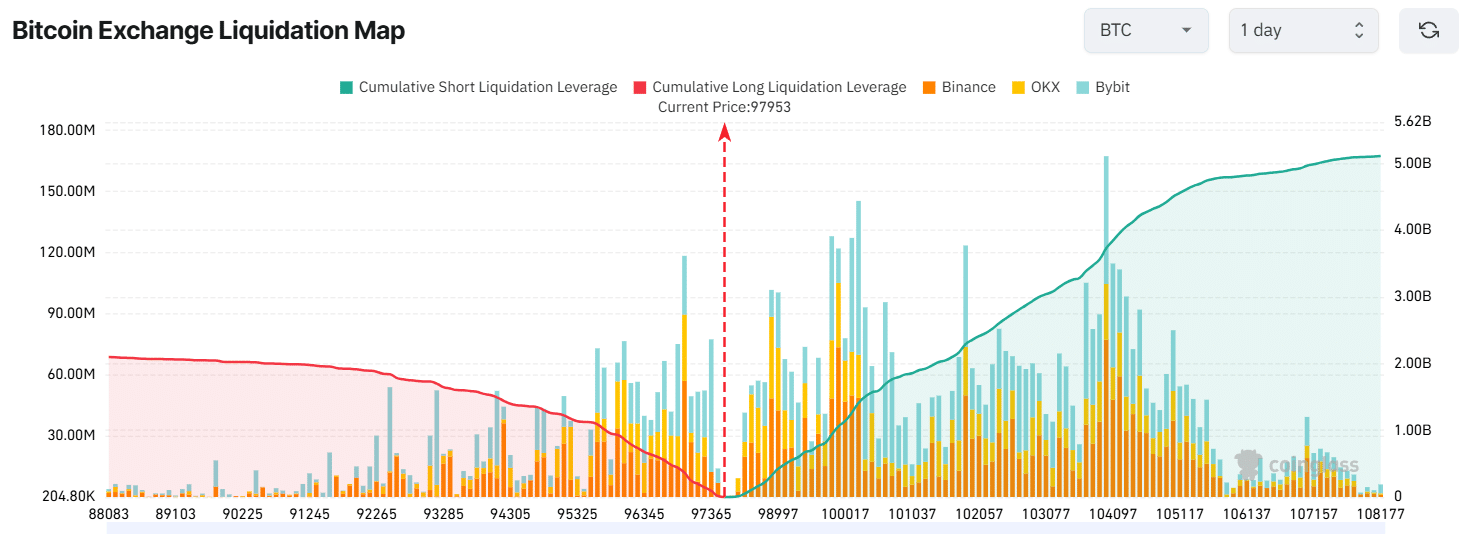

- Traders are overleveraged at $96,957 on the lower side and $99,813 on the upper side.

- Bitcoin will once again cross the $100,000 mark if it closes a daily candle above the $99,700 level.

As a seasoned crypto investor with a decade of experience navigating market volatilities, I find myself both intrigued and cautious at this juncture. The recent price drop following BTC‘s historic $100,000 milestone is reminiscent of the rollercoaster ride we often embark on in this digital frontier.

The value of cryptocurrencies took a hit when Bitcoin (BTC), the world’s leading digital currency, dropped by 5.47% in a single minute, after it reached over $100,000 for the first time.

The significant drop in prices has caused a shift in the general market attitude, leading many traders to sell off approximately a billion dollars’ worth of both long and short investments.

Why is BTC falling?

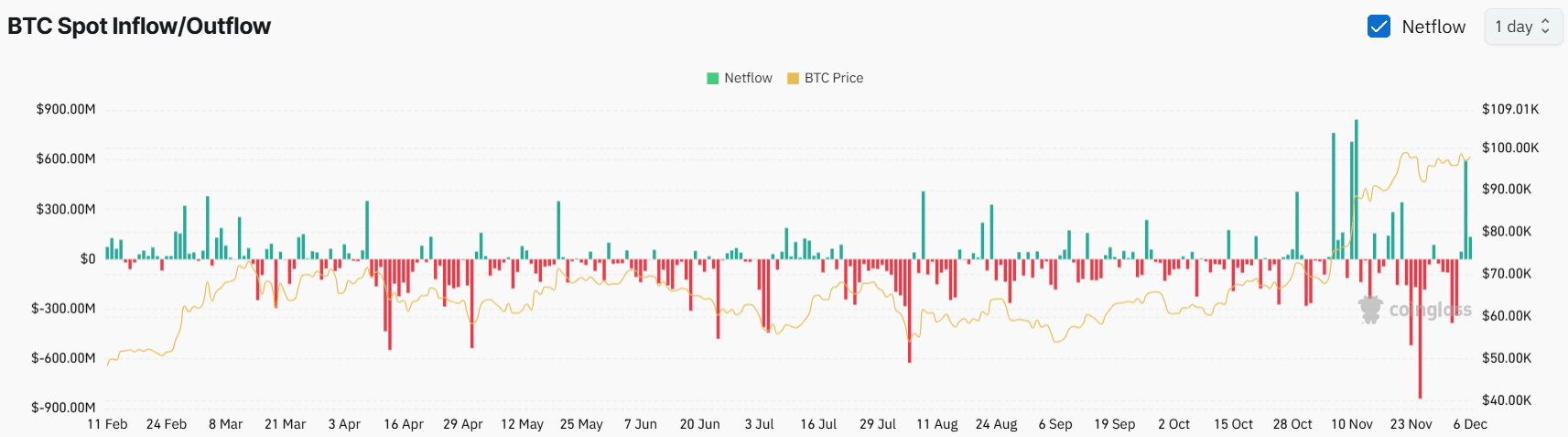

The full extent of this potential price drop remains uncertain. But, according to data from exchange analysis firm Coinglass, it could be due to a substantial increase in deposits into cryptocurrency exchanges, which may have contributed to the recent price decrease.

According to Bitcoin spot inflow/outflow data, there has been a notable departure of approximately $732.5 million worth of BTC from exchanges. In the world of cryptocurrencies, “outflow” means that Bitcoin is moving from digital wallets to exchanges, which can be interpreted as a possible indication of selling pressure and a potential drop in price.

Nevertheless, the recent fall in prices has sparked anxiety amongst traders and investors, leading to questions about whether the price might continue to decrease or if the market will recover instead.

Bitcoin technical analysis and key levels

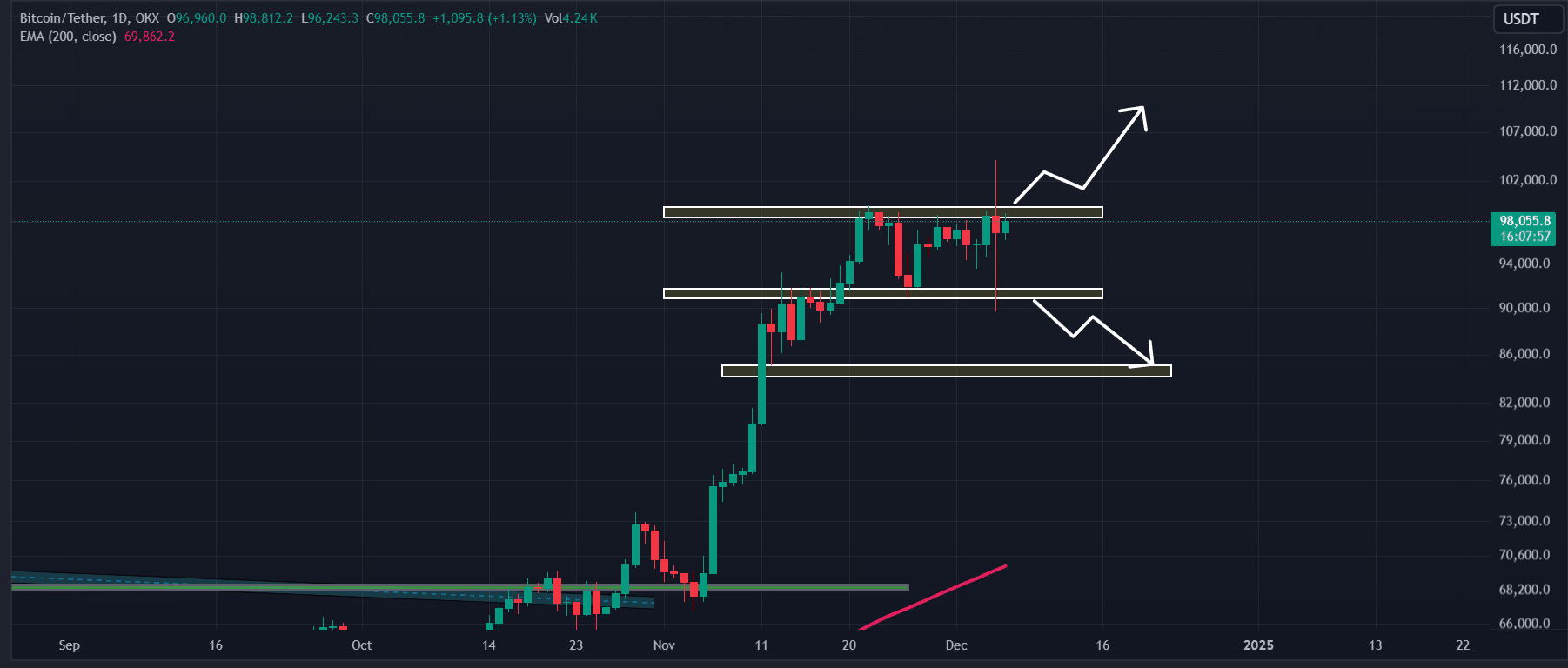

Based on AMBCrypto’s technical assessment, Bitcoin (BTC) is currently holding steady within a narrow band, ranging from $92,000 to $99,100. Yet, a recent escape from this boundary appears to have been a deceptive rally, as BTC was unable to maintain its elevated level and has since retreated back into the original range.

If Bitcoin surpasses the upper limit of its current price range in the recent trend and ends the day trading above $99,700, it’s highly likely that it will revisit the $100,000 level and maintain its value thereafter.

As a researcher examining Bitcoin’s price movements, I can share that should Bitcoin fail to maintain its current range and instead close a daily candle below the $91,500 mark, there’s a substantial possibility it might plummet towards the $86,000 level.

At present, Bitcoin’s Relative Strength Index (RSI) is at 62, slightly below the zone where an asset is considered overbought. This suggests that there may be further increases in its value within the next few days.

Major liquidation levels

As an analyst, I’ve been keeping a close eye on both technical analysis and key liquidation levels in the market. At the moment, the significant support level can be found around $96,957, while the resistance is situated at $99,813. It’s worth noting that traders seem to be overleveraged at these particular price points, as per Coinglass’s latest data.

If there’s a shift towards optimistic market trends and the price reaches approximately $99,813, it would potentially force out around $938 million in short positions.

If sentiment becomes negative (bearish) and the price falls to around $96,957, it’s estimated that about $364 million in long positions might need to be sold off or liquidated.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The data on liquidation shows a clear prevailing pessimism towards the asset, with several people expecting the Bitcoin price to stay below the $99,813 mark.

Currently, Bitcoin was approximately $97,970 per unit at the point of reporting, marking a 4.10% decrease in value over the last 24 hours. Remarkably, during this time frame, the trading volume has grown by 4%, suggesting a slight uptick in investor and trader engagement compared to the day prior.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Masters Toronto 2025: Everything You Need to Know

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-12-06 16:08