- The Bitcoin liquidation cascade in recent hours saw a robust recovery, with BTC bouncing 6.5% already.

- Timing the bottom of each dip is hard, but it helps to have a plan of action when the dip does arrive.

As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I can’t help but feel a sense of both exhilaration and caution when witnessing Bitcoin’s recent liquidation cascade. While it’s never easy to predict the exact bottom of each dip, the opportunity presented by such events is something I’ve learned to appreciate over time.

On Friday, the 6th of December during the Asian trading hours, Bitcoin [BTC] experienced a series of forced sell-offs due to a concentration of selling points being hit by the market price, which we often refer to as a ‘liquidation cascade.’

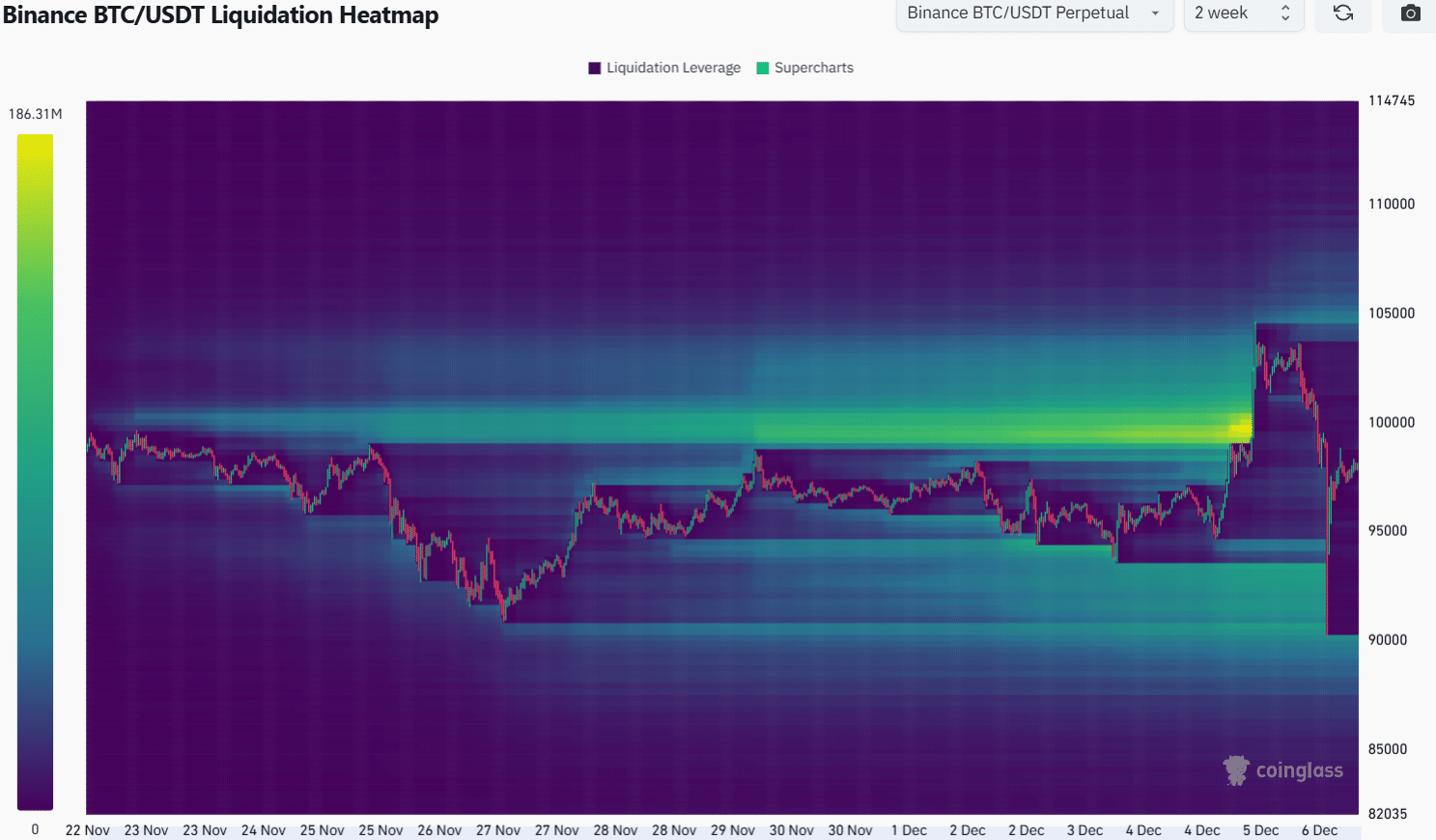

In the last few hours, heavy selling pressure almost caused Bitcoin to dip below $90,000. Analyzing the liquidation map by AMBCrypto revealed that within the past couple of days, there were two instances of liquidation events.

After surging past $104,000, the price increase was seen following the clearing out of the grouping of liquidity around $100,000. A subsequent drop to $94k caused trouble for overextended bulls, setting the stage for a more steady Bitcoin movement thereafter.

Liquidation cascades- a trading opportunity

According to data from Coinglass, during the last 24 hours, a total of approximately $883 million in crypto assets were liquidated across the market. This amount includes around $493 million in Bitcoin, where $418 million was due to short positions.

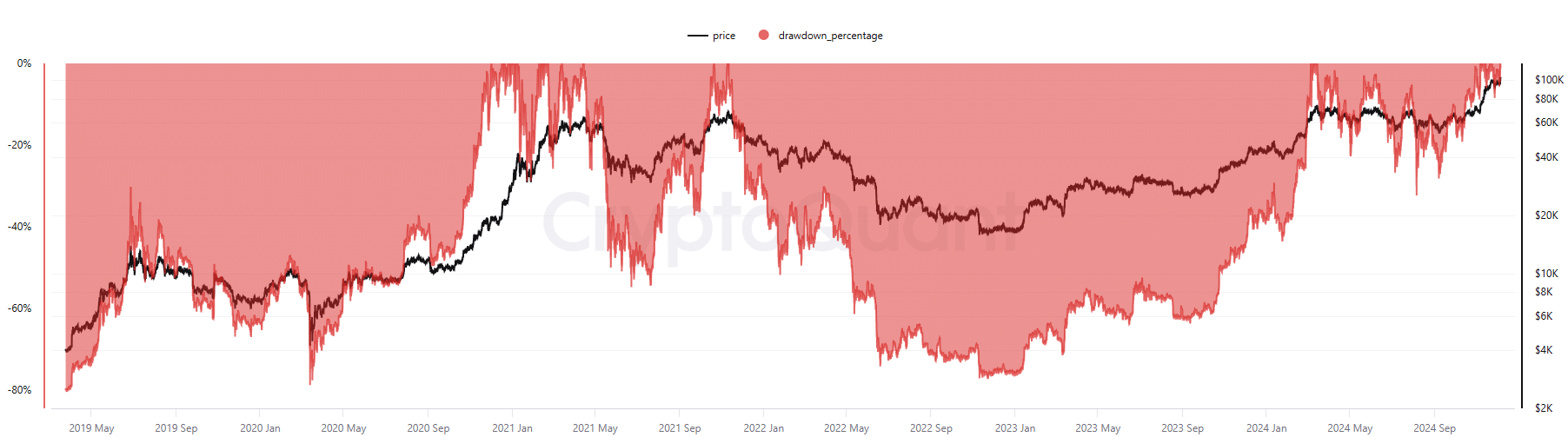

Following a 12.59% decrease in BTC price on Binance, there were slight variations in value across other exchanges. Over a period of seven hours, the price fell from approximately $103,500 to $90,500. Despite this drop, the bull run remained intact, and such significant declines are typically seen during bull runs as Bitcoin often experiences substantial corrections.

During the 2020-21 period, there were several instances where Bitcoin’s price dropped by 20% or more from its all-time high. The most recent drop wasn’t as significant, but it had already started recovering. At the moment of press, the Bitcoin price stood at $98,000.

It was intriguing to consider how much profit traders might have earned if they’d purchased when the significant recent price drops occurred.

How much profit would you be in had you bought the recent Bitcoin dips?

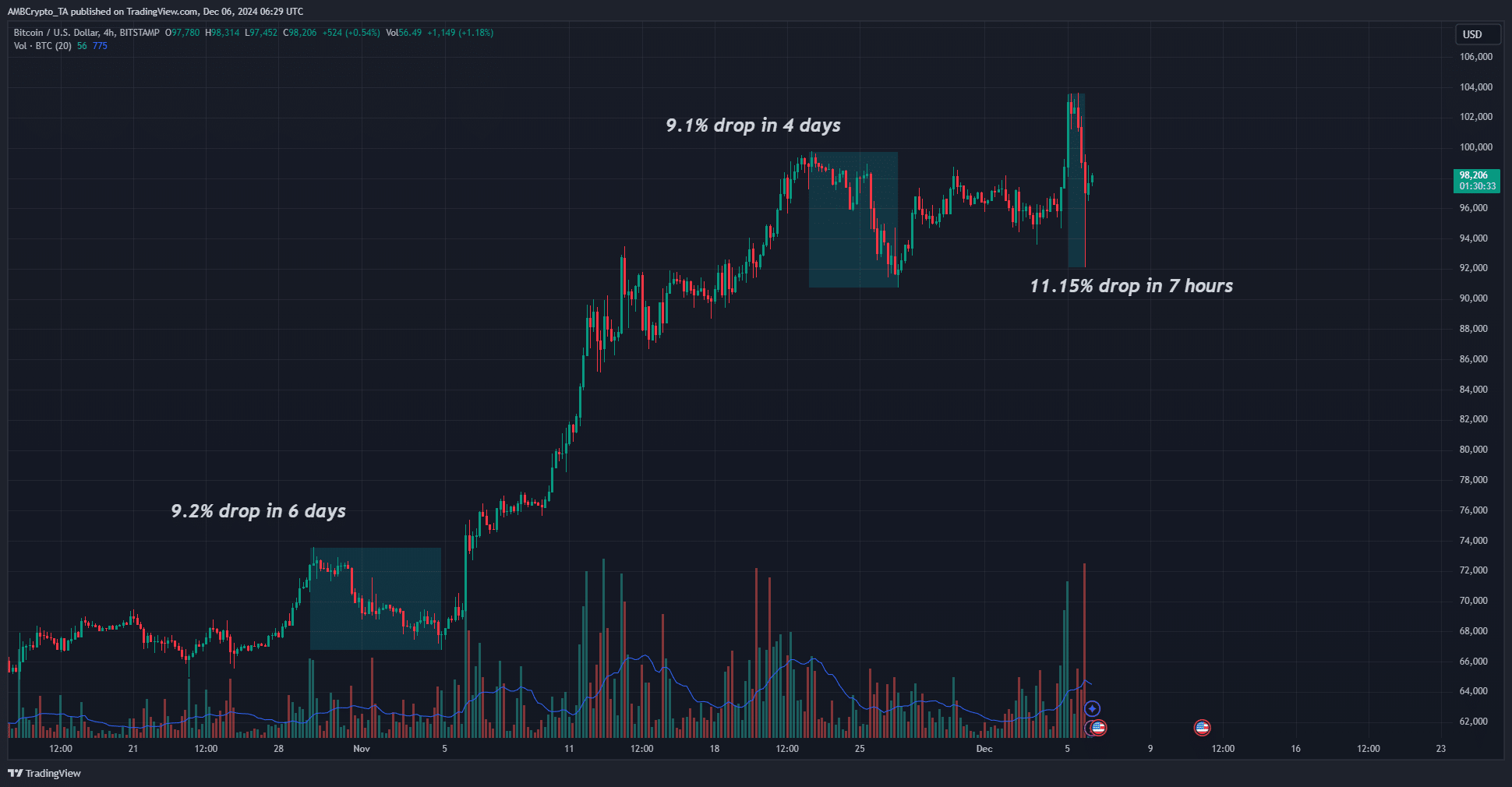

Starting from October 29th, Bitcoin has experienced three significant price declines, with the latest one being the greatest. It’s worth noting that various trading platforms recorded slight variations in prices during these drops, and the fall on Bitstamp was approximately 11.15%.

Initially, those first two instances didn’t resemble typical liquidation cascades, an event usually seen during very excited markets, such as during a prolonged bull run where Open Interest reaches new heights nearly every month.

If a trader had purchased Bitcoin (BTC) for $1,000 during the troughs of the last three price drops, they would currently find themselves in a very lucrative position.

If Bitcoin surpasses $100k once more, an initial investment of $3,000 made during its recent declines would approximately amount to $3,685. It’s worth noting that a significant portion of these returns occurred following the robust surge in value after the U.S. presidential election results were announced.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A 68.5% return in just over a month sounds good enough for traders just buying the dip. Of course, hindsight is 20/20, and timing the exact bottom is difficult.

Yet, the charts show that, in a bull run, the trend is your friend, and high-conviction investors shouldn’t be scared to buy the dip in the coming months.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-06 18:15