- The DOT bearish divergence could see a price dip soon.

- The long-term Polkadot price prediction is bullish, with $24 as a target for Q1 2025

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I find myself both excited and cautious about Polkadot [DOT]. The bullish run over the past month has been impressive, but the recent bearish divergence on the RSI is a cause for concern.

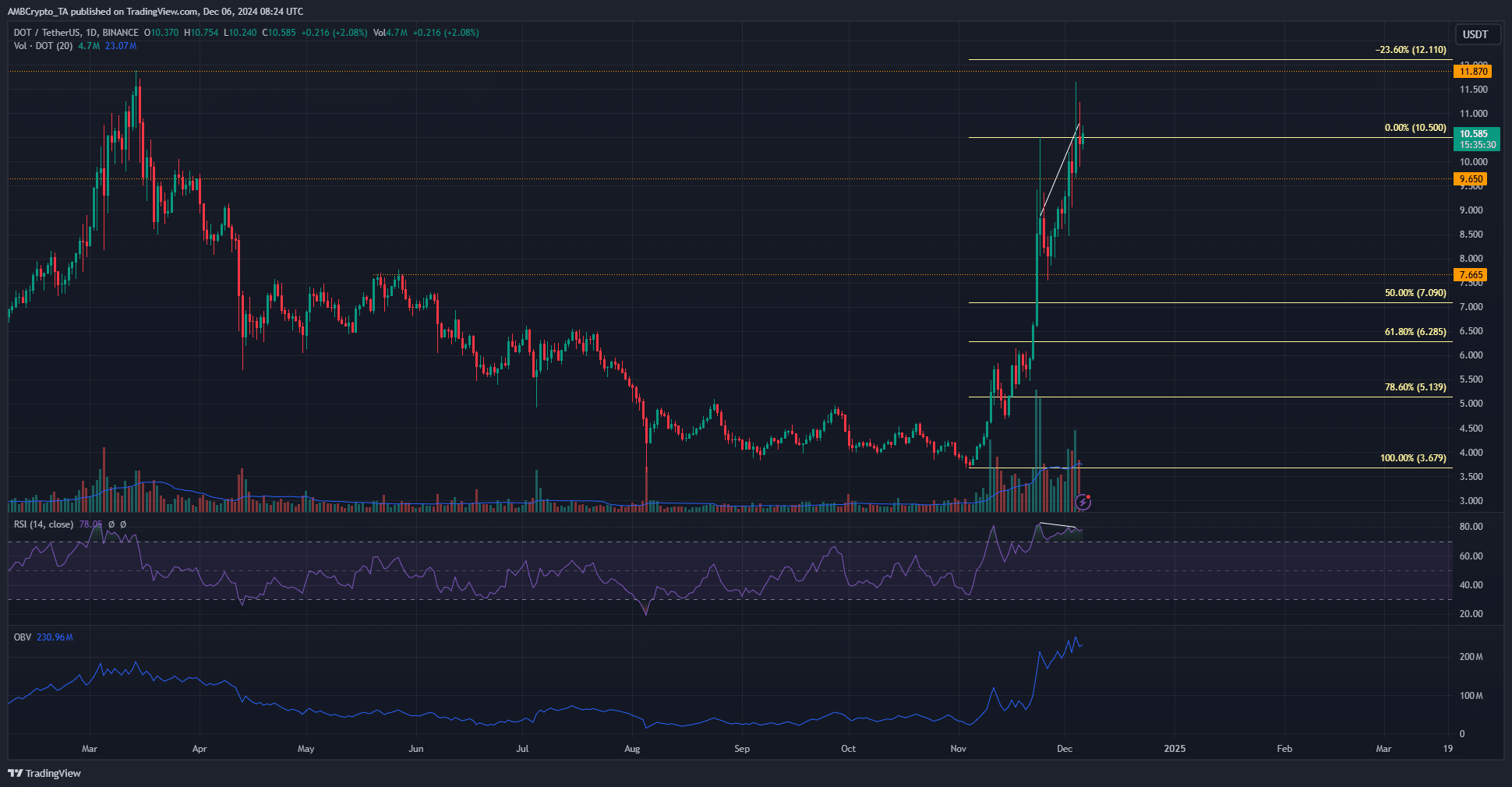

Over the last month, Polkadot (DOT) has been experiencing a robust upward trend. On the 4th of December, it peaked at $11.65, but so far, the buyers haven’t successfully transformed the $10.5 area into a supportive zone.

In simpler terms, it’s expected that Polkadot’s future pricing will trend upward (bullish), but first, the market requires some period of stability and recovery before moving forward.

Polkadot price prediction bearish in the short term

Over the last day, Polkadot showed a robust bullish trend, with purchase activity significantly increasing over the past month. This surge is clearly seen in the On-Balance Volume (OBV), which has reached a new peak. Remarkably, this recent peak surpasses the one set in March when DOT was trading at $11.8.

Although the continuous demand looks promising, the contradictory trend on the Relative Strength Index (RSI) is concerning. In the last fortnight, the RSI formed lower peaks as compared to the rising prices of Polkadot.

Given the current market conditions, a bearish outlook seems likely for Polkadot in the short term. The market appears to be needing some time to stabilize and regroup, which could last anywhere from a week to a month, contingent upon the overall sentiment in the crypto market and Bitcoin‘s [BTC] trajectory.

Despite the temporary period of sideways movement that might occur following this consolidation, the broader trend continues to point upward. For a significant shift in the longer-term outlook to become bearish, we would need to see a fall below the levels of $8.56 and $7.55. However, given the current data, such a decline seems improbable.

If the price of DOT drops down to around $10.5 and holds there, it could be considered a sign of support. In the upcoming weeks, if this happens, the bullish investors might aim for potential prices as high as $16.35 and $23.85, which may act as resistance levels.

Where would the next buying opportunity be?

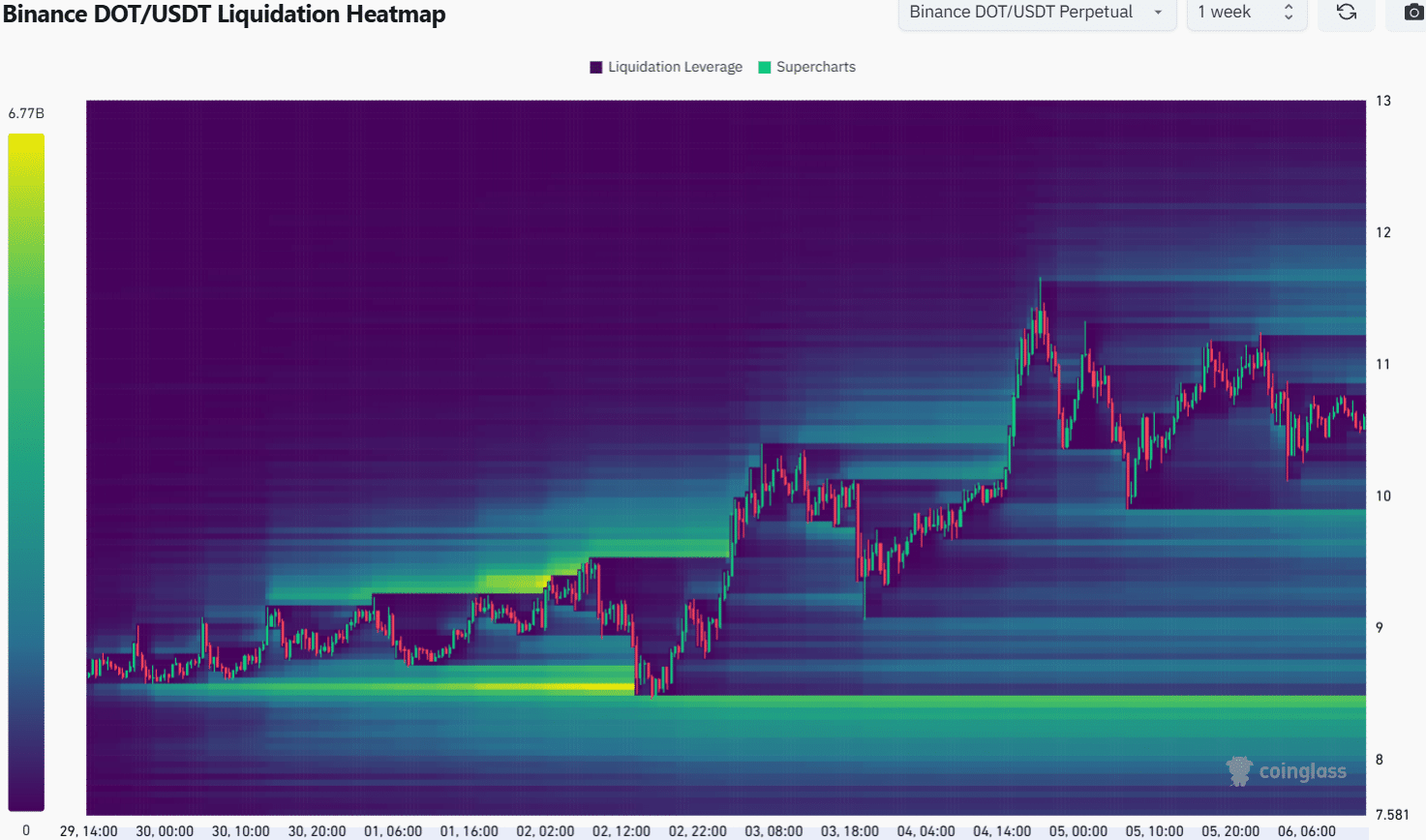

For the last ten days, significant selling pressure has accumulated near the crucial support points at $7.4 and $8.4. This suggests that these levels hold substantial significance and corroborates the conclusions drawn from our daily price analysis.

Is your portfolio green? Check the Polkadot Profit Calculator

Last week’s liquidation map highlighted the areas around $9.9 and $11.3 as potential short-term attractive spots. It’s plausible that DOT could move towards these prices, creating a price range in the process.

However, traders should be prepared for the potential drop to $8.4 or lower.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

2024-12-07 02:15