- Worldcoin had a strong short-term bullish expectation.

- The bearish divergence could be followed by a price dip toward $3.3.

As a seasoned analyst with years of market observation under my belt, I see Worldcoin [WLD] as a coin that has been steadily climbing and flipping resistance zones into support. The bullish sentiment is strong, fueled by a robust daily and weekly market structure, and a significant surge since the September lows. However, a bearish divergence in the Money Flow Index (MFI) could potentially lead to a price dip towards $3.3.

Worldcoin (WLD) has successfully transformed the $2.5 barrier into a support level and is aiming for $4.5 in the near future. Both the daily and weekly market trends are optimistic, but there’s a slight bearish discrepancy for WLD.

In the next few days, we might witness a drop in prices. Previously resistant level at $3.26 is now acting as a support, and it seems less probable that the decline will be significant given the robust flow of capital.

Moving average crossover captures Worldcoin bullishness

Over a six-month period from March to September, WLD showed a sharp decline on its daily chart. However, it then entered a phase of stability for an entire month. As of now, since reaching its lowest point in September, WLD has soared by 198%. A substantial part of these gains happened within the last ten days following the breaking of the $2.5 resistance barrier.

Previously identified as a potential demand area ($2.5-$2.9), this region has now been confirmed as such by subsequent tests. Buying activity managed to hold and even surpass this zone, breaching the previous resistance at $3.26 from July, marking a higher level but not a new high in price for Worldcoin.

As a researcher, I’ve noticed an upward shift in the market structure over the past week, following the break above the key resistance level at $3.26. The daily structure has been trending bullish since the second week of November, after a temporary pullback in late October caused the price to dip down to $1.589.

The lines that represent the average price over the past 20 and 50 days have crossed each other in an upward direction, suggesting potential support if prices fall again. However, the Money Flow Index (MFI), currently at 81, might create a bearish pattern by making a lower peak compared to December 1st, which could indicate a possible downward trend.

As I, the researcher, observe the current market trends, it appears that the next significant area for potential bullish momentum lies around the $4.5 region. This zone served as a crucial support from April to June. Consequently, any sustained rally beyond this level might require some time to materialize due to the resistance at hand. In the meantime, we may expect a period of consolidation beneath this resistance level.

Short-term sentiment remains firmly bullish

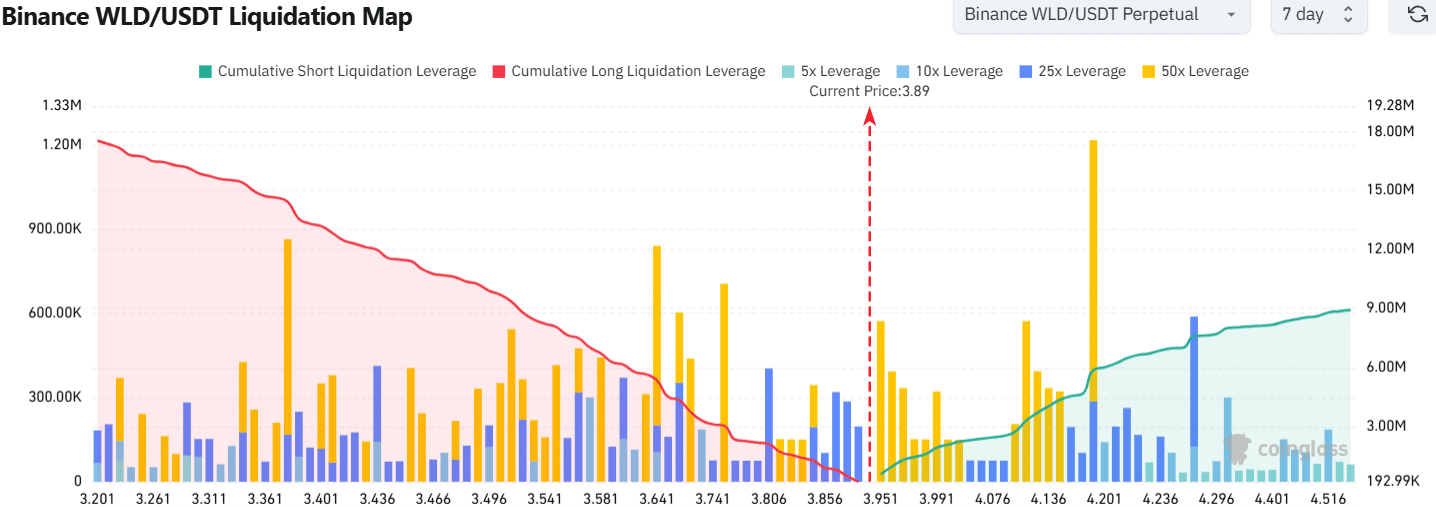

Despite the bearish divergence indicating a potential pullback, the liquidation chart suggested an upward trend might be imminent. A significant number of short positions had accumulated near $4 and $4.15.

Realistic or not, here’s WLD’s market cap in BTC’s terms

Due to a significant buildup of debt near the $4.13 level, it seemed probable that WLD would advance to overtake this zone before experiencing a decline. As of now, it’s uncertain whether the buyers possess enough power to drive the price above $4.13.

Traders should be wary of a breakout beyond $4 since the market might be overextended.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-12-07 06:15