- Ethereum recently witnessed a surge in large transactions.

- ETH has fallen below its $4,000 milestone but remains close.

As an analyst with over two decades of experience in the financial markets, I have seen numerous trends and cycles come and go. The recent surge in large transactions on Ethereum (ETH) has certainly caught my attention.

As an analyst, I’ve observed a significant surge in large transactions within the Ethereum network. The weekly transaction volume skyrocketed approximately 300%, peaking at a staggering $17.15 billion, only to subsequently dip down to around $7 billion.

Whale activity exceeding $100,000 has surged, coinciding with Ethereum’s rally to $4,000.

Based on the flow of trades indicating less urge to sell, the market is focusing on significant resistance levels that could potentially trigger a bullish trend. The situation is further bolstered by robust support systems and increasing buying pressure, painting an optimistic picture overall.

Analyzing Ethereum’s large transaction activity

Ethereum has recently seen a significant uptick in large transactions.

According to AMBCrypto’s examination of the transaction data from IntoTheBlock, the weekly transaction volume significantly increased by more than 300%, peaking at approximately $17.15 billion on December 6. At the current moment, it has dropped down to around $7 billion.

The rise in value has ignited interest regarding the path and consequences of these dealings, particularly since Ethereum’s price nears significant mental thresholds.

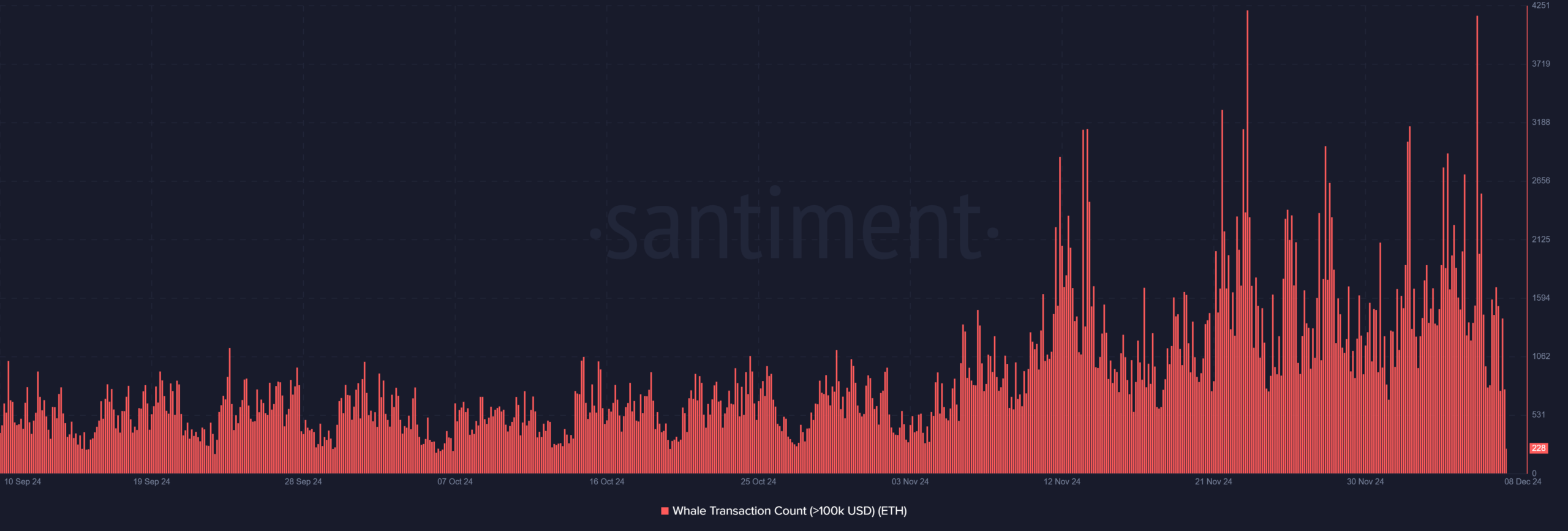

Moreover, Santiment’s extensive transaction graph shows a noticeable surge in whale transactions worth more than $100,000, implying an increase in institutional or wealthy individual activity.

The surge lines up with Ethereum’s recent surge to $4,000, suggesting that certain large investors might be cashing out or rearranging their investments.

The whale transaction count chart demonstrates periodic peaks, underscoring strategic moves during volatile price phases.

Exchange netflow and price correlation

As a crypto investor, I’ve been keeping an eye on the exchange netflow chart, and it seems to be displaying a pattern of alternating inflows and outflows. Lately, there have been substantial outflows, which could indicate decreased selling pressure among investors. In fact, my analysis reveals a negative netflow of over 17,000 tokens or coins, suggesting that more assets are leaving the exchange than entering it at this moment.

Usually, this action suggests a positive outlook among traders since they are transferring their assets to cold storage. Yet, the price has been met with obstacles around the $4,000 mark, which aligns with both a psychological threshold and a period of profit-taking.

Price performance and technical analysis

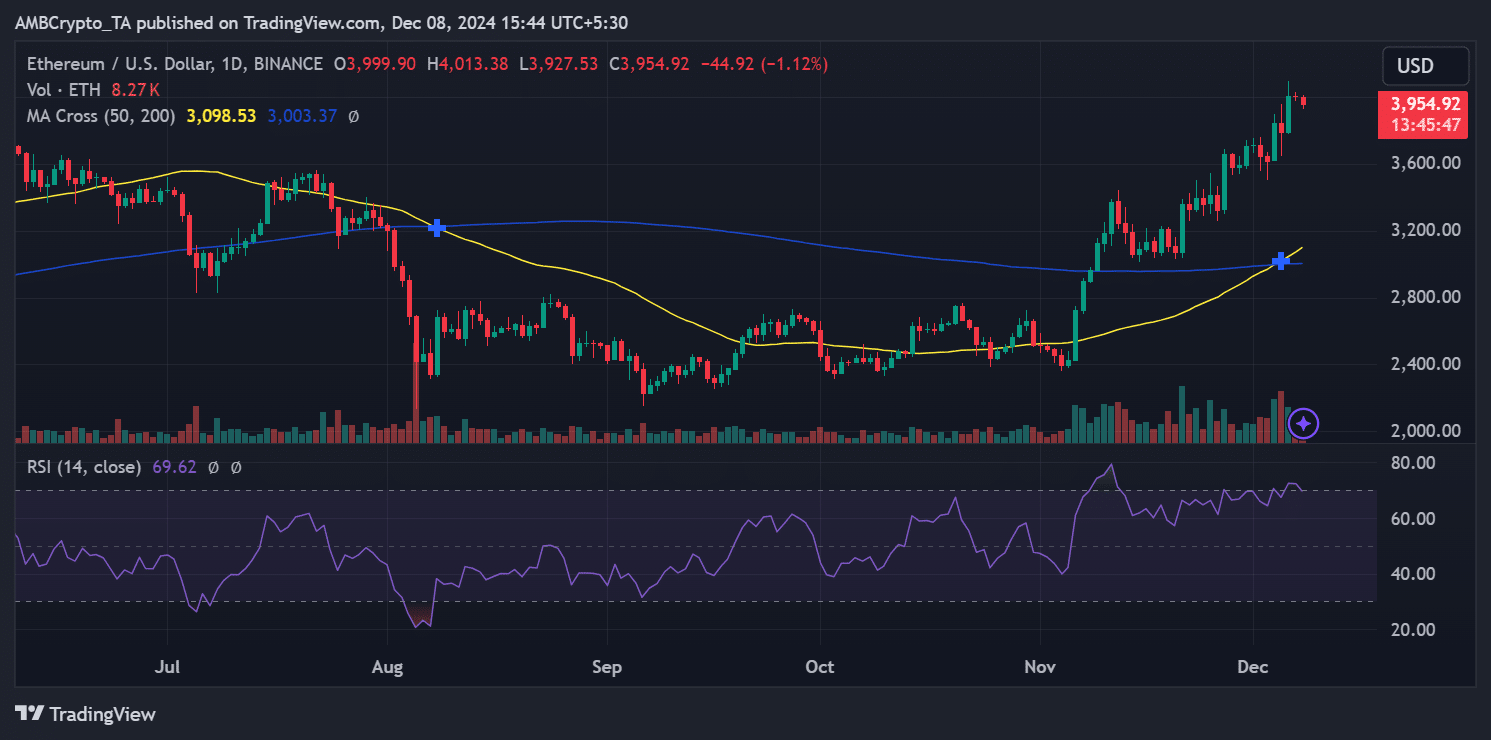

The line graph for Ethereum shows a steady increase in value starting from early November, while its 50-day moving average provides strong backing during this period.

The surge up to $4,000 was marked by a higher level of trading activity, evident from the graph, implying that many investors were actively involved in this price rise.

Yet, the Relative Strength Index (RSI) value of 69.62 suggests that Ethereum may be nearing overbought conditions, typically resulting in a temporary price drop or stabilization period.

It’s worth noting that the MACD is currently in a bullish state, as its signal line sits comfortably above the zero point, suggesting that the trend is still moving upwards.

The graph indicates a decrease in bullish enthusiasm, suggesting a potential slow-down, although it does not definitively point towards a reversal.

Important areas of potential support can be found at $3,800 and $3,500. These levels coincide with the 50-day moving average and former resistance points that have since transformed into supportive zones.

The surge in large transactions highlights growing interest and activity among whales, likely driven by Ethereum’s improving fundamentals and bullish sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

Based on the current market behavior, it appears that Ethereum is experiencing a robust upward trend. Important floor levels are proving resilient, while positive momentum factors point towards potential continued growth.

Keeping a close eye on potential resistance at $4,000 is crucial because there might be a brief pause or dip in the market’s upward momentum before aiming for higher prices.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-09 03:04