- Algorand’s TVL jumped 300% in a month, with Folks Finance driving DeFi growth.

- ALGO’s price maintains bullish momentum, supported by rising network activity.

As a seasoned researcher with years of experience navigating the ever-evolving crypto landscape, I can confidently say that Algorand [ALGO] is showing some truly impressive signs of growth. The 300% surge in TVL over the past month, driven largely by DeFi protocols like Folks Finance, is a testament to the renewed interest and confidence investors are placing in Algorand’s ecosystem.

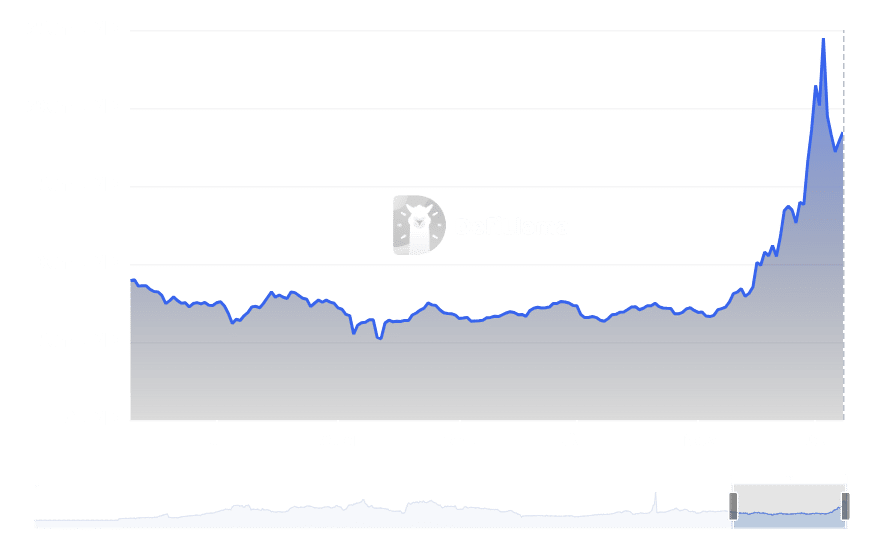

Over the last month, there’s been a significant surge in the Total Value Locked (TVL) for Algorand [ALGO]. This rise can be attributed to platforms such as Folks Finance and indicates a growing enthusiasm towards Algorand’s network.

Simultaneously, although there were brief pullbacks, Algo’s strong upward trend and increasing network activity suggest that its positive momentum remains steady.

DeFi driving the Algorand surge

In the last 30 days, Algorand has seen a remarkable increase of more than 300% in its Total Value Locked (TVL), as reported by DeFiLlama.

On December 3rd, the total value locked within the blockchain reached an all-time high of $244.74 million, which is only surpassed by one other instance in its historical records.

Currently, the total value locked (TVL) stands at approximately $184.5 million during this writing phase. This represents a minor dip, yet it continues to trend upward.

The TVL growth was significantly propelled by Folks Finance, which saw a 289% increase over the past month, with more than $284 million in assets locked.

This positions it as the primary method propelling the growth of Algorand’s Decentralized Finance (DeFi) environment. Additionally, other DeFi systems operating on Algorand have experienced an uptick in engagement, indicating a growing curiosity towards its ecosystem.

Price performance: Bullish momentum sustained

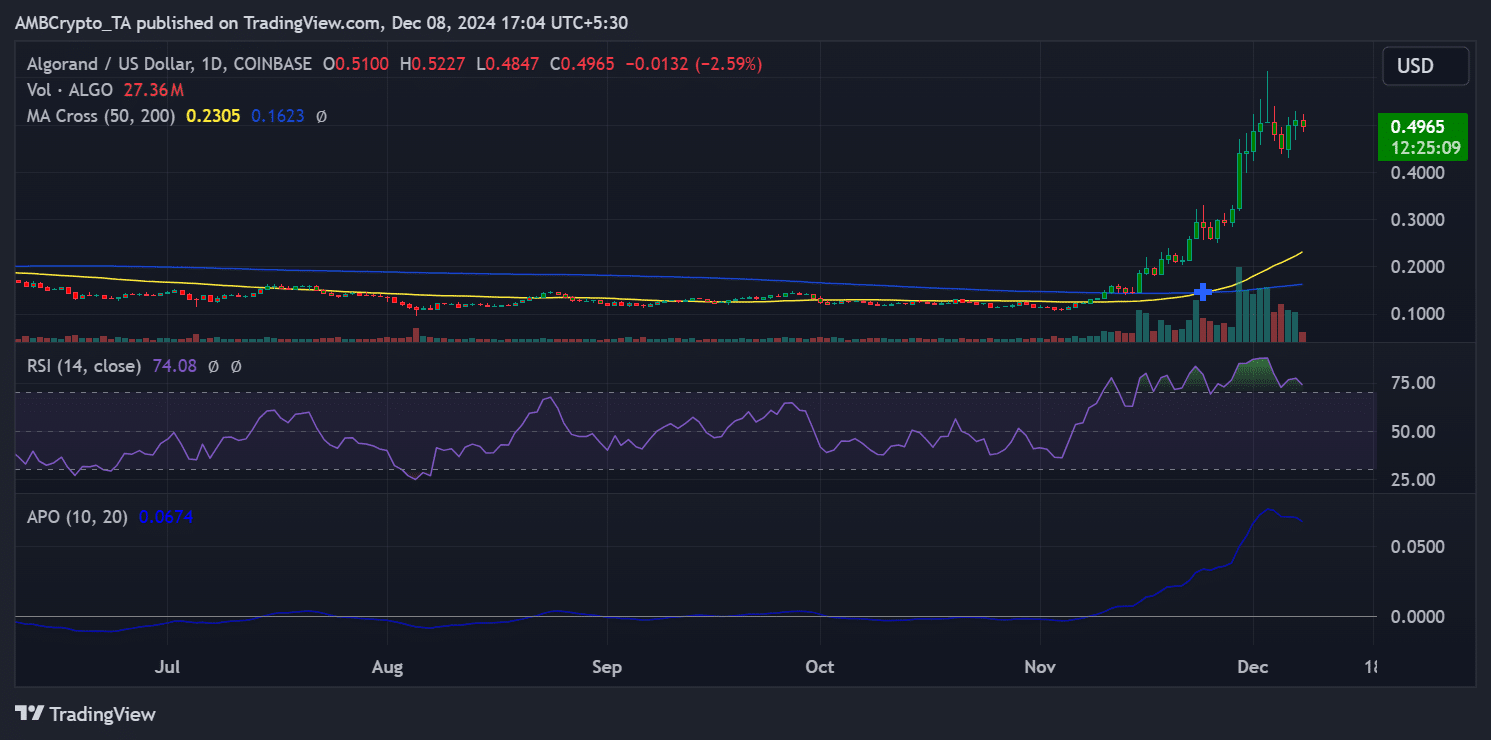

The Algorand’s original token, ALGO, has matched the favorable on-chain statistics by experiencing significant price increases.

As I analyze the current market situation, I find myself observing that ALGO was trading at approximately $0.4965, a slight dip from its recent peak yet still demonstrating a robust upward trend overall. Notably, this token has managed to surpass its 200-day moving average, an indication of a bullish sentiment in the market.

In simpler terms, the Relative Strength Index (RSI) for ALGO being 74.08 means it’s showing signs of being overbought. This could signal a possible pause or correction, as investors might be taking profits from their holdings.

On the other hand, the Average Price Oscillator (APO) persists in showing a positive trend, indicating enduring bullish enthusiasm.

Volume analysis: Network and market activity surge

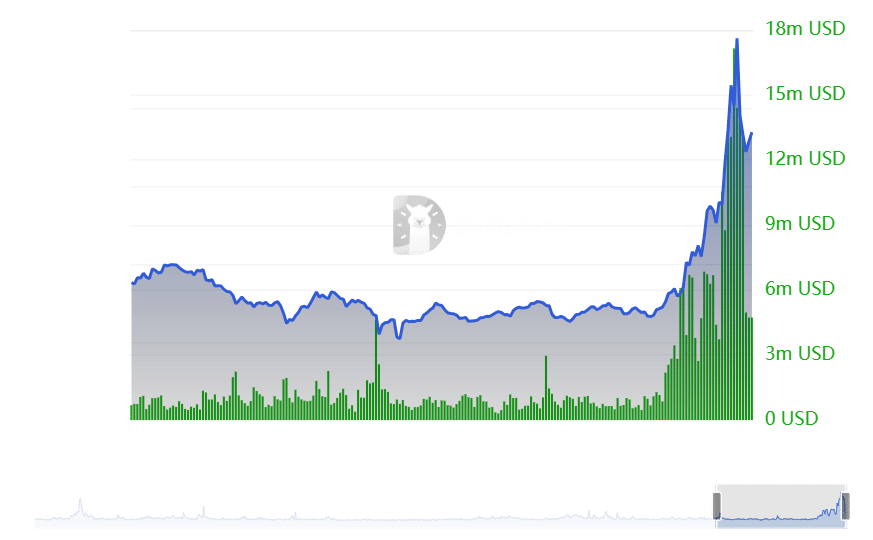

In simple terms, the robust activity in transactions on Algorand’s platform has significantly boosted its Total Value Locked (TVL). On December 8th alone, the trading volume spiked to an impressive 27.36 million.

According to DefiLlama’s data, there was a substantial increase in the network activity of Algorand, reaching a high of approximately 2.33 billion ALGO coins towards the end of November.

As a researcher observing the Algorand network, I’ve noticed that despite its recent dip back to roughly 788.44 million ALGO, the persistently high levels suggest increased activity within the network, indicating continued engagement and usage.

This matches the rapid increase in Total Value Locked (TVL) observed on platforms such as Folks Finance, implying a boost in user interaction within the network.

Furthermore, Santiment’s data indicates a substantial surge in Algorand’s (ALGO) trading activity, with the highest volume reaching approximately $2.33 billion ALGO towards the end of November.

Despite dropping back to around $788.44 million, these high levels suggest increased network activity remains significant.

The interaction between the network and trading activity on Algorand suggests increased usage and curiosity about this platform.

Despite both measures moving away from their previous peaks, it’s unclear whether the network can maintain its current pace or if a downturn might be approaching.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-09 05:12