- HBAR concludes first week of December with an impressive run including a new ATH.

- Demand cools off potentially paving the way for profit-taking.

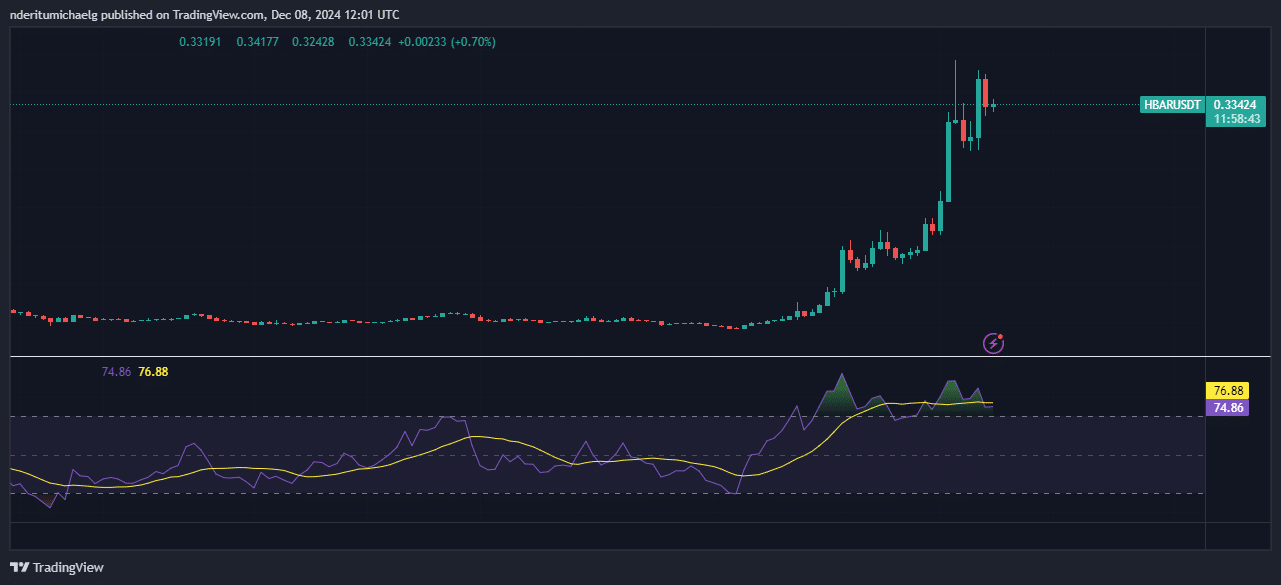

As a seasoned crypto investor with a knack for spotting trends and a portfolio that has weathered numerous market cycles, I must admit that HBAR’s recent performance has been nothing short of impressive. The week-long bull run culminating in a new ATH is a testament to the growing interest in this promising project. However, as with any investment, it’s crucial to read the signs right.

Hedera’s native digital currency, HBAR, has continued to ride the wave of optimism it gained in November. Last week was particularly strong for it, placing it among the biggest winners in the past seven days.

HBAR traded as low as $0.164 and achieved a weekly high of $0.392. This means the price went up by 136% from its weekly bottom to weekly top. The recent rally extended its gains to 831% from its current 2024 low in November.

This underscores an impressive recovery in less than 6 weeks. It closed the week at $0.33.

source: TradingView

As I analyze the current market trends, it’s evident that the surge in the cryptocurrency’s weekly rally has propelled its price to an unprecedented new peak. At the moment of my writing, HBAR was showing signs of overselling, and some sell pressure was already surfacing. This suggests that traders who made purchases at the recent low points are now cashing out their profits.

Is HBAR experiencing a sell pressure build-up?

The bullish momentum was initially supported by a surge in spot demand. The latter peaked at $48.22 million on 2nd December, and has since cooled down.

source: Coinglass

In the past day, there was an outflow of approximately $8.62 million from the spot market, indicating a growing tendency for selling.

The amount of open contracts being held has steadily increased throughout the week as well. It reached an unprecedented peak of $459.87 million on Saturday, establishing a new record high.

At the moment we looked, funding rates remained favorable, indicating that demand was greater than any developing supply pressure in the derivatives market. If funding rates were to turn negative significantly, it would suggest a substantial influx of selling pressure.

Hedera on-chain stats indicate that the momentum is slowing

It’s possible that HBAR may experience further decreases, given that the bullish force seems to be weakening. This is suggested by the drop in on-chain transaction volumes following their high point on December 3rd.

On that significant day, I witnessed the on-chain volume soar to an all-time high of $67.59 million within the Hedera network, marking the busiest transactional activity the system had ever experienced, from my perspective as a crypto investor.

Hedera’s volume has now fallen to about a third of its highest point. On December 3rd, TVL (Total Value Locked) reached a maximum of $211.86 million. However, it has since decreased to $196.65 million. It’s important to note that this recent peak was influenced by the rise in HBAR prices.

As a researcher studying HBAR, I’ve noticed a significant decrease in Total Value Locked (TVL) since mid-November. On the 16th of November, the TVL stood at approximately 1.06 billion HBAR. However, as of the 8th of December, that figure has dropped to around 594.67 HBAR.

A significant drop in TVL (Total Value Locked) might indicate reduced investor confidence or selling due to price increases. However, this doesn’t automatically mean a lack of confidence in HBAR; it could keep rising if demand resurges.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-12-09 13:11