- Trump proposes a strategic Bitcoin reserve, positioning it with traditional commodities as national reserves.

- Peter Schiff warns Bitcoin reserve could lead to U.S. hyperinflation and dollar devaluation risks.

As someone who has spent years studying and observing financial markets, I can say that Trump’s proposal to create a strategic Bitcoin reserve is undeniably intriguing. Given my background, I must admit to a certain level of skepticism when it comes to government interventions in market dynamics. However, the idea of integrating digital assets into national reserves is not entirely unprecedented – after all, we’ve seen central banks explore the use of digital currencies.

Last month, it was reported that the ex-President of the United States, Donald Trump, announced plans for setting up a Bitcoin reserve as part of his strategic initiatives.

If carried out successfully, this daring move could see Bitcoin listed among conventional commodities such as oil, natural gas, and uranium within the U.S. national reserves.

This action is meant to safeguard against unexpected interruptions in the supply chain. It emphasizes Bitcoin’s increasing significance in the country’s economic plans and its transition towards integrating digital assets.

In summary, if Trump were to establish a strategic Bitcoin reserve, it might impact Bitcoin’s price fluctuations. However, it’s hard to predict whether this move would result in a rise (bullish) or fall (bearish) in the market.

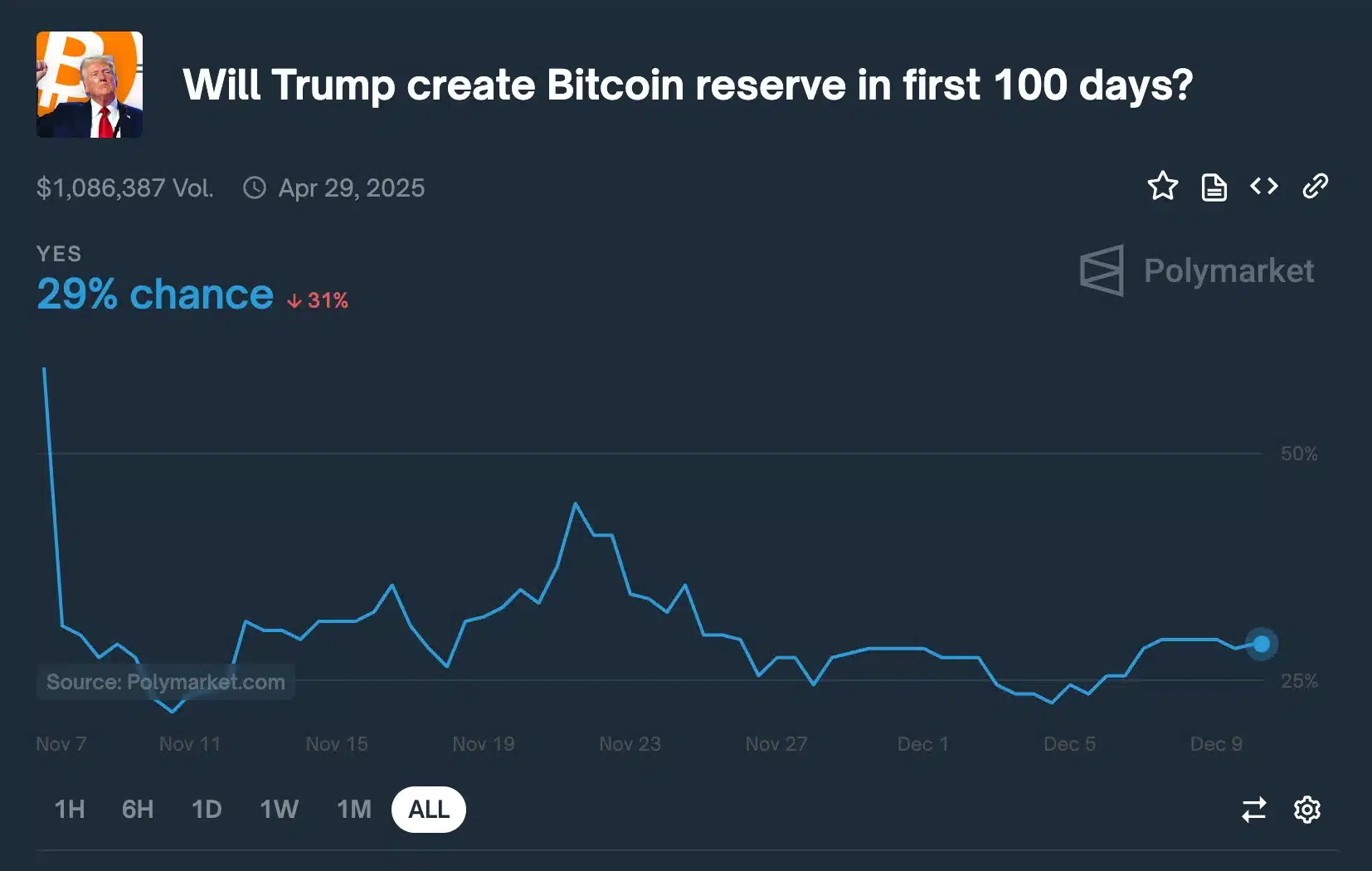

Polymarket trend on US Bitcoin Reserve

As reported by Polymarket’s predictions regarding the query “Will Trump establish a Bitcoin reserve within the initial 100 days?”, the probability currently sits at approximately 29%.

This is a slight increase from the previous 27%, though it previously touched a peak of 45%.

It seems that the majority of investors are taking a tentative approach when it comes to believing in the creation of this reserve, as less than half appear willing to wager on it. This hesitation indicates a degree of doubt within the cryptocurrency sector.

Execs weighing in

Indeed, various notable individuals and organizations are currently advocating for the concept of maintaining a strategic Bitcoin reserve.

In a similar vein, Senator Cynthia Lummis, a notable proponent of digital assets, has forcefully suggested that the U.S. should proceed with creating a reserve for these assets.

Matthew Siggel, who leads digital assets research at VanEck, has endorsed the plan wholeheartedly, emphasizing its significant strategic possibilities.

Furthermore, Anthony Pompliano, head of Professional Capital Management, suggests an immediate issuance of $250 billion to be invested directly into Bitcoin, highlighting its potential as a protective asset during economically turbulent periods.

“On Donald Trump’s first day as President, it would be beneficial to mint $250 billion in U.S. currency and invest all the earnings directly into Bitcoins.

Not all shared the same boat

As expected, not everyone shares the same perspective on the proposal.

In other words, Peter Schiff has voiced some worries, suggesting that this approval might affect both the U.S. dollar and Bitcoin.

He stated,

As a crypto investor, I ponder over the potential consequences if massive amounts of dollars are funneled into purchasing Bitcoin. The United States might then grapple with hyperinflation, stripping the dollar of its value. Once the dollar becomes worthless, it would impede the U.S. from further acquisitions of Bitcoin, thereby limiting their ability to participate in this digital market.

Adding to the fray was former US Secretary of the Treasury Larry Summers who said,

Why does the government opt to build up a non-productive stockpile, such as Bitcoin, instead of supporting other areas? The only explanation seems to be that they are catering to generous political donors who have a particular interest in cryptocurrency.

Given the doubt amongst investors, it is unclear if Trump’s plan will become reality or just continue as an idea.

Currently, according to the most recent figures from CoinMarketCap, Bitcoin is being traded at approximately $98,451.73. This comes after a minor decrease of 1.43% in its value over the last day.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Gold Rate Forecast

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

2024-12-10 01:12