- ARB’s breakout from consolidation and golden cross signals potential for further price increases.

- RSI, daily active addresses, and funding rate show strong bullish support for ARB’s upward momentum.

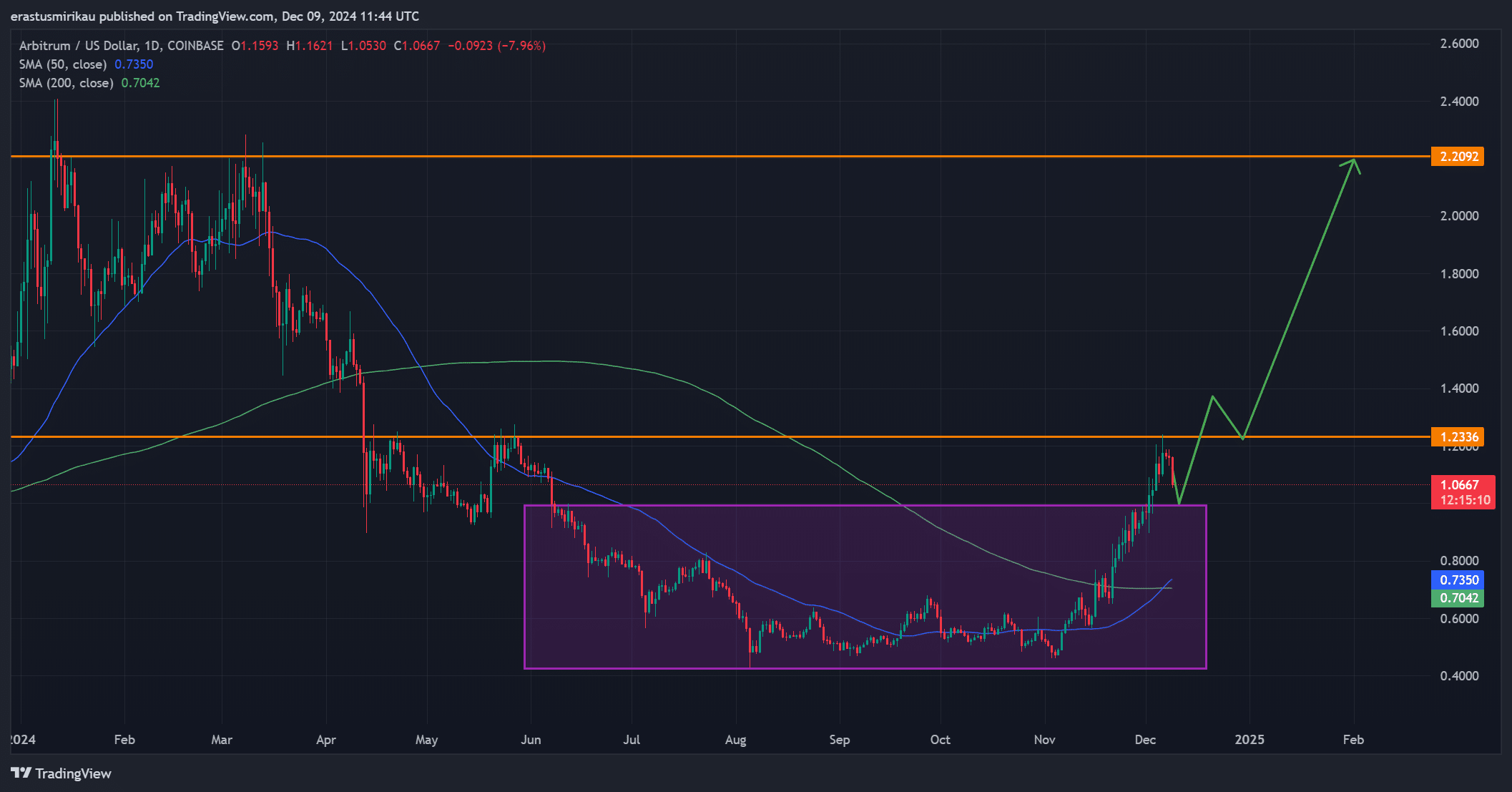

As a seasoned analyst with a knack for spotting trends and patterns in the cryptosphere, I find Arbitrum [ARB]’s recent breakout from consolidation incredibly intriguing. The golden cross signals a promising future for further price increases, but we must remember that even Superman had kryptonite – and for ARB, it seems to be the $1.2 resistance level.

Arbitrum’s [ARB] value has reached an unprecedented peak with a Total Value Locked (TVL) of $5 billion, demonstrating increasing investor trust and market attraction. This achievement underscores a robust dedication to the project’s prospects, as it appears to have broken out in a bullish manner following a prolonged period of consolidation on the technical charts.

As a crypto investor, I’m closely watching ARB right now, as it seems poised to challenge a significant resistance level at $1.2 following the appearance of a golden cross formation. The question is, will this bullish trend persist or will this resistance level halt its upward trajectory? Only time will tell.

Breakout from consolidation likely, but a test lies ahead

After spending more than two years in a prolonged rectangle formation, Arbitrum has finally burst through its confines. Yet, there’s a possibility it might revisit this resistance level for confirmation before a complete breakout. If ARB manages to surpass the $1.2 mark, we could see prices climbing up to $2.2.

As a researcher, I am attentively observing this resistance level, anticipating whether a prolonged breach might signal an uptrend. The golden cross configuration lends credence to this optimistic perspective, hinting at potential continued growth in the market.

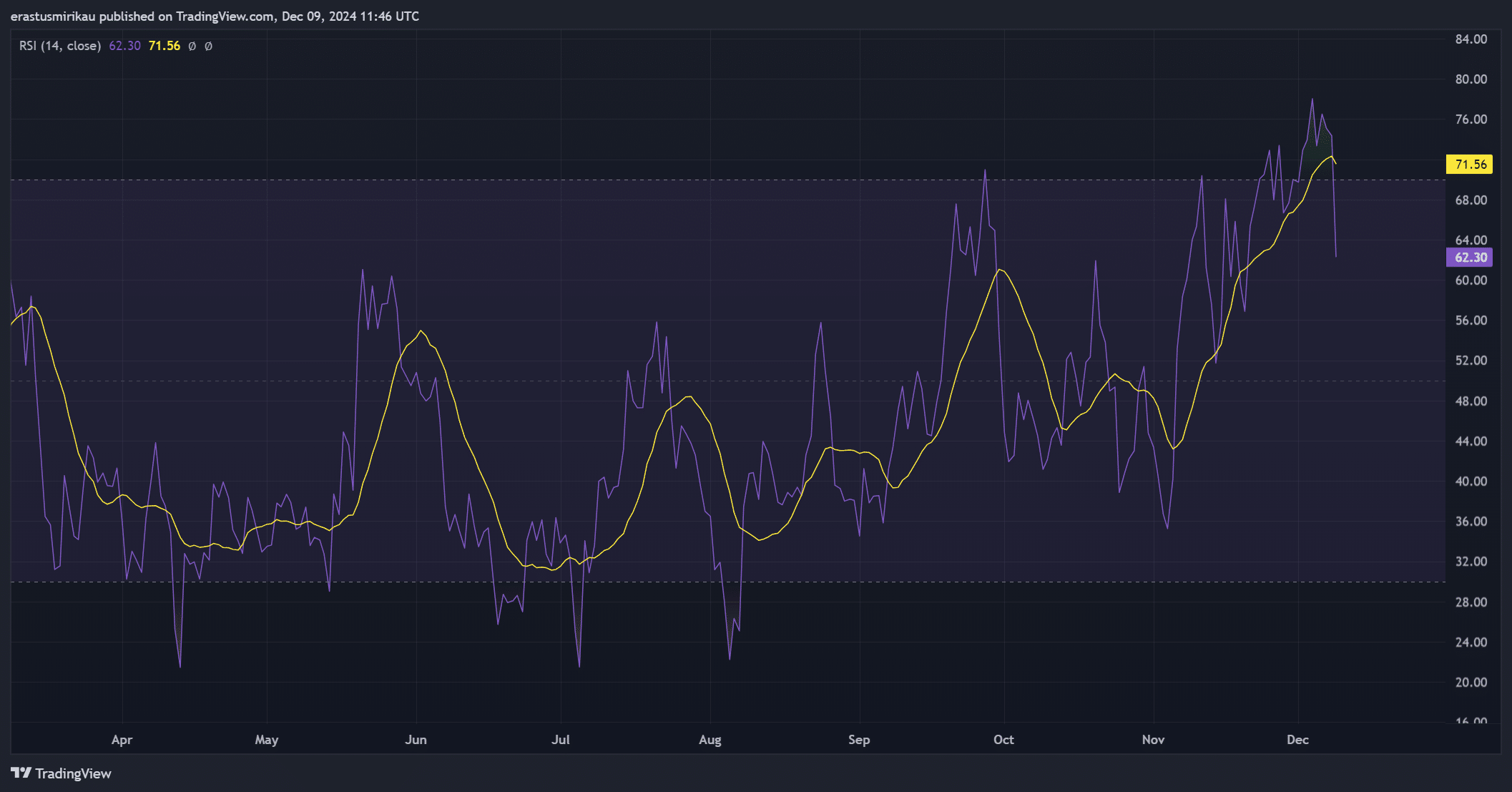

Currently, Arbitrum is being traded for $1.07, representing a decrease of 7.15% over the last 24 hours. Yet, the Relative Strength Index (RSI) stands firm at 62.3, suggesting robust bullish energy. This stability hints that buyers continue to dominate the market, even amid temporary downward trends.

A strongly elevated RSI indicates that investor interest in ARB remains robust, suggesting a bullish sentiment continues, despite recent fluctuations in price.

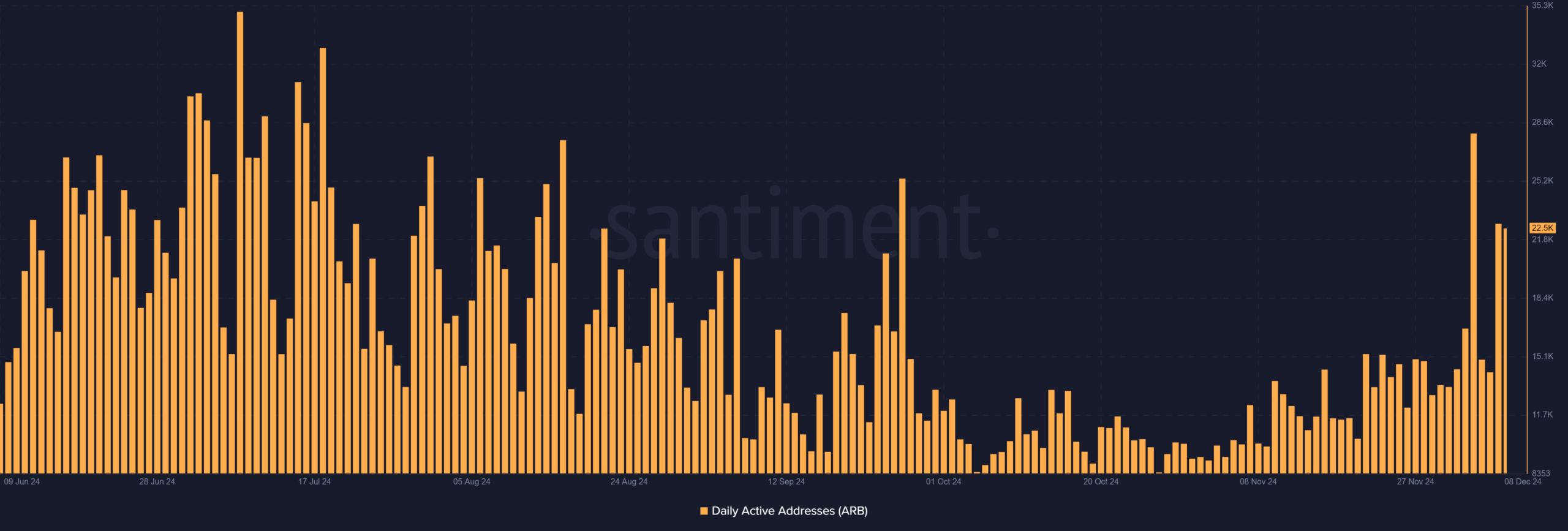

ARB: A healthy level of engagement?

At the moment, around 22,500 active addresses on ARB are observed each day, indicating a steady level of user interaction that still allows for potential expansion. An influx of additional users might lead to an escalation in trading activity, thereby enhancing market forces and encouraging broader investor involvement.

Consequently, a higher level of engagement suggests a stronger curiosity and possibly increased trading activity in the coming days.

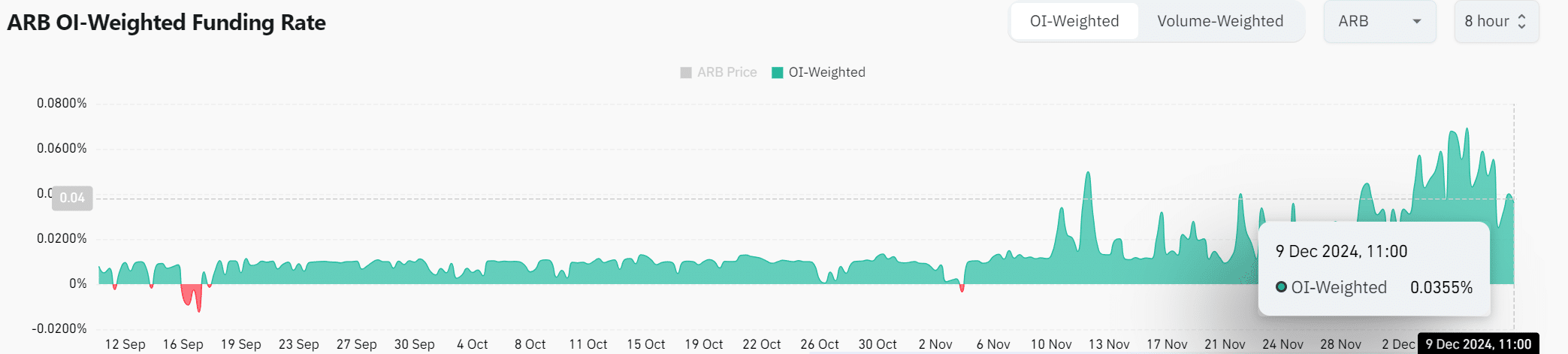

The Current Open Interest Weighted Funding Rate is 0.0355, suggesting a favorable outlook by futures traders. This figure underscores the level of confidence and demand for ARB contracts among investors.

Furthermore, this also indicates that traders are ready to invest in long-term prospects, potentially fueling more upward trends.

Source; Coinglass

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Bullish momentum likely but resistance remains a key hurdle

Based on its recent performance, it appears that ARB is exhibiting a robust bullish pattern. This strength stems from an all-time high Total Value Locked (TVL) and a significant breakout following a prolonged period of consolidation. However, a key challenge arises at the $1.2 level, which serves as a crucial test. Despite this hurdle, the presence of a golden cross and favorable indicators suggests that the bullish trend will persist.

Consequently, temporary drops might occur, but the upward trend seems strong, and if we surpass $1.2, it could lead to substantial increases in ARB’s price.

Read More

2024-12-10 12:39