- Exchanges have recorded $3.5 million worth of UNI inflows.

- UNI could decline by 20% to reach the $11.10 level if it closes a daily candle below the $14.60 level.

As a seasoned researcher with years of experience navigating the tumultuous seas of the cryptocurrency market, I find myself standing on the precipice of uncertainty regarding Uniswap [UNI]. The recent whale sell-off, coupled with the broader market correction, has left me feeling like I’ve stepped into a DeLorean and landed smack in the middle of the 2018 crypto winter.

At the current moment, it seems that Uniswap’s [UNI] appeal to large investors, or “whales,” is dwindling, according to recent reports.

This significant change in investor attention coincided with a general trend in the cryptocurrency sector, as it entered a period of correction.

Whale sells $16.73 million UNI tokens

10th of December, the whale transaction tracker Lookonchain pointed out that a prominent trading company, Cumberland, had sold a substantial quantity of 989,520 UNI tokens, equivalent to around $16.73 million.

These significant digital assets were transferred to multiple centralized trading platforms such as Binance, Coinbase, OKX, and Robinhood.

Furthermore, as the price of UNI fell by 10%, Cumberland chose to offload some of its assets. This quick sale, occurring amid a temporary market fluctuation, has sparked apprehension among both investors and traders.

At press time, UNI was trading near $15.65 after a price decline of over 11% in the past 24 hours.

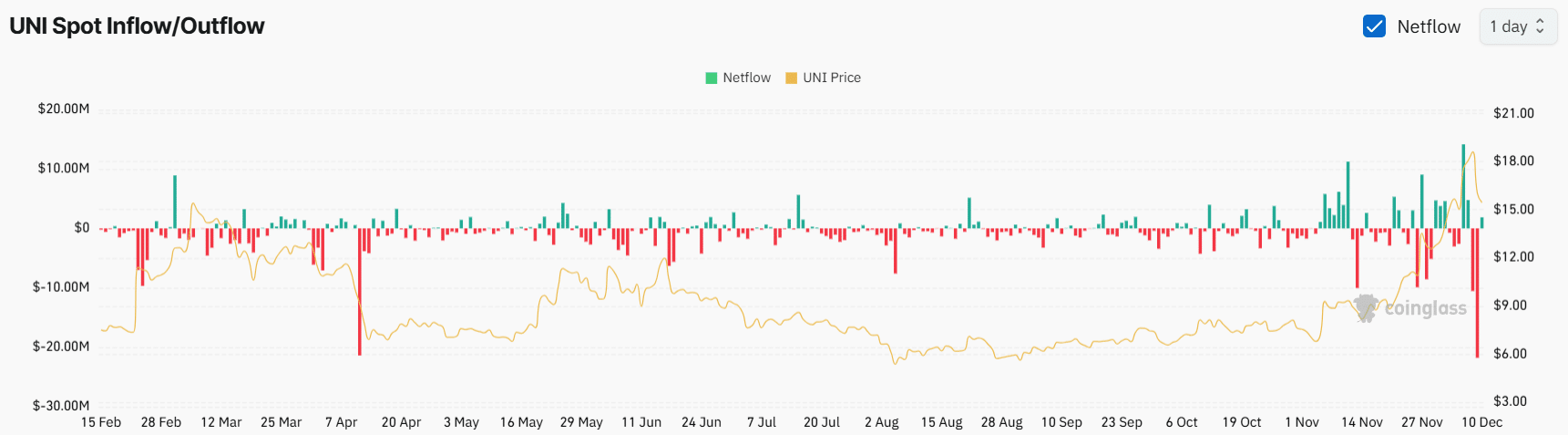

According to AMBCrypto’s analysis using Coinglass data, it appears that large investors like whales and institutions are transferring their digital assets to exchanges, which could indicate a possible selling trend.

Also, per the Spot Inflow/Outflow, exchanges have recorded a modest $3.5 million in asset inflows.

In terms of cryptocurrencies, “inflow” signifies the movement of assets from digital wallets to trading platforms, often suggesting an impending sale and possibly predicting a drop in future prices.

On the other hand, there’s been a noticeable increase in assets leaving exchanges compared to what’s come in during the last three days.

It strongly indicates that these long-term investors may be committed to UNI in the long run, potentially slowing down any future drops in its price.

UNI technical analysis and key levels

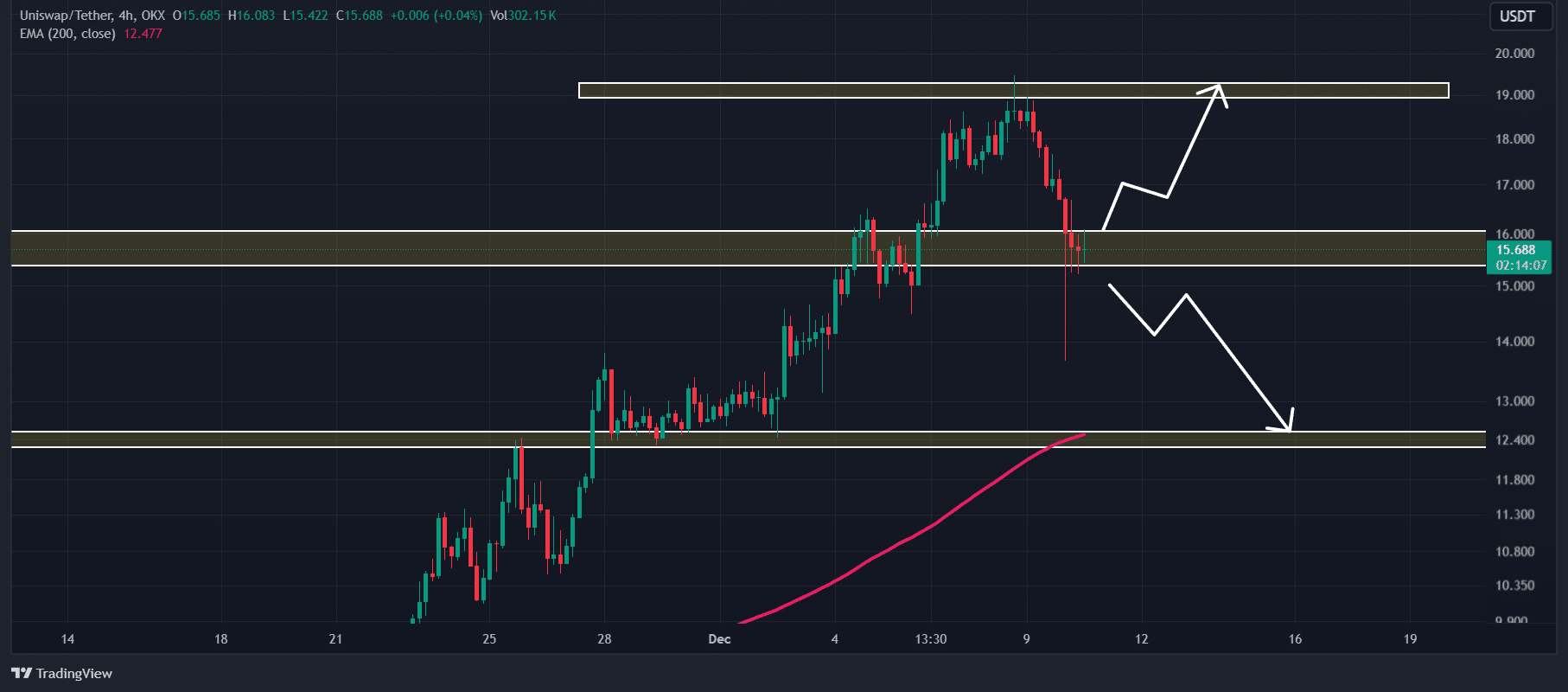

As I delve into my analysis, based on the technical insights provided by AMBCrypto, it appears that the UNI token has hit a pivotal support level at approximately $15.30. This development comes in the wake of recent price drops. The significance of this level makes it a critical juncture for UNI; a potential break or hold could significantly shape its future trajectory as an altcoin.

Considering the latest market trends, UNI might either surge upwards or continue to drop in value.

Read Uniswap’s [UNI] Price Prediction 2024–2025

If the altcoin maintains its position above the $15.50 mark, it’s likely we might witness a surge of approximately 30%, potentially pushing the price up to around $20.50 in the coming days.

If the price of UNI falls beneath the $14.60 mark and ends the daily chart as a lower close, there’s a high chance it could drop by about 20%, possibly falling to approximately $11.10 over the next few days.

Read More

2024-12-10 14:47