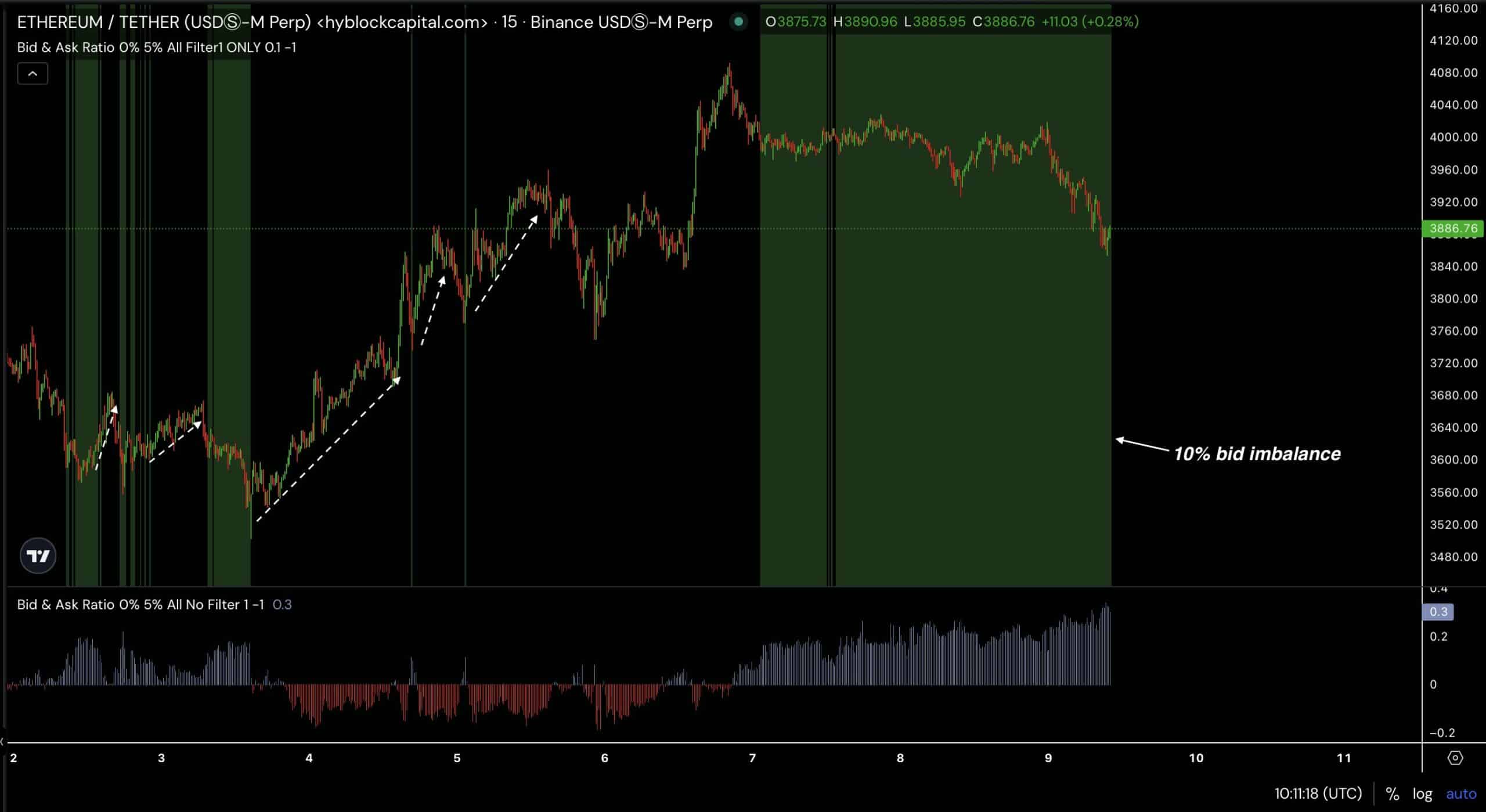

- Ethereum orderbook ratio indicated low supply and high demand at $3886.

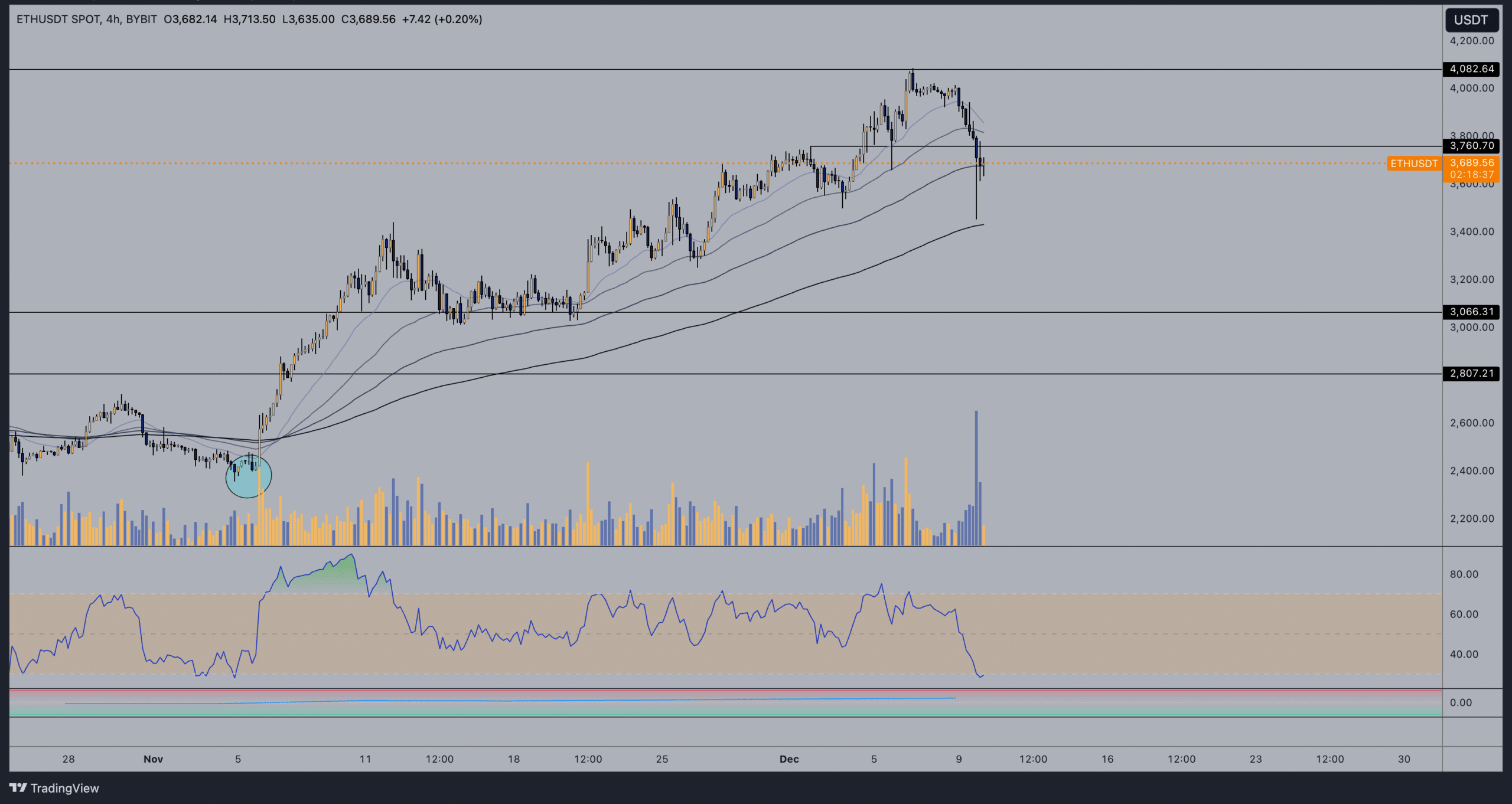

- ETH could revisit $3500 at the 200EMA before rally continuation.

As a seasoned crypto investor with battle-tested nerves and a knack for reading market signals, I find the current Ethereum [ETH] situation to be both intriguing and promising. The order book ratio at $3886 suggests a potential supply shortage amidst high demand, which is bullish if sustained. However, the surge in inflow volume into exchanges could hint at profit-taking or potential selling pressure that might temporarily pull ETH prices down to around $3500, testing the 200EMA before a possible rally continuation.

As a crypto investor, I noticed an intriguing 10% imbalance in bids within the 0-5% depth range on the Ethereum [ETH] order book, which could indicate a possible scarcity of supply and high demand at approximately $3,886.76, suggesting potential price increase.

These prices seem to encourage more buying attempts (bids) by 10% compared to the selling attempts (asks), indicating a higher demand or stronger interest in purchasing rather than selling.

This discrepancy suggests a positive outlook among traders, as they are ready to buy Ethereum at its current price or even higher, potentially pushing the price up further if this trend continues.

Furthermore, an increase in trade activity was observed during periods of substantial price fluctuations, whether they were rising or falling.

A rise in ETH’s bidding superiority coupled with heavy trading activity suggests that the bullish trend may persist for Ethereum. Previous patterns indicate that these imbalances typically occur before price surges.

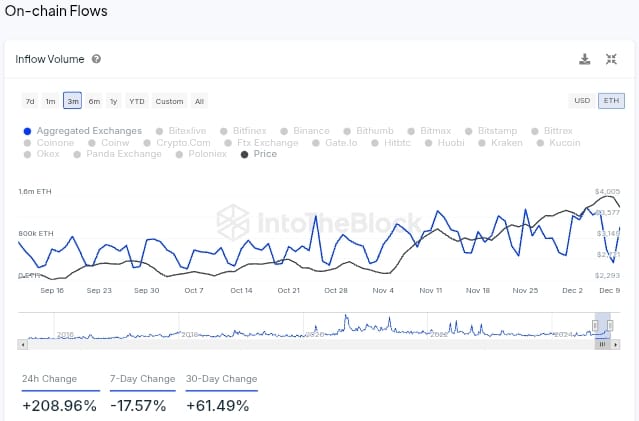

Inflow volume into exchanges

On the other hand, there was a significant increase in the amount of ETH being moved to exchanges, with a rise of approximately 208.96% over the last 24 hours. This increase might indicate that investors are transferring their ETH to exchanges either to cash out their profits or prepare for potential future sell-offs.

Last week’s fluctuations displayed a drop of approximately 17.57% in the amount of ETH transferred to exchanges, suggesting fewer Ethereum were sold off compared to the preceding week. This decline might imply a decrease in selling pressure.

In contrast, I found that the percentage increase in transfers of ETH to exchanges on a monthly basis was approximately 61.49%. This indicates that during the last month, there has been a more significant tendency for users to move their ETH to exchanges compared to previous timeframes.

The increase might moderate the optimistic perspective implied by the order book ratio, suggesting a higher demand relative to the available supply.

If incoming transactions indicate possible selling activity, this might cause a short-term decrease in Ethereum prices, even though there are indications of strong underlying demand.

How low can ETH go before bottoming?

As I analyze the current market trends, it appears that Ethereum (ETH) might experience a brief dip before resuming its bullish momentum. At the moment, ETH is hovering around $3689, which follows a downward movement from the stronger resistance level at approximately $4082.

As a researcher, I’ve noticed an uptick in trading volume during recent sell-offs, which may indicate a potential downward trend. However, the Relative Strength Index (RSI) has dropped below 30, signaling an overextended bear move. This could potentially signal a reversal if buyers decide to enter the market, as the RSI being in the oversold zone suggests that the selling pressure might be exhausted.

When ETH dips below both its 20-day Exponential Moving Average (EMA) and 50-day EMA, it indicates a brief period of downward price action, or bearish momentum. However, the long-term perspective might find support in the 200-day EMA.

The price of Ethereum seemed to be checking the strength of a crucial support point near the 200-day Exponential Moving Average, approximately $3,500. A potentially significant shift in direction may be suggested if the Relative Strength Index (RSI) readings, which indicate overbought or oversold conditions, show signs of being oversold.

If the current level is maintained, it might signal a surge towards higher levels, considering that trading rates have reached a peak not seen for several months. This suggests growing trader assurance and possibly an expectation for price escalations.

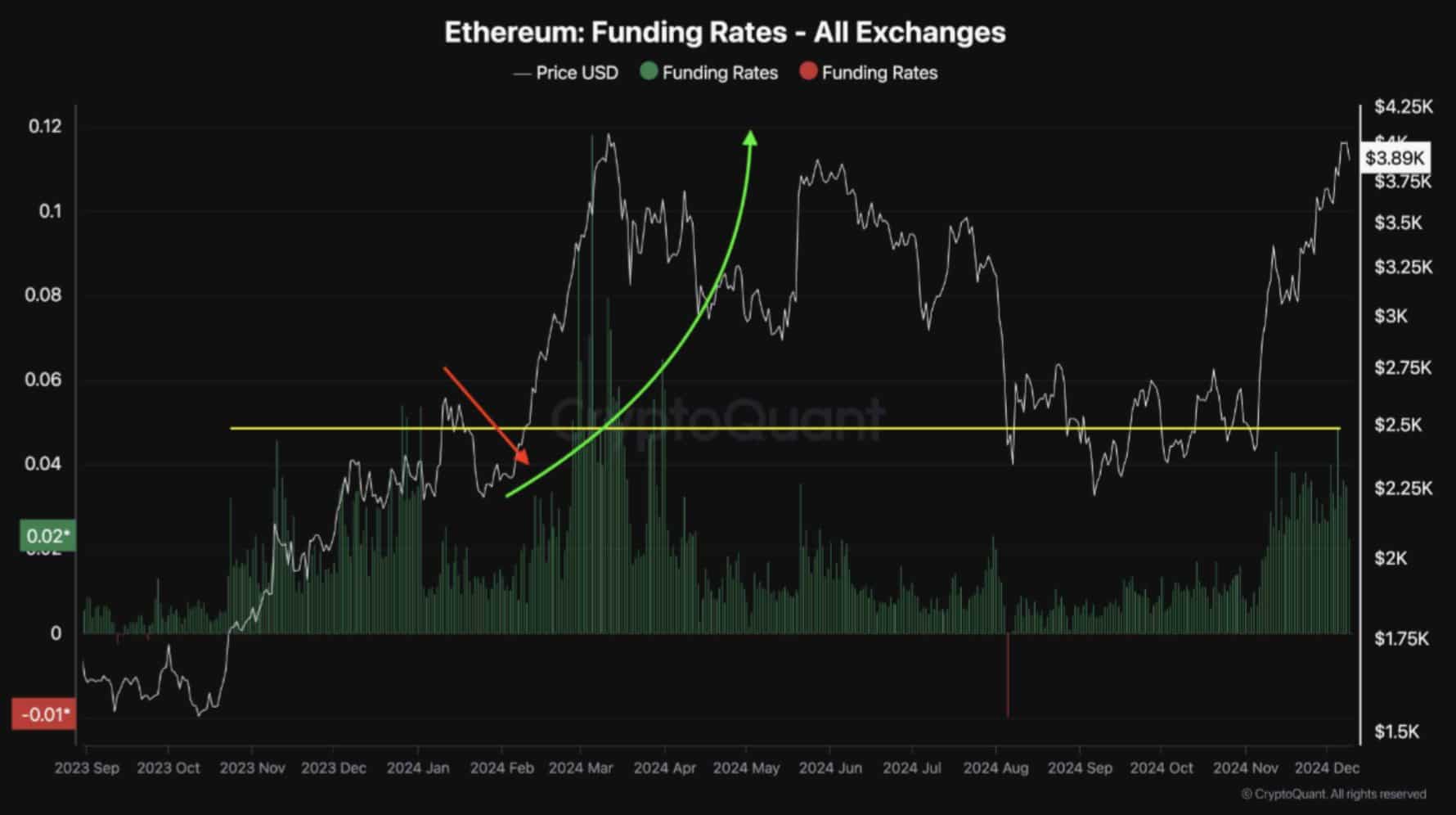

When the funding rates climbed beyond 0.04%, this occurred concurrently with price fluctuations, indicating that traders were significantly increasing their leveraged positions, a pattern typically seen before market instability.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As a crypto investor, I’ve noticed that high funding rates suggest a robustly optimistic market outlook, but these rates could potentially trigger temporary market corrections. This is because excessive leveraging might be at play when the rates are high.

The surge in funding rates, similar to those seen in early 2024, demonstrates strong market participation and confidence. Yet, it carries the potential for a market adjustment or cooling-off period if the market becomes too hot.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2024-12-10 18:48