- Cardano has dropped by 17% in 7 days as bearish trends intensify.

- The network has recorded a drop in DeFi TVL & active addresses, which has fueled the downtrend.

As a seasoned analyst with over a decade of experience in the crypto market, I’ve seen my fair share of bull runs and bear markets. The recent downtrend in Cardano (ADA) has caught my attention, as it’s a project I’ve been closely monitoring due to its potential.

Recently, the market value of Cardano (ADA) exceeded $40 billion for the first time since 2022. This significant increase in value was observed during a substantial uptrend that took ADA to a high not seen for several years at around $1.32.

After a period of growth, Cardano’s price has noticeably decreased, currently trading at approximately $1.02. This represents a 17% drop over the last week. The market value of Cardano has also reduced to around $35 billion. This downward trend might be due to several potential causes.

Cardano’s DeFi TVL drops from record highs

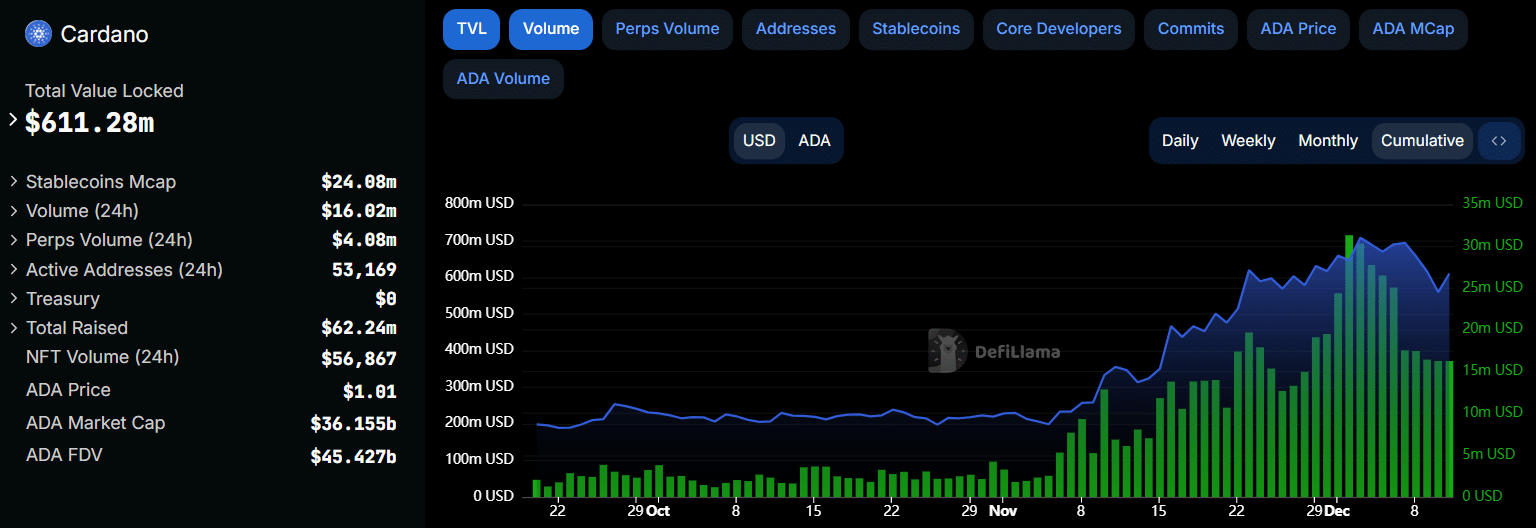

On the 3rd of December, Cardano’s decentralized finance (DeFi) Total Value Locked (TVL) peaked at a record-breaking $708 million, which coincided with ADA experiencing a multi-year high. However, data from DeFiLlama shows that this TVL has significantly dropped since then, now standing at $611 million.

The volume of Decentralized Finance (DeFi) transactions on the Cardano network has decreased from its highest point of $31 million to $16 million, indicating less activity or use of the network within the DeFi industry.

As a crypto investor dabbling in the Cardano ecosystem, I’ve noticed a significant dip over the past week. Specifically, the TVL (Total Value Locked) of Liqwid, our leading DeFi lending platform, has dropped by 16%. Similarly, the Minswap decentralized exchange has experienced a similar decline.

Based on historical patterns, it appears that ADA’s price surge often aligns with increasing DeFi (Decentralized Finance) activity. Consequently, a decrease in such activity might persistently affect the positive outlook for its pricing.

Active addresses hit a weekly low

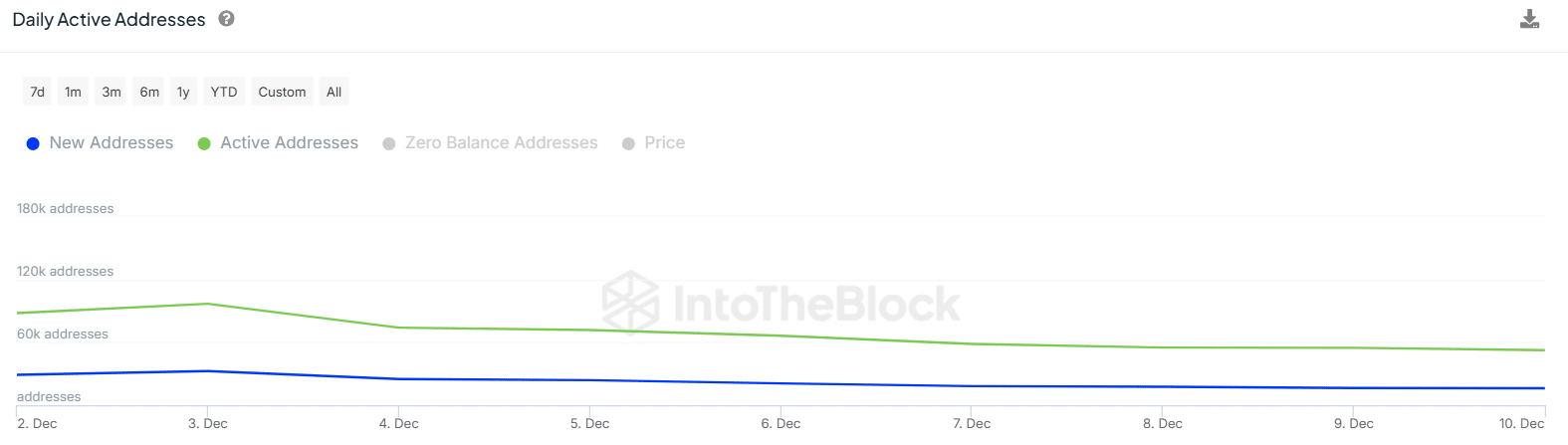

The usage on the Cardano network has seen a significant decrease, dropping to its lowest level in a week, as indicated by the reduction in the number of daily active addresses.

According to IntoTheBlock, Cardano’s active addresses plummeted by approximately 45% within a week, going from 96,740 to 52,380. Similarly, the number of new addresses being created on the network decreased significantly, dropping from 32,590 to 16,190.

As an analyst, I’ve observed a decrease in the number of actively used ADA addresses. This trend suggests a potential drop in user engagement and demand, possibly due to waning interest. Moreover, such a decline might indicate a loss of investor confidence, which could foster a bearish outlook among market participants.

Cardano whale balances drop

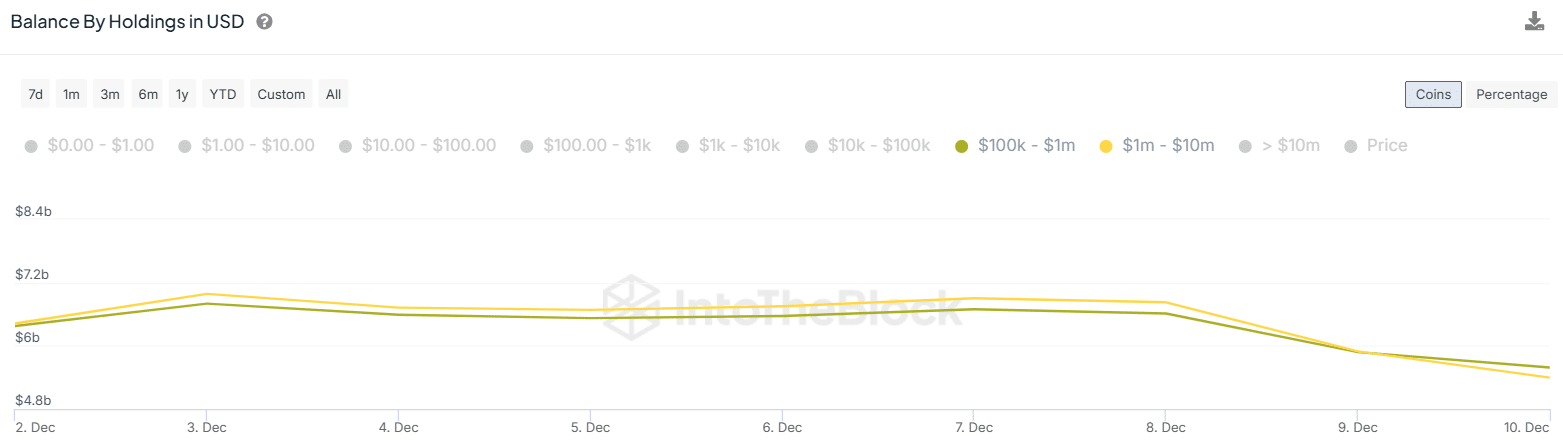

According to IntoTheBlock’s analysis, it appears that large Cardano address holdings have experienced a substantial decrease, potentially leading these ‘whale’ investors towards a period of distributing their assets.

The addresses holding between $100,000 and $1 million worth of ADA have seen their balances drop from $6.61 billion to $5.59 billion.

Those holding between $1 million and $10 million worth of tokens have seen over $1 billion dwindle from their holdings.)

This decrease doesn’t automatically mean whales are offloading their assets. Rather, it signifies a decrease in the worth of their investments, potentially triggering profit-taking behavior among them.

Realistic or not, here’s ADA’s market cap in BTC’s terms

Will ADA break free from these bearish trends?

If the Cardano network doesn’t see increased usage, ADA might persist in its downward trend. Additionally, if sellers seeking to cut their losses outnumber buyers looking to purchase, this imbalance could exacerbate the price drop.

As a crypto investor, I always keep a close eye on three key indicators: an uptick in active addresses, DeFi activity, and whale accumulation. These signs might signal an upcoming recovery, which could potentially trigger a bullish reversal for my investments like ADA. Additionally, a broader market recovery could further bolster this bullish trend.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-11 19:36