- CPI and joblessness claims may influence Bitcoin’s price and risk sentiment.

- Market volatility expected as Fed policy implications unfold from key US economic data.

As a seasoned researcher with over two decades of experience navigating financial markets, I can confidently say that this week is shaping up to be a pivotal moment for Bitcoin investors. With my finger on the pulse of the market and an eye towards historical trends, I sense a palpable tension building in the air.

As an analyst, I’m preparing myself for a pivotal week in the Bitcoin [BTC] market. The upcoming release of the Consumer Price Index (CPI) report tonight and unemployment data tomorrow are crucial economic indicators that have the potential to shape our market’s direction.

As a crypto investor, I’m keeping a close eye on upcoming reports that could offer valuable insights into two critical areas influencing Federal Reserve policies: inflation rates and the overall health of the labor market. These elements are closely intertwined with monetary policy decisions, so understanding their trends can help me make informed investment choices.

Bitcoin’s price sensitivity to economic events

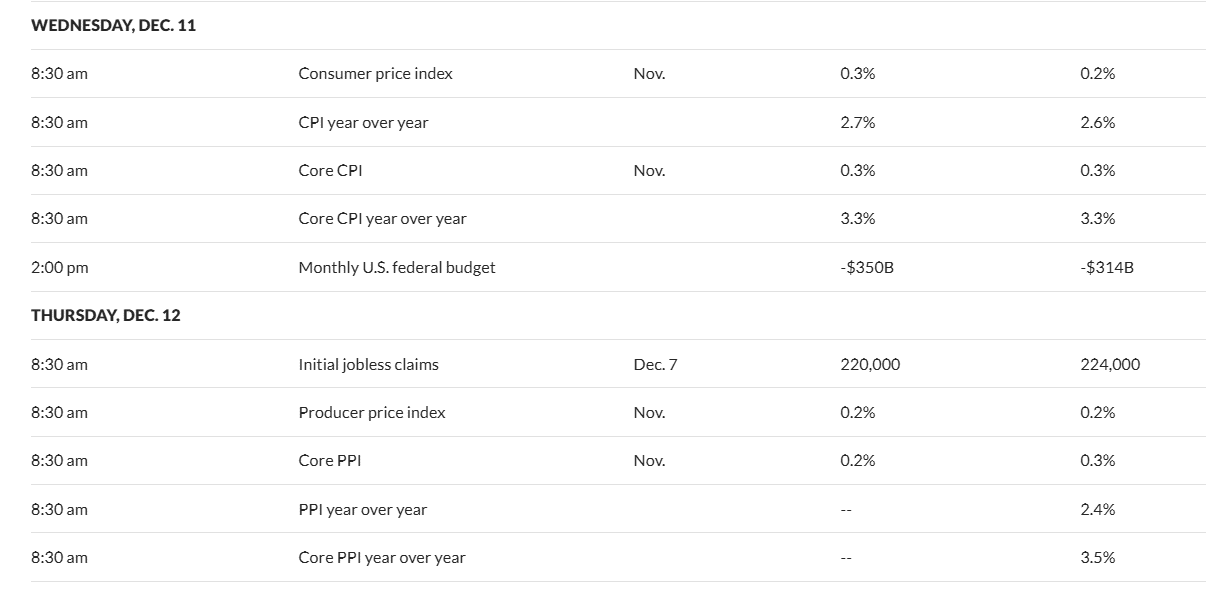

Bitcoin investors find themselves in a state of anticipation as the financial world readies for two significant economic reports scheduled this week. Tonight, the 11th of December, we’ll see the Consumer Price Index (CPI), a key indicator of inflation, and tomorrow brings the unemployment data, which will offer insights into the current condition of the U.S. labor market.

Previously, significant economic occurrences have frequently affected the price fluctuations of Bitcoin, typically by shaping the policy decisions made by the Federal Reserve.

The essential information presented here can be rephrased as follows: The core Consumer Price Index (CPI), which excludes fluctuating factors such as food and energy costs, is of significant importance because it provides insights into the market. An increase in CPI might suggest ongoing inflationary forces, thereby making Bitcoin more attractive as a safeguard against inflationary pressures.

In a similar vein, unemployment figures can impact the general attitude towards markets as they offer glimpses into the economy’s health or turmoil, frequently shaping investor interest in alternative assets such as Bitcoin.

Unemployment data: Can labor market conditions impact risk sentiment?

Last month’s jobless claims increased slightly to 224,000, indicating the overall strength of the U.S. job market according to the latest employment report.

For Bitcoin, the implications are significant: if there’s poor employment data, it might increase its appeal as a secure investment option; on the other hand, robust numbers could potentially decrease enthusiasm for non-traditional investments.

Furthermore, a robust employment report may encourage stricter monetary policies from the Federal Reserve, potentially causing turbulence in speculative markets. Conversely, poor economic data might instill uncertainty, which could make Bitcoin more attractive as a safe haven for value storage.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Potential scenarios

This week’s economic figures might influence Bitcoin’s immediate price fluctuations. If the Consumer Price Index increases significantly or the job market weakens, it could stoke inflation concerns. In such cases, investors might turn to Bitcoin as a protective asset against potential currency depreciation.

Instead, when CPI drops or employment levels are high, there might be a preference towards riskier investments such as stocks (equities), potentially decreasing the need for Bitcoin in the short term. A blend of results could cause market turbulence as investors evaluate the impact on Federal Reserve policies.

As Bitcoin approaches crucial emotional thresholds, these upcoming data disclosures play a vital role in predicting its trajectory and shaping the overall market mood.

Read More

2024-12-11 20:07