- Solana bulls did well to hold the $210 support but selling pressure was rising.

- The market structure and momentum were in favor of the bears.

As a seasoned crypto investor with a decade-long journey under my belt, I must admit that the current Solana [SOL] situation has me on edge. While it’s heartening to see the bulls manage to bounce back from the $210 support, the technical indicators are painting a grim picture.

Over the last two days, Solana’s bulls have held firm at the $210 level, even causing a price surge. However, technical signals suggest that the bears might be regaining control. The uncertain price movement of Bitcoin hasn’t provided much assistance to Solana either.

For the upcoming period, it’s anticipated that the price of SOL will stabilize around $210 to $230. If the price falls below $210, a significant support level, there’s a possibility that SOL could decrease by another 10% in value.

Solana bounces 4% from support

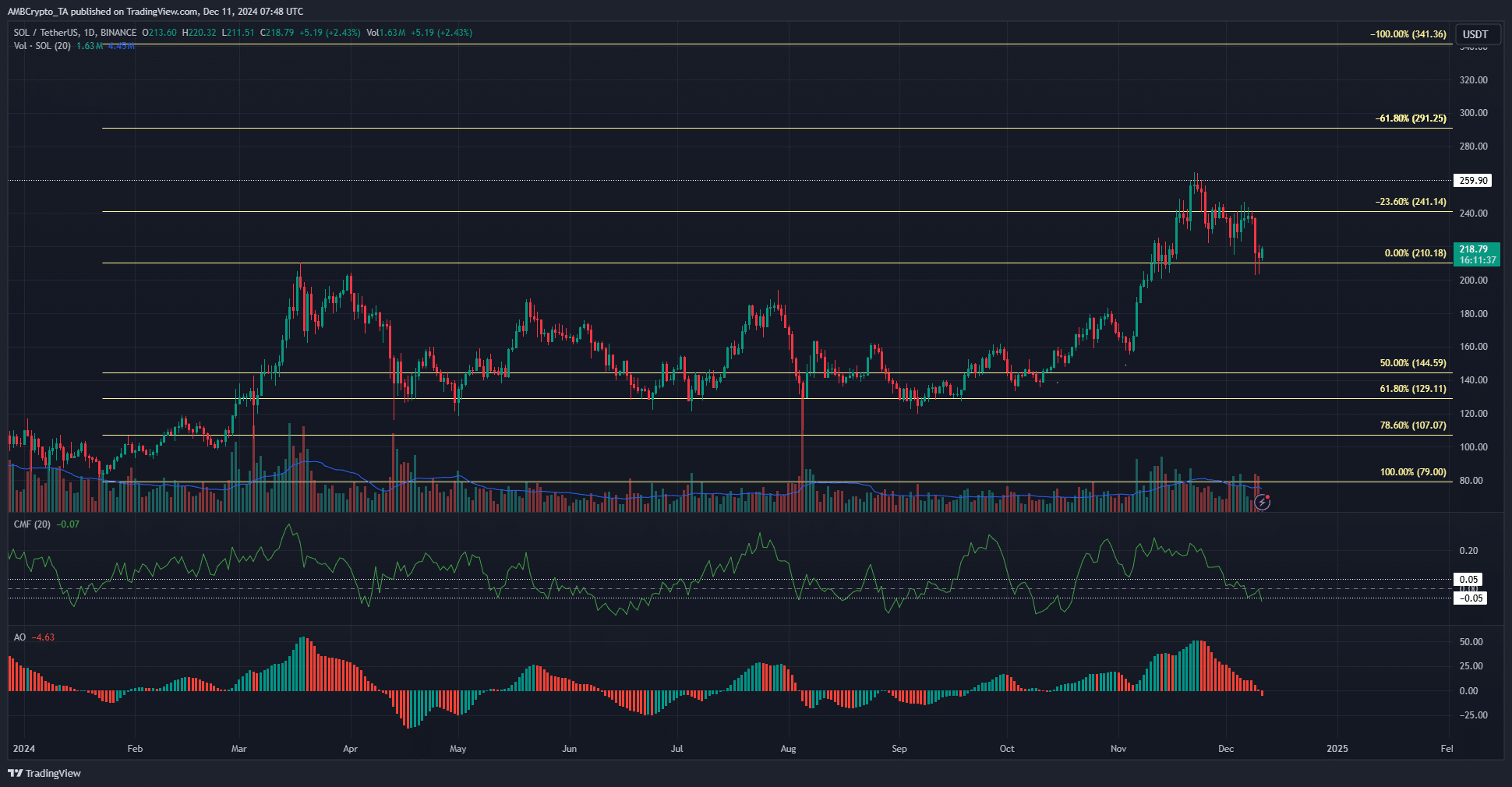

Looking at the daily chart, Solana has shown a downtrend, or bearish pattern. This shift follows a sequence where the price established successive low points over the last fortnight. Remarkably, the levels reached in March at around $210 have been maintained over the past couple of days.

Recently, the trends have changed, showing signs of bearishness. The Capital Movement Factor (CMF) dipped below -0.05, suggesting substantial capital outflow from the market. Additionally, the Awesome Oscillator has generated a bearish crossover, indicating that a strong downward trend might be developing.

It’s likely that Solana’s $210 level will be vigorously protected by bulls as a crucial support point. In the near future, there may be significant price fluctuations.

If Solaris Financial Corporation (SOL) ends its trading day with a price below $202 or $203, it could signal further price drops. Under such circumstances, we might anticipate the stock moving down towards $180.

Volatility expected between $210-$230

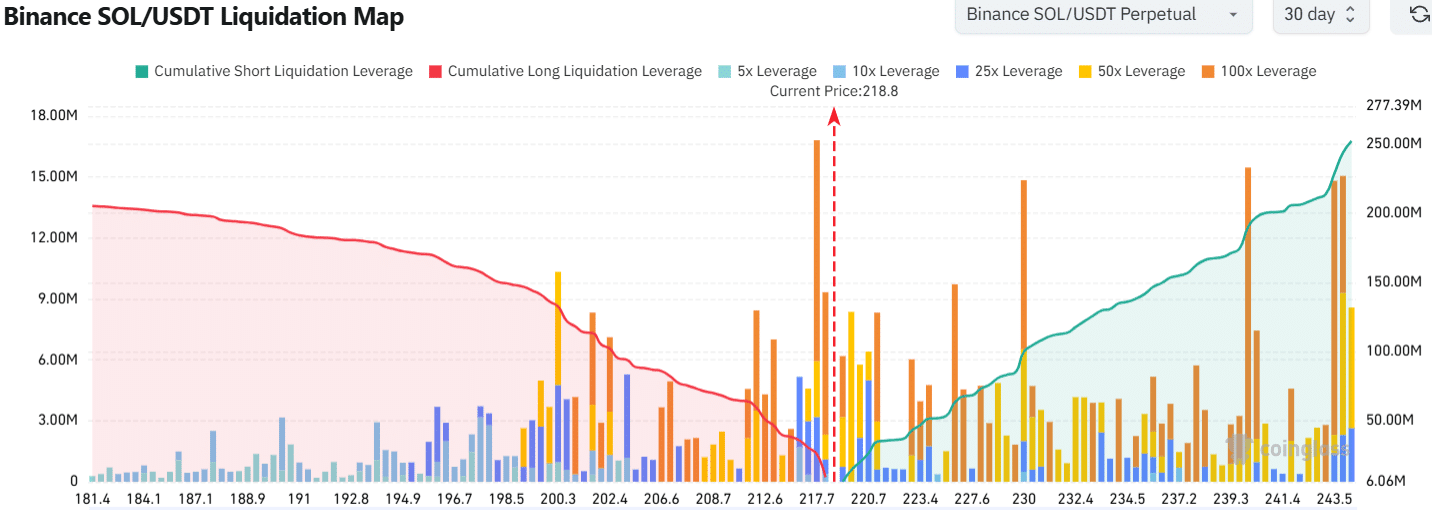

The liquidation map indicates that there was a cluster of high-risk long positions between $210.5 and $218. This area could potentially be revisited as prices approach liquidity points. Above this, the region from $220 to $230.3 also shows a significant concentration of leverage.

Is your portfolio green? Check the Solana Profit Calculator

In simple terms, it’s expected that Solana’s price may oscillate around the $210 to $230 range over the next few days before potentially resuming its upward trajectory. However, if Bitcoin drops below $94,000 and $90,500, the likelihood of Solana continuing its uptrend could decrease.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-12 00:07