- XRP profit-taking intensifies in the second week of December as bullish activity cools off.

- A recap of XRP spot flows and the state of the derivatives segment.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I’ve seen bull runs and bear markets come and go. The current pullback in XRP is reminiscent of a rollercoaster ride that we all love and fear at the same time.

Approximately a week past, Ripple‘s homegrown token, XRP, was exhibiting strong bullish impetus. In fact, it reached a fresh 8-month peak during the initial days of December, extending the positive trend it had established in November.

After reaching a peak of $2.90 on the 3rd of December, XRP then experienced a drawback as traders cashed out some of their gains. This pullback has taken XRP down to a current low (thus far) of $1.90, which represents approximately a 20% decrease from its peak.

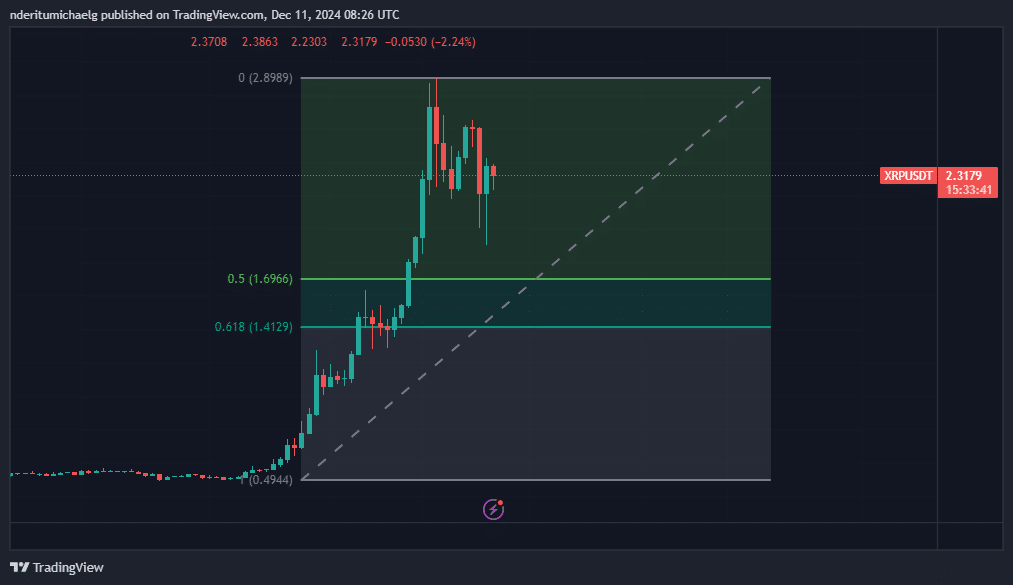

With this pullback, we’ve gained a general sense of the starting and ending points for the recent rally. By overlaying a Fibonacci retracement indicator across the entire price range, it appears that the price might fall within the $1.41 to $1.69 zone.

At the moment of writing, the value of the cryptocurrency was traded at $2.31. This followed an unforeseen dip in its price during Tuesday’s market activity. This could indicate that investors believe there will be further growth, which might explain the renewed interest and increased demand.

Prolonged selling activity might dominate as market feelings move from greed to anxiety, potentially leading to further decreases in the price of XRP. Examining buying and selling trends provides a clearer perspective on the cryptocurrency’s demand dynamics.

The largest influxes of XRP into the spot market occurred at the beginning of December, with a peak of approximately 177.33 million on December 1st. As of December 10th, the most recent inflow was around $11.35 million.

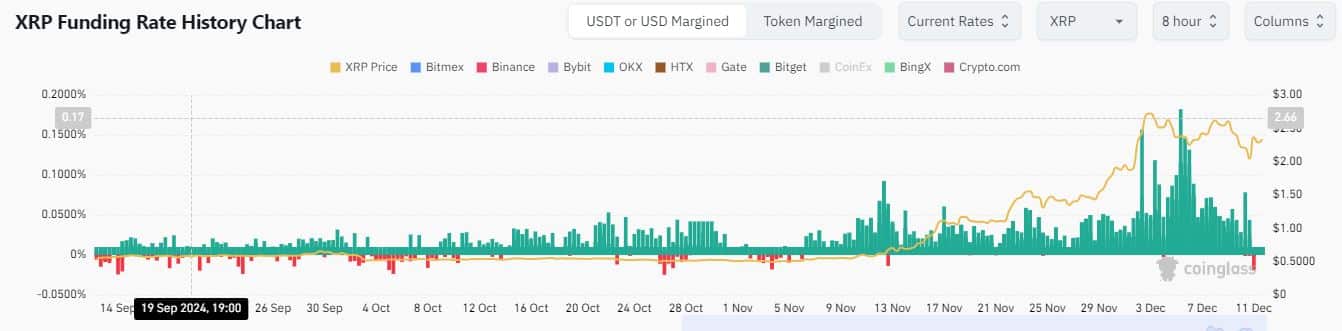

source: Coinglass

Over the past ten days, the flow of funds from the spot has not only continued but has seen an increase. On December 4th, XRP outflows reached a high of $155.79 million. In fact, these outflows have surpassed inflows during this period, indicating a withdrawal trend over the same timeframe.

Speaking as a crypto investor, I’ve been keeping an eye on the derivatives market and here’s what I found interesting: According to Coinglass, XRP saw a significant increase in negative funding rates on December 11. This suggests that there was a substantial influx of short sellers, possibly due to mounting bearish sentiments. It’s always fascinating to see how market dynamics unfold.

After several days of decreasing favorable funding rates, we saw the emergence of unfavorable rates. This shift indicated that the strong demand from earlier had begun to ease.

Read Ripple [XRP] Price Prediction 2024-2025

Based on these findings and the increasing rate at which XRP is being traded, it seems likely that XRP may experience further decline.

However, traders should keep an eye out for potential changes including demand-inducing events that could aid XRP bulls. Extreme volatility is expected along the way as was the case on Tuesday due to liquidations.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-12-12 06:15