- Bitcoin’s decentralization could be at risk as mining power becomes increasingly centralized

- The role of BTC ETFs in powering this shift cannot be overlooked

As a seasoned crypto investor who has weathered the ups and downs of this rollercoaster ride since 2013, I can’t help but feel a sense of déjà vu as I watch Bitcoin’s decentralization come under threat. Back in the day, we were fighting against banks and governments, now it seems we’re battling against institutional giants like BlackRock.

The core of the Bitcoin [BTC] system consists of miners who possess substantial amounts of Bitcoin. In this unpredictable market, monitoring their reserves is now more important than ever. Notably, the quantity of Bitcoin stored in miner wallets has fallen to a yearly minimum of only 1.809 million.

It’s frequently argued that issues such as increasing mining complexity, costs exceeding profits, halvings, and lower rewards are causing problems. However, there might be a significant change occurring beneath the surface. This change could potentially weaken miners’ control over the market as more investors are attracted to alternative investment options like Bitcoin ETFs.

Consequently, there’s growing concern that Bitcoin’s network might become more controlled by a few entities, leading us to ponder – Does this signify progress or regression towards Bitcoin’s vision of a decentralized tomorrow?

Bitcoin’s decentralized future might be under threat

In the year following the 2008 financial crisis, Bitcoin entered the scene as a disruptor, doing away with the necessity for traditional financial intermediaries. As it has evolved, it has cultivated a devoted following of enthusiasts who view Bitcoin not merely as a digital currency, but as a potent emblem of decentralization.

It’s not surprising that miners have become crucial players in turning this idea into a tangible reality. Over the past 15 years since Bitcoin was invented, individual miners have grown into major corporations, amassing substantial quantities of Bitcoin themselves.

Marathon Digital Holdings (MARA) is taking the front seat, holding more than 40,000 Bitcoins in its reserves. This is positive for Bitcoin as it encourages more accumulation, but it also raises concerns about a potential problem – the increasing concentration of mining power, which is now primarily in the hands of a select group of major players.

As more investors opt for mining stocks, which are closely linked to the value of Bitcoin, the situation becomes more complex. If Bitcoin falls in value, these stocks also tend to decrease, leading to potential financial losses for investors.

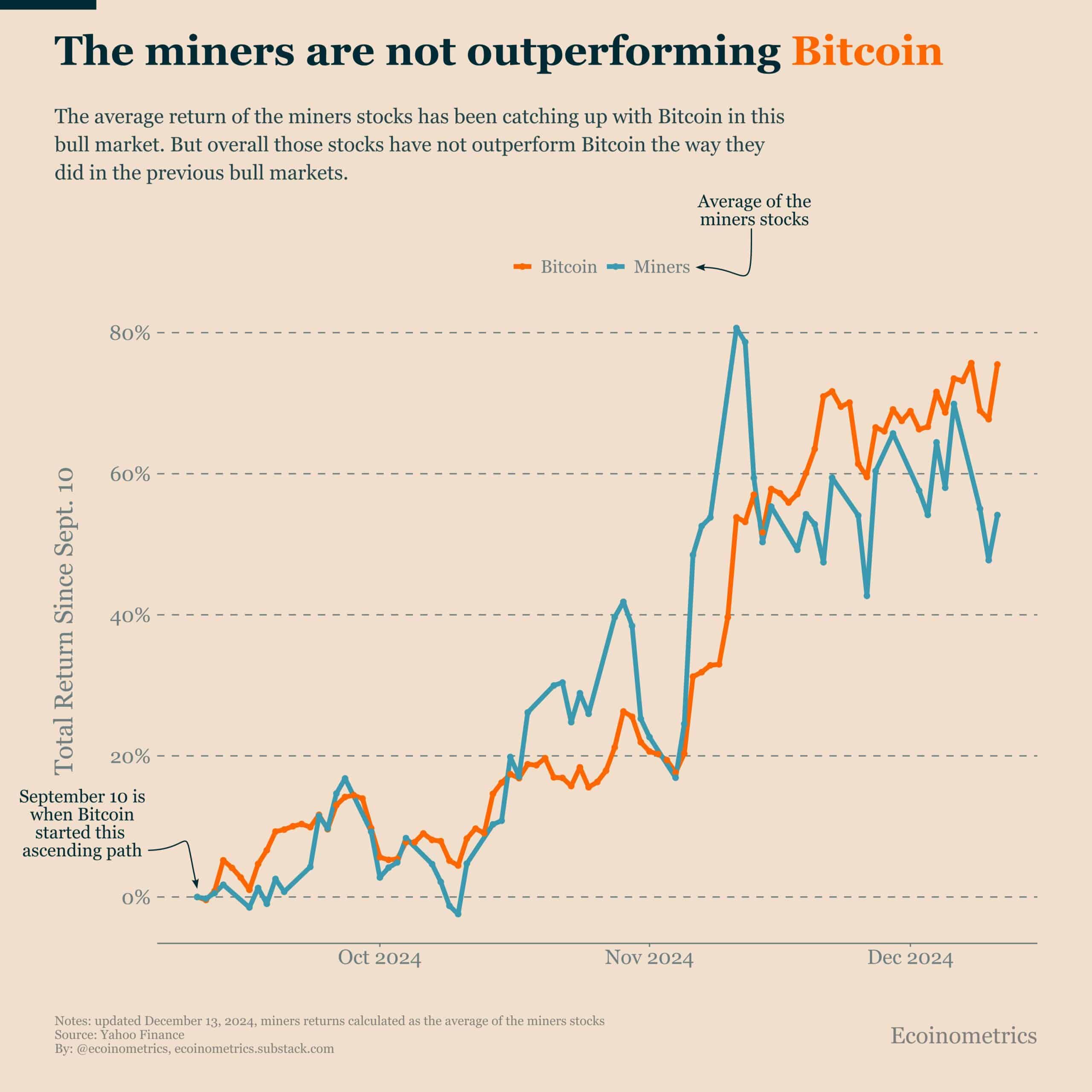

Source : Ecoinometrics on X

With a decreasing return on investment (ROI), investors are increasingly withdrawing funds, leaving mining businesses with two options: either liquidate their Bitcoin reserves or close shop. This situation has a direct or indirect influence on Bitcoin’s value, further increasing the market’s instability and volatility.

Upon examining the graph, it became apparent that the projected yields from Bitcoin investments differed significantly from what mining firms had envisioned, especially when Bitcoin approached the $100k milestone.

Normally, such an event would likely lead to a rise in mining stock prices, enticing fresh investors who are excited about getting involved.

And yet, Marathon Digital Holdings (MARA) has been on a steady downtrend, signaling a shift in a market that demands deeper exploration.

What’s behind this change?

Ever since their debut in January, Bitcoin ETFs have provided a convenient avenue for both large-scale investors and individuals alike to invest in Bitcoin, without the need for direct ownership.

This new investment vehicle removes the complexities of wallet management and mining. In fact, on the day the “Trump pump” began, $1.3 billion in inflows were recorded into Bitcoin ETFs.

It appears that the more recent entrants in the mining sector are swiftly surpassing conventional mining stocks, providing an “apparently safer” avenue for investors seeking to capitalize on Bitcoin’s potential.

Read Bitcoin [BTC] Price Prediction 2024-2025

However, it’s important to note that this transition isn’t without its potential pitfalls. With major entities such as BlackRock amassing large quantities of Bitcoin, concerns about the cryptocurrency’s decentralized structure are arising. In fact, at the last tally, BlackRock was in possession of a considerable 530,000 Bitcoins.

As an analyst, I cannot deny the significant impact that these major market players have on the fluctuation of Bitcoin’s price. It is crucial for investors like myself to remain vigilant, exercise prudence, and meticulously monitor our investments as we move forward in this dynamic market.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-12-14 10:19