- Altcoin season’s hypothetical timeline revealed that a true run higher may be yet to begin

- Bitcoin would need to grow much bigger to sustain the kind of altcoin seasons seen in the past

As a seasoned crypto investor with years of market observation under my belt, I can confidently say that we might be on the cusp of a significant altcoin season. The current trend indicates that Bitcoin’s fight for control over the $100k-level has provided a fertile ground for altcoins to grow.

During Bitcoin’s [BTC] struggle to maintain the $100k mark, it has provided an opportunity for altcoins to advance. This phenomenon often occurs during a bull run – when Bitcoin climbs higher, most altcoins remain stationary, and conversely, when Bitcoin trends lower, altcoins typically gain ground. This behavior aligns with the concept of capital rotation in the cryptocurrency market.

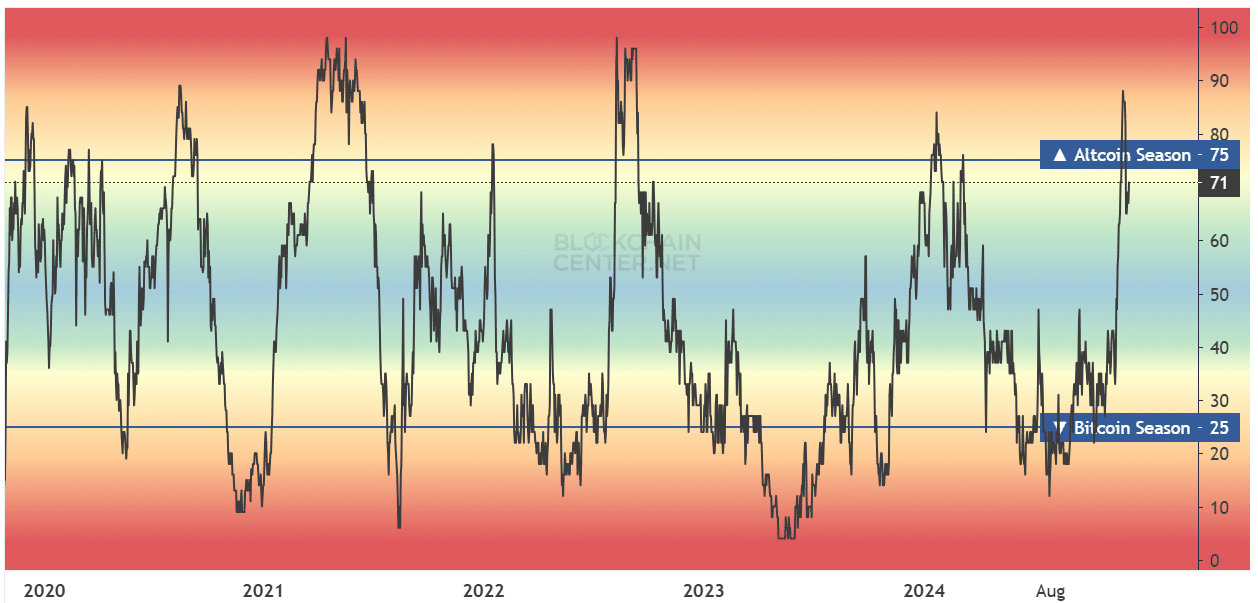

For about two weeks, the Altcoin Season Index indicated an altcoin market surge. However, at the moment of reporting, the index reading had dropped to 71.

However, this does not mean that the cycle is over and it’s time to sell – Far from it.

Altcoin season timeline, and the fuel that would drive it

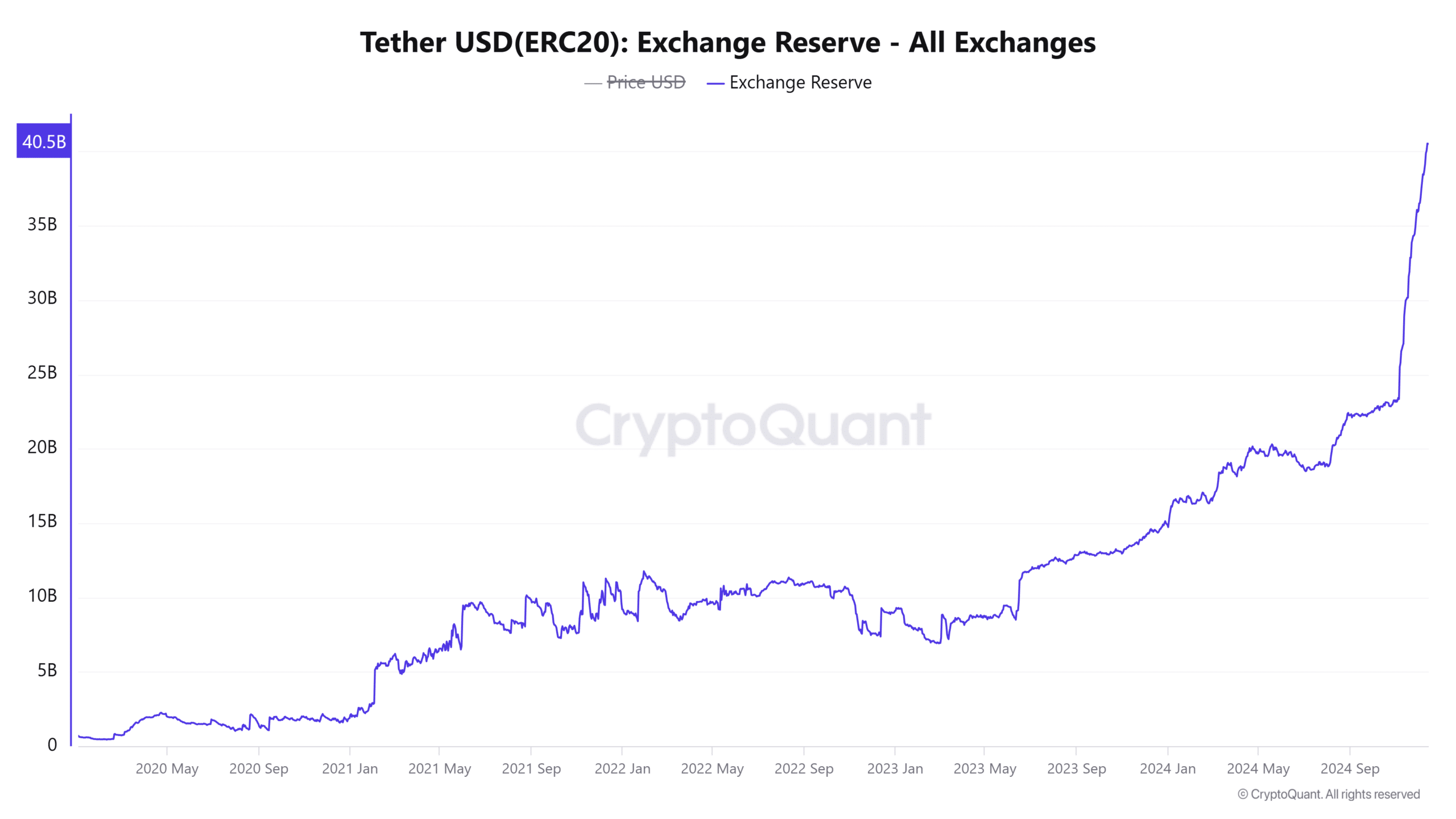

In simpler terms, Stablecoins play a vital role within the cryptocurrency world. They offer a secure space free from price fluctuations, supply necessary liquidity to the market, and facilitate Decentralized Finance (DeFi) operations. An increase in stablecoin transfers to exchanges often indicates a positive trend, suggesting increased purchasing power.

Over the last three months, we’ve observed a significant increase in USDT (Tether) reserves on various exchanges.

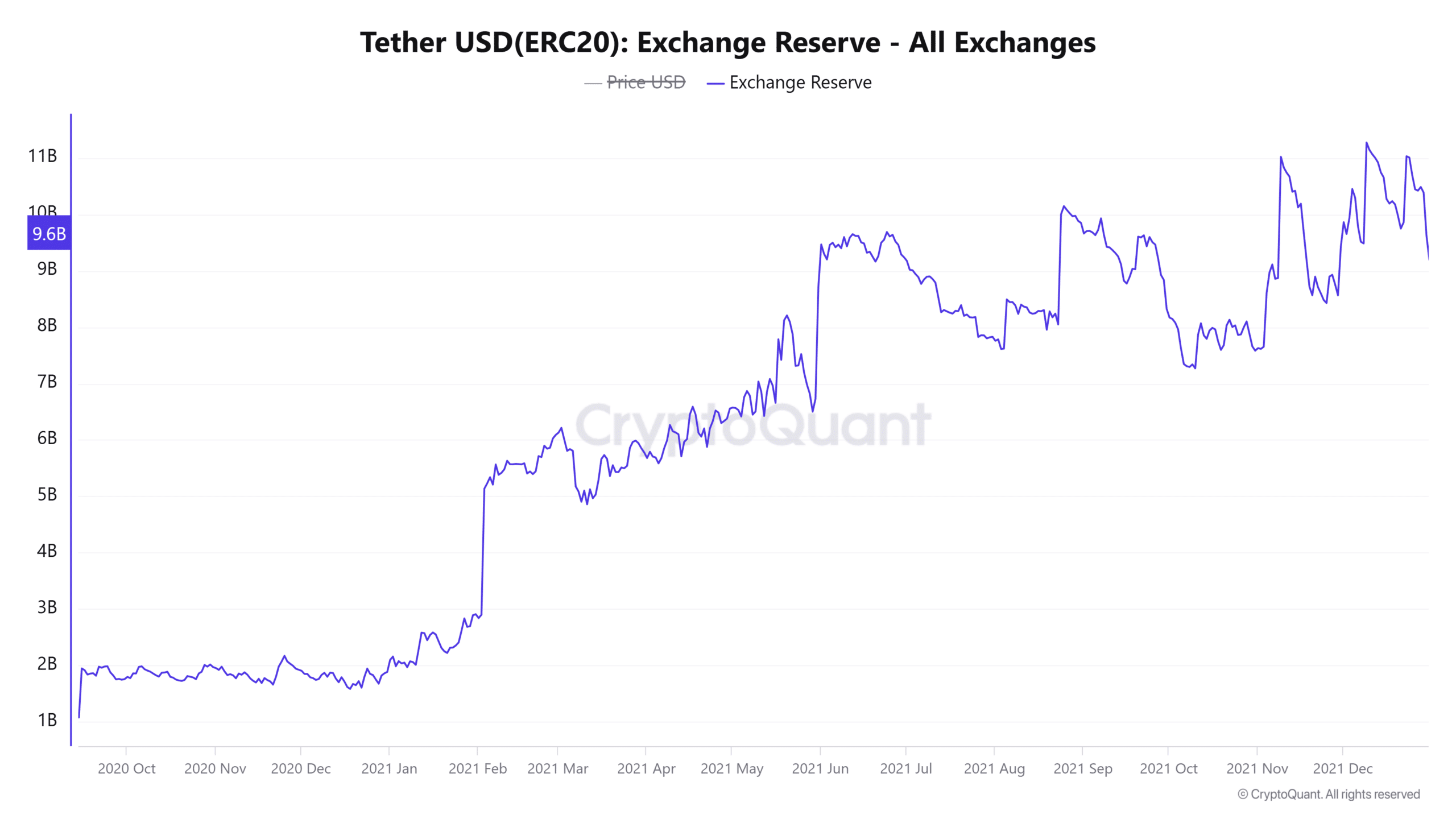

During the 2020-21 period under scrutiny, an upward trend in Tether’s reserve holdings, a well-known stablecoin, mirrored the peak of altcoin market conditions. The process of creating stablecoins and their subsequent transfer from the treasury to centralized exchanges serves multiple purposes: it enhances liquidity and streamlines transactions, acting as a crucial tool for large investors.

As a crypto investor, I’ve noticed that the surge in reserves seen in February 2021 resembles the past two months, which has me pondering if we haven’t fully entered the altcoin boom yet. In our previous cycle, the significant growth spurts occurred in May and November of 2021. If history repeats itself, we might be looking at waiting until Q2 and Q4 of 2025 for those jaw-dropping gains similar to what we experienced before.

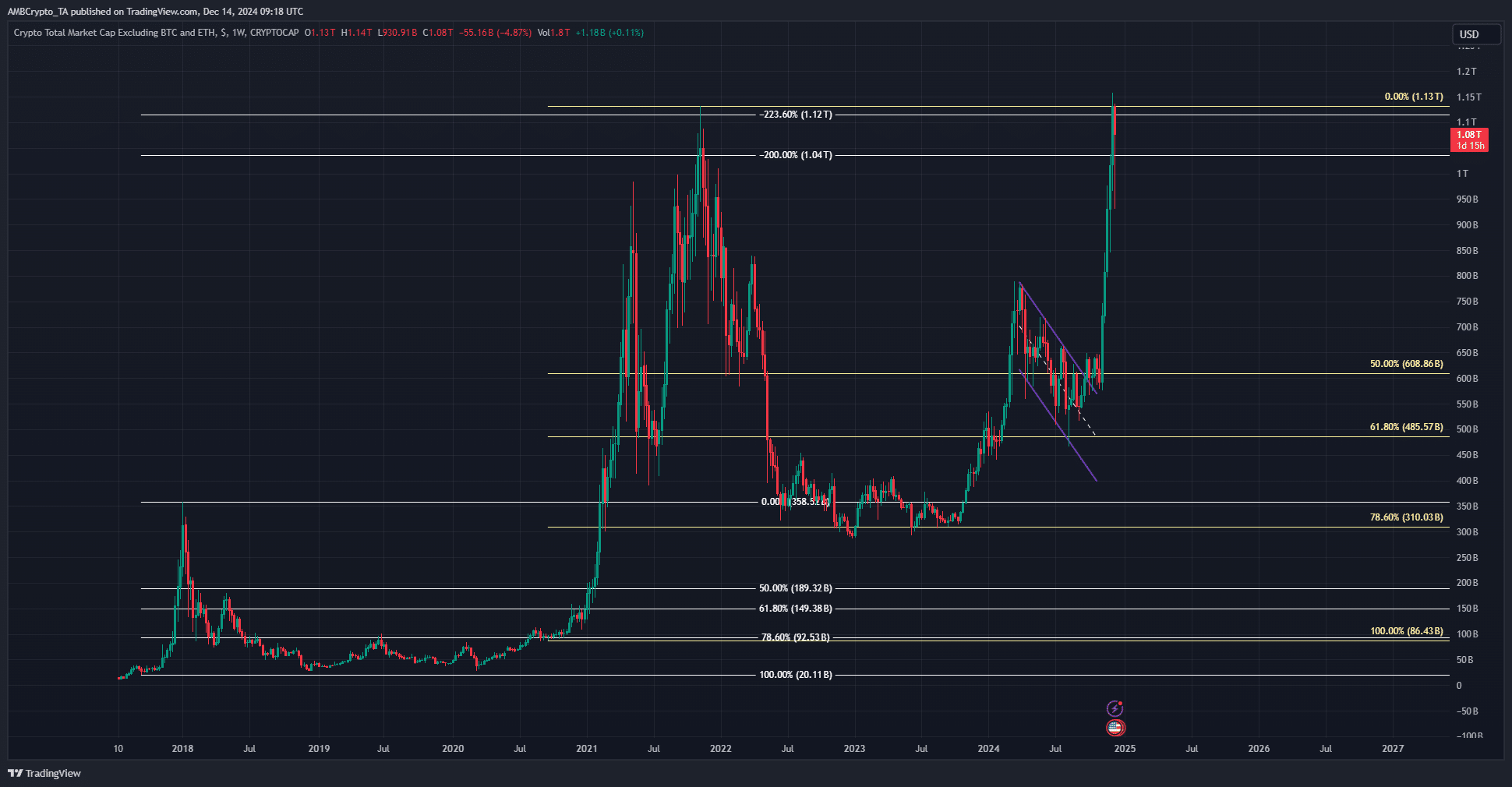

Market capitalization targets for 2025

Starting from its peak in 2018, the total market value of altcoins (excluding Ethereum) soared past a 223.6% Fibonacci extension level at approximately $1.12 trillion in 2021. Applying the same method to the 2021 surge, AMBCrypto estimates that by 2025, the market could potentially reach a value of $3.47 trillion according to the 223.6% extension level.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Should the current trend persist, it’s likely that the value of altcoins will climb to those figures within approximately ten months. Once the American tax season concludes in April, any tax-driven selling may diminish, allowing investors to return as buyers and potentially boost prices noticeably during the early summer months.

In the realm of cryptocurrencies, just like traditional stock markets, it’s worth considering the advice “Sell in May, go away”. Rather than overly relying on past performance as each summer may yield varying returns, investors could consider offloading a portion of their crypto holdings in May and November. Simultaneously, they should remain vigilant about broader market trends to guide their long-term investment strategies.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-12-15 03:03