- Miners sold over $13B BTC in the first half of December.

- Per Puell Multiple, BTC wasn’t overvalued or in a red zone yet.

As a seasoned researcher with years of experience tracking cryptocurrency markets, I must admit that the current state of Bitcoin (BTC) has caught my attention. The massive sell-off by miners, amounting to $13.72B in December alone, is certainly noteworthy. However, when viewed through the lens of the Puell Multiple, it seems that BTC isn’t overvalued yet, at least not according to this particular metric.

As a crypto investor, I’ve noticed an increase in my fellow miners offloading their Bitcoin (BTC) holdings since we breached the $100K mark. In just December, miners have sold approximately 140,000 BTC, equivalent to a staggering $13.72 billion in value.

According to data from Santiment, the current reduction in mining activity has led to a decrease in miners’ holdings, leaving them with approximately 1,950,000 coins at present.

BTC steady above $100K

Despite the aggressive sell-off, the king coin remained resilient above $100K.

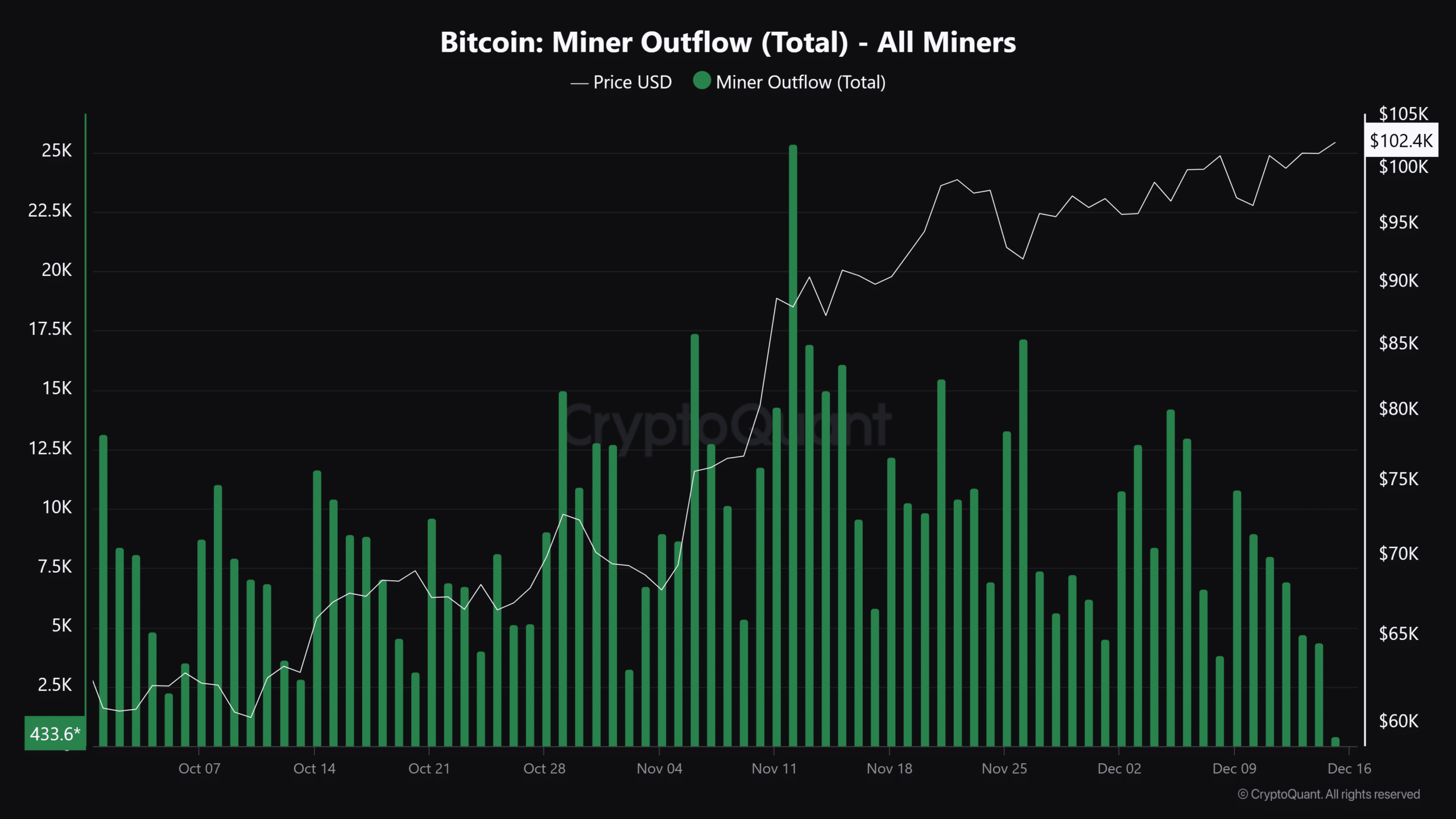

Yet, the rate at which miners were selling seemed comparatively lower if we examine it using the miner outflow data. This measure monitors all miner wallets and their transactions to exchanges.

On November 12th, there was a record high daily miner sell-off of approximately 25,000 BTC. However, this pressure has since started to decrease, as indicated by the miners’ outflows moving in a downward direction.

Perhaps, the bulk of the sell-off might have happened over the OTC (Over The Counter) markets.

Despite the significant drop in prices during December, the increased demand from Bitcoin Exchange-Traded Funds (ETFs) was outweighed by the magnitude of the sell-off. However, over the past fortnight, Bitcoin ETFs have accumulated a total of $4.9 billion, and simultaneously, MicroStrategy has purchased approximately $3.6 billion worth of BTC.

In the last fortnight, excluding Mara Digital and other companies with Bitcoin as part of their corporate reserves (like ETFs and MicroStrategy), the demand for Bitcoin totaled approximately $8.3 billion. However, this was slightly lower than the $13.72 billion in supply mined during that same period by Bitcoin miners.

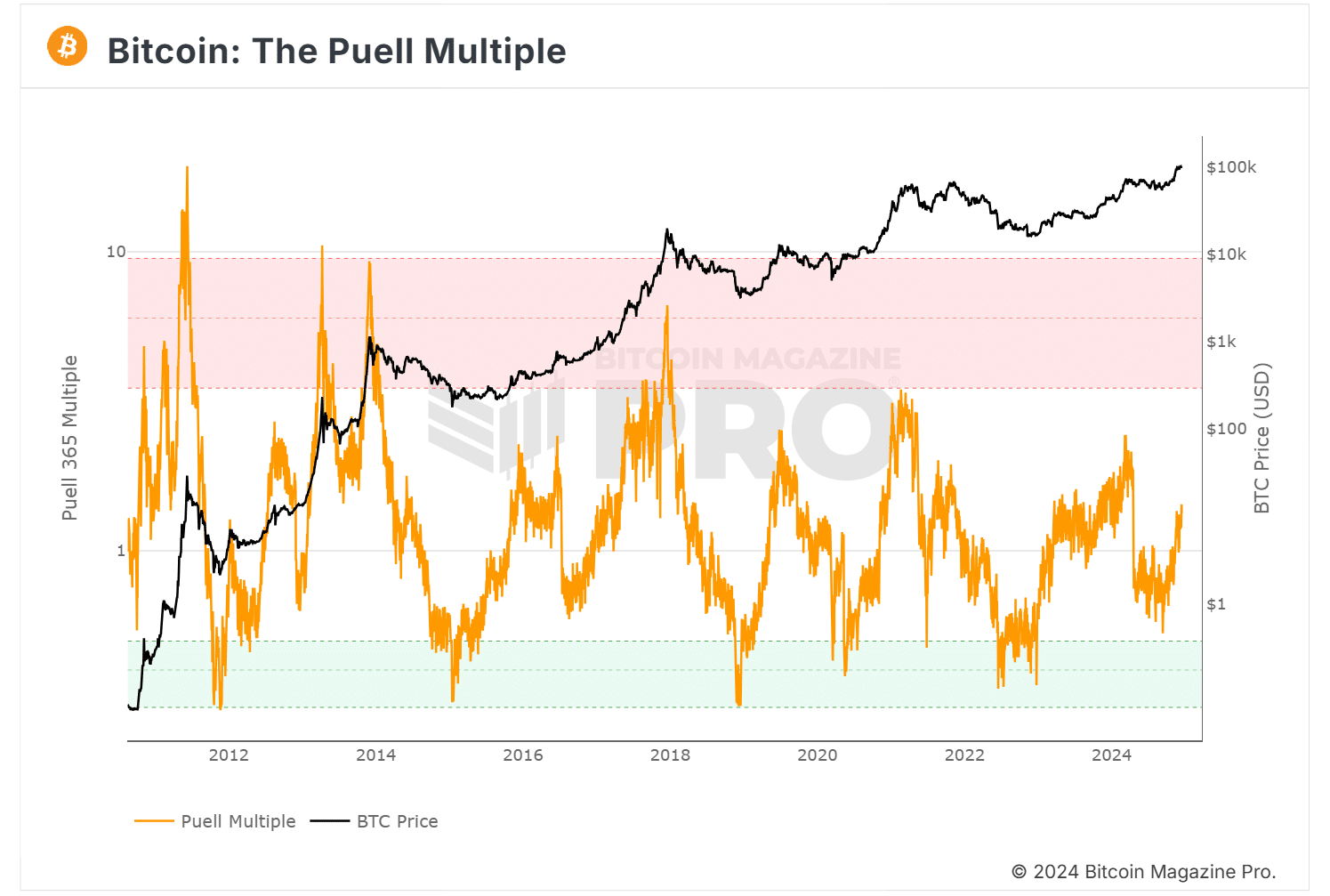

Is it worth being worried about significant mineral sell-offs affecting your investment portfolio? Let’s examine the Puell Multiple for some clarity.

As a researcher delving into Bitcoin analysis, I find the Puell Multiple to be an invaluable tool. This metric offers insights into Bitcoin’s valuation and cycles by providing a miner’s point of view. When this metric reaches its peak, it suggests that Bitcoin’s value might be overextended and potentially unsustainable.

On the flipside, a low Puell Multiple reading suggests a relatively undervalued BTC.

By mid-2024, the value reached 2.4 and established a peak in Bitcoin price around $73.7K. Currently, it’s sitting at 1.3, not much higher before it could potentially surpass 2 or reach the upper limit.

According to the Puell Multiple and miner’s point of view, Bitcoin’s value didn’t seem inflated or excessively high at the time. However, this could shift if the Puell Multiple significantly increases beyond 2.

Meanwhile, Bitcoin held steady around $102K prior to the Federal Reserve’s interest rate decision scheduled for December 18th.

Read More

- OM/USD

- ETH/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Solo Leveling Season 3: What Fans Are Really Speculating!

2024-12-15 16:07