- Dormant XRP tokens reactivated, boosting liquidity and fueling renewed investor confidence.

- Rising taker buy ratio reflects growing bullish dominance in XRP’s derivatives market.

As a seasoned researcher with over a decade of experience in the cryptocurrency market, I find myself intrigued by the recent developments in Ripple‘s [XRP]. The reactivation of dormant tokens and the surge in the taker buy ratio are signs that XRP’s rally might have more room to grow.

On December 10th, the value of XRP (Ripple’s cryptocurrency) momentarily dropped under $2, sparking discussions about whether its prolonged upward movement could be nearing an end.

However, the swift 8% rebound over the past 24 hours has reignited optimism.

Looking deeper beneath the obvious signs, subtler factors suggest that XRP’s price surge might still have significant potential for expansion, implying that its bullish trend could persist longer. Here are some possible reasons that could boost XRP further.

Dormant XRP tokens are on the move

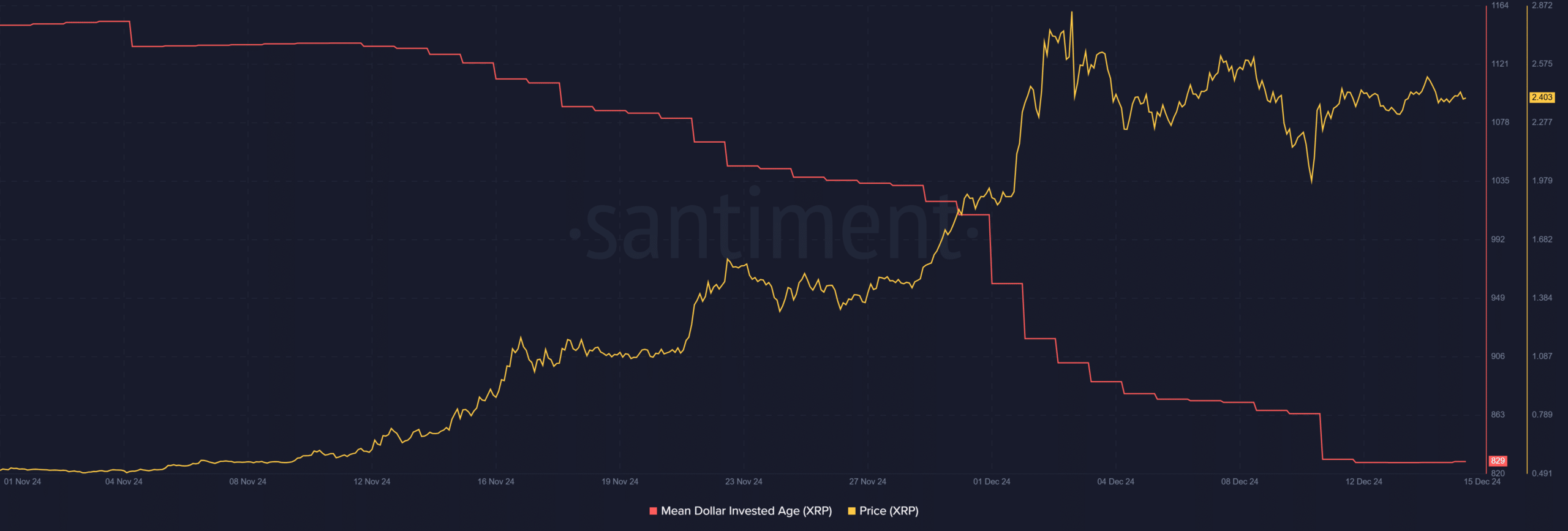

The Mean Dollar Invested Age (MDIA) for XRP has sharply declined, signaling significant on-chain activity.

Historically, when MDIA is low, it typically means that inactive tokens are being activated again, which can indicate a boost in investor trust and optimism.

Instead, an increasing Media Decentralized Internet Asset (MDIA) may suggest a period of growth sluggishness, since coins owned by long-term investors tend to stay undisturbed, limiting the possible upward momentum.

Currently, XRP’s MDIA has dropped to its lowest level since early November.

This decrease suggests that previously dormant assets are being used again, increasing the total amount of assets in circulation, which enhances liquidity and trade volume – two essential factors contributing to a continuous increase in asset prices.

In my research, I’ve observed that during bullish market phases, there tends to be an increase in the circulation of previously inactive assets. This new trading activity indicates that both smaller investors (retail) and larger stakeholders are taking advantage of price fluctuations by reactivating their dormant holdings.

With XRP’s rapid price recovery, the decline in MDIA suggests increasing market involvement, thereby bolstering the argument for a positive forecast regarding XRP.

If this trend persists, XRP could maintain its upward trajectory.

Buyers regain control

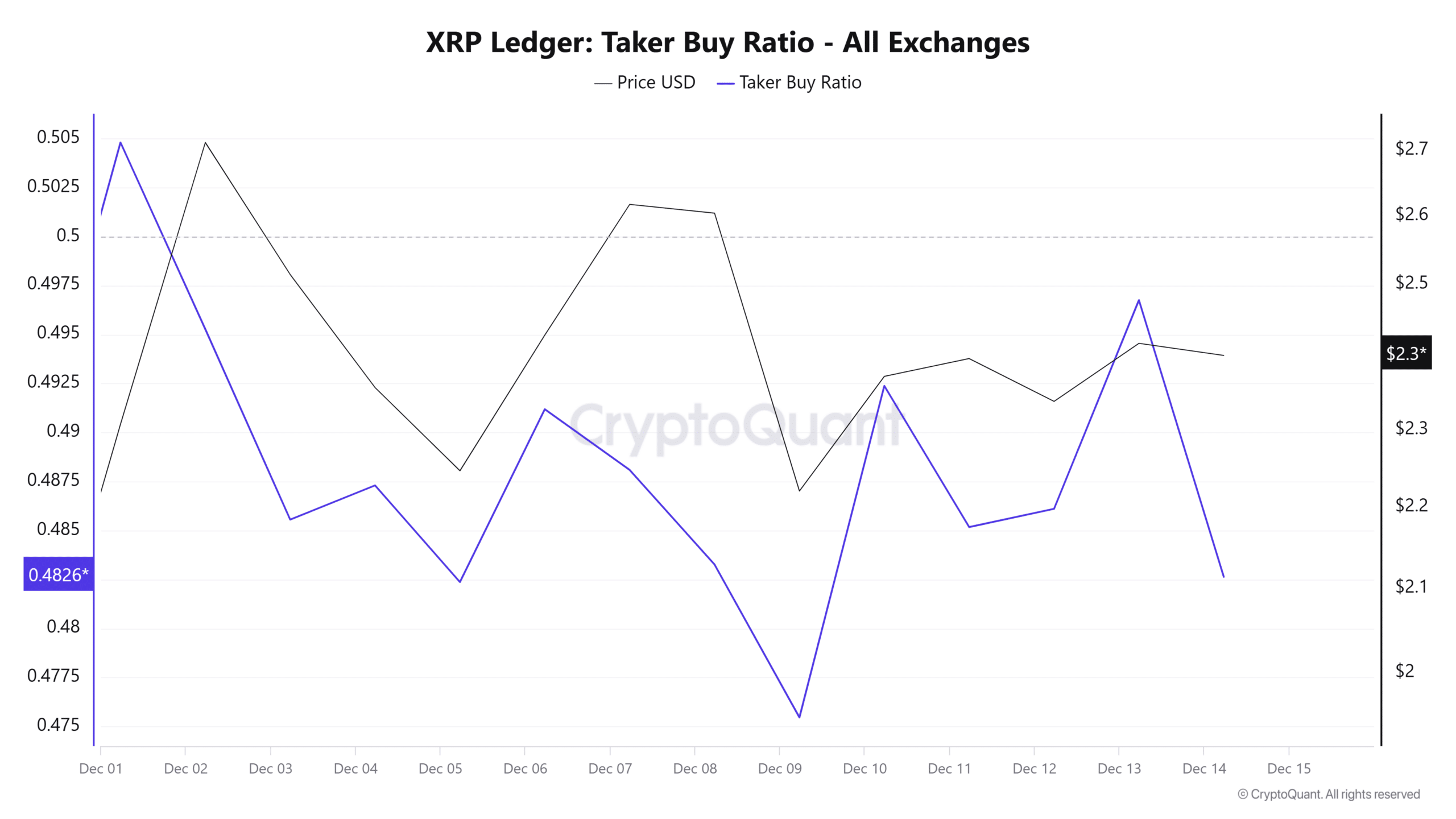

As an analyst, I’ve been closely observing the derivatives market for XRP, and the high taker buy ratio is a compelling bullish indicator. This ratio represents the proportion of buy orders compared to the total number of executed trades by market participants who are taking liquidity (takers). In simpler terms, it suggests that there are more buyers than sellers in the market, which could potentially drive up XRP’s price in the near future.

When the ratio exceeds 0.5, it suggests growing influence of bulls, since more buyers are active than sellers.

Recent data from CryptoQuant showed that the taker buy ratio had surged to 0.55, reflecting a sharp rise in buying pressure.

Historically, these types of movements tend to coincide with prolonged periods of price increases, reflecting a boost in traders’ confidence in the upward trend.

While the current reading indicates a favorable environment, investors should monitor this closely.

Maintaining a consistently high buyer-to-seller ratio (above 0.5) might propel additional growth, while a decline beneath this level could indicate decreasing enthusiasm and potential selling for profits.

XRP price and volume analysis

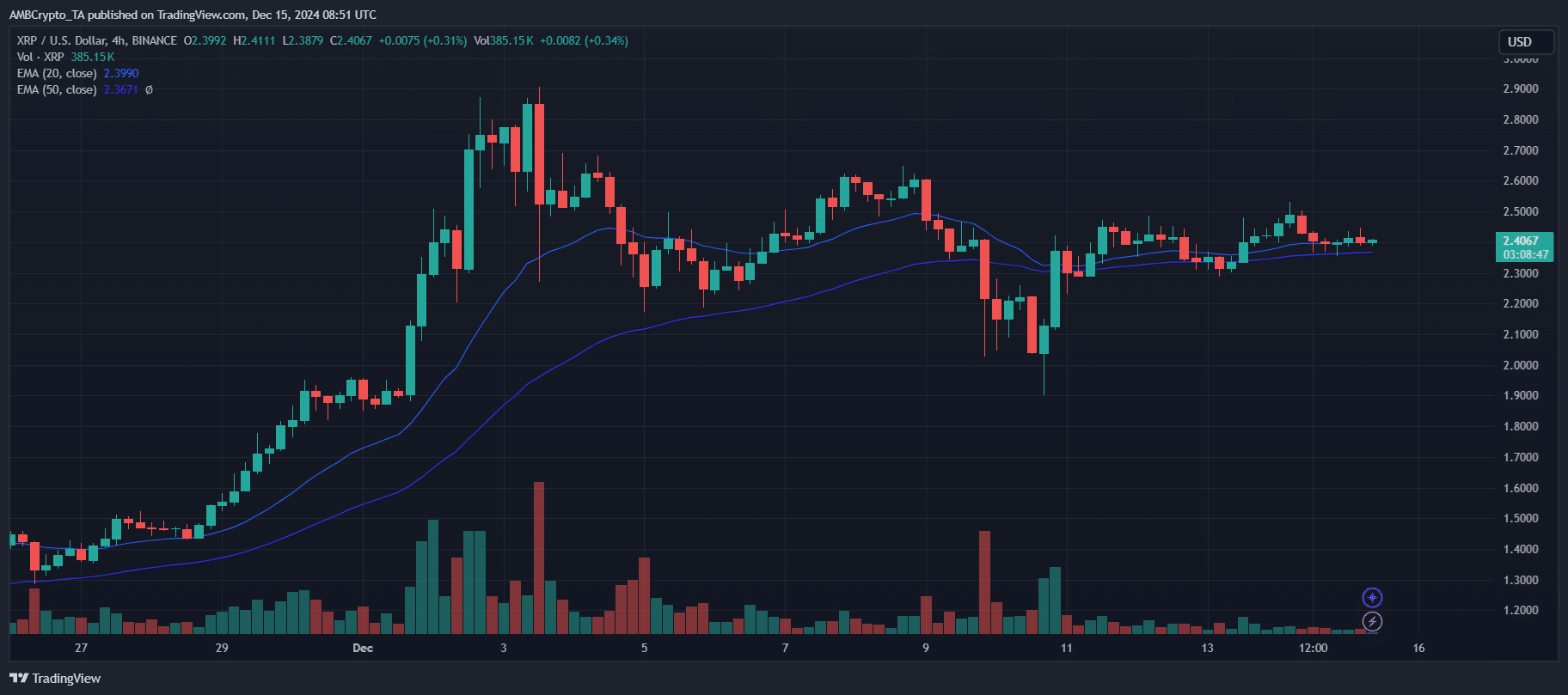

Looking at the 4-hour chart, XRP’s price dipped slightly below both the 20 and 50 Exponential Moving Averages (EMAs) on December 12th, suggesting a possible price correction might occur. Yet, its quick rebound above these indicators has once again boosted optimistic feelings among traders.

As a researcher, I’m observing that the Exchange-Traded Markets (EMAs) are providing a supportive environment for XRP, which is currently holding steady near $2.40. It’s worth noting that the low trading volume accompanying the recent price stabilization indicates decreased selling pressure. This, in turn, seems to favor buyers in the short term, suggesting potential growth opportunities for investors.

If trading activity significantly increases while prices consistently remain above the Exponential Moving Averages (EMAs), it’s possible that XRP might regain its bullish trend and aim for a price of around $2.90.

Read Ripple’s [XRP] Price Prediction 2024–2025

If volume fails to build, it risks sideways movement or a retest of the $2.30 support.

The EMA alignment and ongoing recovery suggest that buyers are in charge, yet continued expansion in trading volume is essential for a drive towards the $3.50 level.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-12-16 01:12