- Sui’s TVL recently hit an all-time high.

- Its native token’s price also set a new price record recently.

As an analyst with years of experience in the cryptosphere, I must admit that the recent surge in TVL and price record of SUI Network’s native token has caught my attention. The exponential growth over the past year, particularly on platforms like Suilend and NAVI Lending, is nothing short of impressive.

Recently, the decentralized finance (DeFi) scene on the SUI Network saw a notable achievement as the total value locked (TVL) reached a substantial new high.

The increase in Total Value Locked (TVL) showcases a rising acceptance and financial commitment towards SUI’s ecosystem, where Suilend and NAVI Lending stand out as significant players.

Analyzing SUI’s lending platform dominance

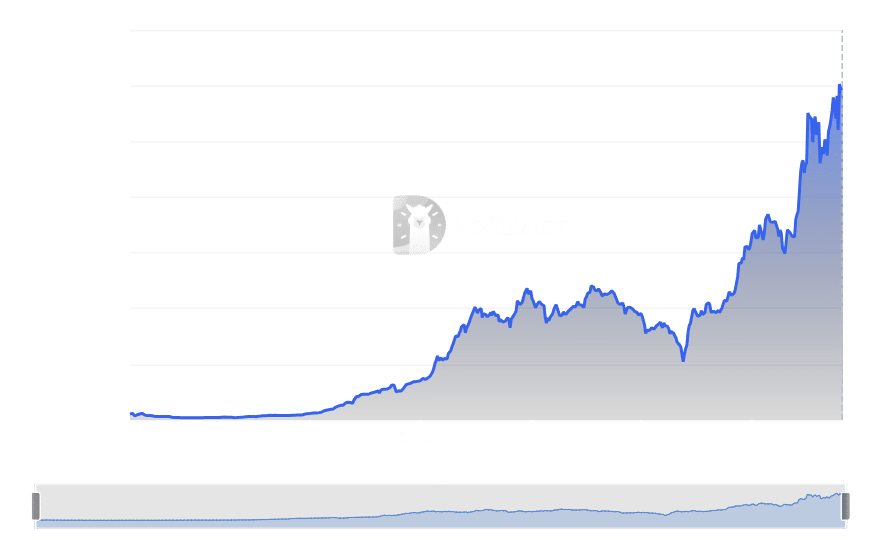

According to AMBCrypto’s analysis of the TVL (Total Value Locked) chart, SUI has experienced remarkable growth over the past year. This digital asset has steadily risen from humble origins, indicating increased engagement and interest in its operations.

According to DefiLlama’s graph, the Total Value Locked (TVL) stood at approximately $1.79 billion at the current moment. A closer look revealed that this figure peaked on the 12th of December, reaching an all-time high of $1.8 billion.

The expansion is primarily fueled by financial services providers such as Suilend and NAVI Lending, who have gained a substantial portion of the market. Together, these service providers control approximately 58% of the network’s total frozen funds.

As of this writing, Suilend’s TVL was $552.5 million, while NAVI’s was $491.23 million.

Volume spike confirms activity

The examination of the Sui volume revealed a unification between the volume and Total Value Locked (TVL). At present, the volume stands at approximately $168 million.

Upon further examination of the data, I discovered that our network experienced its peak transaction volume on the 12th of December, surpassing $551 million. Notably, this surge occurred concurrently with the Total Value Locked (TVL) achieving an all-time high.

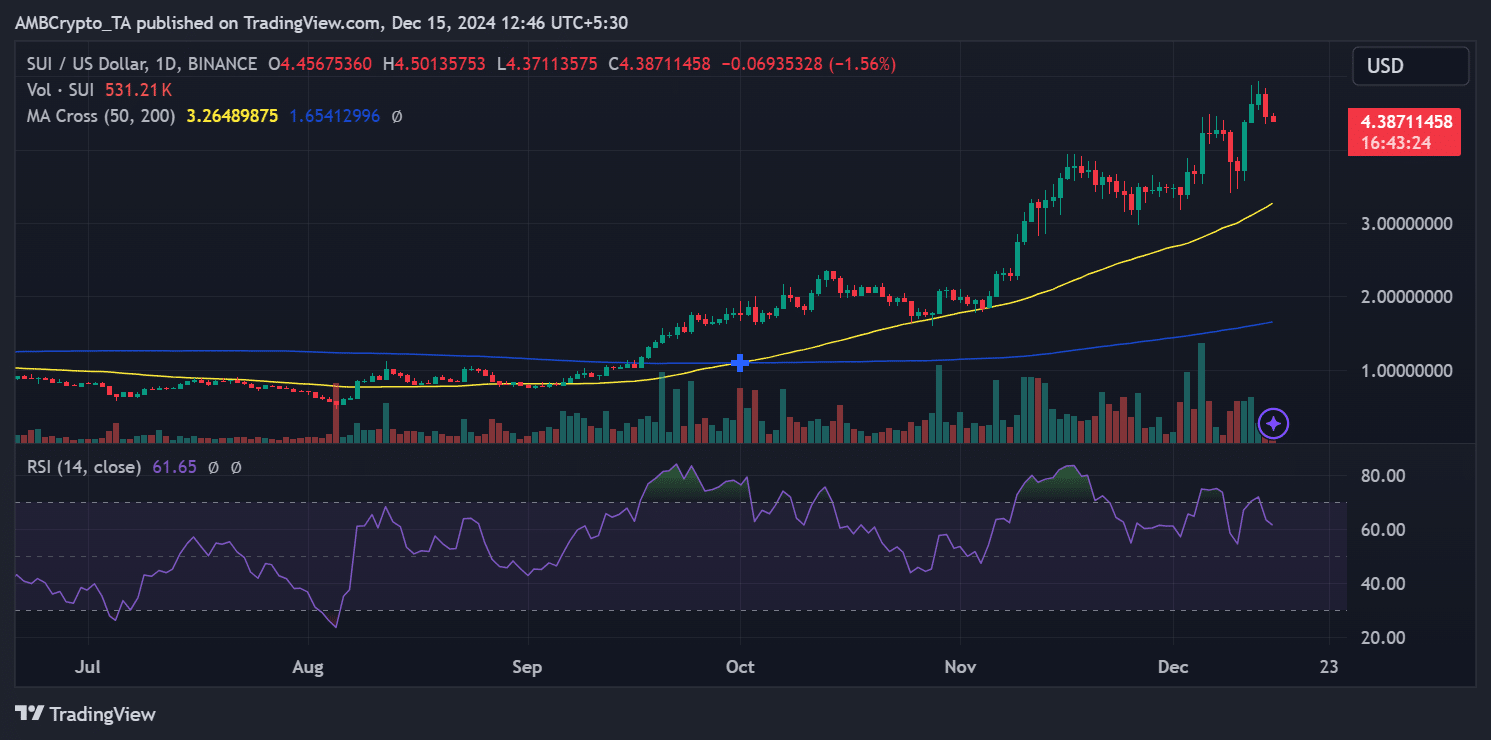

SUI’s bullish momentum faces consolidation

SUI’s price has mirrored its DeFi ecosystem’s growth, rallying significantly over the past months. Trading at $4.38 at press time, SUI remained above its key 50-day moving average, suggesting that bullish sentiment persisted.

At a RSI of 61.65, the asset seemed to be nearing an overbought state, yet there was potential for additional price increases before reaching its peak.

The analysis of trading volumes demonstrated consistent growth, reinforcing the upward movement in prices. Yet, the latest dip away from the $4.50 range hints at possible market stabilization or consolidation.

Should SUI surpass $4.20, it might pave the way for further growth with a potential target of $5 as the next significant barrier for bullish momentum.

Additionally, it was discovered that the price reached its all-time high (ATH) on December 13, peaking at $4.76. This ATH occurred one day following the network’s volume and total value locked (TVL) surpassing significant thresholds.

Reaching a TVL (Total Value Locked) of $1.7 billion, primarily fueled by SuiLend and NAVI Lending, underscores the network’s promising capabilities. Given its stable pricing and the swiftly changing DeFi (Decentralized Finance) terrain, it seems that SUI is poised for continued expansion in the future.

Read More

2024-12-16 08:07