- Recent data showed a significant outflow of XRP by whales from one of the top exchanges.

- Market sentiment was bullish, with expectations that XRP could reach $4 before establishing a new trading range.

As a seasoned crypto investor with battle-tested nerves and a penchant for spotting trends amidst market noise, I must admit that the recent developments surrounding XRP have piqued my interest. The massive outflow of XRP from Binance by whales, as reported by Whale Alert, is a clear signal that these big players are positioning themselves for potential long-term gains.

Over the last four weeks, XRP has seen a significant surge, boosting its price by an impressive 148.54%. Yet, it seems to have lost some steam, indicating a potential period of consolidation or gathering, often referred to as an accumulation phase.

During this phase of strengthening, the price movement has become less volatile, leading to a weekly decrease of 2.43% and a daily drop of 0.93%.

According to AMBCrypto’s analysis, there’s a chance that prices might rebound, yet it’s important to note that this process could be postponed due to varying market circumstances.

Whales trigger market-shifting moves in XRP

As reported by Whale Alert, a substantial amount of XRP has been moved off Binance, one of the world’s leading crypto exchanges, within the last day.

Data tracking indicated that approximately 800,000 units of Ripple (XRP), worth a staggering $1.9 billion at the moment of transfer, were withdrawn from the exchange.

Large-scale outflows like this often points to a bullish market sentiment.

Transferring substantial investments from exchanges to personal wallets often signals a desire to hold onto the assets instead of selling them, since personal wallets are rarely employed for trading purposes.

This trend suggests that whales are positioning themselves for potential long-term gains.

As an analyst, I’m observing a consistent trend of outflows from XRP exchanges. If this pattern continues, it might cause a supply shortage, leading to reduced liquidity for XRP. This could potentially escalate the price of XRP due to increased demand and limited supply.

Over the past few weeks, XRP has been going through an amassing stage, as its value fluctuates within a specific bandwidth.

XRP could reach $4 after accumulation

As an analyst, I’ve noticed the current tightening of the XRP supply due to whale activities suggests a potential breakout from this phase. If this breakout occurs, we might see XRP surging by around 66.44%, potentially reaching a value of approximately $4.

During this stage, referred to technically as a symmetrical triangle, there’s repeated buying and selling activity happening between a narrowing range of support and resistance levels.

Should no breakout occur, it’s expected that XRP will persist in its consolidation stage, showing minimal price fluctuations, modest increases, and limited decreases until this phase ends.

Based on an analysis of investor opinions, AMBCrypto determined that there’s a divided outlook among investors about the short-term path of XRP, with some expressing optimism for a bullish trend while others are more cautious.

XRP market shows contradictory signals

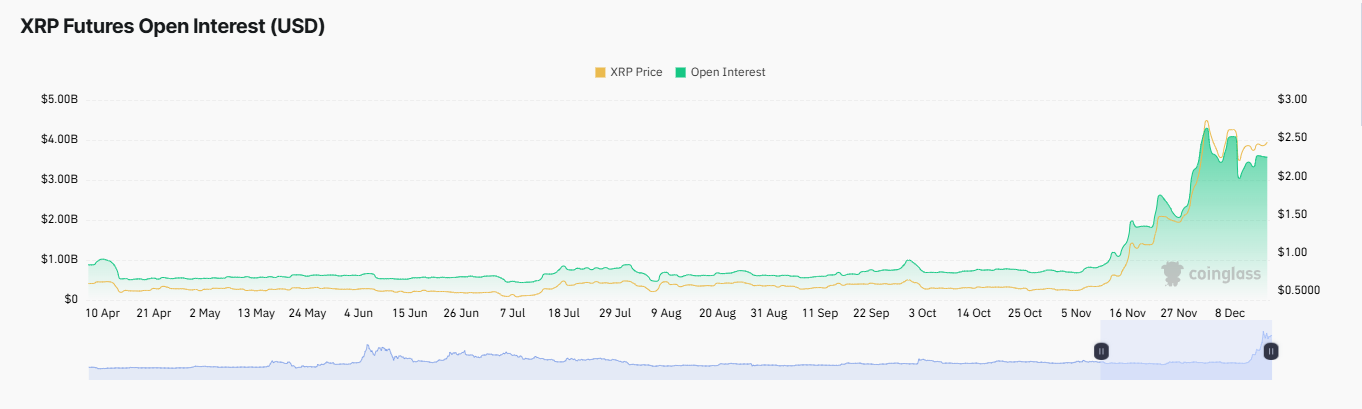

Currently, the Open Interest for XRP has decreased by 2.35% within the past 24 hours, amounting to approximately $0.35 billion at present.

As Open Interest decreases, it indicates that more traders have short positions (betting the price will fall) than long positions (betting the price will rise) in the market. This implies a continued bearish sentiment towards the asset, suggesting ongoing pressure for its value to drop.

Read XRP’s Price Prediction 2024–2025

On the bright side, the Funding Rate continues to show promise since it’s still within the bullish zone, posting a favorable 0.0102% during the specified timeframe.

In simple terms, if the current optimistic feeling among investors (bullish sentiment) is reflected in the Funding Rate, then a shift in the trend of the total number of open contracts (Open Interest) is needed to definitively establish a clear direction for XRP’s market movement.

Read More

2024-12-16 15:36