- Whale dominance in Ethereum pointed to strong bullish sentiment and potential price growth

- Concentrated holdings raised concerns about liquidity risks and potential market corrections

As a seasoned researcher who has weathered countless market cycles, I must admit that Ethereum’s [ETH] current state leaves me both intrigued and cautious. The dominance of whales, holding over 57% of the total supply, is undeniably a powerful signal pointing to strong bullish sentiment. However, this concentration also raises concerns about liquidity risks and potential market corrections, as we’ve seen in Ethereum’s past.

As a seasoned crypto investor, I’ve noticed an intriguing trend in the Ethereum [ETH] ecosystem: A growing number of whales are taking control, with 104 wallets now possessing over 100,000 ETH each. This significant chunk, amounting to more than half (57%) of the total Ethereum supply, is now in their hands.

This major change in Ethereum’s ownership structure poses crucial questions about its upcoming trajectory, focusing on potential manipulation of the market and price fluctuations. With these ‘giant fish’ steadily hoarding more resources, their escalating influence suggests a positive outlook for the market.

Given these highly concentrated ownerships, how could they potentially impact the future direction of Ethereum’s price trend?

Whale accumulation and long-term holders: Bullish sign or a bear trap?

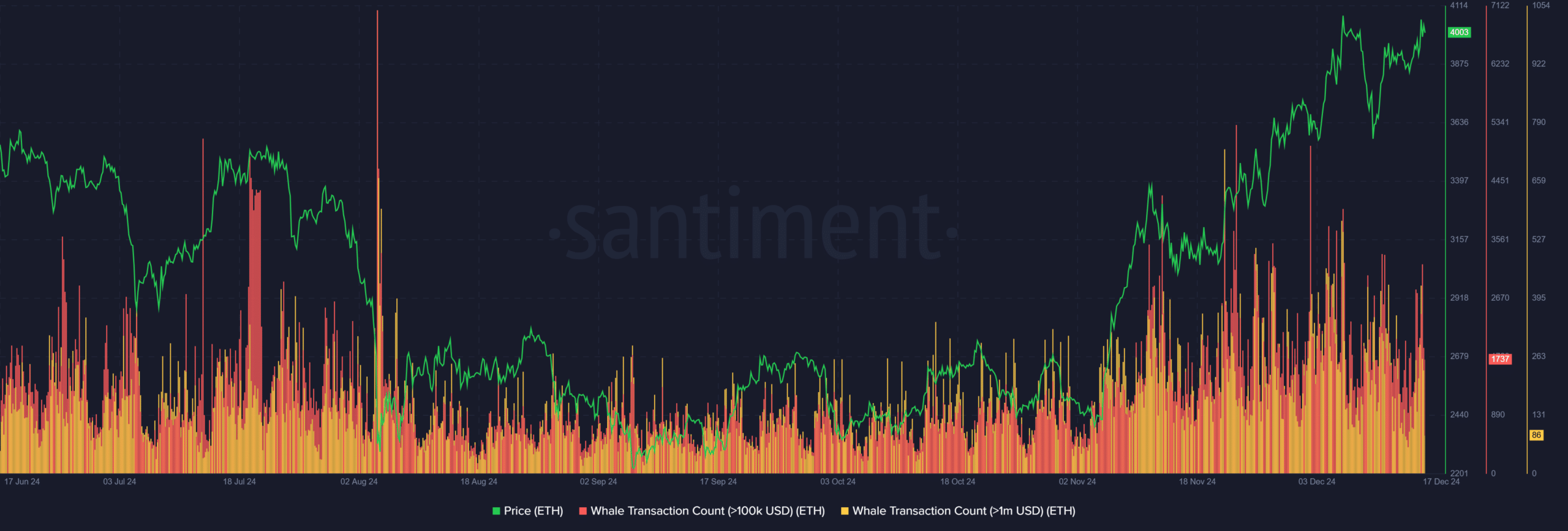

The build-up of large Ethereum holdings by a few significant investors (whales) has become more pronounced during periods of substantial price increases, as indicated by an increase in the number of transactions involving over $100,000 and $1,000,000 worth of Ethereum.

In times of market volatility, these substantial investors, frequently referred to as Long-Term Holders (LTHs), tend to function as anchors, helping to lessen the impact of supply fluctuations when investor sentiment becomes pessimistic.

Their strategy of accumulating during dips and holding through uncertainty aligns with Ethereum’s upward price trajectory in late 2024.

On the other hand, this increase in concentration brings up an important query: Is it a signal of optimism (bullish) or a deceptive trap (bear)? The escalating influence of whales suggests strong conviction and upward movement, yet it intensifies the potential for a downturn.

In simpler terms, if there’s a synchronized drop in prices (a sell-off) or if the enthusiasm to buy runs out (exhaustion), it could lead to sudden price drops, emphasizing the delicate equilibrium between the optimism fueled by people buying and the possibility of a market correction driven by liquidity issues.

Historical whale activity

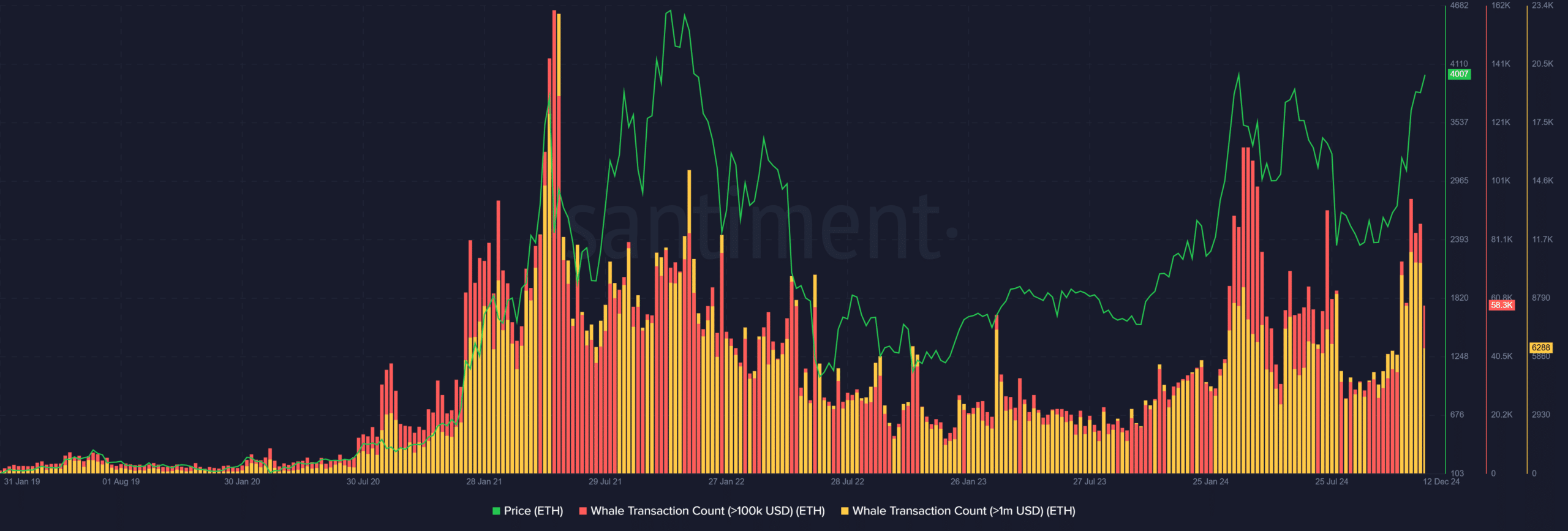

Data from Ethereum’s history suggests a significant link between the actions of large investors (whales) and price fluctuations. Increased transactions by these whales, particularly those exceeding $1M, tend to precede either substantial price increases or decreases. For instance, the spike in whale activity towards the end of 2020 and beginning of 2021, coincided with ETH’s massive bull run. This was a time when whales were buying strategically before retail investors joined in. On the other hand, heightened whale activity during market consolidations, like mid-2022, indicated accumulation phases that helped stabilize prices.

Occasionally, the rise of whales (large investors) has signaled upcoming market downturns, such as the decline of Ethereum in 2022.

Monitoring whale behavior is crucial for understanding market dynamics since amassing assets typically fosters price increases. However, when whales have too much control, this could lead to increased volatility if they choose to sell their holdings. This could potentially challenge the market’s ability to withstand such liquidity tests.

Read Ethereum’s [ETH] Price Prediction 2024-25

What’s next for ETH?

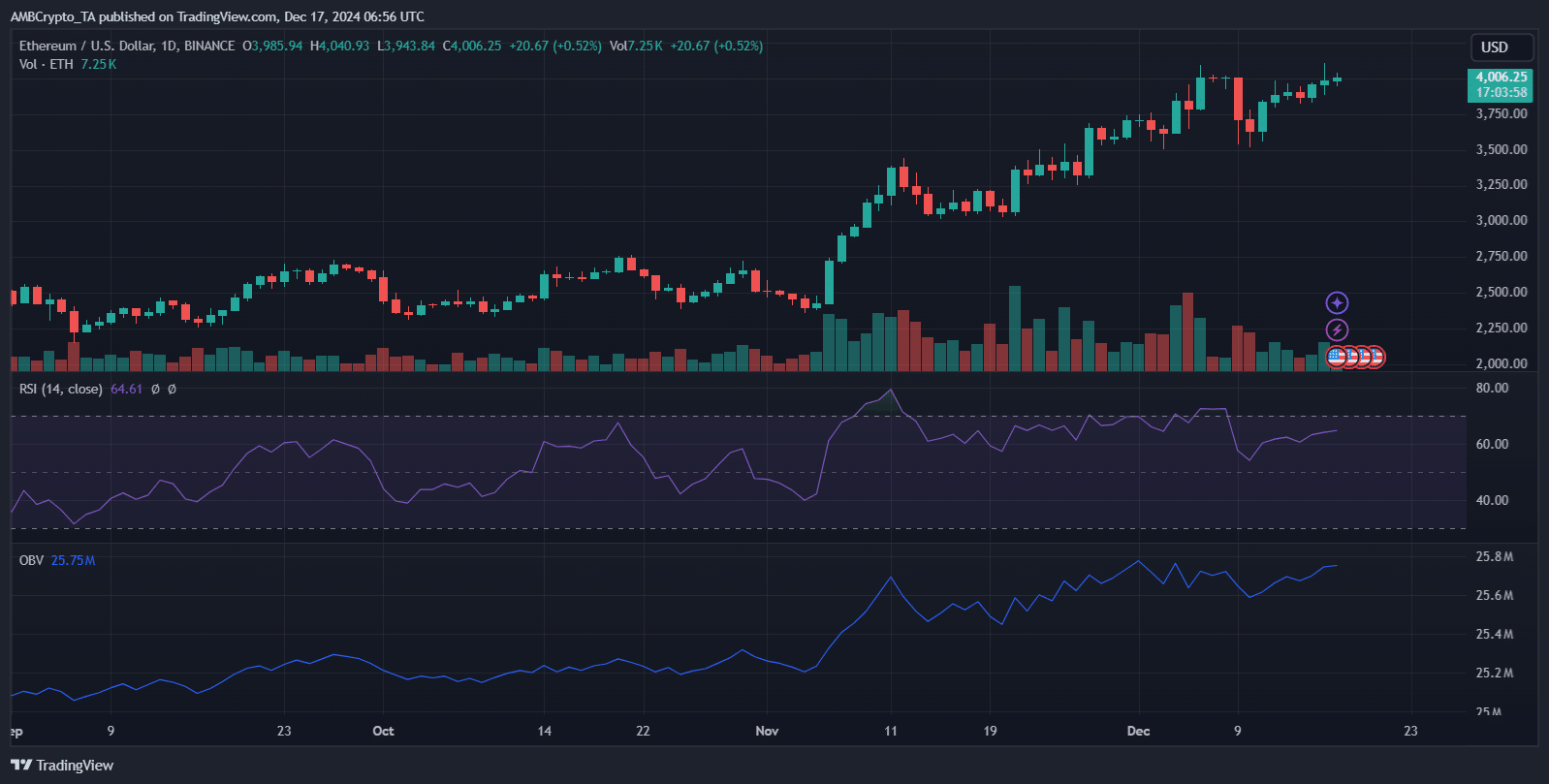

The surge in Ethereum’s price, primarily fueled by large investors (whales), has pushed it beyond the $4,000 threshold. This significant increase in purchasing activity lends credence to a positive market outlook (bullish sentiment).

The Relative Strength Index (RSI) currently reads 64.61, implying Ethereum hasn’t yet entered the overbought region, hinting at possible additional price increases ahead. Meanwhile, the On-Balance Volume (OBV) keeps climbing, which is a strong indication that the upward trend is being fueled by growing demand.

If the buildup of whales continues, Ethereum might aim for the $4,500 to $5,000 region as its potential next goal. Yet, the high concentration of ownership is a situation that can cut both ways.

Although continuous growth builds optimism, it’s important to remember that sudden sales by major investors could lead to market corrections, potentially straining liquidity and investor trust. The upcoming period will show if this upward trend solidifies or encounters a downturn.

Read More

- OM/USD

- ETH/USD

- Solo Leveling Season 3: What You NEED to Know!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-12-17 13:43