- More than 1.7 trillion SHIB tokens have been moved to exchanges in the last two days.

- If SHIB fails to hold support at $0.000024, it could lead to a steep decline.

As a seasoned crypto investor with a knack for spotting patterns and deciphering charts, I find myself cautiously observing the current state of Shiba Inu [SHIB]. The recent surge in exchange inflows, amounting to over 1.78 trillion SHIB tokens, has my alarm bells ringing. If SHIB fails to hold support at $0.000024, it could lead to a steep decline, a scenario I’ve seen unfold too many times in the volatile world of cryptocurrencies.

Shiba Inu [SHIB] traded at $0.0000268 at press time, after a 1.9% drop in 24 hours.

Despite a 10% increase in value over the last month, making it the second most popular meme coin by market capitalization, the upward trend has been limited due to reduced purchasing activity.

On its one-day chart, Shiba Inu (SHIB) appears to have created a widening upward sloping triangle, which is often a sign of a bullish momentum if the price manages to surpass the upper boundary of this pattern.

As a researcher, I’ve observed that the trading volume histogram bars appear shorter than usual. This suggests a decrease in trading activity, implying there’s insufficient buying volume to fuel an upward trend.

In simpler terms, the Money Flow Index (MFI) currently reads as 43, suggesting a lack of strong buying activity or ‘weak momentum’. Furthermore, this index is trending downward, signaling an increase in the number of sellers compared to buyers in the market.

Conversely, the Chaikin Money Flow (CMF), at 0.15, indicated that the demand or buying pressure continued to outweigh the supply or selling pressure.

As buyers and sellers fight for control, it could lead to SHIB consolidating within this channel.

Shiba Inu exchange inflows surge

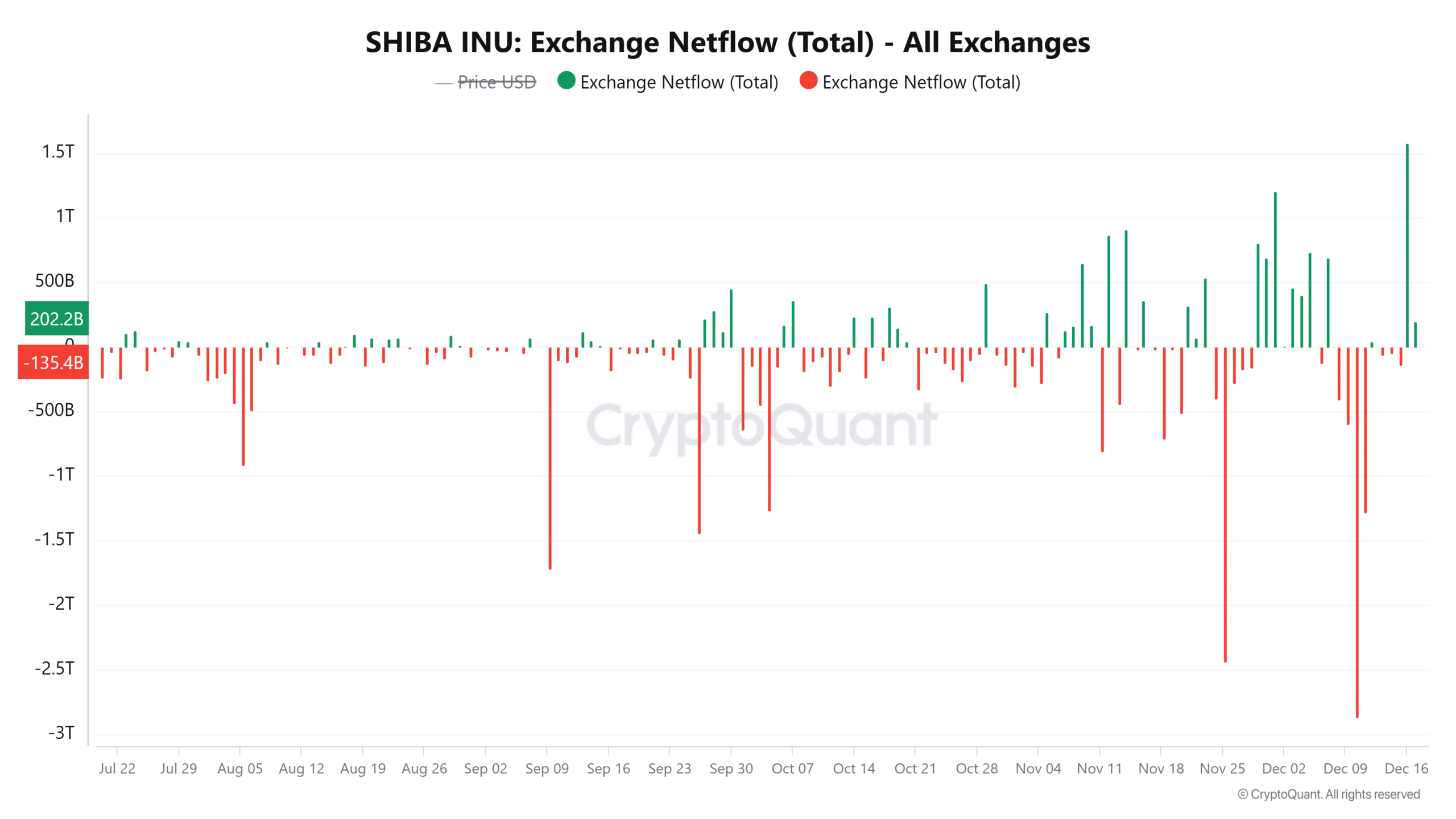

Information from CryptoQuant showed a substantial increase in Shiba Inu (SHIB) cryptocurrency deposits into trading platforms. Reaching its peak in almost five months, the net inflow of SHIB into exchanges was particularly high on December 16th.

Moreover, in the last two days, over 1.78 trillion SHIB has been moved to exchanges.

As I analyze the market trends, it appears that a significant number of traders are continuously transferring their meme coins to exchanges. If the buying demand fails to match this increased supply from sellers, it might lead to an imbalance, causing further price drops for the meme coin.

Key levels to watch

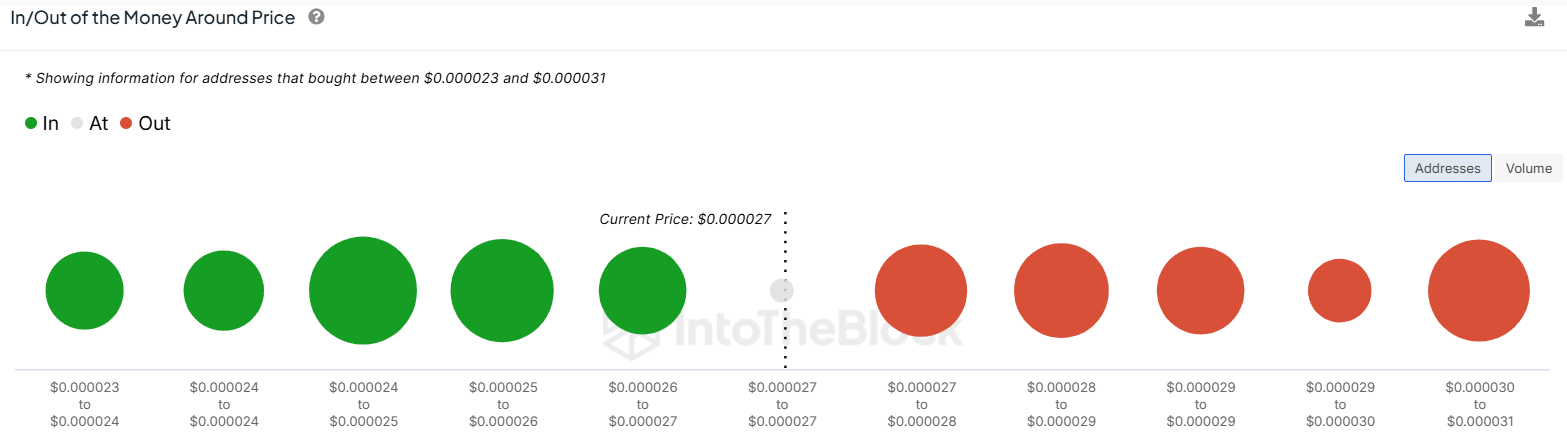

The IOMAP metric indicates that approximately 43,080 investors bought Shiba Inu coins when their prices ranged from $0.000024 to $0.000025.

This area serves as a robust potential support point, since traders could find it attractive for entry considering the profits associated with these specific addresses.

Instead, we find a significant buying area between $0.000030 and $0.000031, with over 3 trillion SHIB tokens purchased by approximately 37,230 different addresses.

When SHIB nears that region, there’s a strong possibility that traders who are currently underwater will choose to offload their holdings in an attempt to limit their losses, potentially creating resistance and making it harder for SHIB to advance further.

Read Shiba Inu’s [SHIB] Price Prediction 2024–2025

Long/Short Ratio shows a bearish bias

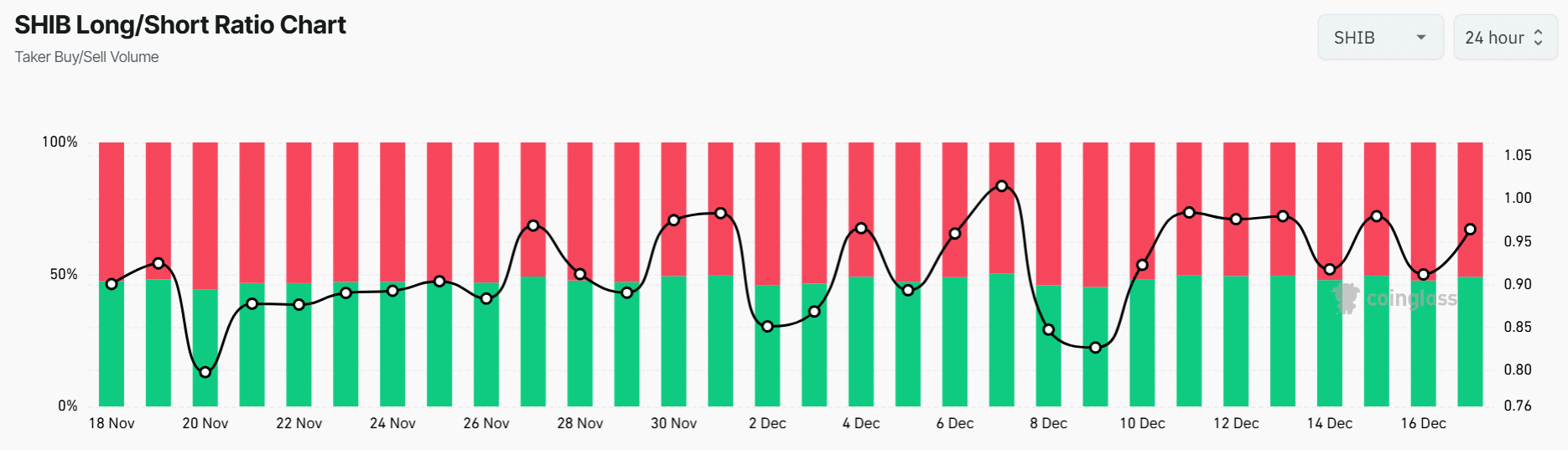

For the last week, there have been more wagers on Shiba Inu as a negative asset compared to those betting on it as a positive one. Currently, the Long/Short Ratio is at 0.96, and it’s been hovering below 1 since December 7th.

As an analyst, I’m observing a significant increase in the number of short sellers, which suggests that they anticipate Shib Inu (SHIB) to persist in its downward trend.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Thief Build

- Gold Rate Forecast

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Elder Scrolls Oblivion: Best Sorcerer Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Ludicrous

2024-12-17 15:03