- Chainlink whales withdrew 100,000 LINK tokens worth $2.95 million in 24 hours.

- LINK has declined by 3.02% over the past day.

As an analyst with years of experience in the cryptocurrency market, I have seen many ups and downs, bull runs, and bear markets. The recent developments in Chainlink (LINK) have caught my attention, and after careful analysis, I believe we are witnessing a buying opportunity.

Following a peak at $30.49, Chainlink’s [LINK] value has undergone a market adjustment, which resulted in its lowest point reaching $27.49.

After that point, Chainlink’s growth trajectory seems to have faltered. At present, it is being traded at approximately $28.22, representing a decrease of 3.02% in its daily value.

In the past week, Chainlink has experienced a significant increase of approximately 21.43%. Over the course of a month, this cryptocurrency has seen a substantial rise of nearly 97.74%.

Following a recent pullback and subsequent drop on daily charts, an attractive purchasing and stockpiling window for the altcoin has opened up. Consequently, many investors, particularly large-scale ones (whales), are taking advantage of this situation by buying and hoarding the cryptocurrency.

Chainlink whale accumulates 100,000 tokens

Based on reports from Lookonchain, a significant investor (often referred to as a ‘whale’) in Chainlink (LINK) appears to be buying more LINK tokens, as the token’s price falls on the market graphs.

In the last 24 hours, a significant investor (often referred to as a “whale”) removed approximately 100,000 LINK tokens, equivalent to around $2.95 million, from Binance. Over the past three days, this same whale has taken out a total of roughly 529,999 LINK tokens, valued at approximately $15.5 million, from Binance.

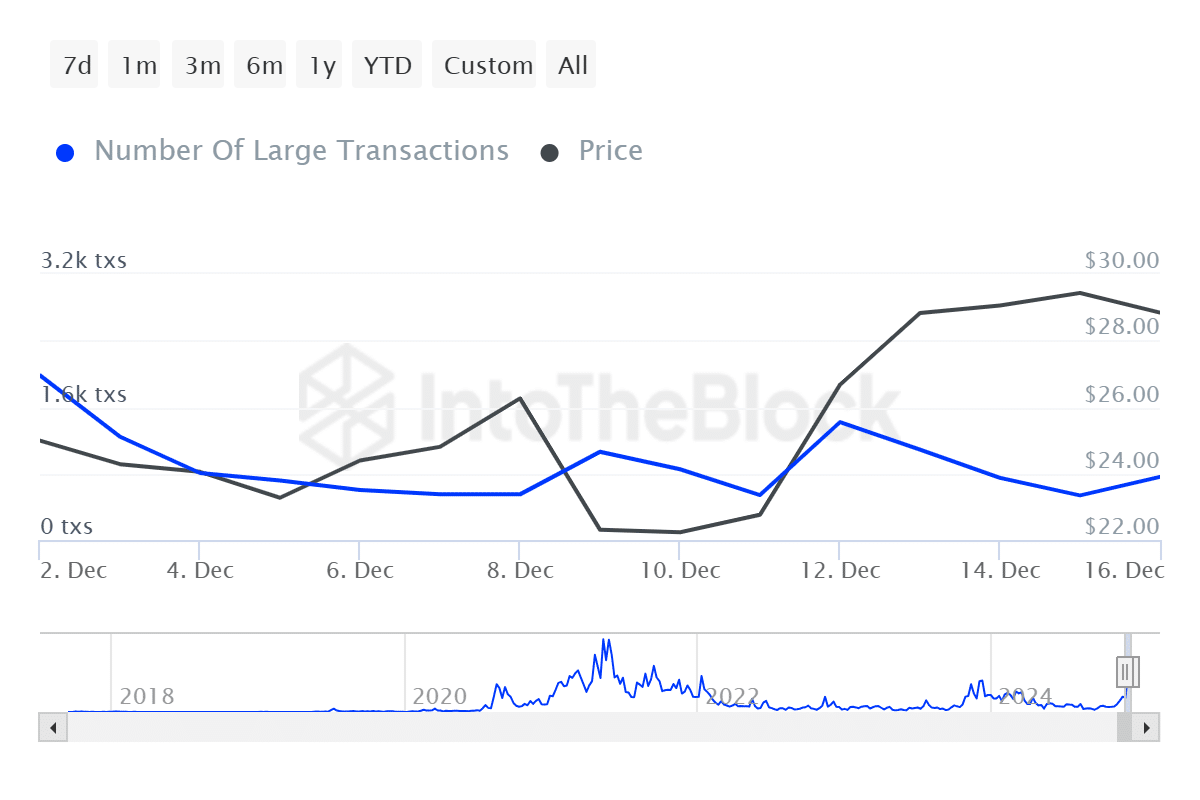

The increased participation of large investors (whales) within the network is highlighted by the recent uptick in whale activity. As reported by IntoTheBlock, this activity has experienced a significant increase of 41.5% over the past day, suggesting that these major players are actively engaged within the system.

As whale behavior becomes more active, it seems they might be accumulating their resources. This increased accumulation is reflected in a decrease of the Large Whales’ Outflow to Exchanges Inflow Ratio during the last seven days, with the ratio staying below zero for the past three consecutive days.

When this ratio decreases, it tends to align with a favorable market outlook because large investors (whales) are accumulating assets. This implies that there are more withdrawals of assets from exchanges by these whales than deposits.

When whales decide to hoard assets, it’s usually an indication of their intention to keep these assets for a prolonged period. Moreover, when big investors pull out their assets from exchanges, there is less pressure to sell, which can be interpreted as a positive sign (bullish) if the demand continues to grow, since it suggests that buyers might be taking up more of the supply left on the market.

Any impact on LINK?

Although an increase in whale activity could be interpreted as a positive sign, the current market conditions don’t seem to align with this, as LINK has experienced a drop in value during the last 24 hours.

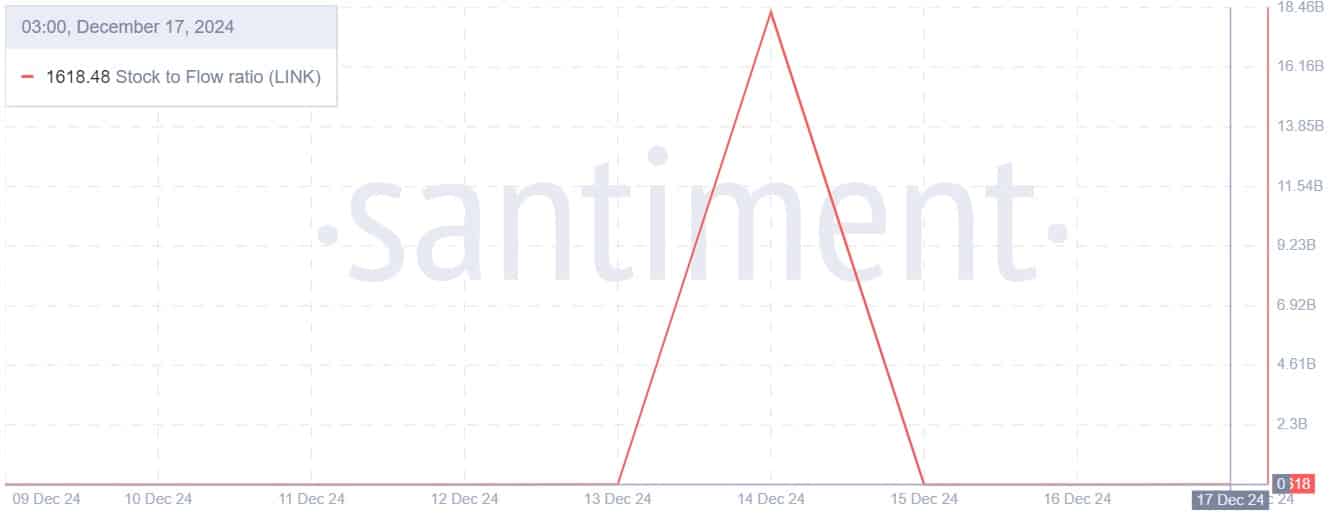

Nevertheless, even though there’s a dip shown on day-by-day graphs, the broader LINK market maintains a bullish trend. This optimism isn’t just suggested by the increasing hoarding of large investors (whales), but also by a spike in the stock-to-flow ratio.

As a researcher, I’ve observed an intriguing trend with Chainlink’s Stock-Flow Ratio (SFR). Initially at zero, suggesting oversupply, it has surged to 1618.48. This surge hints at a scarcity increase, potentially leading investors to hoard or accumulate more, thereby decreasing market liquidity. A decline in liquidity can cause prices to rise when demand exceeds supply, given that the former is outpacing the latter.

Essentially, Chainlink’s market is benefiting from positive attitudes among both large investors (whales) and smaller individual traders (retail). If this optimism continues, LINK might surpass its resistance at $30 and aim for $32.2. On the flip side, if a downward trend intensifies among sellers on daily charts, Chainlink could drop to around $26.9.

Read More

2024-12-17 16:39